The Real Safe Bet: Protecting Your Future Through Diversification

Table of Contents

Understanding the Importance of Diversification

Diversification isn't just a buzzword; it's a fundamental principle of successful investing. By spreading your investments across various asset classes, you significantly reduce your overall risk and increase the chances of achieving your financial goals.

Reducing Risk

The age-old adage "Don't put all your eggs in one basket" perfectly encapsulates the core principle of diversification. Investing in a single asset class exposes you to significant risk. If that asset underperforms or experiences a downturn, your entire investment could suffer. Diversification mitigates this risk by spreading your capital across different, less correlated assets.

- Examples of Asset Classes:

- Stocks (equities)

- Bonds (fixed-income)

- Real Estate (property)

- Commodities (gold, oil, etc.)

- Alternative Investments (private equity, hedge funds)

The concept of correlation is crucial. Uncorrelated assets, meaning those whose prices don't move in the same direction, can help reduce the overall volatility of your portfolio. For example, if the stock market declines, real estate prices might remain relatively stable, cushioning the overall impact on your investments.

Enhancing Returns

Diversification isn't just about minimizing losses; it can also enhance your long-term returns. Different asset classes perform differently over various market cycles. By having exposure to a range of assets, you can potentially capture growth opportunities across different sectors and economic conditions.

- Examples of Diversified Growth: Stocks might outperform in periods of economic expansion, while bonds can offer stability during downturns. Real estate can provide steady income streams and long-term appreciation.

A diversified portfolio aims to capture these diverse market cycles, potentially leading to higher overall returns compared to a concentrated portfolio focused on a single asset class. The goal is not to time the market but to participate in its diverse opportunities.

Identifying Your Risk Tolerance and Investment Goals

Before building your diversified portfolio, you need to understand your risk tolerance and define your financial goals. These two factors will significantly influence your asset allocation strategy.

Assessing Your Risk Profile

Your risk tolerance reflects your comfort level with the potential for investment losses. It's crucial to honestly assess this before making any investment decisions. You can do this through:

- Self-assessment questionnaires: Many online resources offer questionnaires to help determine your risk profile.

- Professional advice: A financial advisor can provide a personalized assessment based on your financial situation and goals.

Key questions to consider include:

- What is your investment time horizon (short-term, long-term)?

- What are your financial goals (retirement, education, etc.)?

- How comfortable are you with the possibility of experiencing temporary losses?

Based on your answers, you'll typically fall into one of three categories: conservative, moderate, or aggressive. Conservative investors prioritize capital preservation and accept lower potential returns. Moderate investors seek a balance between risk and return, while aggressive investors are willing to take on more risk for potentially higher returns.

Defining Your Financial Goals

Clearly defined financial goals are essential for creating an effective investment strategy. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

- Examples of Financial Goals: Retirement planning, funding a child's education, purchasing a home, building an emergency fund.

Your time horizon significantly impacts your diversification strategy. Long-term investors (e.g., those saving for retirement) can generally tolerate more risk and can benefit from a higher allocation to growth assets like stocks. Short-term investors, on the other hand, might prefer a more conservative approach with a higher allocation to less volatile assets like bonds.

Building a Diversified Investment Portfolio

Now that you've assessed your risk tolerance and defined your goals, it's time to build your diversified investment portfolio.

Allocating Assets

Asset allocation refers to the proportion of your portfolio invested in different asset classes. This allocation should align with your risk tolerance and financial goals.

- Sample Portfolio Allocations:

- Conservative: High allocation to bonds, low allocation to stocks.

- Moderate: Balanced allocation between stocks and bonds, with smaller allocations to other assets.

- Aggressive: High allocation to stocks, potentially including higher-risk investments.

Remember that these are just examples, and your specific allocation will depend on your individual circumstances. It’s crucial to rebalance your portfolio periodically to maintain your desired asset allocation. Market fluctuations will inevitably cause your portfolio to drift from its target allocation over time. Rebalancing involves selling some assets that have performed well and buying assets that have underperformed to restore your target asset allocation.

The Role of Professional Financial Advice

While you can manage your own investments, seeking professional financial advice can be invaluable, especially when creating a diversified portfolio. A financial advisor can:

- Provide personalized advice tailored to your specific needs and risk tolerance.

- Help you develop a comprehensive financial plan that includes investment strategies, retirement planning, and tax optimization.

- Manage your portfolio, rebalancing it periodically to maintain your desired asset allocation.

Working with a financial advisor can provide significant peace of mind and increase the likelihood of achieving your financial goals.

Conclusion

Protecting your financial future requires a proactive approach, and diversification is a cornerstone of that strategy. By spreading your investments across different asset classes, you mitigate risk, enhance long-term returns, and increase your chances of achieving your financial goals. Understanding your risk tolerance and setting clear financial goals are crucial steps in building a successful diversified portfolio. Remember that asset allocation is key, and periodic rebalancing ensures your portfolio stays on track.

Start protecting your future today by exploring different diversification strategies. Consult a financial advisor to create a personalized plan tailored to your specific needs and risk tolerance. Don't delay – securing your financial future through effective diversification is the real safe bet.

Featured Posts

-

Travailler A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025

Travailler A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025 -

Growing Tensions In Pakistan Cause Stock Exchange Portal Outage And Market Volatility

May 10, 2025

Growing Tensions In Pakistan Cause Stock Exchange Portal Outage And Market Volatility

May 10, 2025 -

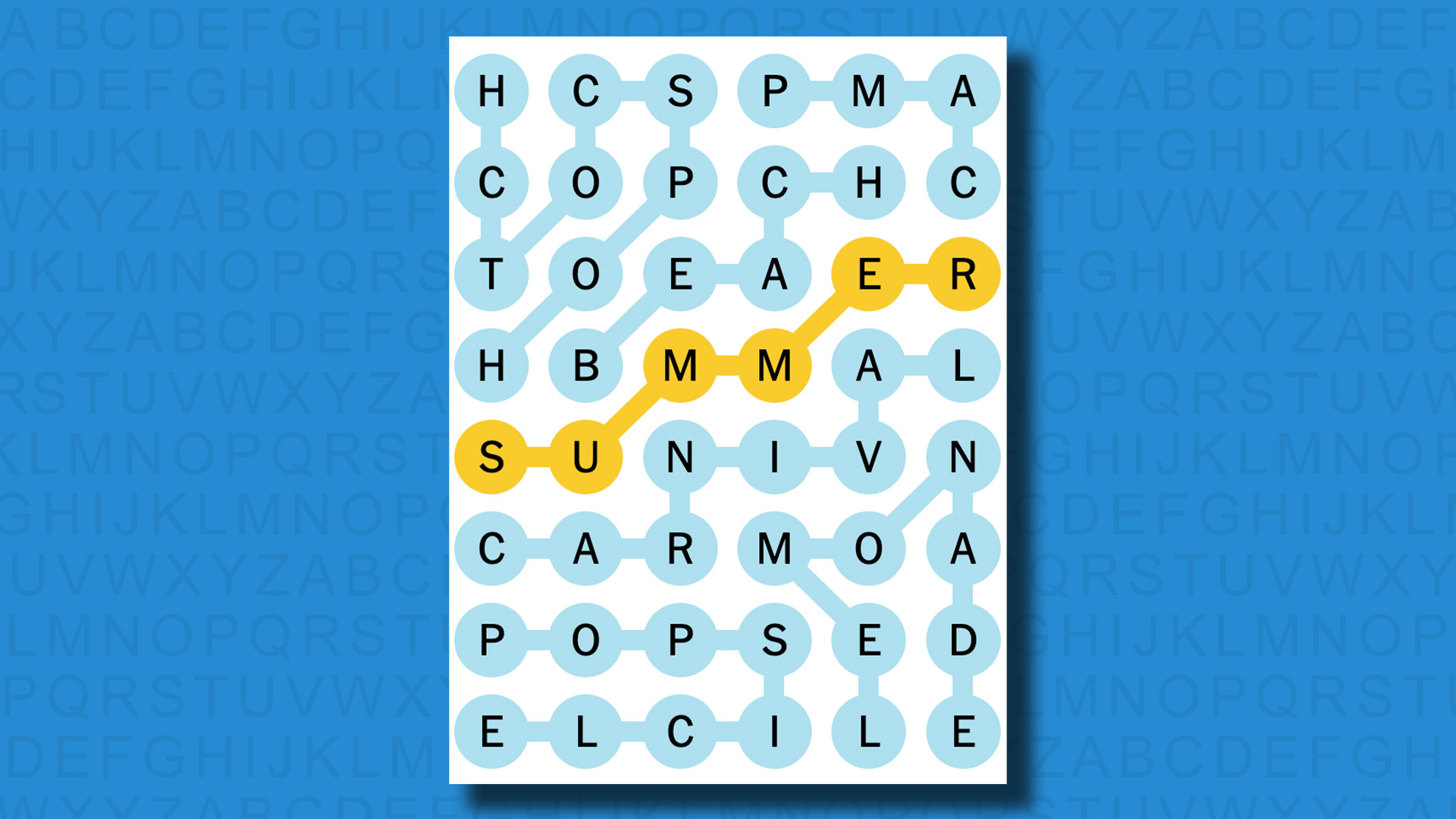

Solutions For Nyt Strands Game 403 Thursday April 10th

May 10, 2025

Solutions For Nyt Strands Game 403 Thursday April 10th

May 10, 2025 -

Red Wings Playoff Hopes Fade After Vegas Loss

May 10, 2025

Red Wings Playoff Hopes Fade After Vegas Loss

May 10, 2025 -

Dakota Johnson El Bolso Hereu La Elegancia Espanola Que Triunfa

May 10, 2025

Dakota Johnson El Bolso Hereu La Elegancia Espanola Que Triunfa

May 10, 2025