Three More Rate Cuts Predicted By Desjardins For Bank Of Canada

Table of Contents

Desjardins' Rationale for Predicted Rate Cuts

Desjardins bases its prediction of three more Bank of Canada rate cuts on a careful analysis of several key economic indicators. Their assessment suggests that the current economic environment warrants further monetary easing to stimulate growth and mitigate the risk of a deeper recession. The economists at Desjardins point to several factors supporting their forecast:

- Falling inflation rate below the Bank of Canada's target: While inflation has cooled significantly from its peak, it remains above the Bank of Canada's 2% target. However, Desjardins anticipates a continued decline in inflation, paving the way for further rate reductions.

- Rising unemployment claims: A recent uptick in unemployment claims signals a softening labor market, suggesting reduced inflationary pressure and a need for stimulative monetary policy.

- Slowing economic growth: GDP growth has decelerated in recent quarters, indicating a weakening economy that requires intervention to prevent a sharper contraction.

- Global economic uncertainty: Geopolitical instability and global economic slowdown are contributing factors to Desjardins' cautious outlook and prediction of further rate cuts.

It's important to note that not all economists share Desjardins' optimistic view. Some argue that inflation remains stubbornly high and that further rate cuts risk reigniting inflationary pressures. These contrasting viewpoints highlight the inherent uncertainty in economic forecasting and the complexity of the current economic climate.

Impact of Predicted Rate Cuts on the Canadian Economy

The predicted three rate cuts by the Bank of Canada, as anticipated by Desjardins, could have significant implications for the Canadian economy, both positive and negative.

Potential Positive Impacts:

- Increased consumer spending: Lower interest rates typically lead to increased borrowing and spending by consumers, boosting economic activity.

- Reduced mortgage payments: Lower interest rates translate to lower mortgage payments, freeing up disposable income for consumers.

- Stimulated business investment: Lower borrowing costs encourage businesses to invest in expansion and job creation.

- Increased consumer confidence: Lower rates can lead to a more positive outlook among consumers, encouraging spending and investment.

Potential Negative Impacts:

- Weakened Canadian dollar: Lower interest rates can make the Canadian dollar less attractive to foreign investors, potentially leading to a weaker exchange rate.

- Potential for increased inflation in the long run: While intended to stimulate the economy, aggressive rate cuts could ultimately fuel inflation if not carefully managed.

- Risk of decreased foreign investment: Lower interest rates might reduce the attractiveness of Canadian assets to foreign investors.

- Impact on savings accounts: Lower interest rates mean lower returns on savings accounts, impacting the income of savers.

Market Reaction and Investor Sentiment

Desjardins' prediction is likely to influence market behavior and investor sentiment in several ways.

- Increased demand for government bonds: Lower interest rates typically increase the demand for government bonds, driving up their prices and lowering yields.

- Potential volatility in the stock market: The market may experience volatility as investors react to the implications of the predicted rate cuts.

- Impact on Canadian dollar exchange rates: The Canadian dollar's value could fluctuate in response to the changing interest rate environment.

- Shift in investment strategies: Investors may adjust their portfolios to account for the anticipated changes in interest rates, potentially moving towards assets that perform well in a low-interest-rate environment.

The overall investor sentiment will likely be a mix of cautious optimism and uncertainty, reflecting the complex interplay of economic factors at play.

Conclusion: Understanding Desjardins' Bank of Canada Rate Cut Prediction

Desjardins' prediction of three more Bank of Canada rate cuts is a significant development with far-reaching implications for the Canadian economy. Understanding the rationale behind this forecast, the potential impacts on various sectors, and the likely market reaction is crucial for making informed financial decisions. The Bank of Canada's monetary policy decisions will continue to shape the economic landscape, and it's essential to stay informed about these developments. Stay updated on the latest forecasts from Desjardins and monitor the Bank of Canada's policy announcements to make informed financial decisions. Desjardins' prediction of three more Bank of Canada rate cuts is a significant development that warrants close attention from investors and consumers alike, impacting everything from Canadian interest rate forecasts to the overall health of the Canadian economy.

Featured Posts

-

Forbes Vetted Memorial Day Appliance Sales 2025 Your Guide To The Best Deals

May 23, 2025

Forbes Vetted Memorial Day Appliance Sales 2025 Your Guide To The Best Deals

May 23, 2025 -

Big Rig Rock Report 3 12 96 1 The Rocket Key Findings And Interpretations

May 23, 2025

Big Rig Rock Report 3 12 96 1 The Rocket Key Findings And Interpretations

May 23, 2025 -

Secure Your Wrestle Mania 41 Tickets This Memorial Day Weekend Golden Belts Await

May 23, 2025

Secure Your Wrestle Mania 41 Tickets This Memorial Day Weekend Golden Belts Await

May 23, 2025 -

Are Museum Programs History After Trumps Cuts A Look At The Impact

May 23, 2025

Are Museum Programs History After Trumps Cuts A Look At The Impact

May 23, 2025 -

Shpani A Shampion Vo Ln Khrvatska Porazena Po Penali

May 23, 2025

Shpani A Shampion Vo Ln Khrvatska Porazena Po Penali

May 23, 2025

Latest Posts

-

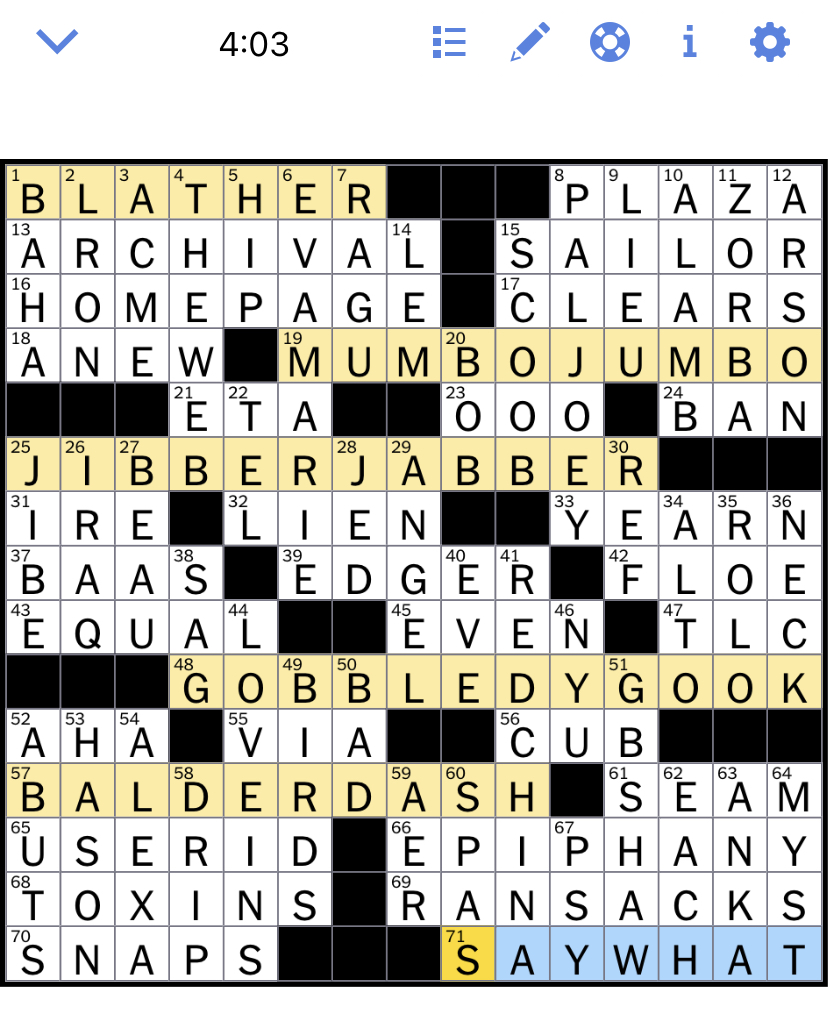

Nyt Mini Crossword March 12 2025 Solutions And Hints

May 24, 2025

Nyt Mini Crossword March 12 2025 Solutions And Hints

May 24, 2025 -

Naechtlicher Waldbrand In Essen Heisingen 07 04 2025 Aktuelle Polizeimeldungen

May 24, 2025

Naechtlicher Waldbrand In Essen Heisingen 07 04 2025 Aktuelle Polizeimeldungen

May 24, 2025 -

Solve The Nyt Mini Crossword March 12 2025 Clues And Answers

May 24, 2025

Solve The Nyt Mini Crossword March 12 2025 Clues And Answers

May 24, 2025 -

Grossalarm In Essen Heisingen Steiles Gelaende Erschwert Loescharbeiten Bei Waldbrand 07 04 2025

May 24, 2025

Grossalarm In Essen Heisingen Steiles Gelaende Erschwert Loescharbeiten Bei Waldbrand 07 04 2025

May 24, 2025 -

Nyt Mini Crossword Sunday April 19th Complete Clue Solutions

May 24, 2025

Nyt Mini Crossword Sunday April 19th Complete Clue Solutions

May 24, 2025