The Ripple Effect: Oil Supply Shocks And The Airline Industry's Future

Table of Contents

The Direct Impact of Fuel Costs on Airline Operations

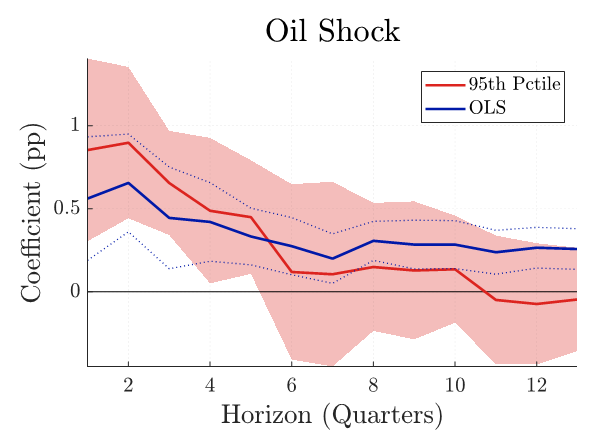

Fuel represents a significant, often dominant, portion of airline operating costs – typically ranging from 20% to 40% depending on the airline and route. Consequently, even minor fluctuations in oil prices can have a dramatic effect on profitability. A sudden spike in oil prices translates directly into increased operational expenses. Airlines are forced to absorb these costs initially, squeezing profit margins. This pressure often leads to difficult choices, including:

- Increased operational expenses: Higher fuel costs necessitate greater capital expenditure, reducing profitability.

- Reduced profit margins: The direct correlation between fuel prices and profitability means even small price increases can dramatically impact the bottom line.

- Potential for route cuts and service reductions: To offset rising costs, airlines may be forced to cut less profitable routes or reduce flight frequencies.

- Pressure on airlines to pass increased costs to consumers: Ultimately, the burden of higher fuel costs is often passed on to passengers through increased ticket prices. This can lead to decreased demand, creating a vicious cycle.

Strategic Responses to Oil Price Volatility

Faced with inherent risks associated with oil price volatility, airlines employ various strategic responses to mitigate the impact. These strategies are crucial for maintaining financial stability and operational efficiency. Key approaches include:

- Fuel hedging contracts (futures and options): Airlines can utilize financial instruments like futures and options contracts to lock in fuel prices at a predetermined rate, hedging against future price increases. However, this strategy carries its own risks, as it can also lock in losses if prices fall unexpectedly.

- Investing in fuel-efficient aircraft (e.g., newer models, technological upgrades): Modern aircraft are significantly more fuel-efficient than older models. Investing in newer planes, incorporating advanced technologies like lighter-weight materials and improved aerodynamics, is a long-term strategy to reduce fuel consumption and operational costs.

- Route optimization and schedule adjustments: Airlines may optimize flight routes to reduce distances and fuel consumption. Adjusting flight schedules to minimize wasted fuel during periods of low demand is another important tactic.

- Operational efficiencies (e.g., improved maintenance, streamlined processes): Implementing efficient maintenance schedules and streamlining operational processes can help reduce fuel waste and improve overall efficiency.

The Impact on Air Travel Demand and Consumer Behavior

Rising fuel costs directly impact consumer decisions regarding air travel. The increased ticket prices resulting from higher fuel costs invariably lead to:

- Decreased demand for air travel due to higher ticket prices: Higher fares make air travel less accessible to price-sensitive consumers, resulting in a drop in demand.

- Shift towards shorter-haul flights or alternative modes of transport: Passengers may opt for shorter flights or consider alternative transportation methods like trains or buses for longer distances, particularly for non-essential travel.

- Increased price sensitivity among consumers: Consumers become more discerning about price, looking for deals and budget-friendly options.

- Potential for a shift in the market towards budget airlines: Budget airlines, with their lower operational costs and often simpler business models, are better positioned to withstand fuel price shocks and may gain market share during periods of volatility.

Long-Term Implications for the Airline Industry's Sustainability

Persistent oil price volatility poses significant long-term challenges to the airline industry's financial health and environmental sustainability. The industry faces increasing pressure to reduce its carbon footprint, which is intricately linked to its reliance on fossil fuels. This necessitates a shift towards:

- Increased pressure to adopt sustainable practices: Airlines are under growing pressure from consumers, investors, and regulators to adopt environmentally sustainable practices.

- Investment in renewable energy sources: Exploring and investing in alternative fuels, such as Sustainable Aviation Fuels (SAFs), is crucial for reducing the industry's carbon emissions.

- Development and implementation of carbon offsetting programs: Carbon offsetting initiatives, while controversial, play a role in mitigating the industry's environmental impact.

- Potential for government regulations impacting fuel consumption: Governments worldwide are likely to introduce increasingly stringent regulations to curb carbon emissions from aviation, potentially affecting fuel consumption and operational costs.

The Role of Government Policies and Regulations

Government policies and regulations significantly influence the airline industry's ability to respond to oil supply shocks. Governments can play a crucial role in promoting sustainable practices by:

- Providing subsidies or tax breaks to incentivize the production and adoption of SAFs.

- Implementing carbon pricing mechanisms, such as carbon taxes, to encourage emission reductions.

- Investing in research and development of new technologies to improve fuel efficiency and reduce emissions.

Conclusion: Navigating the Future with Oil Supply Shock Preparedness

The airline industry's susceptibility to oil supply shocks is undeniable. The ripple effect of oil price volatility extends beyond immediate operational challenges, impacting consumer behavior, long-term financial health, and environmental sustainability. Proactive strategies – including fuel hedging, investment in fuel-efficient aircraft, operational efficiencies, and a commitment to sustainable aviation fuels – are essential for navigating the future. Understanding the complex interplay between oil prices and the airline industry is critical for ensuring its resilience and long-term viability. Stay informed about the evolving landscape of oil supply shocks and the airline industry’s future by exploring related research and initiatives. Learn more about sustainable aviation fuel (SAF) development and implementation strategies.

Featured Posts

-

September Showdown Canelos Size A Decisive Factor Against Crawford

May 04, 2025

September Showdown Canelos Size A Decisive Factor Against Crawford

May 04, 2025 -

Nba Twitter Explodes Fan Reactions To Russell Westbrooks Performance

May 04, 2025

Nba Twitter Explodes Fan Reactions To Russell Westbrooks Performance

May 04, 2025 -

How Marvel Can Enhance Its Storytelling And Production Values

May 04, 2025

How Marvel Can Enhance Its Storytelling And Production Values

May 04, 2025 -

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025 -

Why The Accountant Needs Anna Kendrick For A Third Movie

May 04, 2025

Why The Accountant Needs Anna Kendrick For A Third Movie

May 04, 2025