The Latest April Outlook Update: A Comprehensive Overview

Table of Contents

Key Economic Indicators for April

Understanding the April outlook requires a close examination of key economic indicators. These metrics offer valuable insights into the current state of the economy and help predict future trends.

Inflation Rates

Inflation continues to be a dominant theme. April's inflation rate, while showing signs of easing from the previous month's peak, remains a significant concern.

- Inflation Rate: [Insert specific April inflation rate data here, e.g., 4.2%] – a slight decrease compared to March's [Insert March inflation rate].

- Contributing Factors: Persistently high energy prices and ongoing supply chain disruptions continue to exert upward pressure on prices. Easing of these factors will be crucial for further inflation reduction.

- Comparison to Target Rates: The current inflation rate remains significantly above the central bank's target rate of [Insert target inflation rate], indicating the need for continued monetary policy adjustments.

Employment Figures

The employment market shows mixed signals. While job creation remains positive, other factors suggest caution.

- Job Creation: [Insert specific April job creation numbers here, e.g., 200,000 new jobs created]. This represents a [increase/decrease] compared to March.

- Unemployment Rate: The unemployment rate stands at [Insert April unemployment rate, e.g., 3.5%], indicating a [tight/loose] labor market.

- Sector-Specific Trends: The technology sector witnessed significant job growth, while the manufacturing sector experienced a slight decline. This divergence highlights the varied impacts of the current economic climate on different industries.

Consumer Confidence

Consumer confidence remains subdued, reflecting concerns about inflation and potential interest rate hikes.

- Consumer Confidence Index: The April Consumer Confidence Index stands at [Insert April consumer confidence index number, e.g., 98], a [increase/decrease] from the previous month.

- Contributing Factors: High inflation is the primary factor dampening consumer sentiment. Concerns about rising interest rates further contribute to uncertainty.

- Implications for Future Economic Growth: Weak consumer confidence could hinder future economic growth, as decreased spending impacts business investment and overall economic activity.

Interest Rate Predictions

The central bank is expected to maintain a cautious approach to interest rates in April.

- Potential Interest Rate Changes: Analysts predict a [increase/decrease/hold] in interest rates based on the latest economic data.

- Reasons Behind Potential Changes: The decision will largely depend on the inflation rate and its trajectory. The central bank aims to balance inflation control with maintaining economic growth.

- Impact on Borrowing Costs and Investment: Any change in interest rates will directly affect borrowing costs for businesses and consumers, potentially influencing investment decisions and overall economic activity.

Geopolitical Events and Their April Impact

Geopolitical instability significantly influences the global economic outlook. Understanding these dynamics is essential for accurate forecasting.

International Relations

Ongoing international tensions continue to impact global markets and supply chains.

- Specific Events and Their Impact: The ongoing conflict in [mention specific region/conflict] continues to disrupt global trade routes and energy supplies, leading to increased market volatility.

- Impact on Global Trade and Supply Chains: These disruptions lead to higher transportation costs and potential shortages of goods, influencing inflation and overall economic growth.

Political Developments

Significant political shifts in [mention specific region/country] could have far-reaching economic consequences.

- Specific Political Developments and Their Consequences: The recent political changes in [mention specific region/country] could impact investor confidence and potentially affect trade agreements and economic partnerships.

Industry-Specific April Outlooks

Different sectors experience varying impacts from economic and geopolitical developments. Let's examine a few key industries.

Technology Sector Outlook

The technology sector faces a mixed outlook for April.

- Key Trends: Increased demand for AI-related technologies is driving innovation and investment. However, concerns about a potential slowdown in consumer spending could impact growth.

- Potential Challenges and Opportunities: Competition remains fierce, while regulatory changes could pose additional challenges. However, long-term growth potential remains strong due to technological advancements and increasing digital adoption.

Energy Sector Outlook

The energy sector continues to be a source of both opportunity and uncertainty.

- Price Predictions: Oil prices are expected to remain volatile in April due to ongoing geopolitical tensions and fluctuations in global demand.

- Supply Chain Analysis: Supply chain disruptions continue to impact energy production and distribution, leading to price increases.

- Geopolitical Factors: The ongoing conflict in [mention specific region/conflict] continues to be a major factor influencing global energy prices and supply.

Conclusion

This April Outlook Update highlights the complex interplay of economic indicators, geopolitical events, and industry-specific trends. Inflation remains a primary concern, while employment figures show mixed signals. Geopolitical instability impacts global supply chains and energy prices. The technology sector shows promise, while the energy sector remains volatile. Staying informed about these evolving factors is crucial for navigating the current economic climate. Stay ahead of the curve and prepare for the May Outlook Update by subscribing to our newsletter today! Check back regularly for our monthly economic outlook, market outlook, or industry-specific updates.

Featured Posts

-

Hugh Jackman Dragged Into Blake Livelys Legal Battle Fan Outrage Ensues

May 28, 2025

Hugh Jackman Dragged Into Blake Livelys Legal Battle Fan Outrage Ensues

May 28, 2025 -

Piratska Strana Odchod Peksy A Jeho Dusledky

May 28, 2025

Piratska Strana Odchod Peksy A Jeho Dusledky

May 28, 2025 -

Privacy Regulator Highlights Data Leak Risk From New Cabinet Rules

May 28, 2025

Privacy Regulator Highlights Data Leak Risk From New Cabinet Rules

May 28, 2025 -

Kyle Stowers Walk Off Grand Slam Marlins Win Stowers Stays Hot

May 28, 2025

Kyle Stowers Walk Off Grand Slam Marlins Win Stowers Stays Hot

May 28, 2025 -

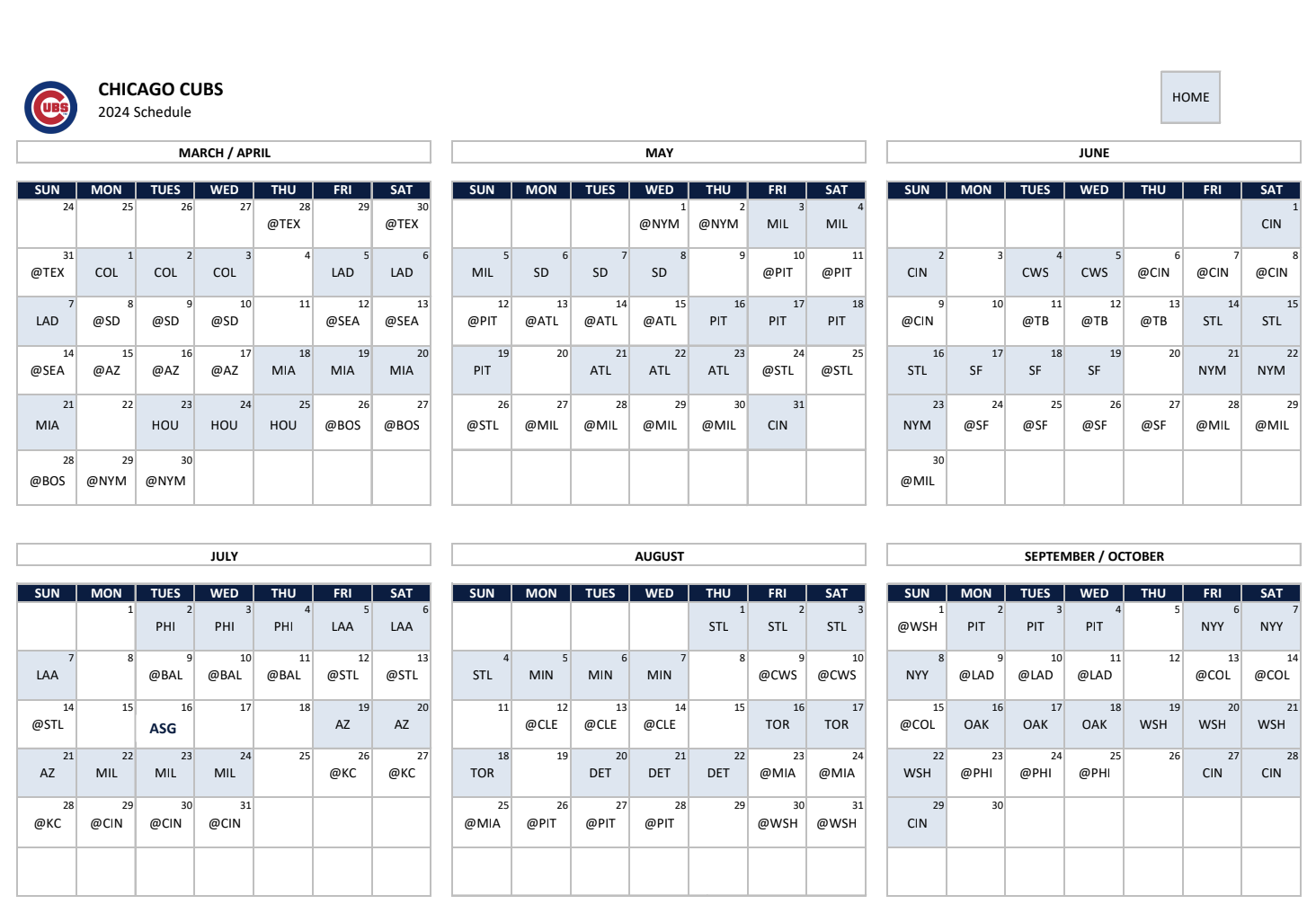

San Diego Padres Preparing For The 2025 Cubs Home Opener

May 28, 2025

San Diego Padres Preparing For The 2025 Cubs Home Opener

May 28, 2025