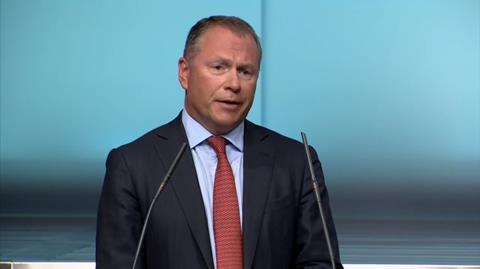

The Trump Tariffs: Nicolai Tangen's Investment Strategy

Table of Contents

Understanding the Trump Tariff Landscape

The Trump administration's tariff policies dramatically reshaped the global trade landscape. Characterized by protectionist measures, these policies targeted specific sectors and countries, triggering retaliatory tariffs and escalating a "trade war." This created significant economic uncertainty and market volatility, impacting global supply chains and investor confidence.

- Specific Tariff Examples: Tariffs were imposed on steel and aluminum imports from various countries, including China and the European Union. Additional tariffs targeted specific goods from China, impacting numerous sectors.

- Sectoral Impact: The manufacturing, agriculture, and technology sectors were particularly affected, experiencing disruptions to supply chains, increased input costs, and reduced competitiveness in global markets. The uncertainty surrounding the tariffs also led to decreased investment and hiring in these sectors. The unpredictability of the "import tariffs" and "export tariffs" further fueled market volatility.

Nicolai Tangen's Investment Philosophy and Risk Management

Tangen's investment approach is characterized by a long-term perspective, emphasizing "value investing" and integrating Environmental, Social, and Governance (ESG) considerations into investment decisions. This "sustainable investing" approach is coupled with robust "risk management" strategies designed to navigate market fluctuations.

- Key Investment Principles: Tangen's philosophy centers around identifying undervalued assets, focusing on long-term growth potential, and maintaining a diversified portfolio. A key component of his approach is to incorporate ESG factors into the investment decision-making process.

- Risk Mitigation Techniques: Diversification across asset classes and geographies is a cornerstone of his strategy. Furthermore, thorough due diligence, scenario planning, and stress testing are employed to anticipate and mitigate potential risks. The inherent unpredictability of "geopolitical risk" under the Trump administration demanded a flexible approach.

Adapting to Tariff-Induced Market Volatility

The unpredictability of the Trump tariffs forced Tangen to adapt his investment decisions. The volatility necessitated adjustments to the fund's portfolio, requiring a flexible and responsive investment strategy.

- Portfolio Adjustments: In response to specific tariff impacts, the fund likely adjusted its holdings across sectors. For example, investments in sectors heavily impacted by tariffs might have been reduced, while others less affected, or even beneficiaries, might have seen increased allocation. "Sector rotation" became a crucial element of the strategy.

- Investment Decision Examples: While specific details of the fund's portfolio adjustments remain confidential, analyzing the overall performance of the fund provides insight into the success of these reactive measures. This likely involved a detailed assessment of the "market volatility" and careful management of "investment decisions."

The Performance of the Norwegian Sovereign Wealth Fund under Tangen's Leadership During the Tariff Era

Assessing the performance of the Norwegian sovereign wealth fund during the Trump tariff era requires a comparison to relevant benchmark indices. While precise figures may be subject to confidentiality agreements, publicly available data can provide a general overview.

- Key Performance Indicators (KPIs): Key metrics include the total return on investment, the fund's growth rate compared to various market benchmarks, and a risk-adjusted return analysis.

- Factors Contributing to Performance: The fund's performance during this period reflects a combination of factors: Tangen's investment strategy, global market conditions beyond the tariffs' direct impact, and the inherent volatility of the markets themselves. The efficacy of the "sovereign wealth fund management" under these volatile conditions is a key point of analysis.

Conclusion: Assessing the Success of Tangen's Approach to the Trump Tariffs

Nicolai Tangen's leadership of the Norges Bank Investment Management during the era of Trump tariffs provides a valuable case study in navigating geopolitical economic uncertainty. While specific details of portfolio adjustments remain confidential, the fund's overall performance offers insights into the effectiveness of a long-term, value-focused, and diversified investment strategy in the face of significant external shocks. His "investment strategy analysis" reveals the importance of adaptability and robust risk management in mitigating the "Trump tariffs impact." This case study highlights the crucial role of flexible "geopolitical risk management" in ensuring the long-term success of even the largest "sovereign wealth fund strategy."

To further understand the intricacies of navigating global trade policy impacts on investment decisions, we encourage readers to delve deeper into the available literature on Nicolai Tangen's investment strategy and the broader implications of global trade policies on portfolio management.

Featured Posts

-

Bob Bafferts Kentucky Derby Return An Identity Crisis In Racing

May 04, 2025

Bob Bafferts Kentucky Derby Return An Identity Crisis In Racing

May 04, 2025 -

Final Destination 6 Bloodline Trailer And Box Office Ranking Of The Franchise

May 04, 2025

Final Destination 6 Bloodline Trailer And Box Office Ranking Of The Franchise

May 04, 2025 -

Iskrennee Priznanie Dzhidzhi Khadid O Novykh Otnosheniyakh S Kuperom

May 04, 2025

Iskrennee Priznanie Dzhidzhi Khadid O Novykh Otnosheniyakh S Kuperom

May 04, 2025 -

Turki Al Sheikh And The Canelo Paul Debacle A Loss Of 40 50 Million Viewers

May 04, 2025

Turki Al Sheikh And The Canelo Paul Debacle A Loss Of 40 50 Million Viewers

May 04, 2025 -

Politika Makrona I Eyo Posledstviya Dlya Otnosheniy S Alzhirom

May 04, 2025

Politika Makrona I Eyo Posledstviya Dlya Otnosheniy S Alzhirom

May 04, 2025