The Implications Of Reduced U.S.-China Tariffs For American Businesses And Consumers

Table of Contents

Impact on American Businesses

Reduced U.S.-China tariffs would dramatically alter the playing field for American businesses, presenting both challenges and opportunities.

Lower Input Costs

Reduced tariffs would translate to lower costs for businesses importing goods from China. This would have a ripple effect throughout the economy.

- Reduced production costs: Businesses could produce goods and services at a lower cost, improving profitability.

- Increased profit margins: Higher profit margins could lead to reinvestment, expansion, and job creation.

- Potential for price reductions for consumers: Businesses may pass some savings on to consumers, leading to lower prices for various goods.

Industries heavily reliant on Chinese imports, such as manufacturing (particularly electronics and textiles) and technology (semiconductors and components), would benefit significantly from lower input costs. This cost reduction could enhance their competitiveness in global markets, allowing them to better compete with businesses in other countries.

Supply Chain Restructuring

The existing tariff landscape has prompted many companies to restructure their supply chains, often leading to diversification away from China. A reduction in tariffs could trigger a reassessment of these strategies.

- Potential for reshoring or nearshoring: Businesses might reconsider bringing manufacturing back to the U.S. or relocating it to nearby countries.

- Reevaluation of sourcing strategies: Companies would need to analyze whether sourcing from China remains cost-effective or if alternative suppliers are preferable.

- Increased complexity of supply chain management: The decision to maintain, shift, or diversify supply chains adds significant complexity to management.

Reshoring, while potentially reducing reliance on China, presents its own challenges. Increased labor costs in the U.S. and the complexities of establishing new domestic supply chains could offset some of the benefits of reduced tariffs. However, it could also foster innovation and improve supply chain resilience.

Increased Competition

Lower tariffs would inevitably lead to increased competition from Chinese goods in the U.S. market.

- Potential price wars: Increased competition could lead to price wars, potentially squeezing profit margins for American businesses.

- Increased pressure on domestic businesses: American companies will need to innovate, improve efficiency, and focus on value-added services to maintain market share.

- Need for innovation and efficiency improvements: Companies will need to constantly adapt and find ways to stay ahead of the competition.

The impact of increased competition will vary depending on the industry. Businesses with a cost advantage or those offering higher-quality or niche products will be better positioned to compete. Others may need to focus on specialization or seek strategic partnerships.

Impact on American Consumers

Reduced U.S.-China tariffs would have a direct and noticeable impact on American consumers.

Lower Prices for Goods

The most immediate impact would likely be lower prices for many consumer goods.

- Increased purchasing power: Lower prices would increase the purchasing power of consumers.

- Greater affordability of imported goods: Consumers would have access to a wider range of goods at more affordable prices.

- Potential for higher consumer spending: Increased disposable income could lead to increased consumer spending, boosting overall economic growth.

Examples of consumer goods significantly affected by tariffs include electronics, clothing, furniture, and toys. The potential savings for consumers could be substantial, depending on the extent of the tariff reduction.

Increased Choice and Variety

Consumers could see a wider selection of products available at lower prices.

- Greater consumer choice: A larger variety of products from China would be readily available.

- Access to a broader range of goods and services: This enhanced variety could cater to diverse consumer preferences and needs.

- Potential benefits for specific consumer segments: Certain demographics might benefit disproportionately from the increased availability of affordable goods.

This increased choice could reshape consumer preferences and spending habits. Consumers may switch to cheaper alternatives, potentially benefiting from better value and a broader range of product options.

Potential for Job Displacement (and Creation)

While lower prices benefit consumers, the increased competition might lead to job losses in some American industries. However, this isn't the complete picture.

- Potential for job displacement in manufacturing and other tariff-sensitive sectors: Businesses facing increased competition might need to reduce their workforce.

- Potential for job creation in logistics, retail, and other sectors: Increased economic activity due to higher consumer spending could create new jobs in other sectors.

It's crucial to note the complexities of job displacement and creation. While some jobs might be lost in tariff-sensitive industries, new opportunities could arise in other sectors. Government support for workforce retraining and adaptation is essential to manage this transition effectively.

Conclusion

Reduced U.S.-China tariffs would have multifaceted implications for both American businesses and consumers, impacting prices, supply chains, and competition. While consumers would likely benefit from lower prices and greater choice, businesses face both challenges and opportunities. Careful consideration of these complex factors is crucial.

Understanding the potential impact of changes in U.S.-China tariffs is critical for businesses to adapt and thrive. Stay informed on the latest developments in trade policy and their implications for your specific industry and the overall economy. Further research into the nuances of U.S.-China tariffs and their potential impact on various sectors is strongly recommended.

Featured Posts

-

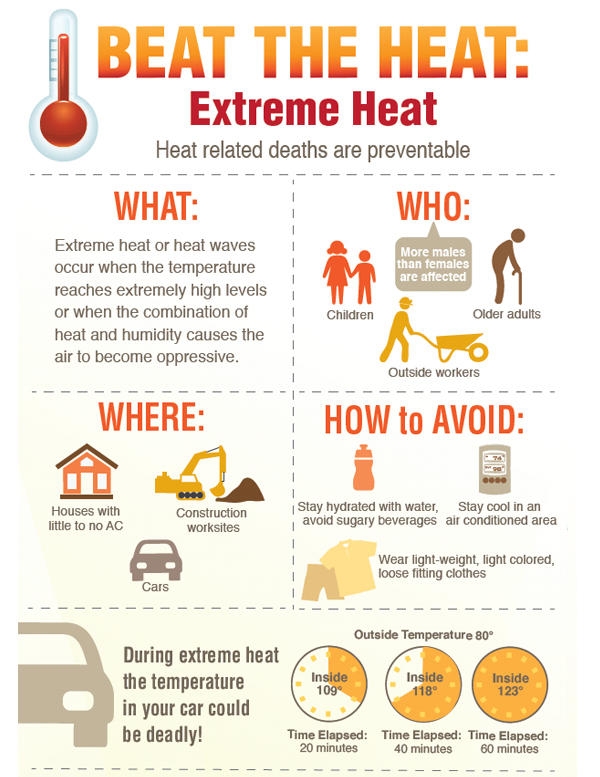

Paso Robles Heatwave Staying Safe During The Heat Advisory

May 13, 2025

Paso Robles Heatwave Staying Safe During The Heat Advisory

May 13, 2025 -

Flushed Away Where To Watch And Streaming Options

May 13, 2025

Flushed Away Where To Watch And Streaming Options

May 13, 2025 -

Arrest Made Man Threatens To Bomb Snl Allegedly Stalking Scarlett Johansson

May 13, 2025

Arrest Made Man Threatens To Bomb Snl Allegedly Stalking Scarlett Johansson

May 13, 2025 -

Liga Hannovers Derby Ersatz Und Die Angespannte Stimmung

May 13, 2025

Liga Hannovers Derby Ersatz Und Die Angespannte Stimmung

May 13, 2025 -

Semiconductor Etf Losses Investors Pre Surge Reactions Analyzed

May 13, 2025

Semiconductor Etf Losses Investors Pre Surge Reactions Analyzed

May 13, 2025