The Rise Of Disaster Betting: Examining The Market For Wildfire Predictions

Table of Contents

The Mechanics of Wildfire Prediction Markets

Data Sources and Predictive Models

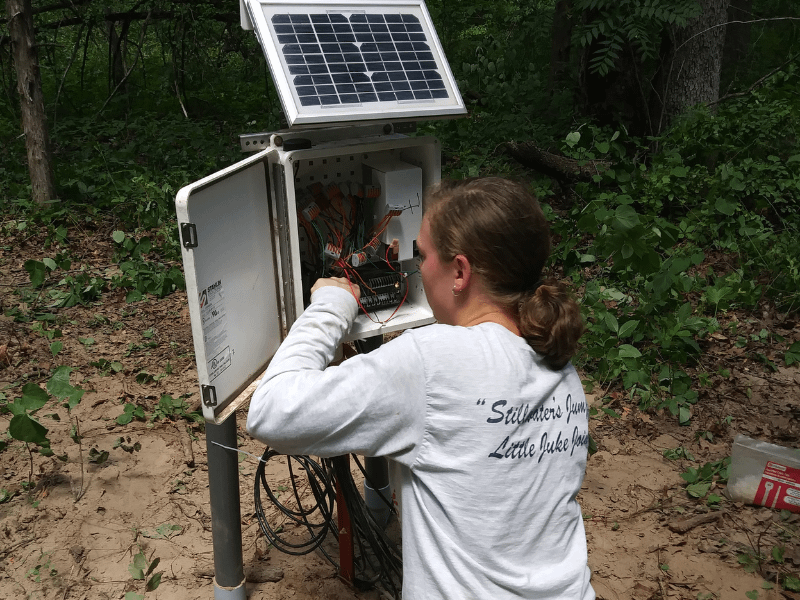

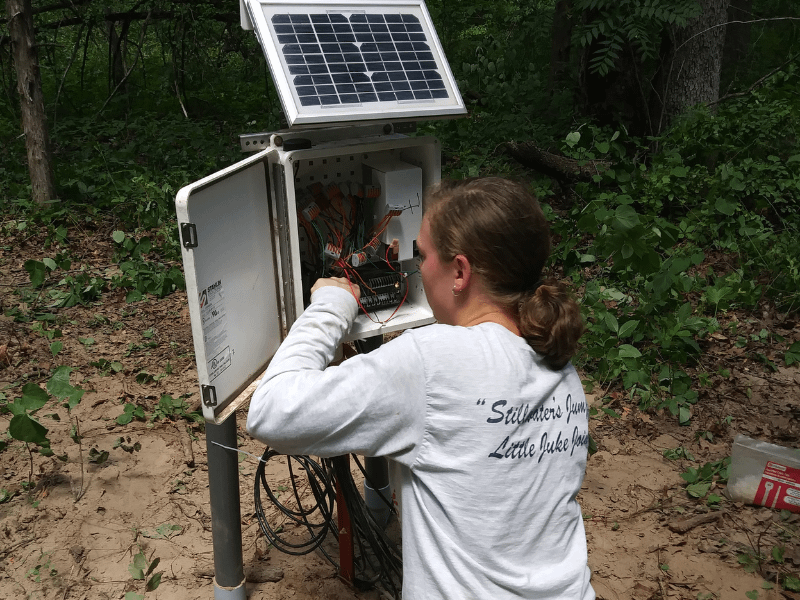

Wildfire prediction markets rely heavily on accurate forecasting. This requires sophisticated data analysis and predictive modeling. Key data sources include:

- Meteorological data: Temperature, humidity, wind speed and direction, precipitation – all crucial factors influencing wildfire ignition and spread, often obtained from sources like the National Oceanic and Atmospheric Administration (NOAA).

- Satellite imagery: Provides real-time monitoring of fire activity, vegetation health, and fuel conditions, leveraging data from agencies like NASA.

- Historical fire data: Analyzing past wildfire events helps identify high-risk areas and patterns, contributing to more accurate predictions.

- AI-powered predictive models: Machine learning algorithms are increasingly used to process vast datasets and generate probabilities of wildfire occurrence and severity. These models consider multiple variables simultaneously, improving forecasting accuracy.

However, limitations exist. Predictive models are not perfect; they are subject to uncertainties inherent in complex weather patterns and human behavior (e.g., accidental ignitions). Inherent biases in data sets can also skew results.

Types of Wildfire Bets

Wildfire betting markets offer various bet types, catering to different risk appetites:

- Binary options: A simple bet on whether a wildfire will exceed a certain size (e.g., hectares burned) or reach a specific location within a defined timeframe. Payouts are binary – either win or lose.

- Spread betting: Involves predicting the total area burned by a wildfire. The payout depends on the accuracy of the prediction, allowing for both profits and losses.

- Catastrophe bonds: While not strictly “bets,” these financial instruments act as a form of insurance against large-scale wildfire events. Investors receive a return unless a predefined catastrophe occurs, triggering payouts to insurers.

Insurance companies and reinsurers are major players in this market, using wildfire prediction markets to assess and manage their risk exposure.

Regulation and Legal Frameworks

The legal landscape surrounding wildfire betting is complex and largely undefined. Many jurisdictions lack specific regulations for this type of speculative market, raising concerns about:

- Gambling legality: The classification of wildfire prediction markets as gambling activities varies across regions, impacting their legality and potential for regulation.

- Market manipulation: The potential for insider trading or manipulation of prediction data poses a significant risk.

- Fraud: The opacity of some prediction markets creates opportunities for fraudulent activities.

The ethical implications of profiting from human suffering and environmental devastation are paramount, demanding careful consideration of appropriate regulations.

The Role of Wildfire Prediction Markets in Risk Management

Insurance and Reinsurance Applications

Wildfire prediction markets offer valuable tools for risk management in the insurance and reinsurance sectors:

- Improved risk assessment: Market data can inform more accurate assessments of wildfire risk, leading to more precise pricing of insurance policies.

- Catastrophe bond pricing: Prediction markets can help determine appropriate pricing for catastrophe bonds, reflecting the actual risk of wildfire events.

- Efficient risk transfer: These markets facilitate more efficient transfer of risk from insurers and reinsurers to investors, increasing market capacity for catastrophe risk.

Government and Public Policy

Wildfire prediction markets could play a significant role in informing government policy:

- Resource allocation: Market data can guide more efficient allocation of resources for wildfire prevention, mitigation, and emergency response. High-risk areas identified by the markets can be prioritized for preventative measures.

- Land management: Incentivizing better land management practices through prediction markets could reduce the likelihood and severity of future wildfires. Successful land management could translate to lower payouts in the market, benefiting those who invest in responsible land use.

Ethical and Societal Considerations of Wildfire Betting

The Problem of Speculation and Market Manipulation

Wildfire betting markets are susceptible to manipulation:

- Insider trading: Individuals with access to privileged information could profit unfairly by manipulating market predictions.

- Information asymmetry: Unequal access to information can create opportunities for exploitation and unfair advantage.

Transparency and robust regulation are crucial to mitigate these risks and ensure fair market operation.

The Impact on Vulnerable Communities

Wildfire betting can disproportionately affect vulnerable communities:

- Exploitation: Predatory actors could target communities lacking resources or understanding of the market, leading to exploitation.

- Exacerbating inequalities: The potential for increased insurance premiums in high-risk areas could disproportionately impact low-income communities.

Social responsibility and equitable access to information are critical to mitigate the negative societal impact of wildfire betting.

Conclusion

The rise of disaster betting, specifically focusing on wildfire predictions, presents a complex interplay of financial innovation, risk management, and ethical considerations. While offering potential benefits for insurance, reinsurance, and government policy, it also raises significant concerns about market manipulation, fraud, and the potential for exacerbating existing societal inequalities. Understanding the mechanics and implications of this emerging field is crucial for developing responsible and ethically sound approaches to disaster risk management. Further research and responsible regulation are needed to harness the potential of wildfire prediction markets while mitigating their inherent risks. Continue to explore the complexities of disaster betting and its implications for wildfire predictions to contribute to a more informed and responsible future.

Featured Posts

-

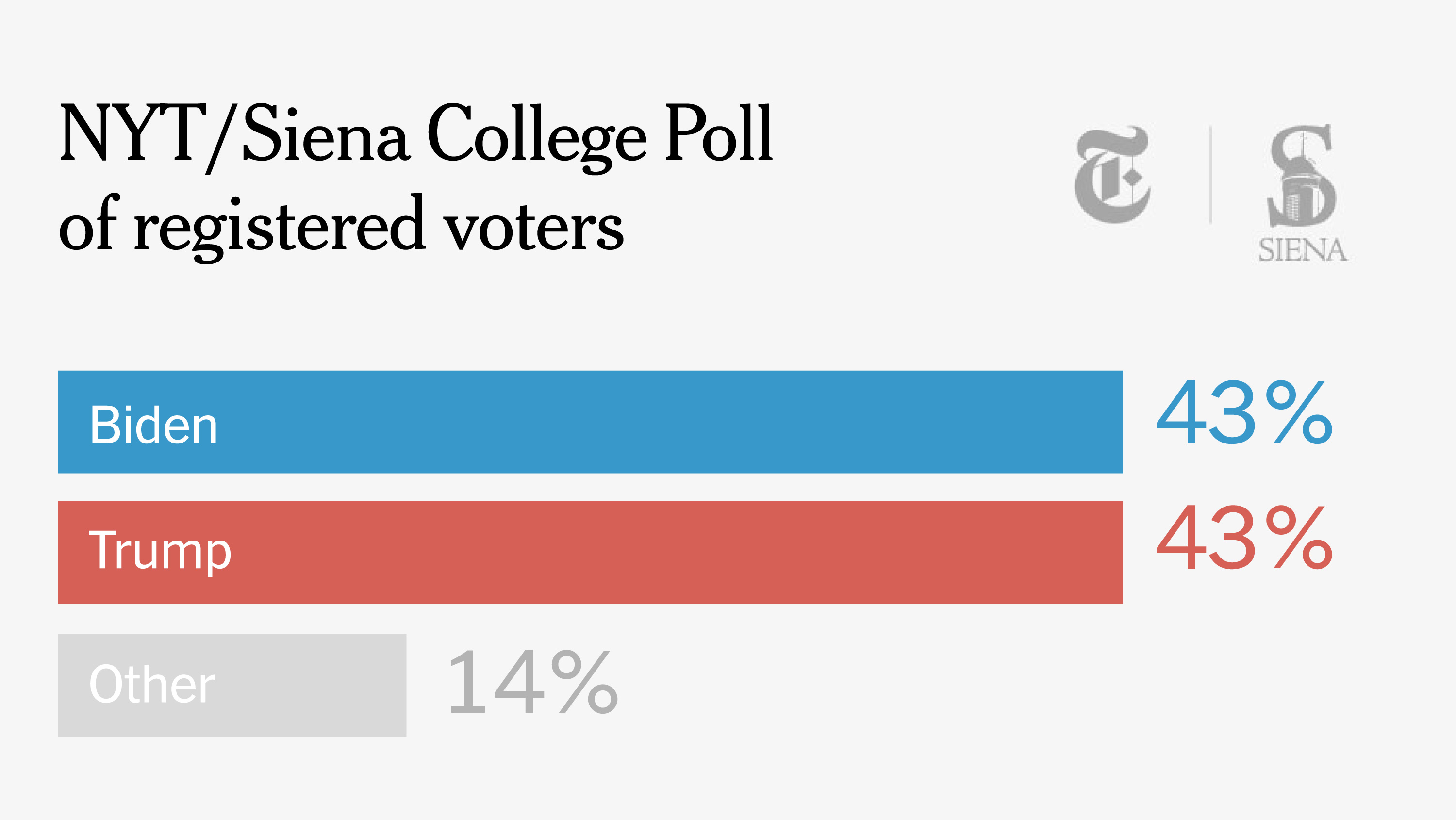

Donald Trump And Joe Biden A Side By Side Comparison Of Their Presidencies

May 15, 2025

Donald Trump And Joe Biden A Side By Side Comparison Of Their Presidencies

May 15, 2025 -

Why Jimmy Butler Not Kevin Durant Is The Perfect Fit For The Golden State Warriors

May 15, 2025

Why Jimmy Butler Not Kevin Durant Is The Perfect Fit For The Golden State Warriors

May 15, 2025 -

The Comeback Kid Players Name Finally Gets His Chance With The Dodgers

May 15, 2025

The Comeback Kid Players Name Finally Gets His Chance With The Dodgers

May 15, 2025 -

Jeremy Arndts Influence On Bvg Negotiations A Detailed Analysis

May 15, 2025

Jeremy Arndts Influence On Bvg Negotiations A Detailed Analysis

May 15, 2025 -

Trumps Egg Price Prophecy A Current Assessment

May 15, 2025

Trumps Egg Price Prophecy A Current Assessment

May 15, 2025