The Looming Bond Crisis: Implications For Investors

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

Inverse Relationship Between Interest Rates and Bond Prices

Bonds and interest rates share an inverse relationship: as interest rates rise, bond prices fall, and vice versa. This is because newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. This price decrease is especially pronounced for longer-maturity bonds due to their greater sensitivity to interest rate changes.

- Example: A bond with a 2% coupon rate will become less appealing if new bonds are issued with a 4% coupon rate. The price of the 2% bond will need to adjust downwards to compete.

- Impact on Bond Types: Government bonds, generally considered safer, are affected, though often less dramatically than corporate bonds, which carry additional credit risk.

- Duration Risk: Longer-duration bonds (bonds with longer maturities) are more sensitive to interest rate changes than shorter-duration bonds. Investors should consider duration risk when evaluating their bond portfolios.

The Federal Reserve's Tightening Monetary Policy

Central banks, particularly the US Federal Reserve (the Fed), are aggressively raising interest rates to combat inflation. This tightening monetary policy aims to cool down the economy by making borrowing more expensive.

- Inflation Control: The primary goal is to reduce inflation by slowing economic growth. Higher interest rates make it more expensive for businesses to invest and for consumers to spend, thus reducing demand-pull inflation.

- Unintended Consequences: While necessary to control inflation, rising interest rates can negatively impact bond markets, potentially leading to a bond crisis, especially if the increases are too rapid or sustained for too long.

- Quantitative Tightening (QT): The Fed's quantitative tightening (QT) program, which involves reducing its balance sheet by allowing bonds to mature without reinvestment, further adds pressure to bond markets.

Impact on Bond Yields

Rising interest rates directly lead to higher bond yields on newly issued bonds. However, existing bonds with lower coupon rates experience price declines to adjust their yields to market levels.

- Recent Yield Changes: We've seen a significant increase in bond yields across various maturities in recent months, reflecting the Fed's actions and inflation concerns.

- Implications for Different Bond Maturities: Longer-maturity bonds are generally more sensitive to yield changes, leading to greater price fluctuations. Short-term bonds offer some protection, as their yields adjust more quickly to changes in the market.

Inflation's Erosive Effect on Bond Returns

Inflation's Impact on Purchasing Power

Inflation erodes the purchasing power of fixed-income investments like bonds. If inflation rises faster than the bond's yield, the real return (adjusted for inflation) will be negative.

- Example: A bond yielding 3% will have a negative real return if inflation is 5%. The investor's purchasing power will decrease even though they receive a positive nominal return.

- Real Yield vs. Nominal Yield: Investors should focus on real yield, which accounts for inflation, rather than nominal yield, which represents the stated interest rate.

The Correlation Between Inflation and Interest Rates

Inflation and interest rates are closely correlated. High inflation typically prompts central banks to raise interest rates to control price increases.

- Central Bank Response: Central banks aim to keep inflation within a target range. They raise rates to slow economic activity and dampen inflation pressures.

- Impact on Bond Valuations: This increase in interest rates negatively impacts bond valuations, creating further downward pressure on prices.

Inflation Expectations and Bond Markets

Investor expectations about future inflation significantly influence current bond prices. If investors anticipate higher inflation, they demand higher yields to compensate for the expected erosion of purchasing power.

- Inflation Breakevens: Inflation breakevens, derived from the difference between nominal and inflation-indexed bond yields, provide insights into market expectations for future inflation.

Geopolitical Risks and Their Influence on Bond Markets

The Impact of Geopolitical Uncertainty

Geopolitical events, such as wars, political instability, and trade disputes, significantly influence investor sentiment and bond markets. Uncertainty often leads to a "flight to safety," where investors move money into perceived safe haven assets like government bonds.

- Examples: The war in Ukraine and escalating US-China tensions have created significant uncertainty, impacting global bond markets.

- Flight to Safety: During times of heightened geopolitical risk, investors tend to flock to government bonds perceived as safe havens, temporarily increasing their demand and potentially pushing yields down.

Diversification Strategies in a Turbulent Global Environment

To mitigate geopolitical risks, investors should adopt a diversified portfolio strategy, including asset classes less correlated with bonds.

- Asset Class Diversification: Consider adding equities, real estate, commodities, or alternative investments to reduce overall portfolio volatility. The optimal mix will depend on individual risk tolerance and investment goals.

Credit Risk and Sovereign Debt

Geopolitical uncertainty increases credit risk, especially for corporate bonds and sovereign debt. Countries facing political instability or economic challenges may struggle to meet their debt obligations.

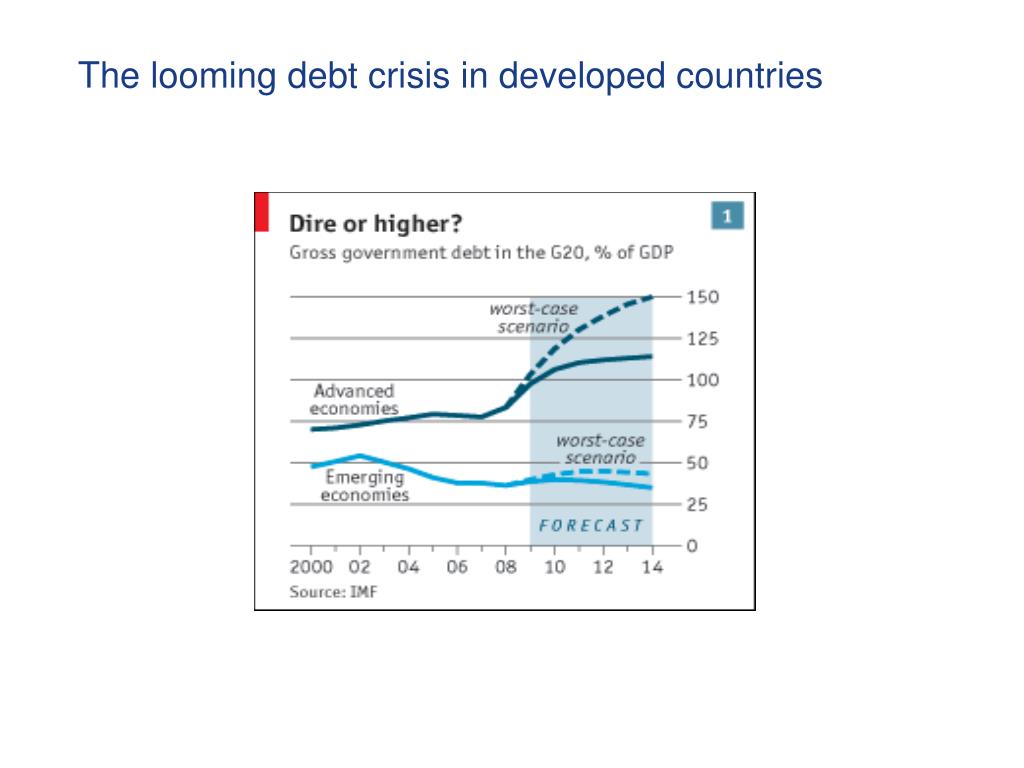

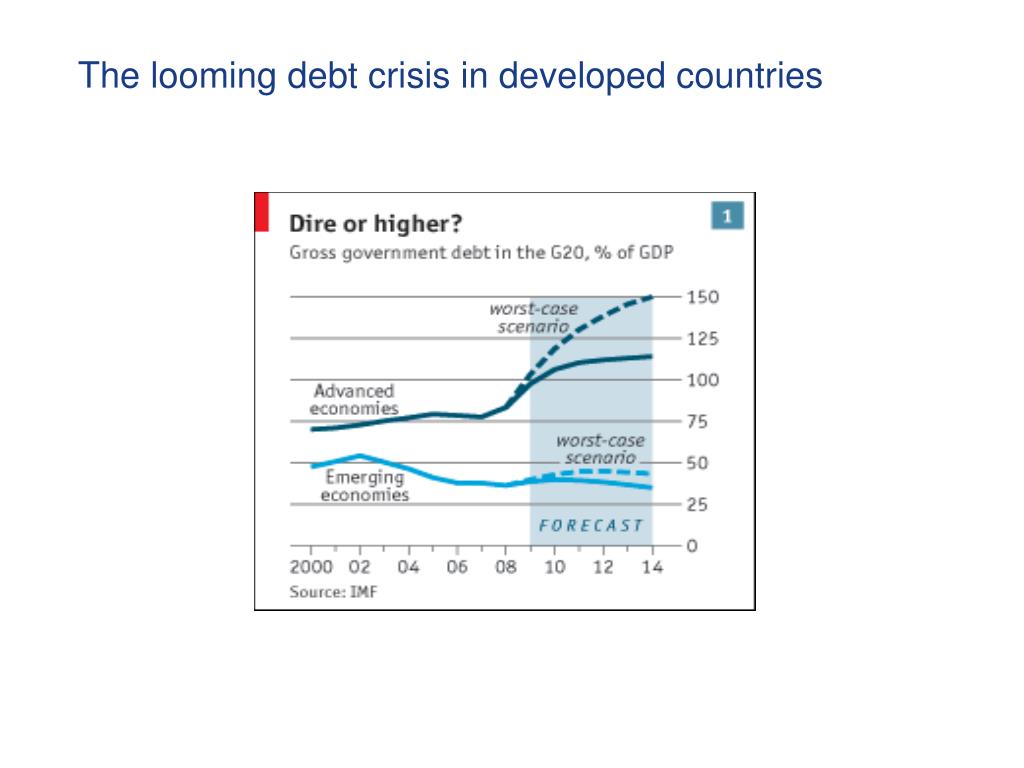

- High Sovereign Debt: Countries with high levels of sovereign debt are particularly vulnerable during periods of economic stress. This could lead to sovereign debt defaults, impacting the value of their bonds.

Conclusion

The potential for a significant bond crisis is real, driven by a confluence of rising interest rates, persistent inflation, and considerable geopolitical uncertainty. Investors must carefully assess their portfolios' exposure to bond risk and consider diversifying to mitigate potential losses. Understanding the inverse relationship between interest rates and bond prices, inflation's impact on real returns, and the influence of geopolitical factors is crucial for navigating this challenging environment. Proactive portfolio management, including exploring alternative investment strategies, is essential to successfully weather this looming bond crisis. Take control of your investments and plan for the potential consequences of a bond market crisis today.

Featured Posts

-

Jacqie Rivera Y Mas Artistas Latinos En Ascenso Descubre El Talento Del Momento

May 29, 2025

Jacqie Rivera Y Mas Artistas Latinos En Ascenso Descubre El Talento Del Momento

May 29, 2025 -

Malaga Plays Host Robbie Williams At Mein Schiff Relax Christening

May 29, 2025

Malaga Plays Host Robbie Williams At Mein Schiff Relax Christening

May 29, 2025 -

U S Student Visa Interviews Paused Increased Screening Procedures Announced

May 29, 2025

U S Student Visa Interviews Paused Increased Screening Procedures Announced

May 29, 2025 -

Did Bryan Cranstons X Files Role Influence Breaking Bad

May 29, 2025

Did Bryan Cranstons X Files Role Influence Breaking Bad

May 29, 2025 -

New Guidelines For Diagnosing Preventing And Treating Long Covid In Canada

May 29, 2025

New Guidelines For Diagnosing Preventing And Treating Long Covid In Canada

May 29, 2025

Latest Posts

-

Obituary Bernard Kerik Former Nypd Commissioner 1955 2024

May 31, 2025

Obituary Bernard Kerik Former Nypd Commissioner 1955 2024

May 31, 2025 -

Bernard Kerik Reflecting On His Service After 9 11

May 31, 2025

Bernard Kerik Reflecting On His Service After 9 11

May 31, 2025 -

Former Nypd Commissioner Bernard Kerik His 9 11 Contributions

May 31, 2025

Former Nypd Commissioner Bernard Kerik His 9 11 Contributions

May 31, 2025 -

Death Of Bernard Kerik Remembering The Nypd Commissioner During 9 11

May 31, 2025

Death Of Bernard Kerik Remembering The Nypd Commissioner During 9 11

May 31, 2025 -

Assessing Bernard Keriks Leadership Following The 9 11 Attacks

May 31, 2025

Assessing Bernard Keriks Leadership Following The 9 11 Attacks

May 31, 2025