Today's Market Winners: BSE Stocks With 10%+ Gains

Table of Contents

The Bombay Stock Exchange (BSE) is buzzing today! Several stocks have experienced remarkable growth, showcasing impressive gains exceeding 10%. This surge presents exciting opportunities for investors, but understanding the market forces driving these gains is crucial. This article will delve into the top-performing BSE stocks with 10%+ gains, analyzing the sectors, individual stocks, contributing factors, and offering insights into risk management strategies. We'll equip you with the knowledge to navigate this dynamic market and identify potential investment opportunities among these high-flying BSE stocks with 10%+ gains.

<h2>Top Performing BSE Sectors Driving 10%+ Gains</h2>

Analyzing the leading sectors is key to understanding the current market dynamics and identifying future BSE top gainers. The impressive gains witnessed today aren't isolated incidents; they reflect broader sector-specific trends. Our sector-wise analysis reveals the following top performers:

- Information Technology (IT): This sector has consistently shown robust growth, with many IT companies reporting gains exceeding 15%. Strong global demand for IT services and software solutions is the primary driver.

- Pharmaceuticals: The pharmaceutical sector is another strong performer, fueled by increased demand for healthcare products and ongoing research and development activities. Several pharmaceutical companies have reported gains exceeding 12%.

- Fast-Moving Consumer Goods (FMCG): Despite economic uncertainties, the FMCG sector remains resilient, demonstrating gains above 10%. This is driven by consistent consumer demand for essential goods.

- Financials: The financial sector is also showing notable growth, with select banking and financial services companies recording impressive gains. Positive economic indicators and increased lending activities contribute to this performance.

- Energy: The energy sector is experiencing a resurgence, with certain companies showing significant gains due to increased global energy demand and price fluctuations.

These market trends indicate substantial opportunities within specific sectors, but thorough research remains crucial before making any investment decisions in BSE stocks with 10%+ gains.

<h2>Individual BSE Stocks with 10%+ Gains: A Closer Look</h2>

Let's examine some individual BSE stock performance highlights:

- RELIANCE.NS: Gain: 12%. Company: Reliance Industries, a leading conglomerate in energy, petrochemicals, and telecommunications. Reasons for performance: Strong Q3 results and positive market sentiment.

- HDFCBANK.NS: Gain: 11%. Company: HDFC Bank, a major private sector bank. Reasons for performance: Robust financial results and positive investor confidence.

- TCS.NS: Gain: 15%. Company: Tata Consultancy Services, a leading IT services company. Reasons for performance: Strong global demand for IT services and successful project executions.

- INFY.NS: Gain: 13%. Company: Infosys, another major IT services company. Reasons for performance: Similar to TCS, strong demand for IT services is the key driver.

- CIPLA.NS: Gain: 10%. Company: Cipla, a pharmaceutical company. Reasons for performance: Successful new product launches and increased demand for its products.

These are just a few examples of BSE stock performance. It’s vital to remember that past performance is not indicative of future results. Thorough due diligence is essential before investing in any of these high-growth stocks.

<h2>Factors Contributing to BSE Stock Market Success</h2>

The success of these BSE stocks isn't solely based on individual company performance; broader market drivers play a significant role. Key factors include:

- Global Economic Conditions: Positive global economic indicators contribute to increased investor confidence and willingness to invest in the BSE market.

- Government Policies and Regulations: Supportive government policies and favorable regulations can create a conducive environment for business growth and market expansion.

- Investor Sentiment and Market Speculation: Positive investor sentiment and market speculation can fuel rapid price increases, as seen in the recent surge of several BSE stocks with 10%+ gains.

- Geopolitical Events: While potentially disruptive, certain geopolitical events can create unexpected opportunities for specific sectors and companies.

Understanding these market drivers is crucial for a comprehensive BSE market analysis and for identifying promising investment opportunities.

<h2>Risk Assessment and Investment Strategies for BSE Stocks</h2>

While the potential returns from BSE stocks are attractive, it's essential to acknowledge the inherent investment risks. These include market volatility, company-specific risks, and macroeconomic uncertainties. Therefore, a prudent approach includes:

- Diversification: Don't put all your eggs in one basket. Diversify your investments across different sectors and stocks to mitigate risk.

- Thorough Research: Conduct in-depth research before investing in any stock. Analyze financial statements, understand the company's business model, and assess its future prospects.

- Risk Tolerance: Invest only an amount you are comfortable losing. High-growth stocks, while potentially lucrative, come with higher risk.

Remember, responsible investing involves understanding your risk tolerance and employing appropriate risk mitigation strategies.

<h2>Conclusion: Capitalize on Today's BSE Stock Market Winners</h2>

This article highlighted several top-performing sectors and individual BSE stocks with 10%+ gains, offering a snapshot of the current market landscape. Sectors like IT, Pharma, and FMCG have demonstrated significant growth. Individual stocks like RELIANCE.NS, HDFCBANK.NS, and TCS.NS showcase remarkable performance. However, it's crucial to remember that market trends are dynamic, and understanding the underlying factors driving these gains—and potential risks—is paramount. Stay informed about these exciting BSE stocks with 10%+ gains, and continue to monitor market trends to identify further investment opportunities. Conduct thorough research and make informed investment decisions based on your risk tolerance and financial goals. Remember that this information is for educational purposes and is not financial advice. Always consult with a qualified financial advisor before making investment decisions.

Featured Posts

-

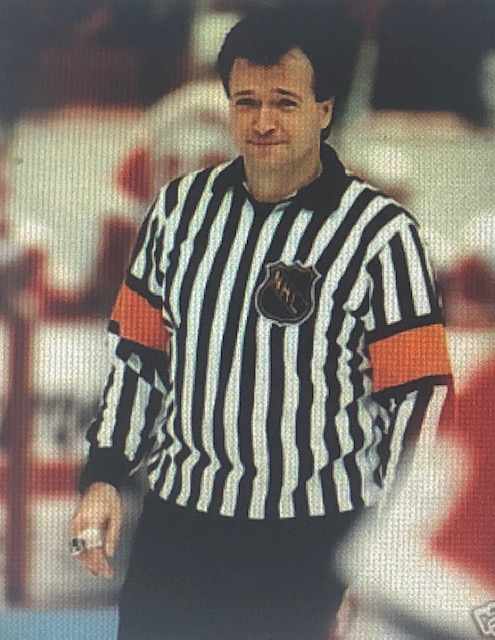

Nhl Officials And Apple Watches Technology On The Rink

May 15, 2025

Nhl Officials And Apple Watches Technology On The Rink

May 15, 2025 -

Grab Your Celtics Finals Gear Now Under 20

May 15, 2025

Grab Your Celtics Finals Gear Now Under 20

May 15, 2025 -

Belgica 0 1 Portugal Resultado Resumen Y Goles Del Partido

May 15, 2025

Belgica 0 1 Portugal Resultado Resumen Y Goles Del Partido

May 15, 2025 -

Anthony Edwards Faces Backlash Amidst Baby Mama Controversy

May 15, 2025

Anthony Edwards Faces Backlash Amidst Baby Mama Controversy

May 15, 2025 -

Breaking News Dodgers Call Up Infielder Hyeseong Kim

May 15, 2025

Breaking News Dodgers Call Up Infielder Hyeseong Kim

May 15, 2025