The Price Of Luxury: Determining Your Watch Spending Limit

Table of Contents

Assessing Your Current Financial Situation

Before you even begin browsing luxury watch catalogs, a thorough assessment of your finances is crucial. This isn't about denying yourself a splurge; it's about responsible luxury.

Understanding Your Disposable Income

Determining your watch spending limit starts with understanding your financial health.

- Calculate your net income: Subtract taxes, essential expenses (rent/mortgage, utilities, groceries, transportation), and loan repayments from your gross income. This reveals your disposable income – the money left for non-essentials.

- Allocate wisely: Decide what percentage of your disposable income you're comfortable allocating to a luxury purchase. A common rule of thumb is 10% or less, but this depends entirely on your individual financial situation.

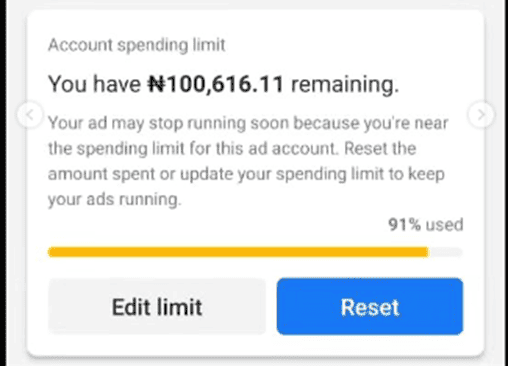

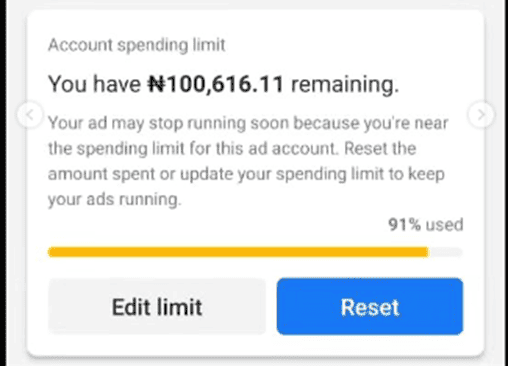

- Budgeting tools: Leverage budgeting apps (Mint, YNAB) or spreadsheets to track your spending habits. Identifying areas where you can save can free up funds for your luxury watch.

Evaluating Your Debt and Savings

Your existing debt and savings significantly influence your watch spending limit.

- Debt reduction: High-interest debt (credit cards, personal loans) should be your priority. Paying down debt improves your credit score and frees up more disposable income.

- Emergency fund: A robust emergency fund (3-6 months' worth of living expenses) safeguards you against unforeseen circumstances. Don't deplete your emergency fund for a luxury item.

- Opportunity cost: Consider the alternative uses for your money. Could you invest it for higher returns? Put it towards home improvements? Weigh the benefits of each option.

Defining Your Watch Needs and Desires

Once you have a clearer picture of your finances, it's time to define what you want in a luxury watch.

Functionality vs. Status

Luxury watches serve different purposes. Clarifying your needs helps determine your spending limit.

- Daily wear: A watch for everyday use requires durability and practicality. Consider scratch-resistant sapphire crystal, water resistance, and a robust movement.

- Status symbol: If the primary purpose is prestige, brand recognition and aesthetic appeal become more significant. This might justify a higher price point.

- Complications: Chronographs, moon phases, and other complications add complexity and increase the cost. Consider if these features are truly necessary for you.

Brand and Style Preferences

Your personal style and brand preferences play a significant role in determining your ideal watch and its price.

- Research brands: Explore brands like Rolex, Omega, Patek Philippe, and others. Each brand offers different aesthetics and price ranges.

- Explore styles: Determine whether you prefer a classic dress watch, a sporty chronograph, or a diver's watch. Browse online and in-store to refine your preferences.

- Resale value: Certain luxury watch brands maintain their value better than others. This is a factor to consider if you anticipate reselling the watch in the future.

Setting a Realistic Budget and Exploring Financing Options

With your needs and desires defined, it's time to set a realistic budget and consider financing options.

The 20/30/50 Rule (Adapting it to Luxury Purchases)

While the 20/30/50 rule (50% needs, 30% wants, 20% savings) provides a useful framework, adapt it for luxury purchases.

- Allocate cautiously: Instead of strictly adhering to the 30% "wants" category, consider a much smaller percentage (5-10%) for your luxury watch purchase. This ensures it doesn't significantly impact your financial stability.

Financing Options (Pros and Cons)

Responsible financing can be an option, but proceed with caution.

- Low-interest options: Explore low-interest credit cards or personal loans only if you're confident in your ability to manage repayments without incurring high interest charges.

- Avoid high-interest debt: High-interest financing can negate the joy of your purchase. The interest accrued might far exceed the watch's initial cost.

- Total cost: Always calculate the total cost including interest when considering financing.

Beyond the Purchase Price: Maintenance and Insurance

The cost of a luxury watch extends beyond the initial purchase price.

The Ongoing Costs of Ownership

Regular maintenance is essential to preserve your watch's value and functionality.

- Servicing: Mechanical watches, in particular, require periodic servicing, which can be costly. Factor these costs into your overall budget.

- Insurance: Consider insuring your luxury watch against loss, theft, or damage. The premium will depend on the watch's value and coverage.

Conclusion:

Determining your watch spending limit requires a balanced approach. By assessing your financial situation, defining your watch needs and desires, setting a realistic budget, and understanding the ongoing costs, you can make an informed decision. Remember, the best luxury watch is the one you can comfortably afford and cherish for years to come. Start planning your luxury watch purchase today by carefully assessing your spending limit!

Featured Posts

-

Gwen Stefani Pregnant Is A Baby With Blake Shelton On The Way

May 27, 2025

Gwen Stefani Pregnant Is A Baby With Blake Shelton On The Way

May 27, 2025 -

Germaniya I Ukraina Sotrudnichestvo V Sfere Pvo Reb I Svyazi

May 27, 2025

Germaniya I Ukraina Sotrudnichestvo V Sfere Pvo Reb I Svyazi

May 27, 2025 -

How To Watch Tracker Season 2 Episode 13 On Cbs Live Tv And Online Options

May 27, 2025

How To Watch Tracker Season 2 Episode 13 On Cbs Live Tv And Online Options

May 27, 2025 -

Bollywood News Nora Fatehi And Jason Derulos Snake Reigns Supreme On Uk Charts

May 27, 2025

Bollywood News Nora Fatehi And Jason Derulos Snake Reigns Supreme On Uk Charts

May 27, 2025 -

Is Taylor Swift Finally Re Recording Reputation New Clues Emerge

May 27, 2025

Is Taylor Swift Finally Re Recording Reputation New Clues Emerge

May 27, 2025

Latest Posts

-

The 202 Million Euromillions Jackpot Is It Time To Play

May 28, 2025

The 202 Million Euromillions Jackpot Is It Time To Play

May 28, 2025 -

202m Euromillions How To Increase Your Chances Of Winning

May 28, 2025

202m Euromillions How To Increase Your Chances Of Winning

May 28, 2025 -

Play Euromillions 202m Jackpot Offers Life Changing Wealth

May 28, 2025

Play Euromillions 202m Jackpot Offers Life Changing Wealth

May 28, 2025 -

Could You Win 202 Million The Euromillions Jackpot Explained

May 28, 2025

Could You Win 202 Million The Euromillions Jackpot Explained

May 28, 2025 -

Record Breaking 202m Euromillions Your Chance At A Fortune

May 28, 2025

Record Breaking 202m Euromillions Your Chance At A Fortune

May 28, 2025