The Unexpected Bitcoin Mining Boom: Reasons Behind The Rise

Table of Contents

The Role of Bitcoin's Price in Fueling the Boom

A higher Bitcoin price is the most direct catalyst for the Bitcoin mining boom. Increased profitability is the primary driver, making mining a more attractive and lucrative endeavor.

Increased Profitability

The profitability of Bitcoin mining is directly tied to the price of Bitcoin itself. Miners are rewarded with newly minted Bitcoin for solving complex cryptographic puzzles, alongside transaction fees. When the Bitcoin price rises, the value of these rewards increases significantly, making the operation more profitable. This, in turn, encourages more miners to join the network and invest in more powerful hardware.

- Price Example: A Bitcoin price of $20,000 per coin translates to a significantly higher reward for miners compared to a price of $10,000. This difference directly impacts their profit margins, incentivizing expansion.

- Halving Events: Bitcoin's halving events, which occur approximately every four years, reduce the block reward by half. While this initially reduces miner rewards, it also often leads to price increases that can offset the reduction in reward and maintain profitability.

- Transaction Fees: High transaction volumes on the Bitcoin network lead to increased transaction fees, providing an additional revenue stream for miners. This is particularly crucial during periods of high network congestion.

Technological Advancements Driving Efficiency

Technological innovations are another key factor driving the Bitcoin mining boom. Advancements in hardware and energy sources are crucial for increasing efficiency and lowering operational costs.

Improved Mining Hardware (ASICs)

Application-Specific Integrated Circuits (ASICs) are purpose-built chips designed solely for Bitcoin mining. The evolution of ASICs has led to exponentially increased hashing power and significantly improved energy efficiency.

- Advancements in ASIC Technology: Each generation of ASICs boasts improved hashing power and lower power consumption, allowing miners to solve cryptographic puzzles faster and more efficiently.

- Lower Operational Costs: The increased efficiency of modern ASICs translates directly into lower operational costs per Bitcoin mined, boosting profitability even at lower Bitcoin prices.

- Specialized Mining Farms: Large-scale mining operations, often located in areas with cheap electricity, leverage the latest ASICs to maximize their output and profitability.

Renewable Energy Sources

The increasing adoption of renewable energy sources in Bitcoin mining is a significant development. This addresses environmental concerns and reduces operational costs in certain regions.

- Environmental Benefits: Utilizing solar, hydro, and wind power reduces the carbon footprint associated with Bitcoin mining, addressing a common criticism of the industry.

- Cost Reductions: In areas with abundant renewable energy resources, the cost of electricity can be dramatically lower than traditional sources, significantly improving miner profitability.

- Environmentally Responsible Mining: Many mining operations are actively seeking sustainable energy solutions, showcasing a commitment to environmentally conscious Bitcoin mining practices.

Regulatory Landscape and its Influence

The regulatory environment plays a crucial role in shaping the Bitcoin mining landscape. Varying approaches across different countries significantly influence the location and growth of mining operations.

Regional Variations in Regulations

Different jurisdictions have adopted contrasting stances towards Bitcoin mining. Some countries offer favorable regulatory frameworks, attracting significant investment, while others have implemented restrictions or outright bans.

- China's Ban: China's crackdown on Bitcoin mining in 2021 forced many miners to relocate to other countries, impacting the global distribution of mining activity.

- Regulatory Uncertainty: Uncertainty regarding future regulations can discourage investment and hamper the growth of Bitcoin mining in certain regions.

- Environmental Regulations: Stricter environmental regulations can impact energy consumption and potentially increase the costs of Bitcoin mining in certain jurisdictions.

Institutional Investment and Growing Interest

The growing involvement of institutional investors is a pivotal aspect of the current Bitcoin mining boom. Large-scale investments are boosting market stability and fostering legitimacy.

Large-Scale Investments

Publicly traded companies and investment funds are increasingly investing in Bitcoin mining operations. This signifies growing confidence in the long-term viability and profitability of the industry.

- Examples of Institutional Investment: Several publicly traded companies have made significant investments in Bitcoin mining infrastructure, demonstrating the growing appeal to institutional investors.

- Market Stability: Large institutional investors can help stabilize the Bitcoin mining market, reducing volatility and attracting further investment.

- Increased Legitimacy: The involvement of reputable institutional investors enhances the overall perception and legitimacy of Bitcoin mining, attracting more mainstream interest.

Conclusion

The unexpected Bitcoin mining boom is a result of a complex interplay of factors: the rising price of Bitcoin, significant technological advancements leading to greater efficiency, the evolving regulatory landscape across different jurisdictions, and the increasing participation of institutional investors. Understanding these forces driving this Bitcoin mining boom is crucial for anyone interested in the future of cryptocurrency. Continue your research to stay informed about this rapidly evolving landscape, and explore the potential of Bitcoin mining further.

Featured Posts

-

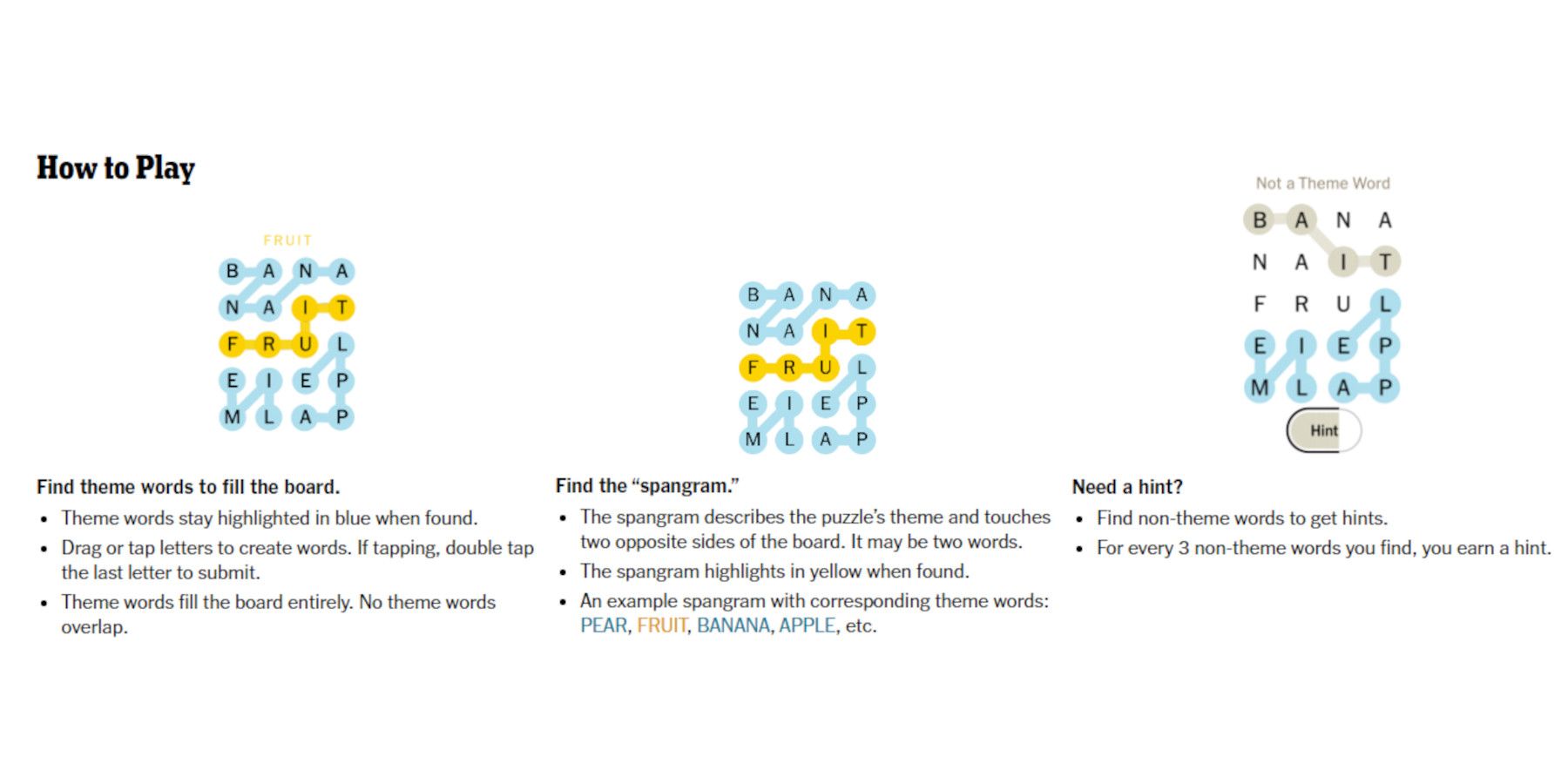

Nyt Strands Game 376 Hints And Answers For Friday March 14

May 09, 2025

Nyt Strands Game 376 Hints And Answers For Friday March 14

May 09, 2025 -

Cowherds Persistent Attacks On Jayson Tatums Skills

May 09, 2025

Cowherds Persistent Attacks On Jayson Tatums Skills

May 09, 2025 -

Pakistan Stock Market Volatility Website Outage And Investor Concerns

May 09, 2025

Pakistan Stock Market Volatility Website Outage And Investor Concerns

May 09, 2025 -

Masat Barbwza Fy Marakana Khsart Alasnan Wntayj Almerkt

May 09, 2025

Masat Barbwza Fy Marakana Khsart Alasnan Wntayj Almerkt

May 09, 2025 -

Olly Murs Concert Massive Music Festival At A Historic Castle Near Manchester

May 09, 2025

Olly Murs Concert Massive Music Festival At A Historic Castle Near Manchester

May 09, 2025