The Struggles Of A Starving Wife: Earning Less Than An A-List Husband

Table of Contents

The Illusion of Wealth and the Reality of Financial Dependence

The societal expectation linked to a high-earning spouse often paints a picture of a lavish lifestyle – designer clothes, luxury vacations, and a life of ease. However, for the lower-earning partner, this illusion of wealth can mask a stark reality: financial insecurity. The "starving wife" phenomenon isn't about literal starvation, but rather a feeling of lack of control and vulnerability. This stems from a significant dependence on the higher earner's income.

- Lack of personal financial independence: The inability to independently manage finances creates a sense of powerlessness and vulnerability.

- Difficulty accessing personal credit or loans: Establishing credit history and obtaining loans becomes challenging without a substantial independent income stream.

- Limited career opportunities due to societal pressures and time constraints: The pressure to maintain a certain lifestyle and manage household responsibilities can hinder career progression.

- Feeling trapped in a financially dependent role: This dependence can lead to feelings of being trapped and unable to pursue personal aspirations.

Navigating Financial Inequality in a Marriage

Managing finances when one spouse earns significantly more than the other presents unique complexities. Open communication and careful financial planning are crucial, yet often challenging to establish. The "starving wife" often finds herself navigating a minefield of unspoken expectations and potential resentment.

- Challenges in budgeting and financial transparency: Difficulties arise in agreeing on spending limits, saving goals, and overall financial transparency.

- The pressure to maintain a certain lifestyle that may not be sustainable on one income: This can lead to overspending and accumulating debt.

- Difficulties in saving and investing independently: Without a substantial independent income, saving and investing for personal goals becomes extremely difficult.

- Potential for conflict and resentment due to financial imbalances: Financial inequality can strain the relationship and create tension.

The Emotional Toll of a "Starving Wife" Situation

Beyond the financial struggles, the psychological impact of financial dependence on self-esteem and overall well-being is profound. A "starving wife," despite potentially having a materially comfortable life, can feel inadequate, powerless, and resentful.

- Impact on self-esteem and confidence: Financial dependence can erode self-worth and create a sense of inadequacy.

- Strained relationships due to financial stress: Financial pressures can lead to arguments, tension, and distance in the relationship.

- Increased risk of depression and anxiety: The constant stress and lack of control can significantly impact mental health.

- Difficulty pursuing personal goals and aspirations: Financial constraints can limit opportunities for personal growth and fulfillment.

Strategies for Financial Empowerment and Independence

Women experiencing the "starving wife" situation can take proactive steps towards financial empowerment and independence. It's about reclaiming control and building a secure future.

- Exploring career development opportunities and reskilling: Investing in education and training can open doors to higher-paying jobs.

- Seeking financial advice from a professional: A financial advisor can help create a personalized plan for achieving financial independence.

- Creating a personal budget and financial plan: Taking control of personal finances is the first step toward independence.

- Establishing separate bank accounts and investments: Building independent financial security is vital for long-term well-being.

Conclusion

The struggles of a "starving wife" are multifaceted, encompassing both significant financial and emotional challenges. The illusion of wealth often masks the reality of financial vulnerability and dependence. A "financially dependent wife" can experience a severe impact on her self-esteem, mental health, and overall life satisfaction. However, reclaiming financial independence is achievable through proactive steps such as career development, seeking financial guidance, and establishing separate financial resources. Don't let the illusion of wealth mask the reality of your financial vulnerability. Take control of your financial future and break free from the struggles of a "starving wife" by exploring career options, seeking financial guidance, and prioritizing your financial independence. Start building your path towards a financially secure and empowered future. Remember, you deserve to thrive, not just survive.

Featured Posts

-

Analyzing Ufc Vegas 106 Odds Burns Vs Morales And The Complete Fight Card

May 19, 2025

Analyzing Ufc Vegas 106 Odds Burns Vs Morales And The Complete Fight Card

May 19, 2025 -

Paige Bueckers Hometown A 24 Hour Online Mystery

May 19, 2025

Paige Bueckers Hometown A 24 Hour Online Mystery

May 19, 2025 -

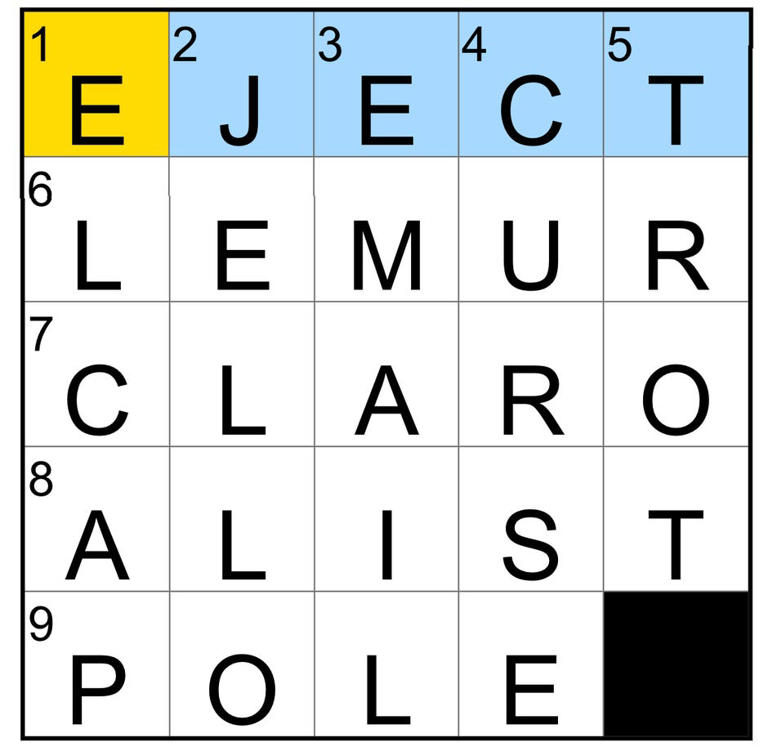

Todays Nyt Mini Crossword Answers March 16 2025

May 19, 2025

Todays Nyt Mini Crossword Answers March 16 2025

May 19, 2025 -

Post Ufc 313 Santos Gives Credit To Marshall For Victory

May 19, 2025

Post Ufc 313 Santos Gives Credit To Marshall For Victory

May 19, 2025 -

Kiprskiy Vopros Turtsiya I Vyvod Voysk Obsuzhdenie Na Haqqin Az

May 19, 2025

Kiprskiy Vopros Turtsiya I Vyvod Voysk Obsuzhdenie Na Haqqin Az

May 19, 2025