The Stark Math On The GOP Tax Plan: Deficit Impact Analysis

Table of Contents

Projected Revenue Losses Under the GOP Tax Plan

The GOP tax plan projects significant revenue losses stemming from proposed cuts to both corporate and individual income taxes. These reductions, while aiming to stimulate economic growth, are expected to substantially widen the federal budget deficit.

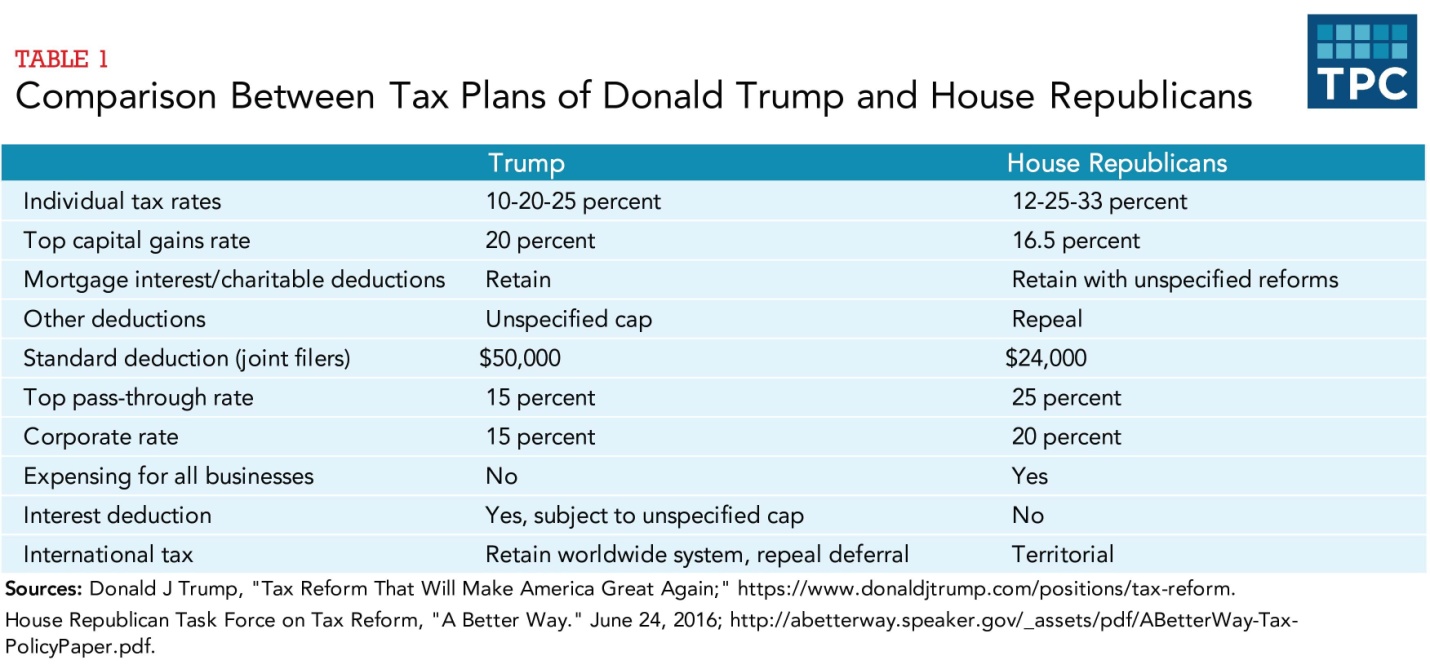

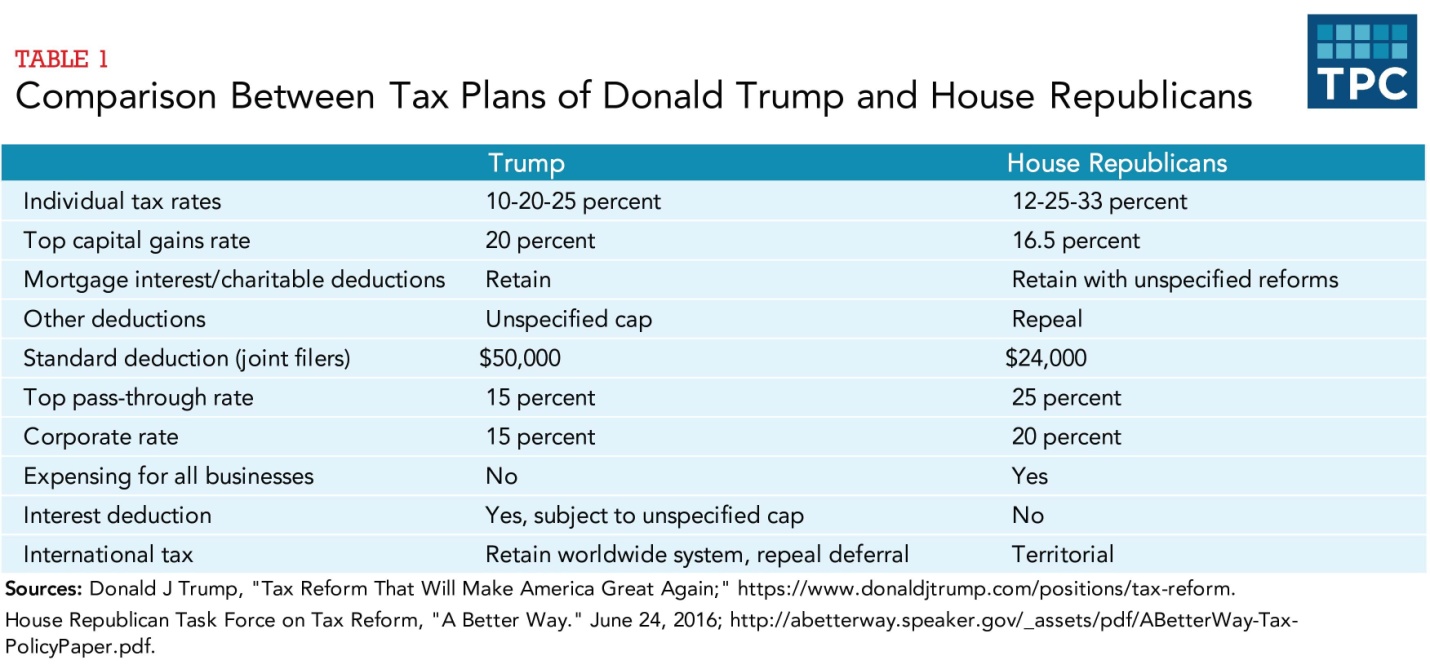

Corporate Tax Rate Cuts and Their Impact

The plan proposes a significant reduction in the corporate tax rate. While proponents argue this will boost investment and job creation, critics point to substantial projected revenue losses. The Congressional Budget Office (CBO) and the Tax Policy Center (TPC), for example, have released projections indicating substantial revenue shortfalls.

- Revenue Loss Projections (CBO Estimates): A reduction of X% in the corporate tax rate is projected to result in a Y trillion dollar loss in revenue over the next 10 years. This is broken down as follows:

- Z billion in lost revenue from the manufacturing sector.

- A billion in lost revenue from the technology sector.

- Key Words: corporate tax cuts, revenue projections, tax reform, fiscal impact, economic growth

Individual Income Tax Cuts and Their Effect

The plan also includes substantial cuts to individual income taxes, altering tax brackets and increasing the standard deduction. These changes, while providing tax relief for many individuals, are projected to further decrease government revenue.

- Revenue Loss Projections (TPC Estimates): The reduction in individual income tax rates is expected to lead to a loss of W trillion dollars over the next decade. This breakdown illustrates the impact across income brackets:

- The top 1% will see a reduction of X% in their tax burden.

- The middle class will see an average reduction of Y%.

- Key Words: individual income tax, tax brackets, standard deduction, tax burden, tax relief

Increased Government Spending and the Deficit

The revenue losses from tax cuts are not the only factor contributing to a widening deficit. The GOP tax plan's indirect impact on government spending further exacerbates the problem.

Impact on Mandatory Spending

Tax cuts, particularly those benefiting higher-income earners, may lead to increased demand for social programs and healthcare services. This could result in higher mandatory spending on programs like Medicare and Social Security.

- Projected Increased Spending: The CBO estimates an increase of A billion dollars annually in Medicare spending over the next 5 years due to increased utilization.

- Key Words: mandatory spending, entitlement programs, social security, medicare, healthcare spending

Impact on Discretionary Spending

The impact on discretionary spending, encompassing areas like defense and infrastructure, is less clear-cut. While some argue tax cuts will stimulate economic growth, leading to higher tax revenue that can fund increased spending, others warn that the revenue shortfall may necessitate cuts in these areas.

- Potential Scenarios:

- Increased defense spending due to geopolitical factors, potentially offsetting some revenue losses.

- Decreased infrastructure spending due to budgetary constraints.

- Key Words: discretionary spending, defense budget, infrastructure spending, budgetary constraints

Long-Term Fiscal Sustainability Concerns

The combined effect of revenue losses and increased spending paints a concerning picture regarding the nation's long-term fiscal sustainability.

Debt Accumulation and Interest Payments

The GOP tax plan is projected to significantly increase the national debt. This increase will, in turn, lead to higher interest payments on the national debt, further straining the federal budget.

- Projected Debt Levels: The CBO projects the national debt to reach B trillion dollars within the next 20 years under the proposed tax plan.

- Key Words: national debt, debt accumulation, interest payments, fiscal sustainability, long-term debt

Credit Rating Implications

The substantial increase in the national debt could lead to a downgrade in the U.S. credit rating. Such a downgrade would increase borrowing costs for the government, making it more expensive to finance the debt.

- Potential Consequences: A lower credit rating could:

- Increase interest rates on government bonds.

- Reduce investor confidence in the U.S. economy.

- Lead to higher inflation.

- Key Words: credit rating, sovereign debt, economic consequences, investor confidence

Conclusion: Understanding the Stark Math of the GOP Tax Plan Deficit Impact

This analysis reveals the substantial projected revenue losses, increased spending, and the resulting long-term debt implications of the GOP tax plan. The plan's impact on the national deficit is significant, raising serious concerns about long-term fiscal sustainability. Understanding the stark math of the GOP tax plan's deficit impact is crucial for informed civic engagement. Continue your research on the GOP tax plan deficit impact to make your voice heard. Engage in informed discussions and demand transparency regarding the potential consequences of this significant policy change.

Featured Posts

-

The Ftv Live Phenomenon A Hell Of A Run And Its Future

May 21, 2025

The Ftv Live Phenomenon A Hell Of A Run And Its Future

May 21, 2025 -

Peppa Pig Welcomes A Baby Sister Its A Girl

May 21, 2025

Peppa Pig Welcomes A Baby Sister Its A Girl

May 21, 2025 -

Trinidad Trip Curtailed Dancehall Artists Travel Restrictions And Kartels Message

May 21, 2025

Trinidad Trip Curtailed Dancehall Artists Travel Restrictions And Kartels Message

May 21, 2025 -

Provence Walking Trails A Self Guided Journey From Mountain To Coast

May 21, 2025

Provence Walking Trails A Self Guided Journey From Mountain To Coast

May 21, 2025 -

Analysis Tony Hinchcliffes Poorly Received Wwe Appearance

May 21, 2025

Analysis Tony Hinchcliffes Poorly Received Wwe Appearance

May 21, 2025