Thursday's CoreWeave (CRWV) Stock Dip: A Detailed Explanation

Table of Contents

Market-Wide Factors Influencing CRWV Stock Performance

Thursday's overall market sentiment played a significant role in the CRWV stock decline. The broader tech sector experienced a downturn, impacting many cloud computing stocks, including CoreWeave. This wider market volatility wasn't isolated to CRWV; it reflected broader concerns affecting the entire technology sector. Several factors contributed to this negative market sentiment:

- Negative investor sentiment due to rising inflation: Persistent inflationary pressures and concerns about the Federal Reserve's interest rate policy created uncertainty in the market.

- Broader sell-off in the technology sector: A general risk-off sentiment among investors led to a sell-off across many technology stocks, irrespective of individual company performance.

- Concerns about future interest rate increases: Anticipation of further interest rate hikes to combat inflation fueled investor apprehension, impacting growth stocks like CRWV. The expectation of higher borrowing costs dampens future earnings expectations for many companies.

These macroeconomic factors, captured by keywords like market volatility, tech stock downturn, interest rate hikes, and economic indicators, created a challenging environment for even fundamentally strong companies like CoreWeave.

Company-Specific News and Events Affecting CRWV

While market-wide trends contributed significantly, it's crucial to examine if any company-specific news or events exacerbated the CRWV stock dip. On Thursday, or in the days leading up to it, there were no major press releases or announcements from CoreWeave that directly triggered the decline. However, the absence of positive news in the face of a negative market environment could have contributed to selling pressure. This highlights the importance of consistent positive news flow to counteract broader market headwinds. Relevant keywords here include CoreWeave news, CRWV earnings, partnerships, and regulatory changes.

- Lack of significant positive news to offset market concerns: The absence of positive catalysts, such as major partnership announcements or positive earnings pre-announcements, left CRWV vulnerable to the negative market sentiment.

- Analyst downgrades or price target reductions: While not confirmed for this specific event, potential analyst downgrades or reductions in price targets could have added to the selling pressure.

- Potential delays in project timelines: While speculative, any rumors or concerns about potential delays in CoreWeave's ambitious projects could have also influenced investor decisions.

Technical Analysis of CRWV Stock Chart

Analyzing the CRWV stock chart using technical analysis provides another perspective. A close examination of trading volume, support and resistance levels, and candlestick patterns offers insights into the price movement. (Note: A chart would be included here in a published article.) Looking at volume, we can see if the sell-off was driven by heavy selling pressure, further indicating a significant shift in investor sentiment.

- High trading volume accompanying the price drop: Increased trading volume during the decline indicates significant investor activity and confirms the magnitude of the sell-off.

- Breakdown below a key support level: A breach of a previously established support level signals a potential shift in the short-term trend, confirming the bearish momentum.

- Appearance of a bearish candlestick pattern: Certain candlestick patterns (e.g., a large bearish engulfing candle) can provide further technical confirmation of the price reversal. These patterns, along with keywords like technical analysis, trading volume, support levels, resistance levels, and chart patterns, provide valuable insights into the market's short-term dynamics.

Investor Sentiment and Social Media Analysis

Gauging investor sentiment is crucial in understanding market movements. Analyzing social media conversations on platforms like Reddit and Twitter, as well as news articles and financial forums, can reveal prevalent opinions and narratives surrounding CRWV. Keywords such as investor sentiment, social media sentiment, news sentiment, reddit, and twitter are crucial to understanding the overall market narrative.

- Negative sentiment expressed on relevant financial forums: A prevailing negative sentiment on platforms dedicated to stock market discussion can amplify selling pressure.

- Increased negative news coverage: Negative news coverage, even if not directly related to CoreWeave's operations, can contribute to a broader negative perception.

- Analysis of Twitter sentiment around CRWV: Analyzing tweets and mentions using sentiment analysis tools can provide quantitative data on the overall sentiment towards the stock.

Conclusion: Assessing the CoreWeave (CRWV) Stock Dip and Future Outlook

Thursday's CRWV stock decline was a complex event influenced by a combination of factors. Market-wide volatility, driven by inflation concerns and broader tech sector weakness, played a significant role. While no company-specific negative news directly triggered the dip, the absence of positive catalysts, coupled with the prevailing negative market sentiment, amplified the downward pressure. Technical analysis of the CRWV stock chart revealed high trading volume and a breakdown below key support levels, confirming the bearish momentum. Finally, an analysis of investor sentiment indicated a prevailing negative outlook.

The future outlook for CRWV remains uncertain. While the short-term outlook might be volatile, CoreWeave's position in the rapidly growing cloud computing and AI infrastructure market offers long-term potential. However, investors should carefully consider the macroeconomic environment and the company's performance before making any investment decisions. Remember that the information presented here is for informational purposes only and should not be considered financial advice. Conduct your own thorough research and consult with a financial advisor before investing in CoreWeave (CRWV) stock or any other security.

Featured Posts

-

Improving Otter Populations In Wyoming A Critical Turning Point

May 22, 2025

Improving Otter Populations In Wyoming A Critical Turning Point

May 22, 2025 -

Looney Tunes And Cartoon Network Collaboration 2025 Animated Short Announced

May 22, 2025

Looney Tunes And Cartoon Network Collaboration 2025 Animated Short Announced

May 22, 2025 -

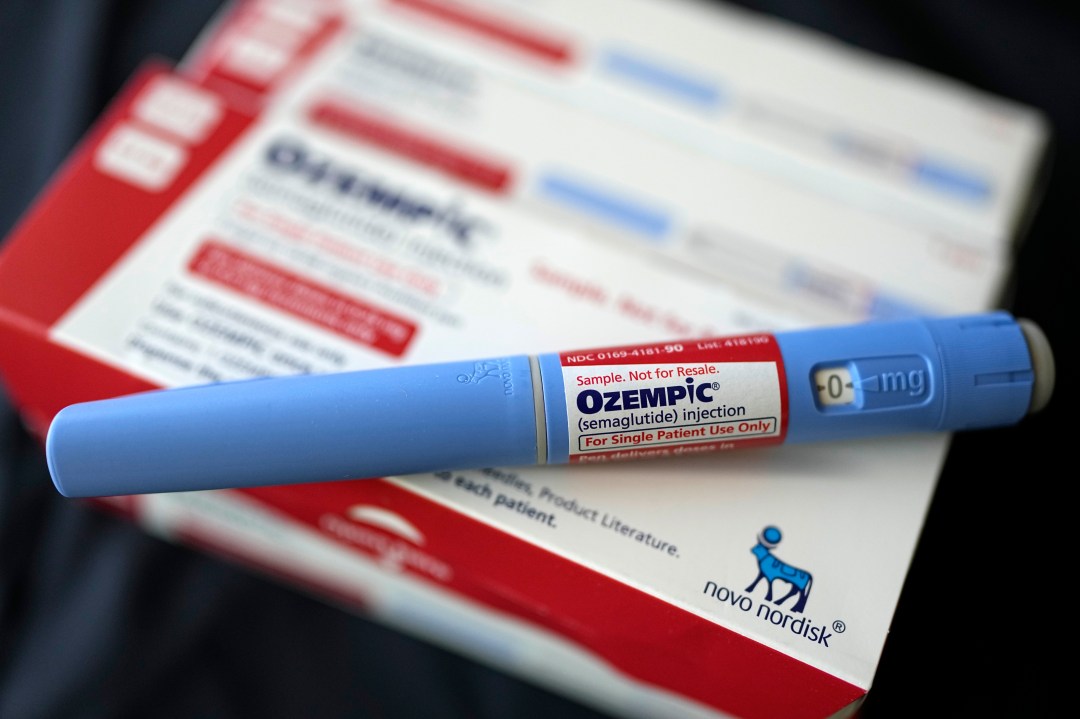

Ozempic Counterfeit Crisis Fda Intervention And Its Consequences

May 22, 2025

Ozempic Counterfeit Crisis Fda Intervention And Its Consequences

May 22, 2025 -

Why Did Core Weave Crwv Stock Decline On Thursday

May 22, 2025

Why Did Core Weave Crwv Stock Decline On Thursday

May 22, 2025 -

Air Traffic Control Outages Beyond Newarks Black Screens And Silent Radios

May 22, 2025

Air Traffic Control Outages Beyond Newarks Black Screens And Silent Radios

May 22, 2025