The Unfolding Bond Market Crisis: What Investors Need To Know

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

Increased interest rates have a direct and significant impact on bond prices. This is a crucial relationship for every investor to understand. When central banks raise interest rates, newly issued bonds offer higher yields. This makes existing bonds with lower coupon payments less attractive to investors. Consequently, the market value of these older bonds declines. This inverse relationship between interest rates and bond prices is a fundamental principle of fixed income investing.

-

Higher interest rates lead to lower bond prices: This is the core principle driving much of the current bond market volatility. As interest rates climb, the value of existing bonds falls, impacting portfolios reliant on fixed-income securities.

-

Longer-term bonds are more sensitive to interest rate changes (duration risk): Bonds with longer maturities are more susceptible to interest rate fluctuations. Their prices will experience larger swings compared to shorter-term bonds. This is often referred to as duration risk, a key factor in bond valuation.

-

Investors need to carefully assess the duration of their bond holdings: Understanding the duration of your bonds is critical for managing risk. Investors with longer-duration holdings face greater potential losses in a rising rate environment. Sophisticated investors actively manage duration to mitigate interest rate risk.

-

Diversification across maturities can mitigate some interest rate risk: Spreading investments across bonds with different maturities can help reduce the overall impact of interest rate changes on a portfolio. This diversification strategy helps smooth out price fluctuations and minimizes exposure to specific interest rate sensitivities.

Inflation's Erosive Effect on Fixed Income Returns

High inflation significantly erodes the purchasing power of fixed income returns. If the rate of inflation surpasses the yield on a bond, investors experience a real loss in value. This means their investment is worth less in terms of what it can actually buy. This is a major concern for investors seeking to preserve capital and maintain a stable purchasing power.

-

Inflation reduces the real return on bonds: The real return is the yield adjusted for inflation. A high inflation rate can quickly diminish the real return, even if the nominal yield appears attractive.

-

Investors should consider inflation-protected securities (TIPS) to hedge against inflation: TIPS, or Treasury Inflation-Protected Securities, are designed to protect against inflation. Their principal adjusts with the Consumer Price Index (CPI), providing a hedge against rising prices.

-

Monitoring inflation expectations is crucial for investment decisions: Closely tracking inflation forecasts and economic indicators helps inform investment choices. Understanding the potential trajectory of inflation is essential for making sound investment decisions.

-

Adjusting investment strategies based on inflation forecasts is vital: Investors may need to adjust their portfolio allocations to accommodate changes in inflation expectations. This might involve shifting toward inflation-protected securities or other assets that perform well during inflationary periods.

Geopolitical Uncertainty and its Influence on Bond Markets

Geopolitical events significantly impact global bond markets. Wars, political instability, and international tensions often lead to increased market volatility. Investors typically seek "safe-haven" assets during times of uncertainty, often driving demand for government bonds and pushing down yields.

-

Geopolitical events increase market volatility: Unexpected geopolitical developments can create significant uncertainty and lead to sharp price swings in bond markets.

-

Diversification across different geographies can reduce risk: Holding bonds issued by governments in various countries can help mitigate risk associated with specific geopolitical events impacting a single region.

-

Understanding the impact of global events on bond markets is critical: Staying informed about global developments and their potential impact on bond markets is vital for making informed investment choices.

-

Consider diversifying into assets less correlated with geopolitical events: Explore asset classes that are less sensitive to geopolitical risks, such as certain commodities or alternative investments.

Recessionary Fears and Their Impact on Bond Yields

Concerns about an economic recession often lead investors to seek the safety of government bonds, driving down yields. This "flight to safety" phenomenon is a common reaction during economic uncertainty. However, a recession can also negatively impact corporate bond performance due to increased credit risk.

-

Recessions typically lead to lower bond yields: The demand for safe-haven assets increases during a recession, pushing down yields on government bonds.

-

Credit risk increases during economic downturns: The risk of corporate defaults rises during recessions, making corporate bonds riskier investments.

-

Careful credit analysis is crucial for corporate bond investments: Thorough due diligence is essential when investing in corporate bonds, especially during times of economic uncertainty.

-

Understanding economic indicators is important for predicting bond market movements: Monitoring leading economic indicators can help investors anticipate potential shifts in bond yields and make informed decisions.

Conclusion

The unfolding bond market crisis demands careful attention from investors. Rising interest rates, persistent inflation, geopolitical uncertainty, and recessionary fears create a complex and volatile landscape. Effective risk management and strategic adjustments are paramount. Investors need to actively monitor market conditions, diversify their portfolios effectively across maturities and geographies, and consider adjusting their strategies to mitigate losses. By proactively addressing the risks associated with this bond market crisis, investors can navigate these challenging times and potentially identify emerging opportunities. Don't let the bond market crisis catch you off guard; proactively manage your fixed income investments today!

Featured Posts

-

Top Music Lawyers 2025 A Billboard Perspective On Industry Leaders

May 29, 2025

Top Music Lawyers 2025 A Billboard Perspective On Industry Leaders

May 29, 2025 -

Luca Marinis Suzuka 8 Hours Crash Serious Injury Confirmed

May 29, 2025

Luca Marinis Suzuka 8 Hours Crash Serious Injury Confirmed

May 29, 2025 -

La Liga Hyper Motion Ver Real Zaragoza Vs Eibar En Directo

May 29, 2025

La Liga Hyper Motion Ver Real Zaragoza Vs Eibar En Directo

May 29, 2025 -

Victor Fernandez Presente Y Futuro

May 29, 2025

Victor Fernandez Presente Y Futuro

May 29, 2025 -

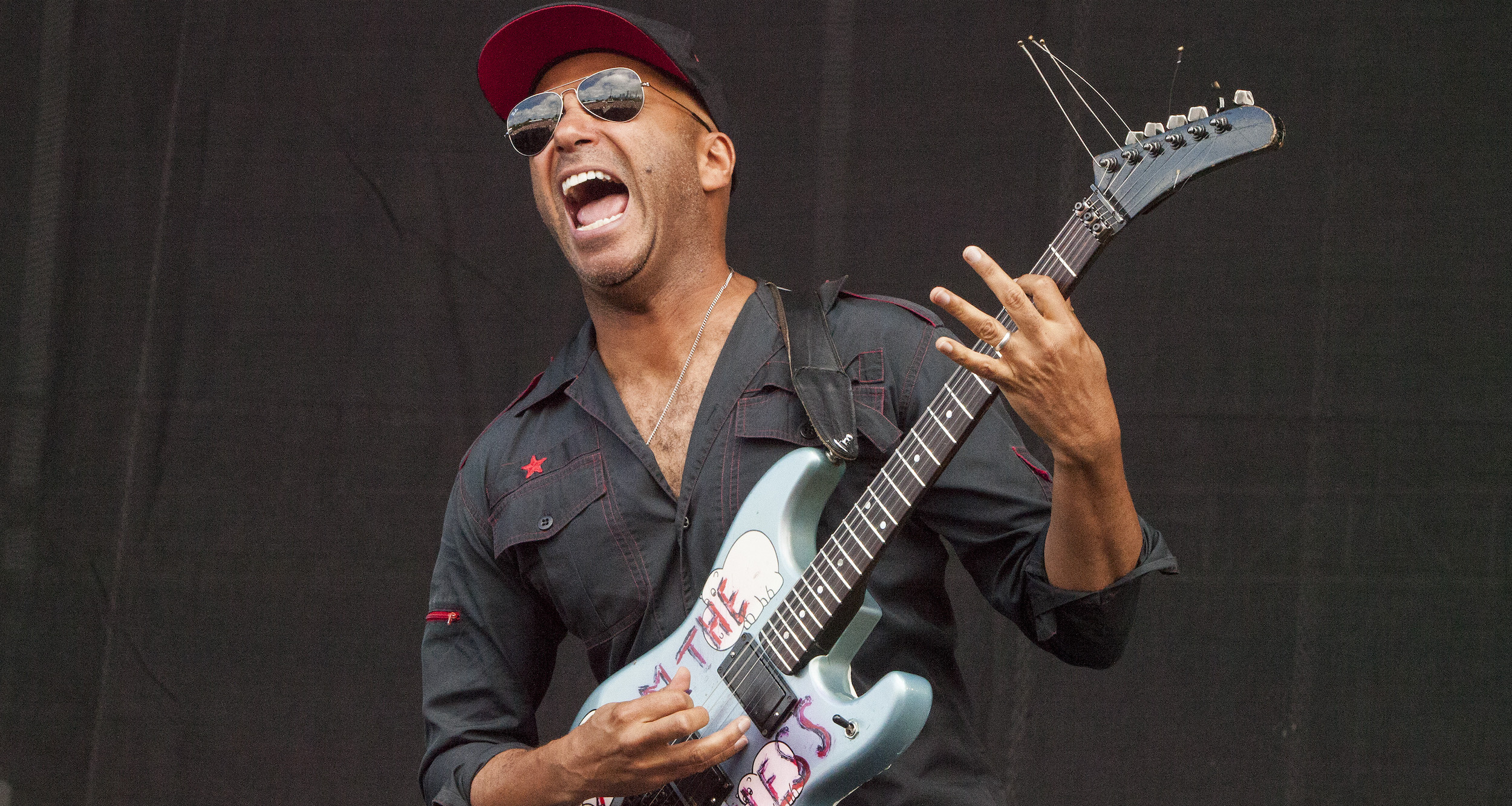

Ipa O Tom Morello Ton Rage Against The Machine Enantion Toy Tramp

May 29, 2025

Ipa O Tom Morello Ton Rage Against The Machine Enantion Toy Tramp

May 29, 2025

Latest Posts

-

Who Is Bernard Keriks Wife Details About His Family

May 31, 2025

Who Is Bernard Keriks Wife Details About His Family

May 31, 2025 -

Bernard Keriks Personal Life Focus On His Wife And Children

May 31, 2025

Bernard Keriks Personal Life Focus On His Wife And Children

May 31, 2025 -

The Family Of Bernard Kerik Details On His Wife And Children

May 31, 2025

The Family Of Bernard Kerik Details On His Wife And Children

May 31, 2025 -

World News Banksy Art Unveiled In Dubai

May 31, 2025

World News Banksy Art Unveiled In Dubai

May 31, 2025 -

Dubai Hosts First Ever Banksy Art Showcase

May 31, 2025

Dubai Hosts First Ever Banksy Art Showcase

May 31, 2025