Today's Personal Loan Interest Rates: Get A Loan Starting At 6%

Table of Contents

Understanding Personal Loan Interest Rates

Before diving into current personal loan interest rates, it's essential to grasp the fundamental concept of interest. Simply put, interest is the cost of borrowing money. Lenders charge interest to compensate for the risk they take in lending you funds. The higher the risk, the higher the interest rate they'll typically charge.

A crucial term to understand is APR, or Annual Percentage Rate. The APR represents the annual cost of borrowing, including interest and any other fees associated with the loan. When comparing personal loan rates, always compare APRs, not just the stated interest rate, to get a true picture of the total cost.

Several factors influence your personal loan interest rate:

- Credit Score: Your credit score is a significant determinant of your interest rate. A high credit score signifies lower risk to the lender, resulting in lower interest rates.

- Loan Amount: Larger loan amounts may sometimes come with slightly lower interest rates, but this isn't always the case.

- Loan Term: A longer loan term means lower monthly payments but significantly higher total interest paid over the life of the loan. Shorter loan terms mean higher monthly payments, but less interest paid overall.

- Lender Type: Different lenders – banks, credit unions, and online lenders – offer varying interest rates based on their risk assessments and lending policies.

Current Personal Loan Interest Rate Ranges

Currently, personal loan interest rates vary widely depending on the factors mentioned above. You can find personal loans with interest rates starting as low as 6% APR, but this is usually reserved for borrowers with excellent credit. The average range for personal loans is generally between 7% and 36% APR.

- Example: Bank A offers personal loans starting at 6% APR for borrowers with excellent credit and a proven history of responsible borrowing.

- Example: Credit unions often offer more competitive personal loan rates than traditional banks, especially for members with good standing.

- Example: Online lenders may provide more competitive rates due to lower operational overhead, but always thoroughly check their reviews and ensure they are reputable.

It's crucial to remember that these are just examples, and your actual rate will depend on your individual circumstances.

Comparing Loan Offers and Finding the Best Rate

Finding the best personal loan interest rates requires diligent comparison shopping. Don't settle for the first offer you receive. Use online comparison tools to streamline the process and get a clear picture of available options. These tools allow you to input your financial information and see offers from multiple lenders side-by-side.

- Check Multiple Lenders: Compare at least three to five different lenders before making a decision.

- Compare APRs: Focus on the APR, which includes all fees, for an accurate comparison.

- Consider Fees and Charges: Pay close attention to origination fees, prepayment penalties, and other potential charges that can significantly impact your overall loan cost.

Factors Affecting Your Eligibility for Low Interest Rates

Securing a low personal loan interest rate largely depends on your creditworthiness. A high credit score is paramount. Lenders view borrowers with good credit scores as less risky, and hence, offer them more favorable terms.

- Credit Score: A higher credit score dramatically increases your chances of qualifying for lower interest rates. Aim for a score above 700 for optimal results.

- Debt-to-Income Ratio (DTI): Your DTI, which is the percentage of your monthly income that goes towards debt repayment, significantly impacts your eligibility. A lower DTI shows lenders you can comfortably manage additional debt.

- Employment History & Income Stability: A stable employment history and consistent income demonstrate your ability to repay the loan, making you a more attractive borrower.

Tips for Securing a Personal Loan with a Low Interest Rate

Improving your chances of getting a personal loan with a low interest rate requires proactive steps:

- Improve Your Credit Score: Pay your bills on time, reduce your credit utilization ratio, and monitor your credit report regularly.

- Negotiate with Lenders: Don't be afraid to negotiate with lenders for a better interest rate. Highlight your strong financial standing and explore options for lower rates.

- Consider a Co-signer: If your credit score is less than ideal, consider a co-signer with a strong credit history. This can significantly improve your chances of approval and lower your interest rate.

Shop Around for the Best Rates: Don't settle for the first offer you see. Compare offers from multiple lenders to find the most competitive rates.

Negotiate with Lenders: Contact lenders directly to see if they're willing to offer a lower interest rate based on your financial situation.

Find Your Ideal Personal Loan Interest Rate Today!

To summarize, securing a low personal loan interest rate involves understanding the factors influencing rates, comparing offers from various lenders, and improving your creditworthiness. Remember, securing a low interest personal loan—even one starting at 6%—requires preparation and diligent comparison shopping. Don't delay your financial goals! Start comparing personal loan interest rates today and secure the financing you need with a rate as low as 6%. Click here to begin your search!

Featured Posts

-

Marlins Win Thriller Stowers Delivers Walk Off Grand Slam Against Athletics

May 28, 2025

Marlins Win Thriller Stowers Delivers Walk Off Grand Slam Against Athletics

May 28, 2025 -

Nintendos Bold New Era A Calculated Risk

May 28, 2025

Nintendos Bold New Era A Calculated Risk

May 28, 2025 -

Bianca Censori In Black Lingerie And Stilettos A Striking Ensemble

May 28, 2025

Bianca Censori In Black Lingerie And Stilettos A Striking Ensemble

May 28, 2025 -

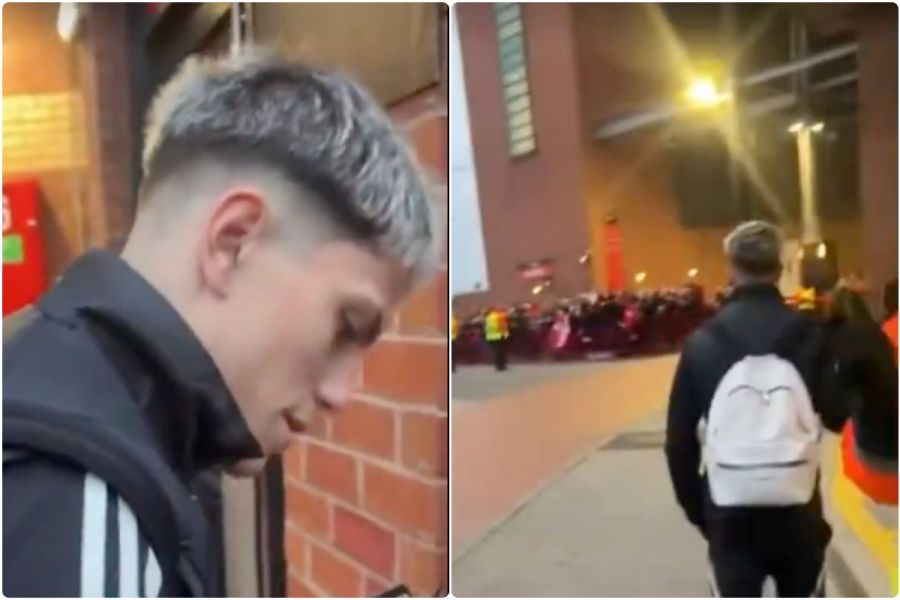

Garnachos Actions Criticized After Autograph Incident With Young Fan

May 28, 2025

Garnachos Actions Criticized After Autograph Incident With Young Fan

May 28, 2025 -

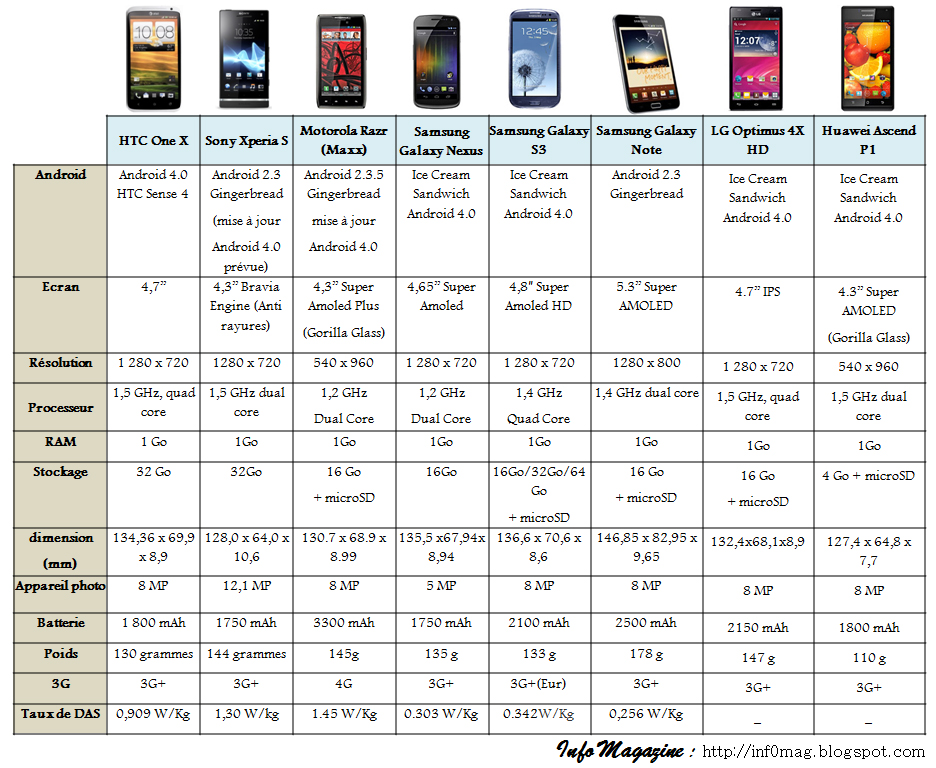

5 Smartphones Qui Tiennent Toute La Journee Comparatif 2024

May 28, 2025

5 Smartphones Qui Tiennent Toute La Journee Comparatif 2024

May 28, 2025