The Ripple (XRP) Rally: A $3.40 Price Target In Sight?

Table of Contents

The Ripple vs. SEC Lawsuit: A Major Catalyst for XRP's Price

The Ripple SEC lawsuit is undeniably the biggest catalyst impacting XRP's price. This protracted legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) centers around the classification of XRP as a security. The outcome will significantly shape the future of XRP and its price.

-

Overview: The SEC alleges that Ripple's sale of XRP constituted an unregistered securities offering. A favorable ruling for Ripple could lead to a significant increase in XRP's price, as it would remove a major regulatory uncertainty. Conversely, an unfavorable ruling could severely depress the price.

-

Recent Court Rulings: Recent court decisions, including partial summary judgments, have offered glimpses into the judge's thinking, impacting market sentiment. These rulings have been closely scrutinized by investors and analysts for hints of the final outcome. Analyzing these rulings is critical for accurate XRP price prediction.

-

Potential Outcomes and Their Effects: A win for Ripple could unlock institutional investment and potentially boost XRP's adoption, driving price appreciation. A loss, however, could trigger further price drops and potentially long-term uncertainty.

-

Expert Opinions: Many cryptocurrency analysts and legal experts have weighed in, offering varied opinions on the potential outcomes. Understanding these diverse perspectives is crucial for a comprehensive XRP price prediction.

-

Unlocking Price Appreciation: A positive resolution could remove the significant overhang of regulatory uncertainty, potentially triggering a substantial XRP rally. This could lead to a surge in buying pressure, pushing the price towards higher targets.

Technical Analysis: Chart Patterns and Price Predictions

Technical analysis of XRP's price chart offers valuable insights into potential future price movements. By examining various indicators and historical trends, analysts can forecast potential price targets.

-

Key Indicators: Analyzing technical indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and various moving averages provides valuable clues about buying and selling pressure.

-

Chart Patterns: Identifying patterns such as head and shoulders, triangles, or flags can help predict potential price breakouts or reversals, offering additional insights for your XRP price prediction.

-

Support and Resistance Levels: Identifying crucial support and resistance levels on the chart can indicate potential price floors and ceilings. These levels act as potential barriers to price movements, offering significant insights into the XRP price target potential.

-

Analyst Predictions: Many reputable cryptocurrency analysts regularly publish their price predictions for XRP, often incorporating technical analysis into their forecasts. Comparing multiple forecasts can help create a more balanced perspective.

-

Volume and Market Cap: Analyzing trading volume and market capitalization in conjunction with technical indicators provides a more holistic picture of market sentiment and potential price movements. Changes in volume often precede significant price changes.

Fundamental Analysis: Ripple's Technology and Adoption

Fundamental analysis focuses on the underlying technology and adoption of Ripple's XRP. This offers long-term perspective on XRP's value proposition.

-

Ripple Technology and Applications: Ripple's technology facilitates fast and efficient cross-border payments, a critical function in the global financial system. Understanding its innovative solutions is crucial for understanding the long-term potential of XRP.

-

RippleNet Growth and Adoption: The success and expansion of RippleNet, Ripple's payment network, directly impacts XRP's utility and potential for increased demand. Growth in RippleNet adoption signals confidence in the underlying technology and could drive future price increases.

-

Partnerships and Collaborations: Ripple's strategic partnerships with financial institutions around the world influence XRP's adoption and utility. Analyzing these partnerships provides insights into the future growth potential and potential XRP price predictions.

-

Future Developments: Ongoing technological developments and improvements within the Ripple ecosystem influence XRP's long-term value proposition. Staying informed about these updates is essential for accurate predictions.

-

Position within the Crypto Market: Assessing XRP's position relative to other cryptocurrencies within the broader market provides context for its future performance and price prediction. Considering overall market trends is crucial.

The $3.40 Target: Realistic or Overly Optimistic?

The $3.40 XRP price target is ambitious. Reaching this level requires a confluence of positive factors.

-

Pros and Cons: A positive outcome in the SEC lawsuit, coupled with strong adoption of RippleNet and a positive overall crypto market, could propel XRP towards this price. However, the risks associated with regulatory uncertainty and market volatility remain significant.

-

Market Conditions and Sentiment: The overall cryptocurrency market sentiment significantly impacts XRP's price. A bullish market increases the likelihood of reaching this target, while a bearish market would make it harder.

-

Short, Mid, and Long-Term Perspectives: Reaching $3.40 could occur in the short term (months) if the SEC lawsuit is resolved favorably and the market sentiment is positive. However, a more realistic timeline might be mid- to long-term (years), depending on Ripple's adoption and overall market conditions.

-

Potential Risks and Challenges: Regulatory uncertainty, competition from other cryptocurrencies, and general market volatility are all potential risks that could hinder XRP's price appreciation. These must be considered in your XRP price prediction.

Conclusion

This article has explored the key factors potentially driving an XRP rally, including the Ripple vs. SEC lawsuit, technical analysis, and fundamental analysis of Ripple's technology and adoption. While a $3.40 XRP price target is ambitious, the potential positive developments make it a possibility, contingent on various key variables. The XRP price prediction remains highly dependent on the lawsuit's outcome and market conditions.

Call to Action: Stay informed about the latest developments surrounding the Ripple (XRP) lawsuit and continuously monitor the technical and fundamental factors influencing XRP's price. Remember that thorough research and due diligence are crucial before investing in any cryptocurrency, including XRP. Make informed decisions regarding your XRP investment strategy based on your own risk tolerance.

Featured Posts

-

Universal Credit Claimants At Risk Following Dwp Reforms

May 08, 2025

Universal Credit Claimants At Risk Following Dwp Reforms

May 08, 2025 -

Bitcoin Mining Why The Recent Increase

May 08, 2025

Bitcoin Mining Why The Recent Increase

May 08, 2025 -

Asias Premier Bitcoin Event Bitcoin Seoul 2025

May 08, 2025

Asias Premier Bitcoin Event Bitcoin Seoul 2025

May 08, 2025 -

Bitcoin Madenciliginin Sonu Mu Geliyor Karlilik Azaliyor Mu

May 08, 2025

Bitcoin Madenciliginin Sonu Mu Geliyor Karlilik Azaliyor Mu

May 08, 2025 -

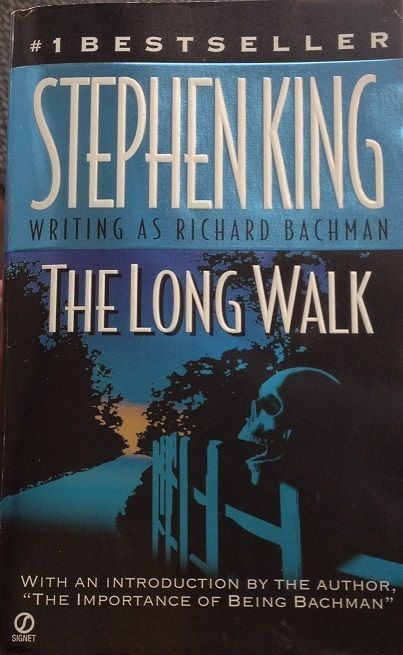

The Long Walk Trailer A Stephen King Approved Dark Thriller

May 08, 2025

The Long Walk Trailer A Stephen King Approved Dark Thriller

May 08, 2025

Latest Posts

-

Latest News Boston Celtics Head Coach Addresses Tatums Wrist

May 08, 2025

Latest News Boston Celtics Head Coach Addresses Tatums Wrist

May 08, 2025 -

Universal Credit Are You Missing Out On Entitlements

May 08, 2025

Universal Credit Are You Missing Out On Entitlements

May 08, 2025 -

Tatums Wrist Injury A Report From The Boston Celtics Head Coach

May 08, 2025

Tatums Wrist Injury A Report From The Boston Celtics Head Coach

May 08, 2025 -

Jayson Tatum Wrist Injury Boston Celtics Head Coachs Statement

May 08, 2025

Jayson Tatum Wrist Injury Boston Celtics Head Coachs Statement

May 08, 2025 -

Dwp Overpayments And Underpayments Understanding Universal Credit

May 08, 2025

Dwp Overpayments And Underpayments Understanding Universal Credit

May 08, 2025