The Lesson In Buffett's Winning Apple Bet

Table of Contents

Understanding Buffett's Investment Philosophy and its Application to Apple

Warren Buffett's core investment philosophy centers around value investing. This approach emphasizes identifying undervalued companies with strong fundamentals and a long-term perspective, focusing on their intrinsic value rather than short-term market fluctuations. Berkshire Hathaway's investment strategy is a testament to this philosophy, and the Apple investment perfectly exemplifies its application. Buffett didn't just jump on the Apple bandwagon; he saw something deeper.

-

Apple's strong brand and ecosystem (its "moat"): Apple boasts an unparalleled brand loyalty and a tightly integrated ecosystem encompassing hardware, software, and services. This creates a significant competitive advantage, making it difficult for competitors to gain market share. This "moat," as Buffett often describes it, protects Apple's profitability.

-

Apple's consistent profitability and cash flow generation: Years of consistent profitability and robust free cash flow generation demonstrated Apple's financial strength and sustainability, crucial factors in Buffett's investment calculus. Analyzing Apple's financial statements revealed a company built for the long haul.

-

Buffett's recognition of Apple's underestimated long-term potential: While many investors focused on short-term market trends, Buffett recognized Apple's potential for long-term growth and market dominance in the technology sector. This highlights the importance of a long-term investment horizon.

The Role of Patience and Discipline in Long-Term Investing

Buffett's Apple investment underscores the crucial role of patience and discipline in successful long-term investing. It wasn't a quick trade; it was a long-term commitment. This approach allowed Berkshire Hathaway to ride out short-term market volatility and capitalize on Apple's sustained growth.

-

Resisting the urge to trade based on short-term market noise: The stock market is inherently volatile. Ignoring daily fluctuations and focusing on the long-term potential of a company is key.

-

The benefits of a buy-and-hold strategy: A buy-and-hold strategy, where investments are held for an extended period, minimizes transaction costs and allows investors to benefit from compounding returns.

-

Overcoming emotional biases in investment decision-making: Emotional investing, driven by fear and greed, often leads to poor decisions. A disciplined approach, focused on fundamentals, helps mitigate these biases.

Analyzing Apple's Intrinsic Value and its Implications for Investors

Buffett likely used various methods, including discounted cash flow (DCF) analysis, to determine Apple's intrinsic value. This involved analyzing Apple's financial statements, projecting future cash flows, and discounting them back to their present value. Understanding a company's financials is essential for making sound investment decisions.

-

Analyzing Apple's revenue streams and profit margins: Examining Apple's diverse revenue streams (iPhone, services, wearables, etc.) and healthy profit margins provided insights into its financial health and growth potential.

-

Assessing Apple's balance sheet strength: A strong balance sheet, reflecting Apple's substantial cash reserves and low debt, further solidified its investment appeal.

-

Understanding the key metrics that indicate a company's long-term health: Investors should focus on metrics such as return on equity (ROE), revenue growth, and debt-to-equity ratio to assess a company's long-term health and sustainability.

Lessons Learned and Practical Applications for Individual Investors

Buffett's Apple investment provides invaluable lessons for individual investors looking to achieve long-term growth. It’s not just about picking a winning stock; it's about understanding the underlying principles of successful investing.

-

The importance of thorough due diligence before investing in any company: Before investing, conduct comprehensive research to understand the company's business model, financial performance, and competitive landscape.

-

The benefits of focusing on quality companies with sustainable competitive advantages: Invest in companies with strong brands, defensible moats, and consistent profitability.

-

The power of long-term investing and patience: Avoid short-term market timing and focus on the long-term growth potential of your investments.

-

The need for diversification in your investment portfolio: Diversification reduces risk by spreading investments across different asset classes and sectors.

Conclusion

Buffett's Apple bet highlights the importance of value investing, patience, discipline, and thorough due diligence in building a successful long-term investment strategy. Focusing on high-quality companies with sustainable competitive advantages, much like Apple, offers the best path to long-term growth. Learn from the success of Buffett's Apple bet and start building your own successful long-term investment strategy today. Research companies that exhibit the characteristics of a strong, long-term investment. Remember, consistent effort and a focus on long-term value are key to successful investing. Don't miss out on the lessons from this incredible investment – learn more about value investing and the secrets of Buffett's winning Apple bet!

Featured Posts

-

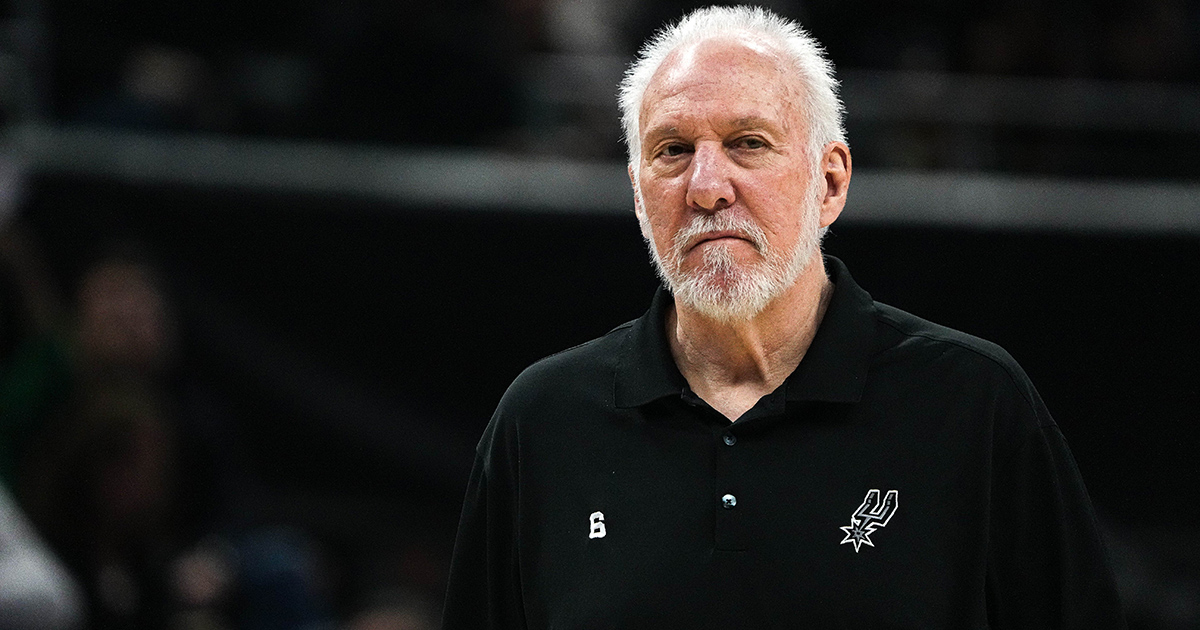

Gregg Popovich Uncertain Future With The San Antonio Spurs

May 06, 2025

Gregg Popovich Uncertain Future With The San Antonio Spurs

May 06, 2025 -

Rihannas Savage X Fenty Lingerie For The Bride

May 06, 2025

Rihannas Savage X Fenty Lingerie For The Bride

May 06, 2025 -

Sabrina Carpenter Fortnite Skin Nsfw Controversy Explained

May 06, 2025

Sabrina Carpenter Fortnite Skin Nsfw Controversy Explained

May 06, 2025 -

Fhm Ndae Alhjylan Rwyt Lthqyq Alslam Fy Alymn

May 06, 2025

Fhm Ndae Alhjylan Rwyt Lthqyq Alslam Fy Alymn

May 06, 2025 -

Koetue Koku Sorunu Itibari Nasil Korursunuz

May 06, 2025

Koetue Koku Sorunu Itibari Nasil Korursunuz

May 06, 2025