The U.S. Dollar's Performance: A 100-Day Comparison To The Nixon Era

Table of Contents

The Nixon Shock: A Brief Overview

The Bretton Woods System and its Collapse

The Bretton Woods system, established after World War II, pegged the value of most currencies to the US dollar, which in turn was convertible to gold at a fixed rate. This system fostered relative stability in the global economy, facilitating international trade and investment. However, persistent US balance-of-payments deficits and growing inflation gradually eroded the system's viability. The US dollar's role as the global reserve currency meant that other nations held large amounts of US dollars, and as the US printed more dollars to finance its expenses, the value of the dollar decreased, creating pressure to devalue the dollar against gold.

The Impact of Nixon's Decision

On August 15, 1971, President Nixon unilaterally ended the convertibility of the US dollar to gold, effectively closing the gold window. This decision had profound and lasting consequences:

- Increased inflation: The removal of the gold standard allowed the US to print more money without the constraint of gold reserves, leading to increased inflation domestically and globally.

- Currency devaluation: The US dollar experienced a significant devaluation against other major currencies, as the fixed exchange rate system crumbled.

- Shift to a floating exchange rate system: The world transitioned to a system of floating exchange rates, where currency values are determined by market forces of supply and demand.

- Global economic uncertainty: The Nixon shock created considerable uncertainty and volatility in global financial markets, impacting international trade and investment.

The US Dollar's Performance in the First 100 Days Post-Nixon Shock

Analyzing the US dollar's performance in the 100 days following the Nixon shock requires examining various economic indicators. While precise data visualization with charts and graphs is beyond the scope of this text, studies show the dollar experienced significant fluctuations in this period, reflecting the initial market reaction to the end of the Bretton Woods system. The initial shock was followed by a period of volatility and uncertainty as markets adjusted to the new floating exchange rate system. This period saw a range of fluctuations in the dollar's value against other major currencies, illustrating the uncertainty surrounding the new economic landscape.

The Current Economic Climate and the US Dollar's Recent Performance

Identifying the Relevant Current Event

For this comparison, let's consider the period starting with [Insert Date of Relevant Current Economic Event – e.g., the start of a significant interest rate hike cycle by the Federal Reserve]. This event triggered considerable uncertainty and fluctuation in the financial markets, impacting various economic indicators, including the US dollar's value.

Key Economic Indicators

Analyzing the first 100 days following this event reveals key trends in various economic indicators:

- Inflation rate: [Insert data on inflation rate for the 100-day period].

- Interest rates: [Insert data on interest rate changes during the 100-day period].

- Unemployment figures: [Insert data on unemployment during the 100-day period].

- Stock market performance: [Insert data on stock market performance (e.g., S&P 500) during the 100-day period].

- US Dollar Index (DXY) fluctuations: [Insert data on the DXY fluctuations during the 100-day period, noting highs and lows].

Comparative Analysis

A direct comparison of the dollar's movement during the first 100 days of both periods requires a detailed analysis of the US Dollar Index (DXY) and other relevant exchange rates. While graphical representation is ideal, comparing the rate and magnitude of change during both periods will help illuminate the similarities and differences in the market's response to these major economic shifts. For instance, the speed at which the market adjusted to the new floating system post-Nixon shock might be compared to the speed of adjustment seen in the current period. This could include the examination of peak-to-trough movements, indicating the volatility of the US dollar's value within those 100-day windows.

Factors Influencing the US Dollar's Performance in Both Periods

Similarities

Several common factors influenced the US dollar's value in both eras:

- Global political instability: Geopolitical events and uncertainties played a significant role in both periods.

- Inflationary pressures: Inflationary pressures impacted investor confidence and the value of the dollar in both instances.

- Changes in investor sentiment: Shifts in investor confidence, driven by economic news and geopolitical events, affected currency markets.

- Monetary policy decisions: Federal Reserve actions regarding monetary policy influenced the US dollar's exchange rate.

Differences

Despite similarities, several distinct factors shaped the US dollar's performance in each period:

- Technological advancements impacting global trade: Globalization and technological advancements significantly increased the interconnectedness of global markets post-Nixon shock, impacting currency exchange.

- Different geopolitical landscapes: The global geopolitical landscape differed significantly between the 1970s and the present day, impacting economic relations and currency valuations.

- Variations in global economic power dynamics: The distribution of global economic power has shifted considerably since the Nixon era, affecting the dollar's influence.

- Technological disruptions: The impact of technological disruptions and their ripple effects on global markets were much less pronounced in 1971 than they are today.

Conclusion: Understanding the U.S. Dollar's Trajectory

This comparative analysis of the US dollar's performance in the 100 days following the Nixon shock and a recent significant economic event reveals both similarities and differences in the market's response to major economic shifts. While inflationary pressures and global uncertainty impacted the dollar in both instances, the speed and nature of market adjustments differed due to changes in the global economic landscape, technological advancements, and the evolution of global financial markets. The key takeaway is that understanding historical context is crucial for navigating current market volatility. Investors and policymakers must carefully consider the interplay of global political and economic forces to anticipate future trends in the US dollar's value.

Stay informed about the US dollar's performance by continuing to monitor key economic indicators and geopolitical developments. Further research into the historical trends of the US dollar, including detailed analyses of periods of significant change, can provide valuable insights for developing effective investment strategies. [Link to a relevant resource, e.g., Federal Reserve Economic Data (FRED)]

Featured Posts

-

The China Factor Analyzing The Automotive Challenges Faced By Bmw Porsche And Competitors

Apr 29, 2025

The China Factor Analyzing The Automotive Challenges Faced By Bmw Porsche And Competitors

Apr 29, 2025 -

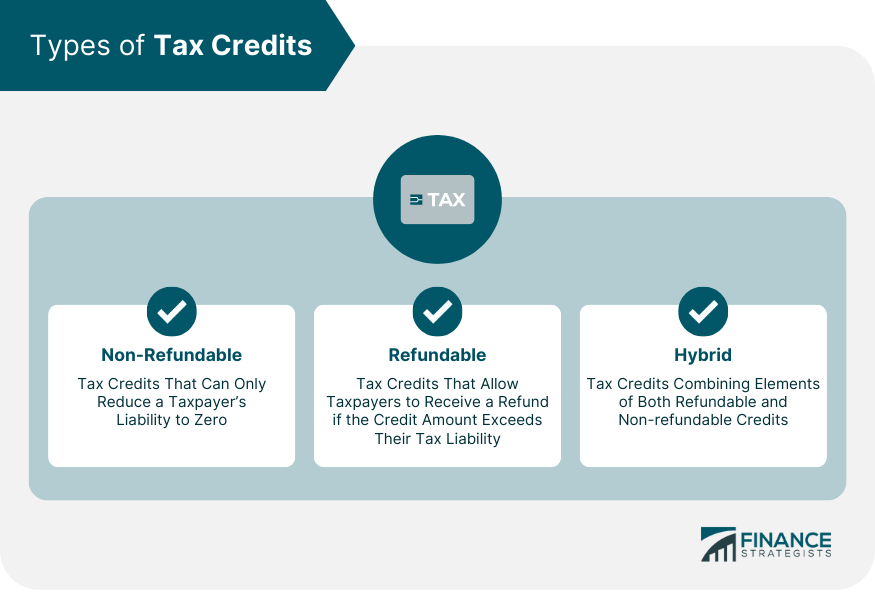

Minnesota Film Production The Impact Of Tax Credits

Apr 29, 2025

Minnesota Film Production The Impact Of Tax Credits

Apr 29, 2025 -

Vancouver Festival Tragedy Car Rams Crowd Leaving Many Injured

Apr 29, 2025

Vancouver Festival Tragedy Car Rams Crowd Leaving Many Injured

Apr 29, 2025 -

Southern Beirut Hit By Israeli Airstrike Residents Urged To Evacuate

Apr 29, 2025

Southern Beirut Hit By Israeli Airstrike Residents Urged To Evacuate

Apr 29, 2025 -

The Dysprosium Shortage A Major Threat To The Future Of Electric Vehicles

Apr 29, 2025

The Dysprosium Shortage A Major Threat To The Future Of Electric Vehicles

Apr 29, 2025

Latest Posts

-

Trump To Issue Full Pardon For Rose Latest Updates

Apr 29, 2025

Trump To Issue Full Pardon For Rose Latest Updates

Apr 29, 2025 -

You Tubes Growing Appeal To Older Viewers Nostalgia And Accessibility

Apr 29, 2025

You Tubes Growing Appeal To Older Viewers Nostalgia And Accessibility

Apr 29, 2025 -

How You Tube Caters To The Preferences Of Older Viewers

Apr 29, 2025

How You Tube Caters To The Preferences Of Older Viewers

Apr 29, 2025 -

You Tube A Platform For Classic Tv Shows And Older Viewers

Apr 29, 2025

You Tube A Platform For Classic Tv Shows And Older Viewers

Apr 29, 2025 -

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025

You Tube A New Home For Classic Tv Shows And Older Viewers

Apr 29, 2025