The Ripple Effect: Tariff Shock And Its Consequences For Bond Investors

Table of Contents

How Tariff Shocks Impact Bond Yields

A tariff shock, defined as a sudden and significant increase in tariffs, disrupts global trade and has far-reaching consequences. One primary impact is on bond yields.

Inflationary Pressures

Tariffs contribute to inflation through several mechanisms:

- Increased import costs: Tariffs directly raise the price of imported goods, leading to higher consumer prices.

- Reduced competition: Tariffs can protect domestic industries from foreign competition, potentially leading to less price pressure and higher prices for consumers.

- Supply chain disruptions: Tariffs can disrupt established supply chains, increasing costs and potentially leading to shortages.

These inflationary pressures force central banks to consider raising interest rates to combat inflation. Higher interest rates generally lead to lower bond prices and higher bond yields, impacting the returns on fixed-income investments. Investors holding bonds with fixed interest rates face a decline in the real value of their investment as inflation erodes purchasing power.

Economic Uncertainty and Flight to Safety

The uncertainty created by tariff shocks significantly affects investor sentiment. This uncertainty leads to a "flight to safety," where investors seek refuge in assets perceived as less risky, such as government bonds.

- Flight to safety: This increased demand for government bonds pushes their prices up and their yields down.

- Risk premiums: Uncertainty also increases risk premiums on corporate bonds, leading to higher yields to compensate for the increased risk of default. This difference in yield between government and corporate bonds widens the credit spread. The impact varies depending on the creditworthiness of the issuer and the sector's exposure to the tariffs.

The Effect of Tariff Shocks on Credit Spreads

Tariff shocks don't just affect bond yields; they also significantly impact credit spreads – the difference in yield between lower-risk government bonds and higher-risk corporate bonds.

Increased Corporate Risk

Tariffs can negatively impact corporate profitability and creditworthiness in several ways:

- Increased input costs: Tariffs increase the cost of imported raw materials and intermediate goods, squeezing corporate profit margins.

- Reduced demand: Tariffs can lead to retaliatory tariffs from other countries, reducing export demand for affected companies.

- Supply chain disruptions: The complexities of navigating new tariff regimes can disrupt supply chains, creating inefficiencies and increasing costs.

These factors increase the risk of corporate defaults, which are reflected in wider credit spreads. Industries heavily reliant on imports or exports are particularly vulnerable. Credit rating agencies often downgrade the credit ratings of companies facing these challenges, further impacting bond prices.

Sectoral Diversification and Risk Management

Diversifying a bond portfolio across various sectors is crucial to mitigating the risk associated with tariff shocks.

- Less sensitive sectors: Sectors less sensitive to tariff changes, such as those focused on domestic markets or those with strong pricing power, may offer relative stability.

- Credit analysis and due diligence: Thorough credit analysis and due diligence are essential in identifying companies with strong balance sheets and the ability to weather tariff-related challenges. This includes carefully evaluating a company's supply chain resilience and its ability to pass on increased costs to consumers.

Investment Strategies for Navigating Tariff Shock

Effective strategies are crucial for navigating the uncertainty caused by tariff shocks.

Adjusting Portfolio Allocation

Investors can adjust their bond portfolio allocations to mitigate the impact of tariff shocks:

- Higher-quality bonds: Shifting to higher-quality, lower-risk bonds, such as government bonds or investment-grade corporate bonds, can reduce exposure to default risk.

- Inflation-protected securities: Investing in inflation-protected securities (TIPS) can help offset the erosive effects of inflation driven by tariffs.

- Hedging strategies: Employing hedging strategies, such as using derivatives, can help mitigate potential losses from interest rate changes or credit defaults.

Active vs. Passive Management

The choice between active and passive management depends on individual circumstances and risk tolerance:

- Active management: Active managers aim to outperform the market by identifying undervalued bonds and adjusting portfolios based on economic forecasts, including anticipating the impacts of tariff changes. This approach requires expertise in global economics and trade policy.

- Passive management: Passive management involves holding a diversified index of bonds, offering broader market exposure but potentially missing out on opportunities for outperformance. During periods of high uncertainty, a passively managed portfolio may provide a more stable and predictable return profile.

- Professional advice: Seeking advice from a financial advisor can be invaluable in developing a tailored bond investment strategy that aligns with your risk tolerance and financial goals.

Conclusion: Mitigating the Impact of Tariff Shock on Your Bond Portfolio

Tariff shocks significantly impact bond yields and credit spreads, creating a volatile environment for bond investors. Understanding the mechanisms through which tariffs affect inflation, investor sentiment, and corporate creditworthiness is crucial for effective risk management. By diversifying your portfolio across sectors, focusing on higher-quality bonds, and potentially incorporating inflation-protected securities and hedging strategies, you can mitigate the negative consequences. Remember, seeking professional financial advice tailored to your situation is key to developing a robust bond investment strategy that can withstand the volatility of global trade disputes. Consult with a financial advisor today to build a portfolio resilient to future tariff shocks and maximize your returns in this dynamic market.

Featured Posts

-

Asylunterkuenfte Effizienzsteigerung Und Kostenersparnis Von 1 Milliarde Euro Moeglich

May 12, 2025

Asylunterkuenfte Effizienzsteigerung Und Kostenersparnis Von 1 Milliarde Euro Moeglich

May 12, 2025 -

Benny Blanco And Selena Gomez The Truth Behind The Cheating Allegations

May 12, 2025

Benny Blanco And Selena Gomez The Truth Behind The Cheating Allegations

May 12, 2025 -

Valentina Shevchenkos Dragon Themed Ufc Apparel A Closer Look

May 12, 2025

Valentina Shevchenkos Dragon Themed Ufc Apparel A Closer Look

May 12, 2025 -

Lionsgate Officially Confirms John Wick 5 Following Fan Speculation

May 12, 2025

Lionsgate Officially Confirms John Wick 5 Following Fan Speculation

May 12, 2025 -

Jurickson Profar And The 80 Game Ped Suspension A Deeper Look

May 12, 2025

Jurickson Profar And The 80 Game Ped Suspension A Deeper Look

May 12, 2025

Latest Posts

-

Deite Tin Serie A Odigos Athlitikon Metadoseon

May 13, 2025

Deite Tin Serie A Odigos Athlitikon Metadoseon

May 13, 2025 -

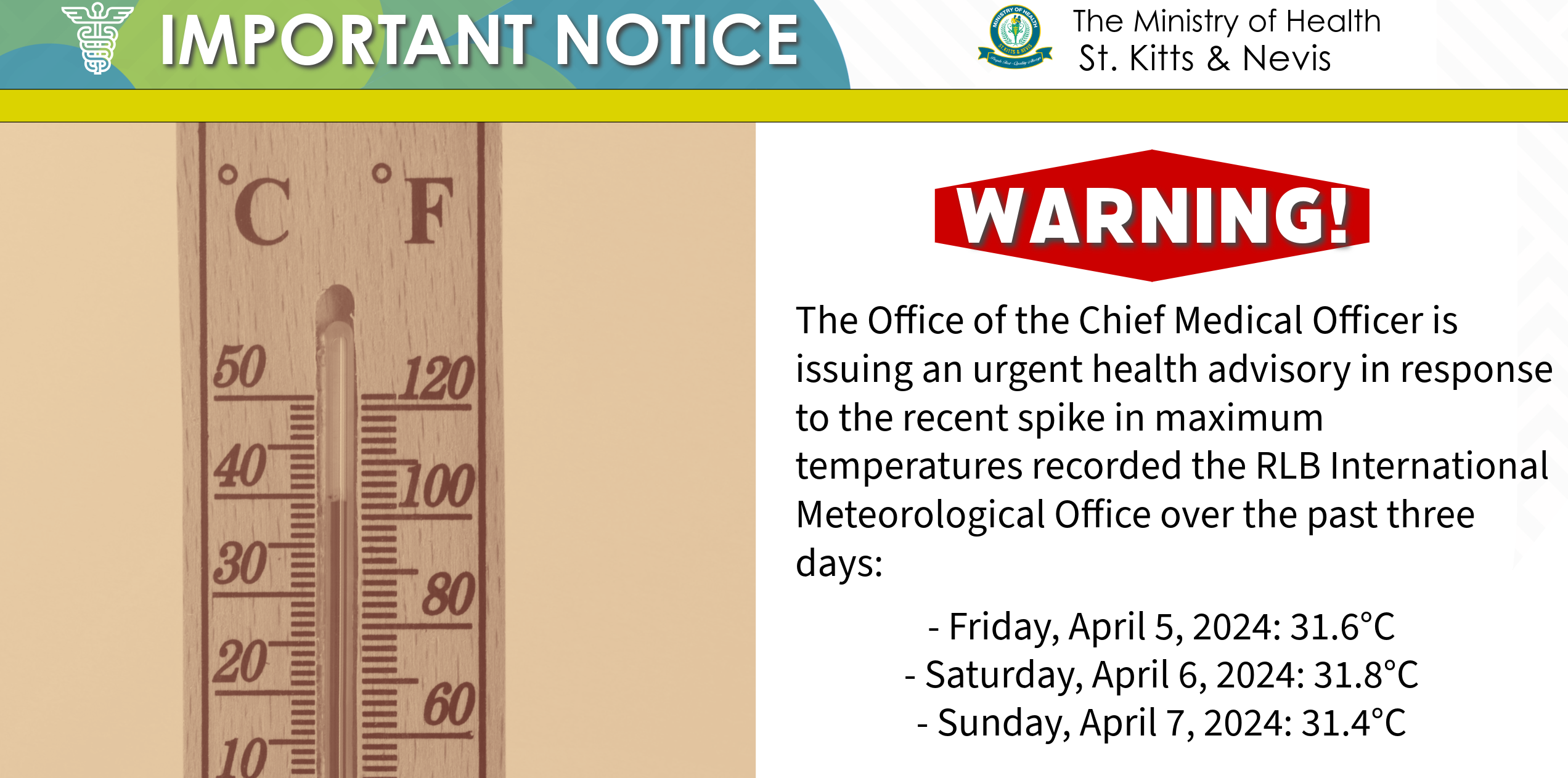

Health Department Issues Heat Advisory Rising Temperatures Prompt Urgent Warning

May 13, 2025

Health Department Issues Heat Advisory Rising Temperatures Prompt Urgent Warning

May 13, 2025 -

Athlitikes Metadoseis Serie A Pliris Odigos

May 13, 2025

Athlitikes Metadoseis Serie A Pliris Odigos

May 13, 2025 -

Kalyteres Epiloges Gia Athlitikes Metadoseis Serie A

May 13, 2025

Kalyteres Epiloges Gia Athlitikes Metadoseis Serie A

May 13, 2025 -

Live Streaming Serie A Platformes And Epiloges

May 13, 2025

Live Streaming Serie A Platformes And Epiloges

May 13, 2025