The Saudi ABS Market: Post-Reform Growth And Opportunities

Table of Contents

H2: Regulatory Reforms Driving Market Growth

The Saudi Arabian Monetary Authority (SAMA) has played a pivotal role in fostering the growth of the Saudi ABS market through strategic regulatory reforms. These reforms have simplified the issuance process, increased transparency, and attracted both domestic and international investors.

H3: Easing of Regulations and Increased Transparency

SAMA's efforts have significantly streamlined the process of issuing ABS in Saudi Arabia. This has led to a more efficient and accessible market for businesses seeking alternative financing options.

- Streamlined approval processes for ABS issuance: The reduction in bureaucratic hurdles has significantly shortened the time it takes to bring ABS to market.

- Improved disclosure requirements for enhanced investor confidence: Clearer and more comprehensive disclosure requirements have built trust and attracted a wider range of investors.

- Clearer legal framework for asset securitization: The establishment of a robust legal framework minimizes ambiguity and protects investors' interests.

- Increased participation of international investors: The improved regulatory environment has attracted significant interest from international investors seeking exposure to the growing Saudi market. This influx of foreign capital further fuels market growth and liquidity.

H3: Development of a Robust Legal and Regulatory Framework

The development of a strong legal and regulatory framework is fundamental to the long-term success of the Saudi ABS market. This framework reduces risk, encourages investor participation, and promotes market stability.

- Introduction of specialized laws and regulations for asset-backed securities: These specialized regulations provide clarity and address specific concerns related to ABS issuance and trading.

- Improved investor protection mechanisms: Stronger investor protection mechanisms ensure that investors' rights are protected and disputes are resolved efficiently.

- Establishment of specialized courts to handle disputes: Dedicated courts streamline the dispute resolution process, reducing delays and uncertainties.

H2: Growth Sectors Fueling ABS Market Expansion

Several high-growth sectors in Saudi Arabia are significantly driving the expansion of the ABS market. The robust growth in these sectors creates a substantial pool of assets suitable for securitization.

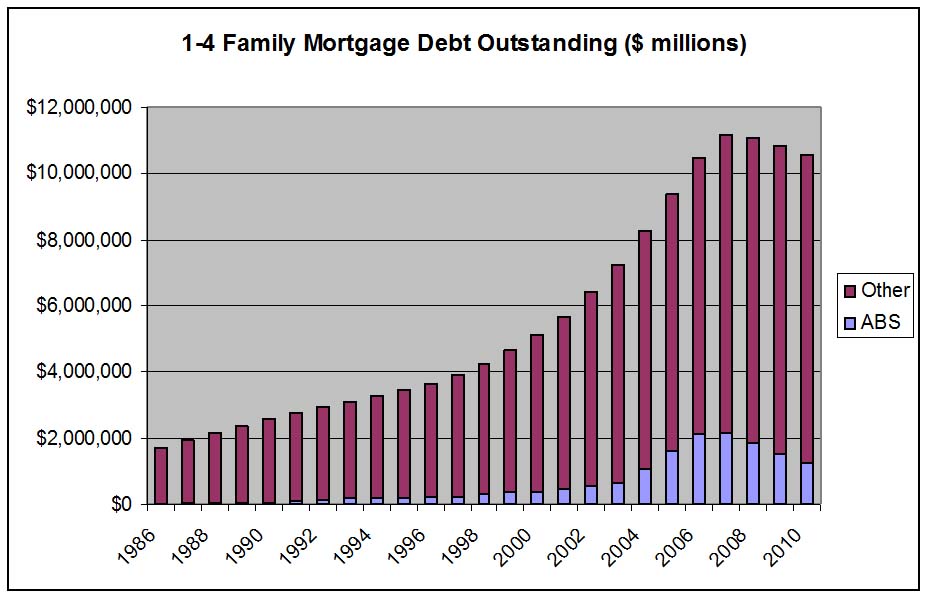

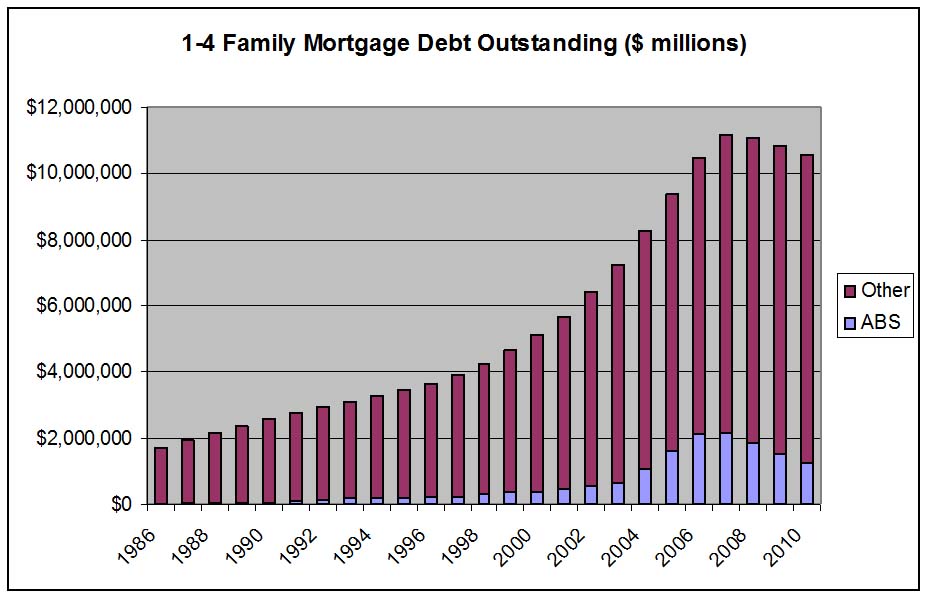

H3: Real Estate

The Saudi real estate sector is experiencing a boom, fueled by government initiatives and increased demand. This growth translates directly into opportunities for mortgage-backed securities (MBS) within the Saudi ABS market.

- High demand for residential and commercial properties: Rapid urbanization and population growth are driving strong demand for both residential and commercial real estate.

- Government initiatives to support the housing market: Government programs aimed at increasing homeownership are further stimulating the real estate market.

- Increasing use of ABS for financing real estate projects: Developers are increasingly using ABS as a cost-effective financing tool for large-scale projects.

H3: Automotive Finance

The burgeoning automotive sector, with its increasing car ownership rates, offers considerable potential for auto loan securitization within the Saudi ABS market.

- Rapid growth of car ownership in Saudi Arabia: Rising incomes and improved infrastructure are leading to a significant increase in car ownership.

- Increased availability of automotive financing options: The expansion of financing options makes auto loan securitization a viable and attractive investment opportunity.

- Development of specialized ABS products for the automotive sector: The market is witnessing the development of innovative ABS products tailored specifically to the automotive financing needs.

H3: Consumer Finance

The expanding consumer finance market, characterized by rising consumer spending and credit utilization, presents a fertile ground for ABS issuance backed by consumer loans and credit card receivables.

- Rising consumer spending and credit utilization: A growing middle class and increased access to credit are fueling consumer spending and credit utilization.

- Increasing penetration of credit cards and other consumer finance products: The widespread adoption of credit cards and other consumer finance products creates a large pool of assets for securitization.

- Development of innovative ABS structures for consumer finance assets: The market is developing sophisticated ABS structures to accommodate the diverse nature of consumer finance assets.

H2: Opportunities for Investors and Businesses

The Saudi ABS market presents compelling opportunities for both investors seeking attractive returns and businesses requiring flexible financing solutions.

H3: High Returns and Diversification

The Saudi ABS market offers investors the potential for attractive returns and portfolio diversification.

- Relatively high yields compared to other fixed-income investments: ABS often provide higher yields than traditional fixed-income investments.

- Potential for capital appreciation: Depending on market conditions, there is potential for capital appreciation on ABS investments.

- Diversification benefits for investors' portfolios: ABS offer investors the opportunity to diversify their portfolios beyond traditional asset classes.

H3: Access to Funding for Businesses

ABS provide businesses with access to cost-effective financing, enhancing their financial flexibility and growth prospects.

- Improved access to capital for SMEs and large corporations: ABS offer a viable alternative financing source for businesses of all sizes.

- Reduced reliance on traditional bank financing: ABS reduce dependence on traditional bank loans, providing businesses with more financing options.

- Enhanced financial flexibility for businesses: Access to ABS financing allows businesses to better manage their cash flow and pursue growth opportunities.

3. Conclusion:

The Saudi ABS market is demonstrating remarkable growth, driven by Vision 2030's economic reforms and the expansion of key sectors. Regulatory improvements, increased transparency, and a robust legal framework are all contributing to this positive trajectory. The opportunities for investors seeking attractive returns and businesses needing flexible financing are substantial. By understanding the dynamics of this evolving market, participants can effectively capitalize on the significant potential within the Saudi ABS market. To learn more about the specific opportunities available in the Saudi ABS market and how to participate, explore dedicated resources and connect with experts today.

Featured Posts

-

A Generations Wellbeing The Importance Of Investing In Childhood Mental Health Now

May 02, 2025

A Generations Wellbeing The Importance Of Investing In Childhood Mental Health Now

May 02, 2025 -

The Calibri Ms 13 Tattoo Confusion Fact Or Fiction

May 02, 2025

The Calibri Ms 13 Tattoo Confusion Fact Or Fiction

May 02, 2025 -

Funding Crisis Puts Indigenous Arts Festival In Jeopardy

May 02, 2025

Funding Crisis Puts Indigenous Arts Festival In Jeopardy

May 02, 2025 -

Dalys Late Show Steals Victory England Edges France In Six Nations Thriller

May 02, 2025

Dalys Late Show Steals Victory England Edges France In Six Nations Thriller

May 02, 2025 -

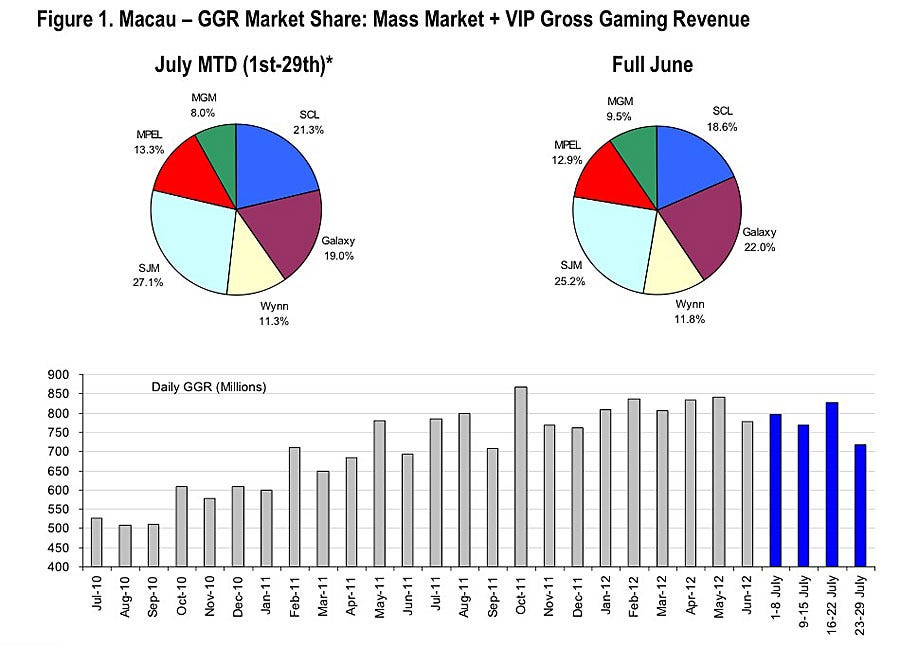

Golden Week Boost Macaus Gaming Revenue Defies Expectations

May 02, 2025

Golden Week Boost Macaus Gaming Revenue Defies Expectations

May 02, 2025

Latest Posts

-

Ndcs Techiman South Election Petition A High Court Decision

May 02, 2025

Ndcs Techiman South Election Petition A High Court Decision

May 02, 2025 -

Techiman South Parliamentary Election Court Dismisses Ndc Petition

May 02, 2025

Techiman South Parliamentary Election Court Dismisses Ndc Petition

May 02, 2025 -

High Court Ruling Techiman South Parliamentary Seat Petition Rejected

May 02, 2025

High Court Ruling Techiman South Parliamentary Seat Petition Rejected

May 02, 2025 -

Pancake Day The History And Traditions Of Shrove Tuesday

May 02, 2025

Pancake Day The History And Traditions Of Shrove Tuesday

May 02, 2025 -

Techiman South Ndc Election Petition Dismissed By High Court

May 02, 2025

Techiman South Ndc Election Petition Dismissed By High Court

May 02, 2025