Today's Stock Market: A Deep Dive Into Dow Futures And China's Economic Outlook

Table of Contents

Understanding Dow Futures and Their Implications

Dow Jones Futures are contracts obligating the buyer to purchase the Dow Jones Industrial Average (DJIA) at a predetermined price on a specific future date. These futures contracts are traded on exchanges like the CME Group and act as a barometer of investor sentiment towards the US stock market. They offer a way to speculate on the future direction of the DJIA without directly owning the underlying stocks.

- Defining Dow Futures contracts: These contracts represent a standardized unit of the DJIA, allowing for efficient trading and hedging.

- Reflecting investor sentiment: Rising Dow Futures prices generally suggest optimism and anticipated market gains, while falling prices indicate pessimism and potential declines.

- Relationship with the actual DJIA: Dow Futures prices often closely track the DJIA, providing a forward-looking perspective on potential market movements. Discrepancies can sometimes highlight short-term volatility or anticipation of future events.

- Interpreting Dow Futures price movements: Analyzing price charts, trading volume, and open interest can help investors decipher the signals embedded in Dow Futures. Technical analysis and fundamental analysis can be combined for a more comprehensive understanding.

- Risks and rewards of Dow Futures trading: While offering potential for high returns, Dow Futures trading also carries significant risk, particularly due to leverage and market volatility. Sophisticated risk management strategies are crucial.

China's Economic Outlook: A Global Impact

China's economic performance significantly impacts global markets, particularly the US. Analyzing key economic indicators provides insights into its current trajectory and potential future effects on investment strategies. Factors such as GDP growth, inflation rates, and consumer spending are closely monitored.

- Recent economic data from China: Closely following official government releases, independent analyses, and expert commentary offers a comprehensive understanding of economic trends in China.

- Impact of government policies: China's government actively intervenes in its economy. Understanding these policies, their impact on various sectors, and their effectiveness is key to gauging future economic performance.

- China's role in global supply chains: China's immense manufacturing capacity and its position in numerous global supply chains mean its economic fluctuations ripple outwards affecting various industries globally.

- Potential risks and opportunities: Investing in China presents both substantial risks and equally significant opportunities. Understanding these dynamics is crucial for sound investment decisions.

- Effects of US-China relations: The complex relationship between the US and China significantly impacts both economies. Trade disputes, technological competition, and geopolitical tensions heavily influence the global economic landscape.

The Interplay Between Dow Futures and China's Economic Outlook

The relationship between China's economic performance and Dow Futures is complex but undeniable. Changes in Chinese economic indicators often influence investor sentiment, impacting Dow Futures prices and, consequently, the overall US stock market.

- Correlation between Chinese economic data and Dow Futures movements: Positive economic news from China often boosts investor confidence, potentially leading to higher Dow Futures prices. Conversely, negative news might depress prices.

- Informed investment decisions: Understanding this correlation allows investors to anticipate potential market movements and adapt their strategies accordingly. This requires close monitoring and analysis of both economic and market data.

- Geopolitical factors: Geopolitical events and tensions between the US and China can significantly influence both Dow Futures and the overall market sentiment. A thorough understanding of this context is crucial.

- Managing risk in a volatile market: Diversification, hedging strategies, and careful risk assessment are crucial for mitigating potential losses stemming from market volatility linked to Chinese economic fluctuations.

- Portfolio diversification strategies: Diversifying investments across different asset classes and geographical regions can help mitigate the impact of economic shocks originating from China or affecting the US market.

Developing a Robust Investment Strategy

Incorporating insights from Dow Futures analysis and China's economic outlook into a comprehensive investment strategy is crucial for long-term success. This requires careful consideration of individual risk tolerance and financial goals.

- Understanding your risk tolerance: Before making any investment decisions, assessing your personal risk tolerance is critical. This will determine the level of risk you are comfortable accepting in exchange for potential higher returns.

- Strategies for hedging against market downturns: Various hedging strategies exist to help protect investments from potential market declines. These strategies may involve using derivatives, like Dow Futures, or diversifying into less volatile asset classes.

- Long-term vs. short-term investment approaches: Consider whether your investment goals are better served by a long-term, buy-and-hold strategy or a more short-term, active trading approach.

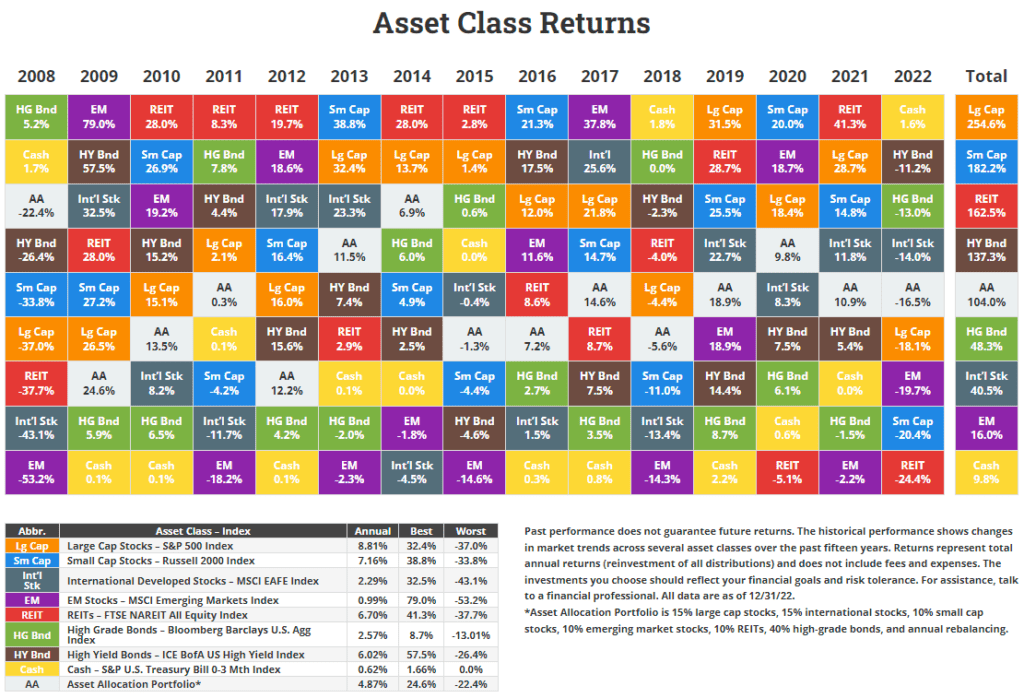

- The role of diversification: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) and geographic regions significantly reduces risk.

- Importance of professional financial advice: Seeking guidance from a qualified financial advisor can significantly improve investment outcomes by providing personalized advice tailored to individual circumstances and risk tolerance.

Conclusion

Understanding today's stock market requires a nuanced understanding of the interconnectedness of global economies. The interplay between Dow Futures, a leading indicator of US market sentiment, and China's economic outlook significantly impacts investment decisions. By carefully analyzing market data, understanding the correlation between these factors, and implementing appropriate risk management strategies, investors can navigate the complexities of the market more effectively. Continue learning about Dow Futures and China’s economic impact to make informed investment decisions and build a robust portfolio. Consider seeking professional financial advice to optimize your investment strategy in light of the ever-changing dynamics of today's stock market.

Featured Posts

-

The Growing Market Of Disaster Betting Analyzing The Los Angeles Wildfires Example

Apr 26, 2025

The Growing Market Of Disaster Betting Analyzing The Los Angeles Wildfires Example

Apr 26, 2025 -

Love Island Nepo Babies Ranking The Biggest Names

Apr 26, 2025

Love Island Nepo Babies Ranking The Biggest Names

Apr 26, 2025 -

Country Name S Top Performing Business Locations 2024 Investment Guide

Apr 26, 2025

Country Name S Top Performing Business Locations 2024 Investment Guide

Apr 26, 2025 -

Exposition De Pierre Terrasson Galerie Le Labo Du 8

Apr 26, 2025

Exposition De Pierre Terrasson Galerie Le Labo Du 8

Apr 26, 2025 -

Car Discovered In Sunken World War Ii Warship

Apr 26, 2025

Car Discovered In Sunken World War Ii Warship

Apr 26, 2025

Latest Posts

-

The Significance Of Ariana Grandes New Hair And Tattoos

Apr 27, 2025

The Significance Of Ariana Grandes New Hair And Tattoos

Apr 27, 2025 -

A Professional Look At Ariana Grandes Latest Style Update

Apr 27, 2025

A Professional Look At Ariana Grandes Latest Style Update

Apr 27, 2025 -

Ariana Grandes Transformation Professional Styling And Body Art

Apr 27, 2025

Ariana Grandes Transformation Professional Styling And Body Art

Apr 27, 2025 -

Get Professional Help Understanding Ariana Grandes Style Choices

Apr 27, 2025

Get Professional Help Understanding Ariana Grandes Style Choices

Apr 27, 2025 -

Hair And Tattoo Transformations Ariana Grandes Bold New Image

Apr 27, 2025

Hair And Tattoo Transformations Ariana Grandes Bold New Image

Apr 27, 2025