The Posthaste Implications Of The New Tariff Ruling For Canadian Businesses

Table of Contents

Increased Import Costs and Supply Chain Disruptions

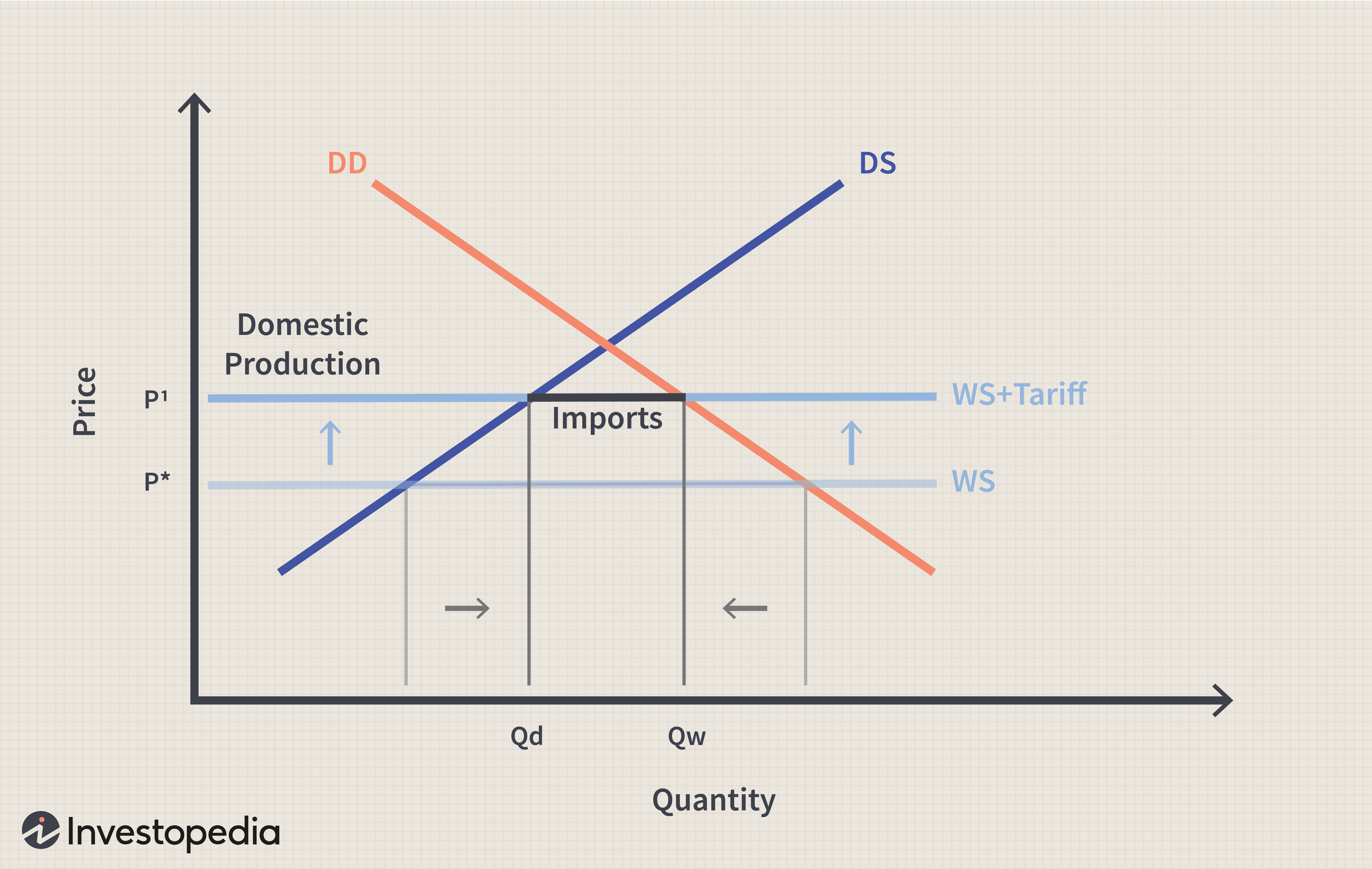

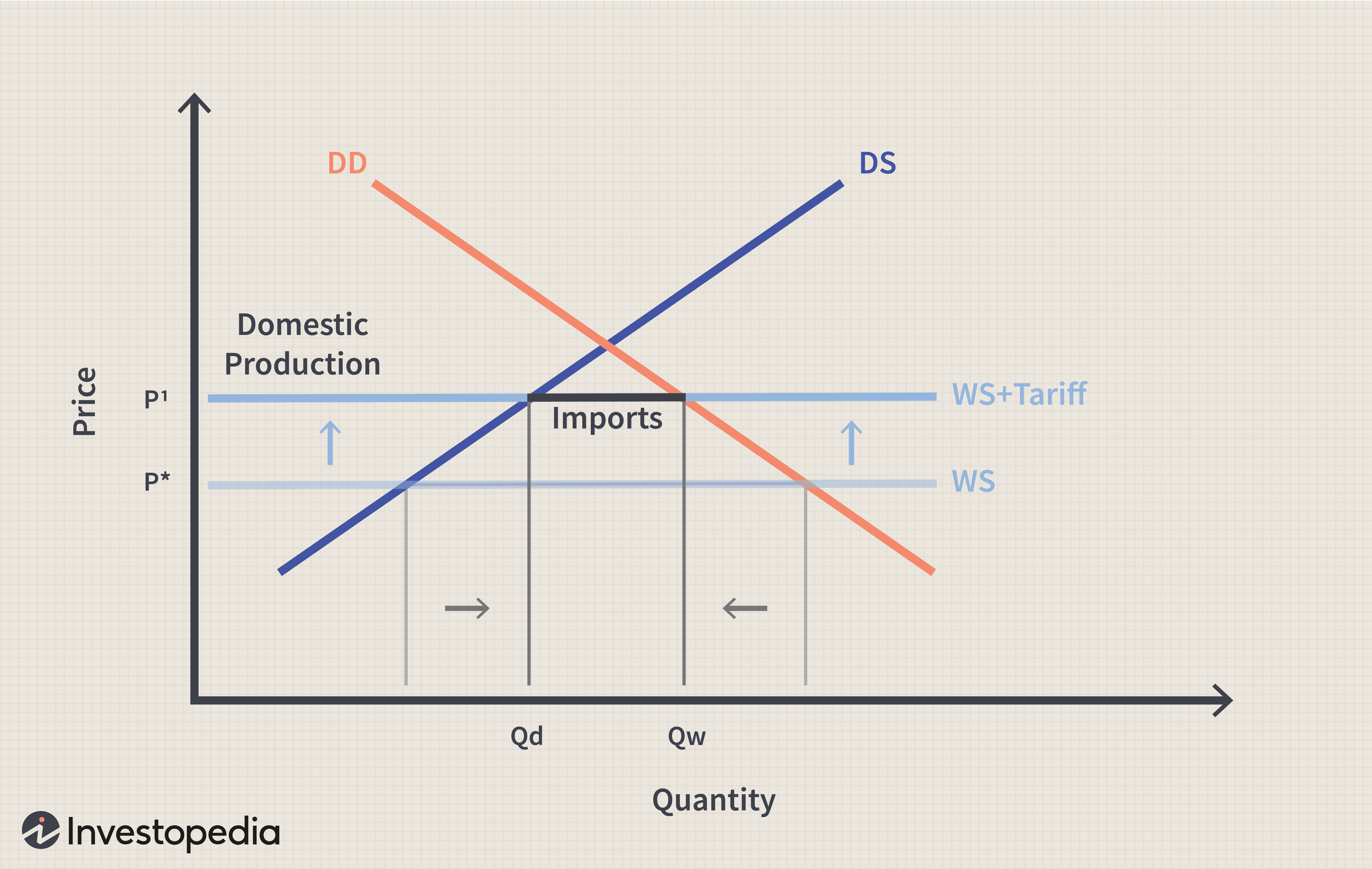

The new tariff ruling directly translates to significantly increased import costs for Canadian businesses. This increase impacts profitability margins across various sectors, from manufacturing and retail to agriculture and technology. Higher tariffs mean businesses face a difficult choice: absorb the increased costs, reducing profitability, or pass them on to consumers, potentially impacting sales volumes.

-

Higher tariffs directly translate to increased costs for imported goods: This is the most immediate and impactful consequence. Businesses relying on imported raw materials, components, or finished goods will see their input costs rise sharply.

-

Supply chain disruptions are likely: Businesses may struggle to find alternative suppliers offering comparable quality and price, leading to delays and shortages. Renegotiating existing contracts may be challenging, especially in a volatile global market.

-

Businesses may need to explore alternative sourcing strategies: This often means longer lead times, increased logistics costs, and potential quality control challenges. Diversification of supply sources becomes crucial to mitigate risk.

-

The impact will be felt across various sectors: Industries heavily reliant on imported goods, such as automotive manufacturing, electronics, and textiles, will be particularly vulnerable. The ripple effect could impact numerous related businesses.

-

Inflationary pressures are expected to intensify: As businesses pass on increased costs to consumers, inflation is likely to increase, potentially impacting consumer spending and overall economic growth. This necessitates careful pricing strategies and financial planning.

Challenges to Canadian Exports and International Competitiveness

The new tariffs don't just affect imports; they also pose significant challenges to Canadian exports and international competitiveness. Increased production costs due to higher input prices make Canadian goods less attractive in global markets. Furthermore, the ruling may invite retaliatory tariffs from other countries, further hindering export opportunities.

-

The new tariffs could trigger retaliatory measures: Other countries may impose their own tariffs on Canadian goods, creating a trade war scenario that harms both exporting and importing businesses. This necessitates a proactive approach to international trade relations.

-

Canadian businesses may face reduced competitiveness: Higher production costs make Canadian goods less price-competitive compared to those from countries without similar tariff burdens. This necessitates a focus on differentiation and value-added products.

-

Access to key international markets could be restricted: Reduced competitiveness and retaliatory tariffs can significantly impact market access, hindering growth and expansion plans for Canadian businesses. Market diversification becomes essential.

-

Trade negotiations and agreements may become more complex: The new tariffs complicate existing trade agreements and necessitate careful navigation of international trade policies and regulations. Strong diplomatic engagement becomes crucial.

-

Businesses need to reassess their international market strategies: Diversification of export markets, focusing on regions less affected by the tariffs, is essential for mitigating risk and ensuring continued growth.

Strategic Responses for Canadian Businesses

Canadian businesses must adopt proactive strategies to mitigate the negative impacts of the new tariff ruling. This involves a combination of cost reduction measures, supply chain diversification, and engagement with government support programs.

-

Conduct a thorough cost analysis: Identify areas for potential cost reduction and efficiency gains to offset the increased import costs. This could involve streamlining operations, negotiating better deals with suppliers, or improving internal processes.

-

Diversify supply chains: Explore alternative suppliers and sourcing options to reduce reliance on a single source and mitigate risks associated with supply chain disruptions. This also involves geographically diversifying suppliers.

-

Invest in innovation and technological advancements: Improve productivity and reduce reliance on imported goods by investing in automation, technology, and research and development. This focus on innovation will increase long-term competitiveness.

-

Explore government support programs and incentives: Several government programs aim to help businesses navigate the challenges posed by new tariffs. Research and apply for relevant financial assistance, tax breaks, or export support programs.

-

Engage in lobbying efforts: Advocate for policy changes that support Canadian businesses by engaging with government officials and industry associations. This proactive approach is essential for creating a more favorable business environment.

The Role of Government Support and Policy

Government intervention is crucial for helping Canadian businesses navigate this challenging environment. Targeted support programs, clear communication, and proactive policy adjustments are vital for mitigating the negative impacts of the new tariff ruling.

-

Government initiatives to help businesses are crucial: Financial aid, tax breaks, and export support programs can significantly alleviate the burden on businesses. These initiatives must be timely, targeted, and effective.

-

Financial aid, tax breaks, and export support programs: These measures can provide much-needed relief and help businesses adapt to the changing market conditions. Easy access to these programs is essential.

-

Clear communication and transparent policy frameworks: Businesses need clear information and guidance to understand the implications of the tariff ruling and effectively plan their responses. This involves timely and easily accessible information.

Conclusion:

The new tariff ruling presents significant challenges to Canadian businesses, impacting import costs, export opportunities, and overall competitiveness. Understanding the posthaste implications and adopting proactive strategic responses are crucial for survival and continued growth. By carefully assessing risks, diversifying operations, and leveraging available government support, Canadian businesses can navigate this challenging landscape and position themselves for long-term success. Don't wait – proactively assess the impact of this new tariff ruling on your business and develop a robust plan to mitigate the risks. Take control of your future and understand the posthaste implications of the new tariff ruling for your Canadian business today.

Featured Posts

-

Forgotten Wife Unforgettable Cost Constance Wilde And Oscars World

May 31, 2025

Forgotten Wife Unforgettable Cost Constance Wilde And Oscars World

May 31, 2025 -

Do Algorithms Contribute To Mass Shooter Radicalization Holding Tech Companies Accountable

May 31, 2025

Do Algorithms Contribute To Mass Shooter Radicalization Holding Tech Companies Accountable

May 31, 2025 -

Vatican City To Host Giro D Italia Cyclists Pope Leo Xivs Greeting

May 31, 2025

Vatican City To Host Giro D Italia Cyclists Pope Leo Xivs Greeting

May 31, 2025 -

2025 Love Moto Stop Cancer Online Auction Now Live

May 31, 2025

2025 Love Moto Stop Cancer Online Auction Now Live

May 31, 2025 -

Podcast Forget Everything You Know About Money

May 31, 2025

Podcast Forget Everything You Know About Money

May 31, 2025