Thursday's CoreWeave (CRWV) Stock Rally: Reasons And Implications

Table of Contents

Strong Financial Performance and Growth Projections

CoreWeave's recent stock price increase is largely attributable to its robust financial performance and incredibly optimistic growth projections. The company's strategic positioning within the rapidly expanding AI cloud computing sector is a major contributing factor.

Exceeding Expectations

CoreWeave's recent financial reports have significantly exceeded expectations, demonstrating impressive growth across key metrics.

- Revenue Growth: Reports indicate a substantial increase in revenue compared to the previous quarter and year, showcasing strong demand for their services. (Specific numbers would be included here if available from a reliable source).

- Profitability: Improved profitability metrics point to efficient operations and increasing economies of scale, bolstering investor confidence. (Specific numbers would be included here if available from a reliable source).

- Customer Acquisition: The company has successfully attracted a growing number of high-profile clients, further solidifying its position in the market. (Specific numbers or examples would be included here if available from a reliable source).

- Analyst Upgrades: Several financial analysts have upgraded their ratings for CRWV stock, citing the strong performance and promising future outlook.

AI-Driven Demand

CoreWeave's infrastructure is ideally suited to meet the exploding demand for AI computing power. The company's specialized data centers and partnerships with key players in the AI ecosystem are crucial to its success.

- Partnerships with AI Giants: CoreWeave boasts strategic partnerships with industry leaders like Nvidia and Microsoft, providing access to cutting-edge technology and a wider customer base.

- High-Performance Computing: The company's focus on providing high-performance computing resources is perfectly aligned with the intensive computational needs of AI development and deployment.

- Competitive Advantage: CoreWeave's specialized infrastructure and expertise give it a significant competitive advantage in this rapidly growing market.

Strategic Partnerships and Industry Collaborations

CoreWeave's strategic partnerships are a key driver of its recent success and the subsequent CRWV stock rally.

Nvidia's Influence

CoreWeave's relationship with Nvidia, a dominant force in the AI hardware market, is particularly significant.

- Access to Cutting-Edge Technology: The partnership provides CoreWeave with access to Nvidia's latest GPUs and other advanced technologies, enhancing its ability to deliver high-performance computing services.

- Joint Ventures: The potential for future joint ventures and collaborations with Nvidia further strengthens CoreWeave's position and fuels investor optimism.

- Enhanced Service Offerings: The collaboration allows for the development of more efficient and innovative solutions for AI workloads.

Expanding Ecosystem

Beyond Nvidia, CoreWeave is actively expanding its ecosystem of partnerships.

- Strategic Alliances: The company has forged alliances with other key players in the cloud computing and AI sectors (Specific examples would be included here if available from a reliable source).

- Synergistic Relationships: These partnerships offer synergistic benefits, expanding CoreWeave's reach and capabilities.

- Market Penetration: These collaborations are critical to CoreWeave's success in penetrating new markets and solidifying its dominance in existing ones.

Market Sentiment and Investor Confidence

The positive market sentiment surrounding the cloud computing and AI sectors, combined with increased investor interest in CoreWeave, has significantly contributed to the CRWV stock rally.

Positive Market Outlook

The overall outlook for the cloud computing and AI industries is exceptionally positive.

- Industry Growth: The market is experiencing phenomenal growth, fueled by increasing adoption of cloud-based services and AI technologies across various sectors.

- Expert Analysis: Industry analysts predict continued expansion of the market, contributing to optimistic investor sentiment towards companies like CoreWeave.

- Technological Advancements: Constant technological innovations further accelerate the growth and adoption of cloud computing and AI solutions.

Increased Investor Interest

CoreWeave has attracted significant interest from both institutional and retail investors.

- Investment Announcements: (Specific examples of investment announcements would be included here if available from a reliable source).

- Increased Trading Volume: The CRWV stock has experienced a substantial increase in trading volume, indicating heightened investor interest.

- Positive Analyst Ratings: Improved analyst ratings and increased coverage reflect growing confidence in the company's future prospects.

Potential Risks and Future Outlook

While the outlook for CoreWeave is positive, investors should be aware of potential risks.

Competition and Market Saturation

The cloud computing market is highly competitive, and market saturation is a potential concern.

- Key Competitors: CoreWeave faces competition from established players in the cloud computing market (Specific examples would be included here).

- Competitive Advantages: CoreWeave's competitive advantages lie in its specialized infrastructure, strategic partnerships, and focus on AI computing.

- Maintaining Market Share: The company needs to continue innovating and adapting to maintain its market share and stay ahead of the competition.

Economic Uncertainty

Economic downturns or changes in the broader technology market could impact CoreWeave's growth.

- Economic Headwinds: Potential economic slowdowns could affect demand for cloud computing services.

- Risk Mitigation: CoreWeave's strong financial position and diversified customer base can help mitigate these risks.

- Adaptability: The company's ability to adapt to changing economic conditions will be crucial to its long-term success.

Conclusion

Thursday's CoreWeave (CRWV) stock rally is primarily driven by the company's strong financial performance, strategic partnerships, particularly with Nvidia, and the overwhelmingly positive market sentiment surrounding AI and cloud computing. The surge reflects investor confidence in CoreWeave's ability to capitalize on the explosive growth of the AI-powered cloud computing market.

Key Takeaways: Investors should recognize the significance of CoreWeave's financial strength, strategic alliances, and the overall positive market trend. However, it's crucial to acknowledge potential risks associated with competition and economic uncertainty.

Call to Action: Stay informed about the ongoing developments in CoreWeave (CRWV) and the dynamic cloud computing market to make informed investment decisions. Further research into CoreWeave's financial reports and future plans is recommended before making any investment decisions. Consider consulting with a financial advisor before investing in any stock, including CRWV.

Featured Posts

-

The Lancaster City Stabbing Impact On Local Businesses And Residents

May 22, 2025

The Lancaster City Stabbing Impact On Local Businesses And Residents

May 22, 2025 -

Core Weave Crwv Soars Thursdays Stock Price Increase Explained

May 22, 2025

Core Weave Crwv Soars Thursdays Stock Price Increase Explained

May 22, 2025 -

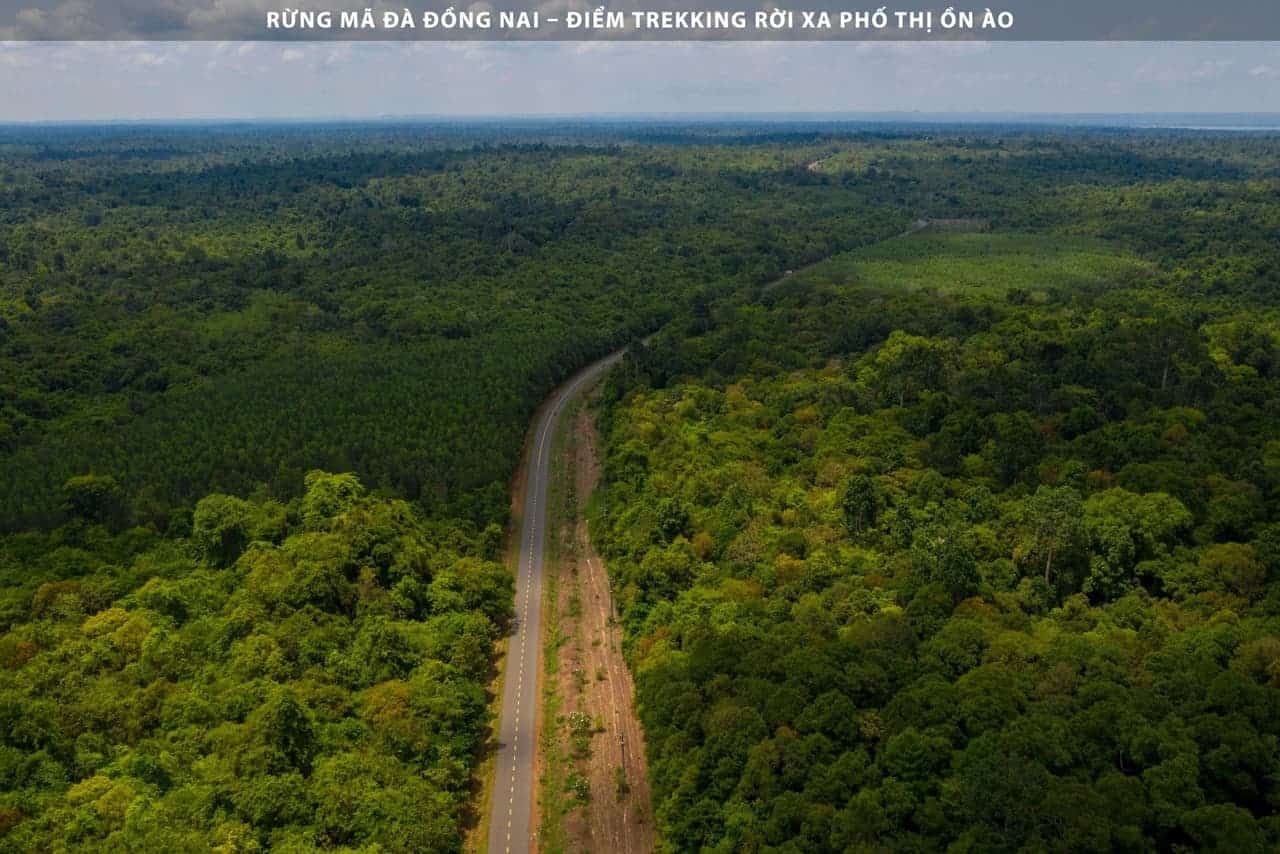

Tuyen Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Voi Binh Phuoc

May 22, 2025

Tuyen Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Voi Binh Phuoc

May 22, 2025 -

Nom De La Ville La Petite Italie De L Ouest Et Son Architecture Unique

May 22, 2025

Nom De La Ville La Petite Italie De L Ouest Et Son Architecture Unique

May 22, 2025 -

Nato Nun Tuerkiye Ve Italya Icin Ortak Plani

May 22, 2025

Nato Nun Tuerkiye Ve Italya Icin Ortak Plani

May 22, 2025