The Unpopularity Of 10-Year Mortgages: A Canadian Perspective

Table of Contents

Higher Interest Rate Risk with 10-Year Mortgages in Canada

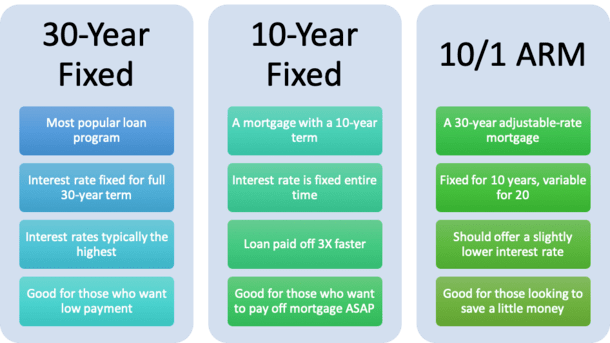

The primary deterrent for many Canadians considering a 10-year mortgage is the inherent risk associated with long-term fixed interest rates. Locking into a fixed rate for a decade means accepting the prevailing interest rate, regardless of future market fluctuations. This poses a significant challenge, especially considering the unpredictable nature of Canadian mortgage interest rates.

- Uncertainty surrounding future interest rate fluctuations: No one can accurately predict future interest rate movements. Rates could significantly drop during your 10-year term, leaving you paying more than necessary.

- Potential for significantly lower rates during the term: The possibility of refinancing at a substantially lower rate after a shorter-term mortgage is a powerful incentive for many Canadians. This flexibility provides peace of mind.

- The impact of rate changes on monthly payments: While fixed-rate mortgages offer payment stability, significantly higher rates can strain household budgets, especially if unforeseen circumstances arise.

- The advantage of flexibility with shorter-term mortgages allowing for refinancing: Shorter-term mortgages, such as 5-year terms, offer the opportunity to refinance and potentially secure a better interest rate after the initial term. This flexibility is highly attractive in a dynamic market like Canada's. This allows borrowers to potentially reduce their monthly payments and overall interest paid over the life of the mortgage.

The Flexibility Factor: Why Canadians Prefer Shorter-Term Mortgages

Canadians value flexibility, and this extends to their home financing. A shorter-term mortgage, typically a 5-year term, offers significantly more flexibility than a 10-year mortgage. This adaptability allows homeowners to react to changing financial circumstances and market conditions.

- Ability to refinance at lower rates: Shorter terms provide more frequent opportunities to refinance at potentially lower rates, minimizing the overall interest paid.

- Greater control over mortgage payments: Shorter terms give homeowners more control over their monthly payments and allow them to adjust their financial strategies more frequently.

- Option to break the mortgage early (with penalties, of course): While penalties apply, the option to break a shorter-term mortgage provides greater freedom compared to a longer-term commitment. This flexibility is important in an unpredictable housing market like Canada’s.

- The potential to leverage home equity after a shorter term: After a shorter term, homeowners can leverage their accumulated equity to pursue other financial goals, such as renovations or investment opportunities. This is a particularly appealing aspect of shorter term mortgages in the Canadian context.

The Psychological Factor: Canadian Attitudes Towards Long-Term Debt

Beyond the practical aspects, psychological factors also play a role in the preference for shorter-term mortgages. Canadians might exhibit a degree of risk aversion and a preference for shorter-term commitments.

- Preference for shorter-term commitments: Many find comfort in regularly reviewing their financial situation and adjusting their mortgage strategy accordingly.

- Fear of long-term financial obligations: A 10-year mortgage represents a significant long-term commitment, which can cause anxiety for some.

- Greater comfort with more frequent mortgage reviews: Regular reviews provide a sense of control and allow for proactive adjustments if needed.

- The influence of shifting market conditions on homeowner sentiment: Rapid changes in the Canadian housing market can impact homeowner sentiment, potentially leading to a preference for shorter-term commitments to maintain greater flexibility.

Limited Awareness of Long-Term Mortgage Benefits

Another factor contributing to the unpopularity of 10-year mortgages in Canada might be a lack of awareness regarding their long-term financial benefits. Many Canadians may not fully grasp the potential savings achieved by locking in a lower interest rate for an extended period.

- The lack of comprehensive education on mortgage options: Improved financial literacy initiatives are crucial to educate Canadians about the various mortgage options available.

- The role of financial advisors in guiding clients: Mortgage brokers and financial advisors play a critical role in helping clients understand the nuances of different mortgage terms.

- The need for clear and accessible information about long-term mortgages: More straightforward information on the benefits of long-term mortgages can help dispel misconceptions and increase their appeal.

Conclusion

The unpopularity of 10-year mortgages in Canada stems from a confluence of factors. The inherent interest rate risk, the desire for greater flexibility, and psychological preferences for shorter-term commitments all contribute to the prevalence of shorter-term mortgages. While a 10-year mortgage might not suit everyone, understanding these factors is crucial. Explore the benefits of a 10-year mortgage carefully and talk to a mortgage specialist about your options. Finding the right mortgage term for your Canadian home requires a thorough assessment of your individual financial situation and risk tolerance.

Featured Posts

-

Miami Heat Coaching Search Is Gregg Popovich A Realistic Option

May 06, 2025

Miami Heat Coaching Search Is Gregg Popovich A Realistic Option

May 06, 2025 -

Retro Trainers Are Back Suki Waterhouse Leads The Trend

May 06, 2025

Retro Trainers Are Back Suki Waterhouse Leads The Trend

May 06, 2025 -

Shvartsenegger I Chempion Pravda O Syemkakh Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemkakh Dlya Kim Kardashyan

May 06, 2025 -

How To Watch Gypsy Rose Life After Lockup Season 2 Episode 1 For Free

May 06, 2025

How To Watch Gypsy Rose Life After Lockup Season 2 Episode 1 For Free

May 06, 2025 -

Kilauea Volcano 40 Year Old Eruption Pattern Returns

May 06, 2025

Kilauea Volcano 40 Year Old Eruption Pattern Returns

May 06, 2025