The Paradox Of Trump And Cheap Oil: A Critical Analysis

Table of Contents

Trump's Energy Policies and Their Intended Impact on Oil Prices

The Trump administration's energy policy was characterized by a strong emphasis on domestic energy production, particularly oil and natural gas. The intended impact was a boost in US energy independence and, potentially, higher oil prices due to increased domestic supply.

Increased Domestic Oil Production

The administration's focus on deregulation significantly impacted shale oil production.

- Reduced environmental regulations: Easing environmental restrictions on drilling and fracking eased the permitting process and reduced operational costs, leading to increased production.

- Streamlining permitting processes: Faster approvals for drilling permits allowed energy companies to bring new wells online more quickly.

- Promotion of fossil fuel exploration: The administration actively promoted the exploration and development of fossil fuels, sending a clear signal to the industry to invest further.

This combination of factors was anticipated to increase the overall supply of oil, potentially leading to a downward pressure on global prices, although the intention was primarily to boost domestic production and reduce reliance on foreign oil.

Opposition to International Agreements

The withdrawal from the Paris Agreement on climate change significantly altered the global landscape regarding energy policy.

- Impact on international cooperation regarding climate change: The withdrawal signaled a reduced commitment to transitioning away from fossil fuels, potentially impacting long-term global demand.

- Potential reduction in global efforts to reduce fossil fuel consumption: This decision weakened international efforts to curb greenhouse gas emissions, which indirectly could have supported continued high demand for oil in the short-to-medium term.

- Effect on long-term oil demand projections: While the immediate effect might not be drastic, a lack of significant international commitment to reducing fossil fuel consumption could have influenced long-term oil demand projections.

Sanctions and Geopolitical Factors

The imposition of sanctions on oil-producing nations like Iran and Venezuela created significant geopolitical ripple effects.

- Disruption of supply chains: Sanctions disrupted the flow of oil from these nations, temporarily tightening global supply and potentially impacting prices upward.

- Potential price volatility due to geopolitical instability: The inherent instability associated with sanctions created uncertainty in the market, contributing to price volatility.

- Impact on global oil markets: The reduction in supply from sanctioned nations, coupled with increased US production, created a complex dynamic within global oil markets.

Unexpected Factors Contributing to Cheap Oil

While Trump's policies aimed to influence oil prices, several unforeseen factors contributed to periods of relatively cheap oil.

Global Economic Slowdown

Slower economic growth in several major economies played a crucial role in reducing global oil demand.

- Reduced industrial activity: Slower economic growth led to decreased industrial activity and subsequently lower demand for energy.

- Lower transportation fuel consumption: Reduced economic activity resulted in decreased transportation and consequently, lower consumption of gasoline and diesel.

- Impact on overall oil consumption: The combined effect of these factors significantly reduced the overall global demand for oil, pushing prices down.

Technological Advancements

Continued technological advancements in oil extraction and refining also influenced prices.

- Increased efficiency in extraction: Improved techniques, particularly in fracking, led to more efficient extraction of oil from shale formations.

- Lower production costs: Technological advancements resulted in lower production costs, enabling oil producers to maintain profitability even at lower prices.

- Impact on global oil market dynamics: These efficiency gains helped maintain a relatively high oil supply even with periods of reduced demand.

OPEC's Role

The Organization of the Petroleum Exporting Countries (OPEC) also played a significant role, often making decisions that counteracted some of the expected effects of Trump’s policies.

- OPEC production quotas: OPEC's decisions regarding production quotas significantly impacted global oil supply and prices.

- Market share competition: Increased US oil production presented a challenge to OPEC's market share, influencing their strategic production decisions.

- Influence on global oil prices: OPEC's choices frequently acted as a balancing force in the global oil market, sometimes working in tandem with and sometimes counter to US policy effects.

The Paradox Resolved: A Critical Assessment

The relationship between "Trump and cheap oil" is far from straightforward. While the administration's policies aimed to increase domestic oil production and potentially drive up prices, a confluence of other factors – including a global economic slowdown, technological advancements, and OPEC's strategic decisions – resulted in periods of relatively low oil prices. It's inaccurate to attribute low oil prices solely to Trump's policies; rather, it was a complex interplay of various domestic and international elements. The long-term implications of these policies and price fluctuations remain to be fully understood, but they highlight the limitations of using domestic policy alone to drastically influence global commodity prices.

Conclusion

In summary, the relationship between Trump's presidency and oil prices presents a compelling case study in the complexities of global energy markets. The intended consequences of the administration's pro-energy policies were counterbalanced by unexpected factors such as global economic shifts and technological advancements. Understanding the paradox of "Trump and cheap oil" requires a nuanced understanding of these interconnected elements. The key takeaway is that while Trump’s policies aimed to increase domestic oil production, other forces, both internal and external, resulted in periods of relatively low oil prices. To further enrich your understanding of this dynamic relationship, we encourage further research into the relationship between Trump's energy policies and global oil prices, furthering the conversation on the intricacies of energy markets and their interaction with national policy.

Featured Posts

-

Celtics Pritchard Signs With Converse New Shoe Deal Announced

May 12, 2025

Celtics Pritchard Signs With Converse New Shoe Deal Announced

May 12, 2025 -

Irish Golfer Shane Lowry Viral Video Sparks American Fan Debate

May 12, 2025

Irish Golfer Shane Lowry Viral Video Sparks American Fan Debate

May 12, 2025 -

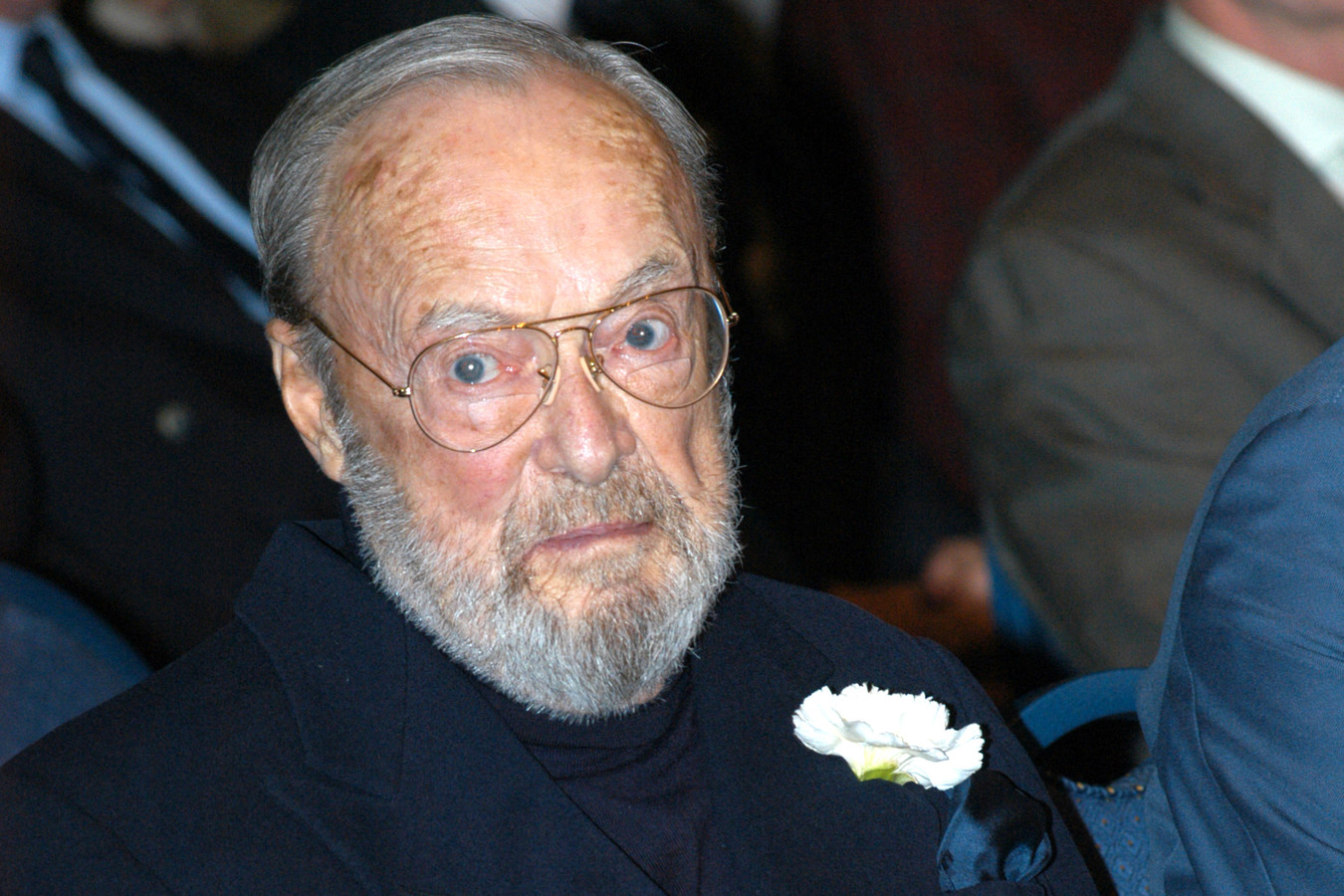

John Wick 5 Death Rumors Debunked Keanu Reeves Returns Says Lionsgate

May 12, 2025

John Wick 5 Death Rumors Debunked Keanu Reeves Returns Says Lionsgate

May 12, 2025 -

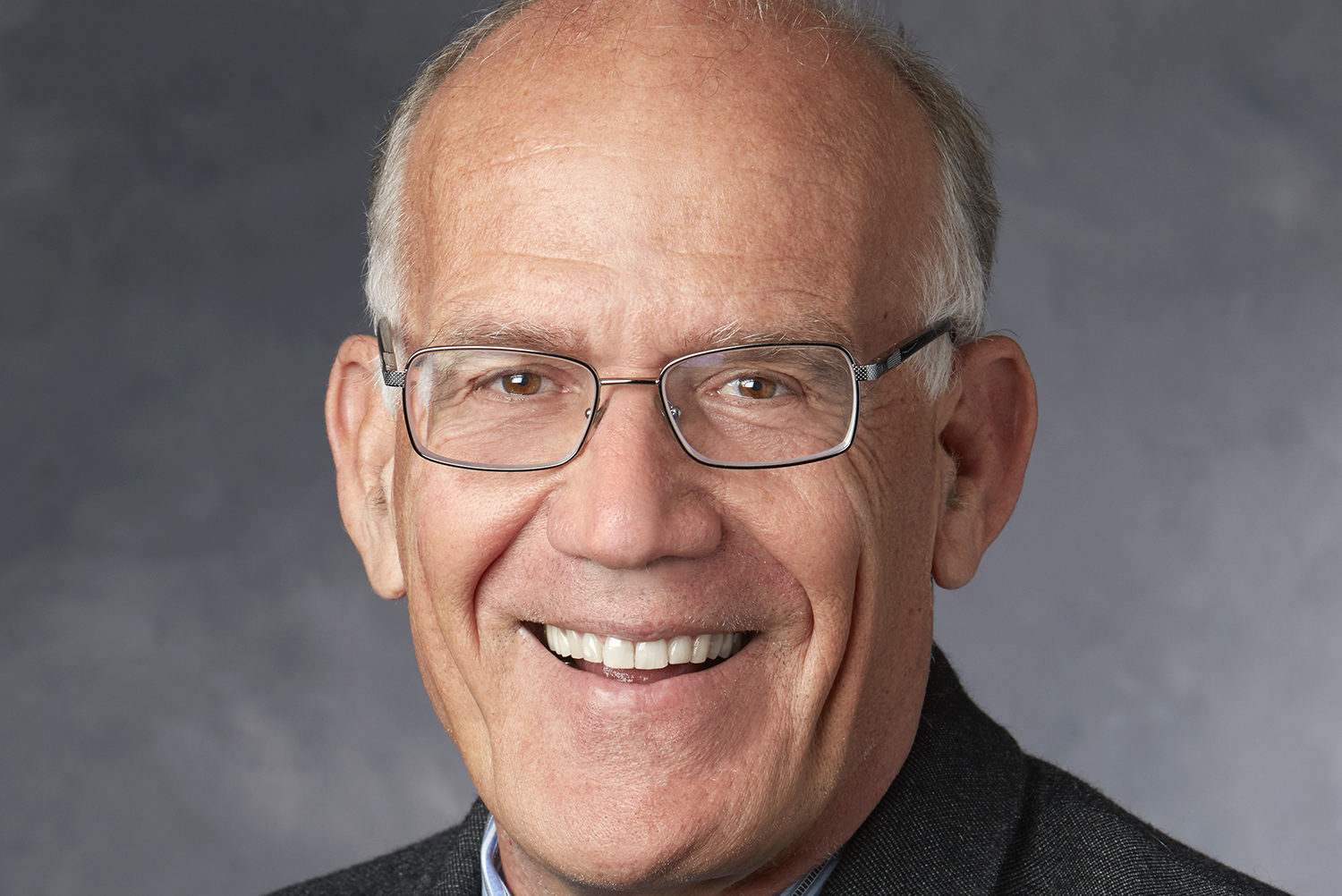

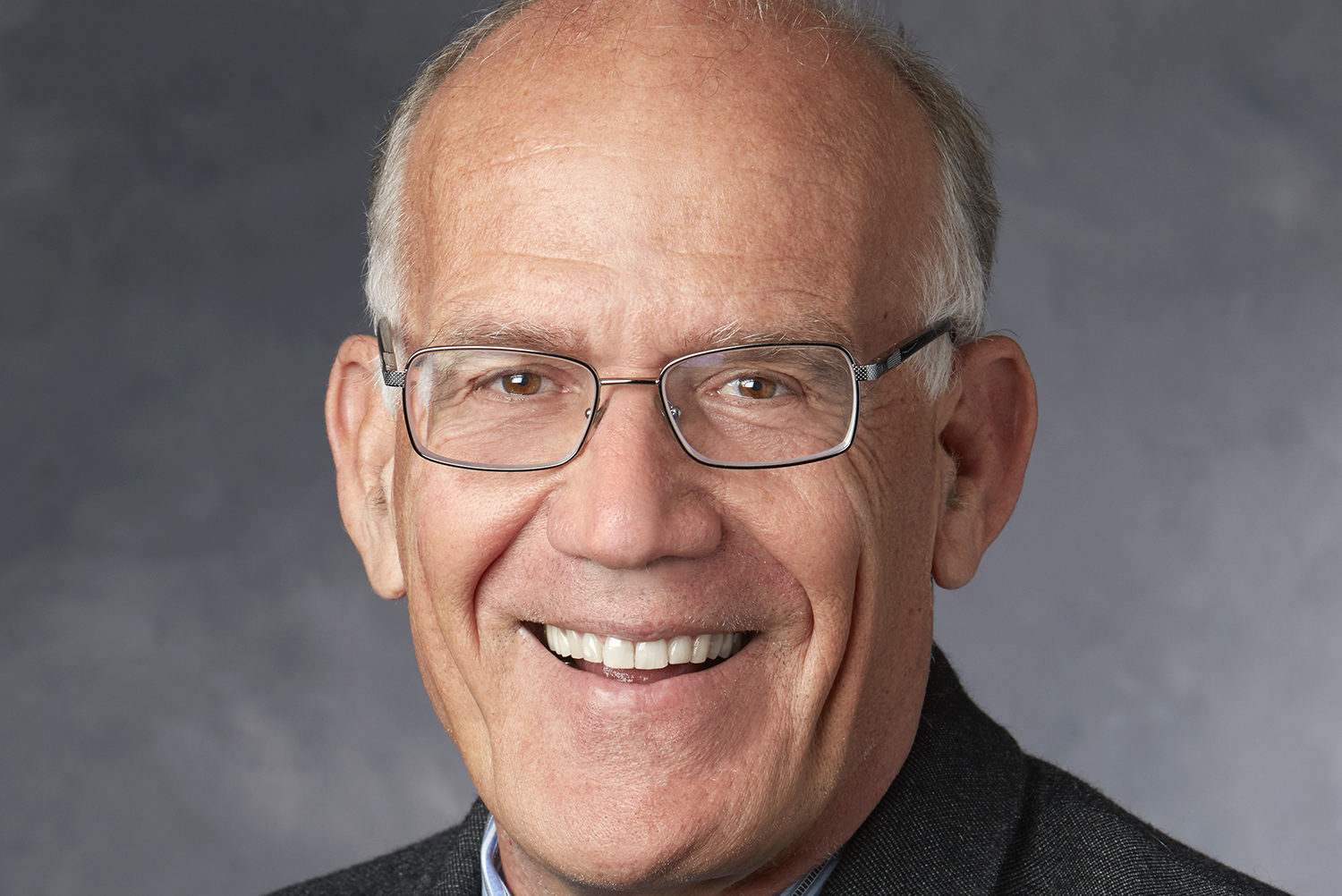

Senator Collins Prepares For 2026 Re Election The Democratic Challenge Looms

May 12, 2025

Senator Collins Prepares For 2026 Re Election The Democratic Challenge Looms

May 12, 2025 -

Thomas Mueller Vertrekt Het Bittere Einde Van Een Bayern Legende

May 12, 2025

Thomas Mueller Vertrekt Het Bittere Einde Van Een Bayern Legende

May 12, 2025

Latest Posts

-

Cubs Game 25 2025 Heroes And Goats Of The Match

May 13, 2025

Cubs Game 25 2025 Heroes And Goats Of The Match

May 13, 2025 -

2025 Chicago Cubs Game 16 A Performance Review

May 13, 2025

2025 Chicago Cubs Game 16 A Performance Review

May 13, 2025 -

Yamamoto And Edman Power Dodgers To 3 0 Win Against Cubs

May 13, 2025

Yamamoto And Edman Power Dodgers To 3 0 Win Against Cubs

May 13, 2025 -

6 Mlb 2 1

May 13, 2025

6 Mlb 2 1

May 13, 2025 -

Cubs Game 16 Heroes And Goats Of 2025

May 13, 2025

Cubs Game 16 Heroes And Goats Of 2025

May 13, 2025