The Treasury Market On April 8th: What Happened And Why

Table of Contents

Impact of Economic Data Releases on Treasury Yields

Economic data releases often serve as catalysts for significant movements in the Treasury market. On April 8th, several key indicators likely influenced Treasury yields.

Inflation Data and its Influence

Inflation data, particularly the Consumer Price Index (CPI) and Producer Price Index (PPI), are crucial indicators for the Federal Reserve's monetary policy decisions. Let's assume, for illustrative purposes, that the CPI for March showed a higher-than-expected increase. This could lead to:

- Specific inflation numbers released: Let's assume a CPI increase of 0.4%, exceeding analysts' predictions of 0.3%. A PPI increase of 0.6% could also have been reported.

- Market reaction to the data: A higher-than-expected inflation reading would likely trigger a sell-off in the bond market, as investors anticipate further interest rate hikes by the Federal Reserve to combat inflation.

- Impact on inflation expectations: Increased inflation expectations would put upward pressure on Treasury yields, as investors demand higher returns to compensate for the erosion of purchasing power.

Employment Report and its Correlation with Treasury Yields

The employment report, released by the Bureau of Labor Statistics, provides valuable insights into the health of the economy. A strong employment report, characterized by robust job growth and a low unemployment rate, typically suggests a healthy economy, potentially leading to higher interest rates.

- Employment figures: Let's hypothesize that the April 8th employment report showed a significant increase in non-farm payrolls, coupled with a decline in the unemployment rate.

- Unemployment rate: A lower unemployment rate might suggest a tightening labor market, reinforcing expectations of further interest rate increases by the Federal Reserve.

- Impact on bond market sentiment: This positive economic news could increase investor confidence, potentially leading to higher Treasury yields as demand for safer assets decreases slightly in favor of higher-risk investments that promise better returns.

Federal Reserve Actions and their Ripple Effects

The Federal Reserve's actions and communications significantly influence the Treasury market. Any statements or actions from the Fed on April 8th would have had a profound effect on Treasury yields.

Fed Statements and Market Reactions

The Federal Reserve's statements often provide clues about the future direction of monetary policy. Even subtle changes in language can significantly impact market expectations.

- Specific Fed statements: Imagine the Fed Chair reiterates a commitment to combating inflation, hinting at further interest rate hikes in the coming months.

- Interpretation of statements by analysts: Analysts would dissect these statements, assessing their implications for the trajectory of interest rates. Different interpretations could lead to diverse market reactions.

- Market response to the Fed's actions: A hawkish stance from the Fed (emphasizing inflation control) would likely push Treasury yields higher, as investors anticipate higher interest rates in the future.

Impact of Quantitative Tightening (QT) or other monetary policy tools

The Federal Reserve's quantitative tightening (QT) program involves reducing its balance sheet by allowing Treasury securities and other assets to mature without reinvestment.

- QT details: The pace of QT, the volume of securities allowed to mature, and the overall approach all influence the supply of Treasury securities in the market.

- Impact of QT on bond supply and demand: QT reduces the demand for bonds which can increase Treasury yields.

- Effect on Treasury prices and yields: A faster pace of QT could push Treasury yields higher, due to reduced demand and increased supply.

Global Geopolitical Events and their Influence

Global geopolitical events can significantly influence investor sentiment and the demand for U.S. Treasuries as a safe-haven asset.

International Events and their impact on Safe-Haven Demand for Treasuries

Geopolitical instability often increases demand for safe-haven assets like U.S. Treasuries.

- Specific geopolitical events: Let’s assume increased tensions in a specific region of the world.

- Impact on risk appetite: This could trigger a "flight to safety," increasing demand for U.S. Treasuries and potentially lowering their yields.

- Effect on Treasury demand and yields: Increased demand for Treasuries, due to risk aversion, could drive down yields.

Conclusion: Recap and Call to Action: Understanding the Treasury Market on April 8th

The Treasury market's movements on April 8th were shaped by a complex interplay of factors. Economic data releases, particularly inflation and employment figures, influenced investor expectations about future interest rate hikes. The Federal Reserve's actions and communications, including any hints about future monetary policy and the continued impact of QT, played a crucial role. Finally, global geopolitical events contributed to shifts in investor risk appetite and demand for U.S. Treasuries as a safe haven asset. Understanding these interactions is vital for navigating the complexities of the Treasury market.

Key Takeaways: The Treasury market is highly sensitive to economic data, Federal Reserve policy, and global events. These factors often interact in complex ways, influencing Treasury yields and investor sentiment. Analyzing these individual components and their interplay is crucial for comprehending the dynamics of the Treasury market.

Call to Action: Staying informed about daily Treasury market movements is critical for effective investment strategies. Continue to monitor the Treasury market for further insights and updates. For in-depth Treasury market analysis, Treasury yield forecasts, and information on Treasury bond market trends, visit [link to relevant resource].

Featured Posts

-

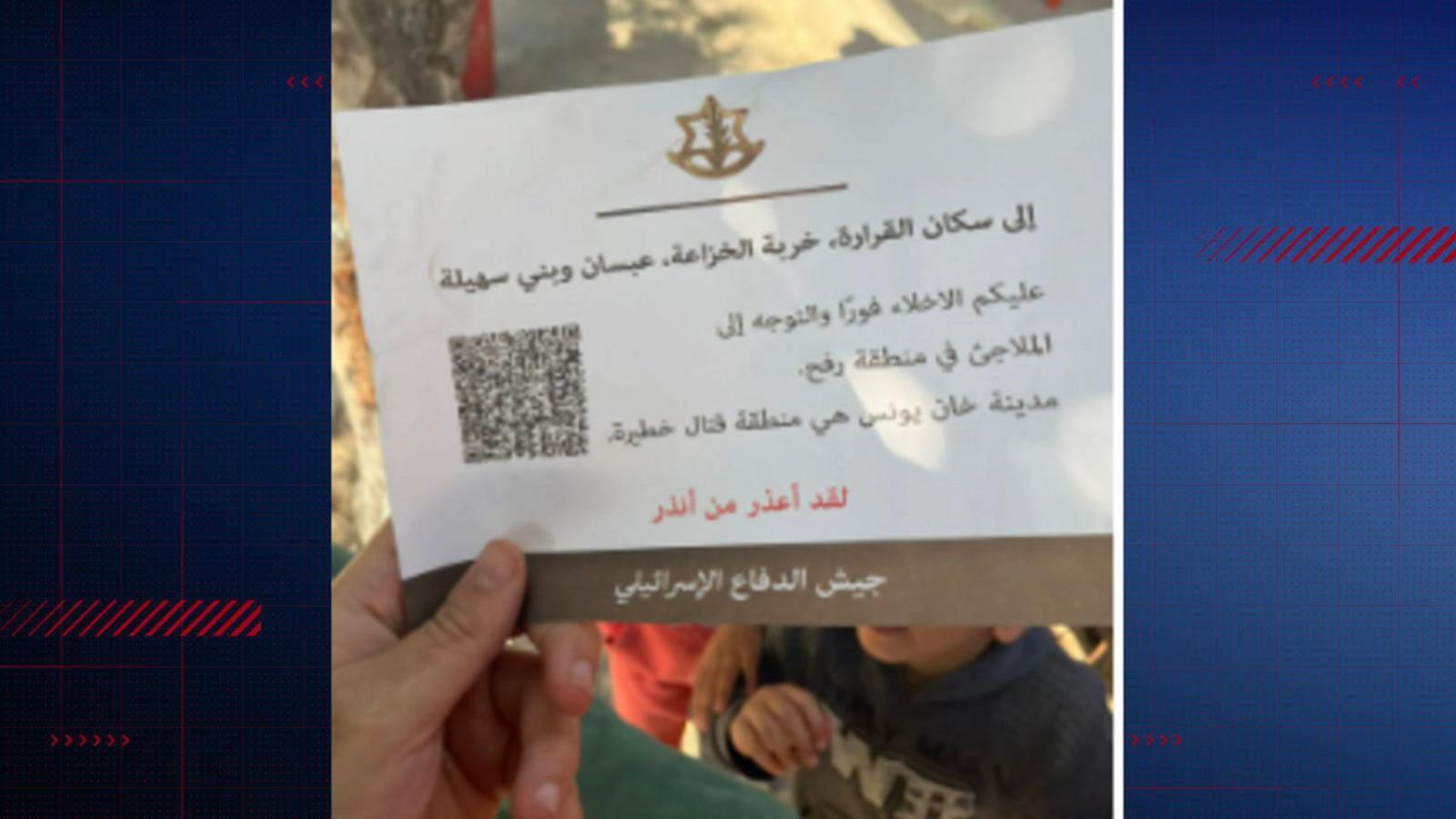

Israel Faces Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025

Israel Faces Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025 -

The Pete Rose Pardon Understanding Trumps Latest Announcement

Apr 29, 2025

The Pete Rose Pardon Understanding Trumps Latest Announcement

Apr 29, 2025 -

Snow Fox Tuesday February 11th Closures And Delays

Apr 29, 2025

Snow Fox Tuesday February 11th Closures And Delays

Apr 29, 2025 -

Nyt Strands Puzzle April 27 2025 Solutions And Spangram

Apr 29, 2025

Nyt Strands Puzzle April 27 2025 Solutions And Spangram

Apr 29, 2025 -

Willie Nelsons Wife Denies Inaccurate Media Claims

Apr 29, 2025

Willie Nelsons Wife Denies Inaccurate Media Claims

Apr 29, 2025

Latest Posts

-

You Tubes Growing Appeal To Older Viewers Nostalgia And Accessibility

Apr 29, 2025

You Tubes Growing Appeal To Older Viewers Nostalgia And Accessibility

Apr 29, 2025 -

How You Tube Caters To The Preferences Of Older Viewers

Apr 29, 2025

How You Tube Caters To The Preferences Of Older Viewers

Apr 29, 2025 -

You Tube A Platform For Classic Tv Shows And Older Viewers

Apr 29, 2025

You Tube A Platform For Classic Tv Shows And Older Viewers

Apr 29, 2025 -

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025 -

You Tubes Growing Appeal To Older Viewers A Trend Analysis

Apr 29, 2025

You Tubes Growing Appeal To Older Viewers A Trend Analysis

Apr 29, 2025