The Ripple Effect: US Tariffs, Honda's Production, And Canadian Export Potential

Table of Contents

H2: The Impact of US Tariffs on Honda's North American Operations

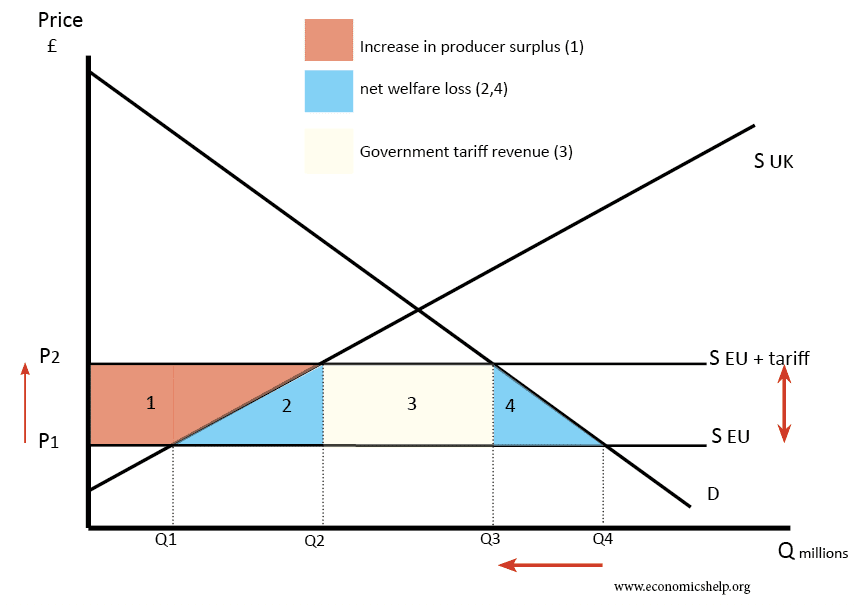

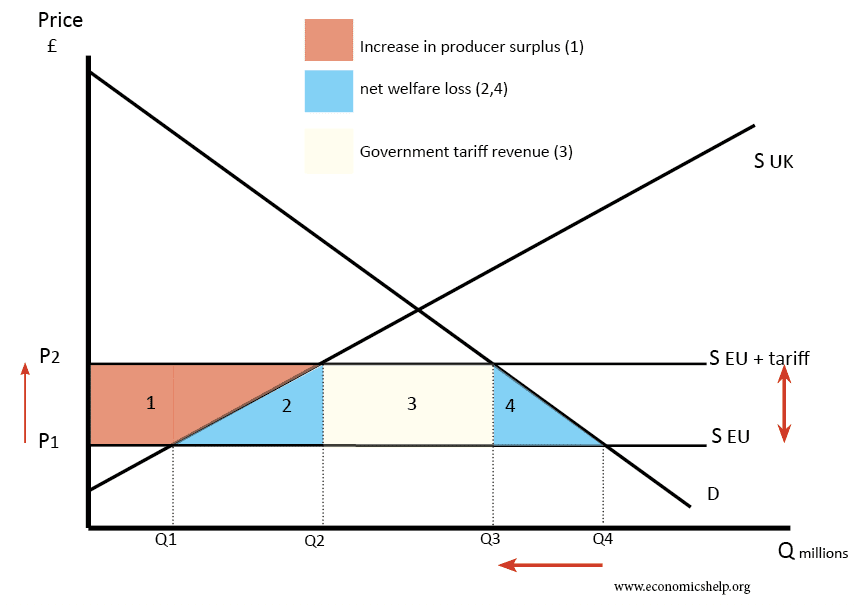

The imposition of US tariffs on imported auto parts significantly increased Honda's manufacturing costs within the United States. This had far-reaching implications across its North American operations.

H3: Increased Production Costs

- Tariffs specifically impacted imported steel, aluminum, and various electronic components, leading to a substantial increase in Honda's input costs.

- Estimates suggest a 5-10% increase in production costs for certain Honda models due to these tariffs (Source: [Insert reputable source, e.g., a financial news article or industry report]).

- This rise in costs directly impacted Honda's profitability margins, forcing a reevaluation of its production and supply chain strategies.

H3: Shifting Production Strategies

Faced with heightened production costs in the US, Honda strategically adjusted its operations:

- Increased production of certain models in its Canadian plants, leveraging Canada's proximity to the US market and potentially lower overall costs.

- Diversified sourcing of parts, actively seeking suppliers in Canada and Mexico to mitigate the impact of US tariffs on imported components.

- Honda's official statements (Source: [Insert link to relevant Honda press release or official statement]) alluded to a need for operational adjustments in response to changing trade dynamics.

H3: Implications for US Consumers

The increased production costs were ultimately passed on to US consumers:

- Prices of Honda vehicles in the US market saw a noticeable increase, reflecting the higher manufacturing expenses.

- This price hike affected Honda's market share, with some consumers opting for more competitively priced alternatives.

- Consumer sentiment surveys (Source: [Insert link to relevant consumer survey data]) indicated a decrease in consumer confidence regarding vehicle affordability.

H2: Increased Export Opportunities for Canadian Businesses

Honda's strategic shift in production and sourcing created a significant opportunity for Canadian businesses.

H3: Filling the Supply Chain Gap

Canadian automotive parts suppliers found themselves in a prime position:

- The demand for auto parts increased, with Honda actively seeking Canadian suppliers to meet its production needs.

- Companies specializing in metal fabrication, electronics, and other automotive components benefited immensely, experiencing substantial growth.

- [Example: Insert name of a successful Canadian company and briefly describe its success story, citing sources if available].

H3: Government Initiatives and Support

The Canadian government played a crucial role in supporting this growth:

- Programs like [Insert name of relevant Canadian government program supporting automotive exports] provided funding and incentives to Canadian companies to expand their capacity and competitiveness.

- Government initiatives focused on streamlining export processes and facilitating access to international markets.

- [Insert link to relevant government website detailing support programs for automotive exporters].

H3: Long-Term Economic Benefits for Canada

The increased automotive exports hold significant long-term benefits for the Canadian economy:

- Job creation in the automotive parts sector experienced a noticeable surge, contributing to regional economic growth.

- Canada's GDP saw a positive impact, with increased export revenue boosting overall economic performance.

- [Insert data on job creation and GDP growth projections, citing reputable economic sources].

H2: Geopolitical Considerations and Future Outlook

US tariff policies have undeniably impacted North American trade relations, leading to uncertainty and adjustments across the automotive industry.

- Future trade agreements will significantly shape the landscape for Honda's production and the Canadian automotive sector.

- Automation and technological advancements pose both challenges and opportunities, influencing production strategies and employment dynamics.

- Long-term projections for the Canadian automotive sector are positive, but contingent on navigating trade complexities and adapting to technological change.

3. Conclusion

US tariffs on imported goods have profoundly impacted Honda's North American operations, necessitating strategic adjustments in production and supply chains. This shift, however, unexpectedly created a surge in export opportunities for Canadian businesses in the automotive parts sector. Understanding the impact of US tariffs on Canadian export potential is crucial for continued growth. This interconnectedness highlights the far-reaching consequences of trade policies. To learn more about leveraging the ripple effect of US trade policy for Canadian businesses and exploring new opportunities in the Canadian automotive export market, visit [insert link to relevant government resources or industry associations].

Featured Posts

-

27 Puntos De Anunoby Impulsan A Knicks A La Victoria Sobre 76ers

May 17, 2025

27 Puntos De Anunoby Impulsan A Knicks A La Victoria Sobre 76ers

May 17, 2025 -

Bahia Derrota Al Paysandu 0 1 Resumen Completo Y Goles

May 17, 2025

Bahia Derrota Al Paysandu 0 1 Resumen Completo Y Goles

May 17, 2025 -

Angel Reese Offers Rookie Advice To Hailey Van Lith

May 17, 2025

Angel Reese Offers Rookie Advice To Hailey Van Lith

May 17, 2025 -

Nba Playoffs Celtics Vs Cavaliers Game Prediction And Analysis

May 17, 2025

Nba Playoffs Celtics Vs Cavaliers Game Prediction And Analysis

May 17, 2025 -

Jalen Brunsons Return Knicks Pistons Playoff Hopes Rise

May 17, 2025

Jalen Brunsons Return Knicks Pistons Playoff Hopes Rise

May 17, 2025