The Trade War's Impact On Crypto: One Cryptocurrency That Could Still Thrive

Table of Contents

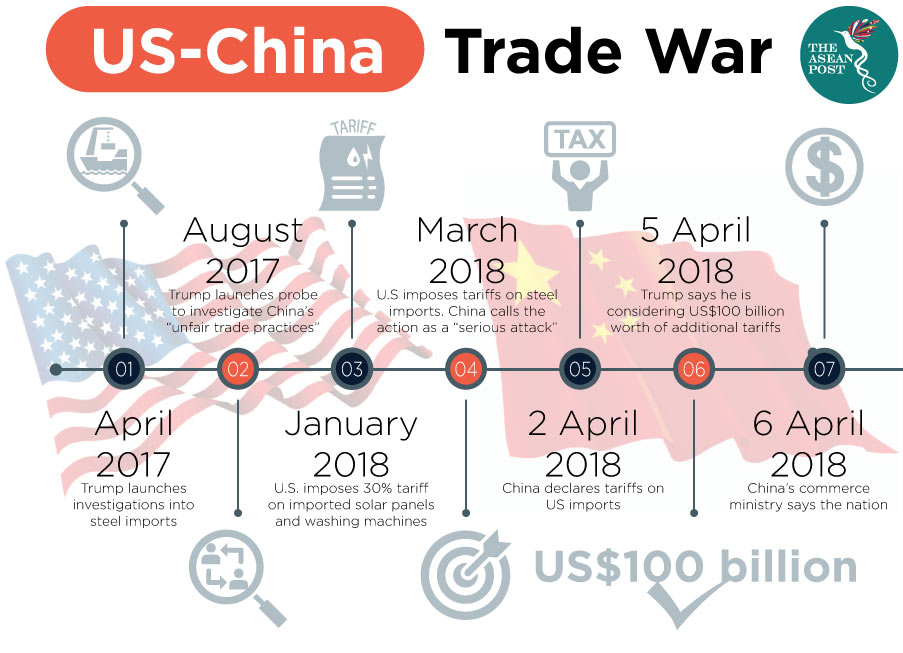

The Trade War's Impact on Traditional Markets

Trade wars, characterized by escalating tariffs and trade restrictions, significantly disrupt global economies. The negative consequences are far-reaching:

- Increased uncertainty and volatility: Businesses face unpredictable costs and market conditions, hindering investment and growth. This uncertainty ripples through stock markets, leading to price swings and investor anxiety.

- Reduced international trade and investment: Tariffs increase the cost of goods, reducing the volume of international trade. Uncertainty discourages foreign direct investment, impacting economic growth in affected countries.

- Potential for inflation and currency devaluation: Trade wars can disrupt supply chains, leading to shortages and price increases. Currency fluctuations are common, adding further complexity to international commerce.

- Negative impact on investor confidence: The overall uncertainty and negative economic outlook resulting from trade disputes erode investor confidence, leading to capital flight and market downturns.

These factors indirectly impact the cryptocurrency market. Investor sentiment, often driven by broader economic trends, influences cryptocurrency prices. A global economic slowdown, for example, could lead to reduced investment in cryptocurrencies, even those considered relatively insulated from traditional markets.

How Trade Wars Affect the Cryptocurrency Market

While the cryptocurrency market often exhibits a degree of independence from traditional markets, it's not entirely immune to their influence. The relationship is complex and not always directly correlated.

- Safe-haven asset status of some cryptocurrencies during economic uncertainty: Some investors view cryptocurrencies, particularly Bitcoin, as a safe-haven asset during times of economic uncertainty, driving up demand during periods of market turmoil.

- Increased demand for privacy coins due to regulatory pressures: Increased government scrutiny and regulatory uncertainty can lead to a rise in demand for privacy-focused cryptocurrencies, as investors seek to protect their assets from potential government intervention.

- Potential for increased volatility in the crypto market mirroring traditional markets: Global economic instability can amplify volatility in the crypto market, leading to sharp price swings that mirror, though not always directly correlate with, movements in traditional markets.

- Impact of sanctions and regulatory changes on cryptocurrency exchanges and usage: Trade wars can lead to sanctions and regulatory changes affecting cryptocurrency exchanges and usage, limiting access and potentially stifling growth in certain regions.

Decentralized Finance (DeFi) and its Resilience

Decentralized Finance (DeFi) presents a compelling case study in resilience during times of global economic uncertainty. Its inherent characteristics offer several advantages:

- Decentralized nature of DeFi mitigating geopolitical risks: DeFi protocols operate on distributed networks, making them less susceptible to the influence of individual governments or geopolitical events. This decentralization helps protect them from the direct impact of trade wars.

- Global accessibility and borderless transactions: DeFi offers seamless cross-border transactions, circumventing many of the restrictions imposed by traditional financial systems affected by trade wars.

- Potential for DeFi to offer alternative financial solutions outside traditional systems: DeFi provides alternative lending, borrowing, and investment opportunities, offering solutions outside of traditional banking systems, which are often heavily impacted by trade conflicts.

- Growing adoption of DeFi protocols and applications: The DeFi ecosystem is constantly evolving, with new protocols and applications emerging, increasing its resilience and adaptability.

- Specific examples of DeFi projects showcasing resilience: Many DeFi projects have shown remarkable resilience during periods of market volatility, demonstrating the potential for sustained growth even amidst global economic uncertainty. For instance, stablecoins continue to provide a safe harbor for users seeking price stability.

One Cryptocurrency Poised for Growth: Aave (AAVE)

Aave, a leading decentralized lending and borrowing platform, is well-positioned to thrive in the face of trade war uncertainty. Its decentralized and borderless nature offers several advantages:

- Unique features and benefits relevant to the current economic climate: Aave offers users the ability to earn interest on their crypto assets and borrow cryptocurrencies at competitive rates, providing financial flexibility in uncertain times.

- Strong community support and development: Aave has a large and active community, ensuring ongoing development and innovation.

- Potential for real-world applications and utility: Aave’s technology has the potential to disrupt traditional lending markets, offering more efficient and accessible financial services globally.

- Growth projections and market analysis: Market analysis indicates significant growth potential for Aave, given the increasing adoption of DeFi and the demand for alternative financial solutions.

- Comparison to other cryptocurrencies and their vulnerabilities: Unlike centralized exchanges vulnerable to regulatory pressures and geopolitical risks, Aave’s decentralized nature provides inherent resilience.

Conclusion

The trade war's impact on the cryptocurrency market is complex, but it's clear that DeFi protocols like Aave are uniquely positioned to thrive. While the broader cryptocurrency market might experience volatility mirroring traditional market fluctuations, the decentralized and borderless nature of DeFi offers significant protection against the negative impacts of trade disputes. Aave, with its robust functionality, strong community, and potential for real-world applications, stands out as a cryptocurrency poised for long-term growth despite the challenges posed by the global trade landscape.

Call to Action: Learn more about Aave and its potential to navigate the complexities of the global trade landscape. Start your research into this resilient cryptocurrency today and discover the opportunities in this evolving market. Explore the world of Aave and secure your financial future.

Featured Posts

-

Play Station 5 Pro Disassembly Exploring The Next Gen Consoles Hardware

May 08, 2025

Play Station 5 Pro Disassembly Exploring The Next Gen Consoles Hardware

May 08, 2025 -

Why You Need Trustworthy Sources For Crypto News

May 08, 2025

Why You Need Trustworthy Sources For Crypto News

May 08, 2025 -

Ukraine Cemetery Corruption And The Exploitation Of Soldiers Remains

May 08, 2025

Ukraine Cemetery Corruption And The Exploitation Of Soldiers Remains

May 08, 2025 -

Bitcoin Seoul 2025 Asias Largest Bitcoin Conference

May 08, 2025

Bitcoin Seoul 2025 Asias Largest Bitcoin Conference

May 08, 2025 -

Boston Celtics Jayson Tatum Injured Ankle Pain Raises Concerns

May 08, 2025

Boston Celtics Jayson Tatum Injured Ankle Pain Raises Concerns

May 08, 2025

Latest Posts

-

Planlegg Vinterreisen Sjekk Vaermeldingen For Du Kjorer I Sor Norges Fjell

May 09, 2025

Planlegg Vinterreisen Sjekk Vaermeldingen For Du Kjorer I Sor Norges Fjell

May 09, 2025 -

Elaxista Xionia Sta Imalaia Simadia Klimatikis Allagis

May 09, 2025

Elaxista Xionia Sta Imalaia Simadia Klimatikis Allagis

May 09, 2025 -

The Colin Cowherd Jayson Tatum Debate Examining The Points Of Contention

May 09, 2025

The Colin Cowherd Jayson Tatum Debate Examining The Points Of Contention

May 09, 2025 -

Pogoda V Permi I Permskom Krae V Kontse Aprelya 2025 Prognoz Pokholodaniya I Snegopadov

May 09, 2025

Pogoda V Permi I Permskom Krae V Kontse Aprelya 2025 Prognoz Pokholodaniya I Snegopadov

May 09, 2025 -

Kjoreforhold I Sor Norges Fjell Oppdatert Informasjon Om Sno Og Is

May 09, 2025

Kjoreforhold I Sor Norges Fjell Oppdatert Informasjon Om Sno Og Is

May 09, 2025