Today's Stock Market: Analyzing The Impact Of Global Trade News

Table of Contents

Understanding the Interconnectedness of Global Trade and Stock Markets

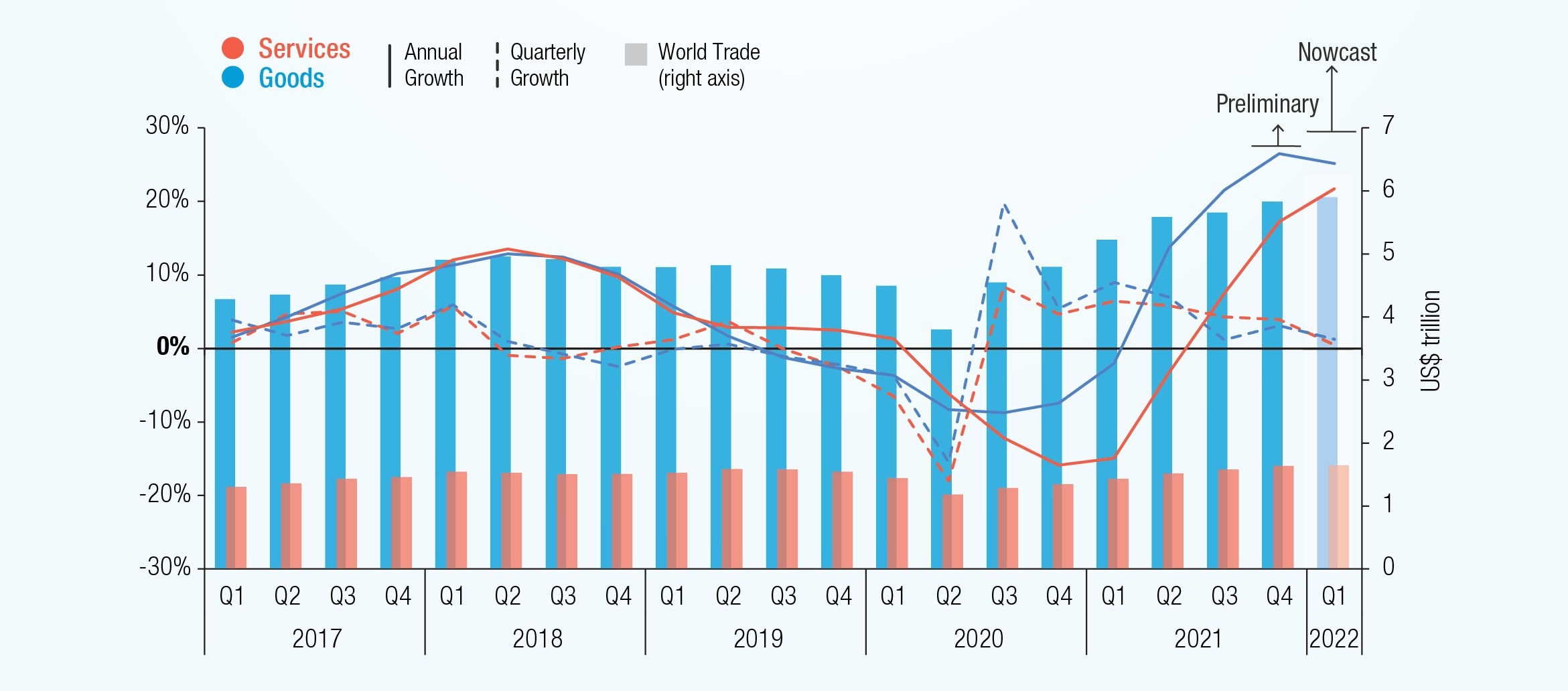

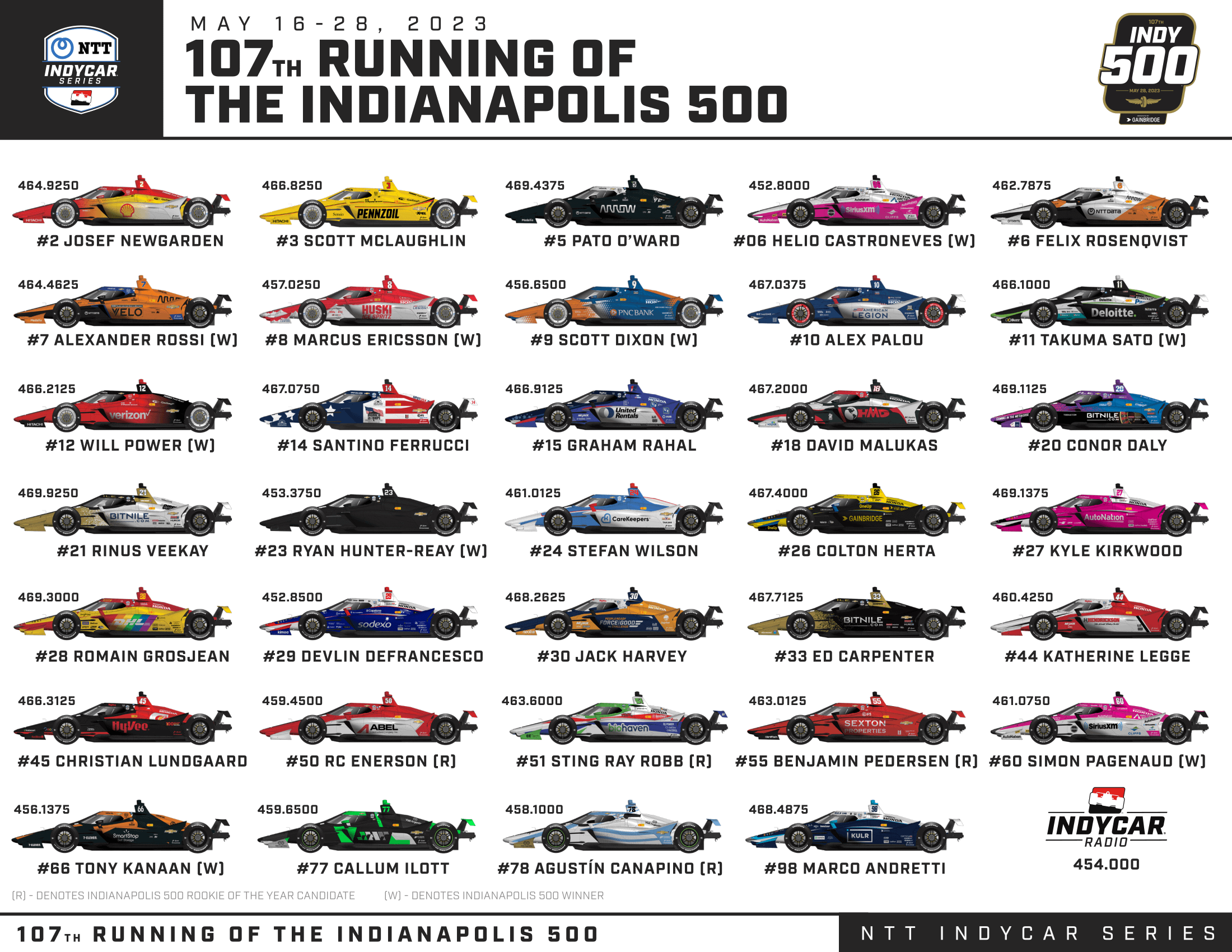

International trade and stock market performance are fundamentally intertwined. Global trade acts as a lifeblood for many multinational corporations, influencing their revenue streams, supply chains, and overall profitability. Positive trade developments generally boost investor confidence, leading to higher stock prices, while negative news, such as trade wars or sanctions, can trigger significant market downturns.

- Impact of trade wars on investor confidence: Trade wars create uncertainty, discouraging investment and slowing economic growth. The fear of tariffs and retaliatory measures leads to decreased consumer and business spending, impacting company earnings.

- Influence of export/import data on company valuations: Strong export data signals robust global demand, positively affecting companies heavily reliant on international sales. Conversely, weak import data can indicate slowing domestic consumption and negatively impact related businesses.

- The role of supply chain disruptions in market volatility: Disruptions to global supply chains, often caused by trade disputes or geopolitical events, can lead to production delays, shortages, and increased costs, impacting company profitability and stock prices.

- Examples of specific industries heavily affected by global trade: The technology sector, with its intricate global supply chains, and the manufacturing industry, heavily reliant on international trade for both inputs and outputs, are particularly vulnerable to trade-related shocks.

For instance, a recent study by the International Monetary Fund (IMF) showed that escalating trade tensions between countries X and Y resulted in a 2% decrease in global GDP growth. This directly impacted stock market performance, as investors reacted to the reduced economic outlook.

Recent Global Trade Developments and Their Market Impact

Recent global trade news has been a rollercoaster. The implementation of new tariffs on certain goods has created ripple effects across various sectors. Furthermore, the renegotiation of existing trade agreements has introduced further uncertainty. These developments have immediate and long-term implications for the stock market.

- Specific examples of companies affected positively and negatively: Company X, a major exporter of agricultural products, saw its stock price decline following the imposition of new tariffs. Conversely, Company Y, a domestic producer of substitute goods, experienced a surge in demand and its stock price increased.

- Analysis of stock price changes in response to specific trade-related events: A graph illustrating the correlation between specific trade news events (e.g., announcement of new tariffs) and subsequent stock market movements would clearly demonstrate this impact.

- Mention of relevant economic indicators influenced by trade (e.g., GDP growth, inflation): Trade tensions often lead to decreased GDP growth and increased inflation, impacting investor sentiment and market valuations.

(Insert chart or graph visualizing the impact of specific trade events on relevant stock indices here.)

Strategies for Navigating Market Volatility Caused by Trade News

Navigating the volatility caused by global trade news requires a proactive and informed approach. Investors can employ several strategies to mitigate risks and capitalize on opportunities.

- Diversification strategies to minimize exposure to specific sectors: Diversifying investments across various sectors and asset classes reduces the impact of negative news affecting any single sector.

- Importance of fundamental analysis in assessing company resilience to trade shocks: Understanding a company's financial health, competitive advantages, and ability to adapt to changing trade environments is crucial for making informed investment decisions.

- The role of hedging techniques in mitigating risk: Hedging strategies, such as using derivatives, can help offset potential losses resulting from adverse trade developments.

- Recommendations for monitoring global trade developments: Regularly monitoring reputable news sources, economic indicators, and government publications related to trade is vital for staying informed.

Risk management and responsible investing are paramount. Avoid impulsive reactions to short-term market fluctuations driven by trade news. Focus on a long-term investment strategy based on thorough research and understanding of underlying economic factors.

The Importance of Staying Informed about Global Trade

Staying abreast of global trade news is crucial for successful investment. Understanding the implications of trade agreements, tariffs, and sanctions allows investors to anticipate market shifts and adjust their portfolios accordingly.

Reliable sources for tracking trade information include:

- The World Trade Organization (WTO) website

- Financial news outlets like the Financial Times, Bloomberg, and Reuters

- Government publications from relevant ministries of trade and economy

Conclusion: Making Informed Decisions in Today's Stock Market

Global trade news significantly impacts today's stock market. Investors must understand the interconnectedness between global trade and market performance, employing informed strategies to mitigate risk and capitalize on opportunities. Staying informed about global trade developments is crucial for effective investment decisions.

Stay ahead of the curve by regularly analyzing today's stock market and the impact of global trade news. Use reliable sources to track market trends and make informed investment choices.

[Link to a relevant financial news website or investment platform]

Featured Posts

-

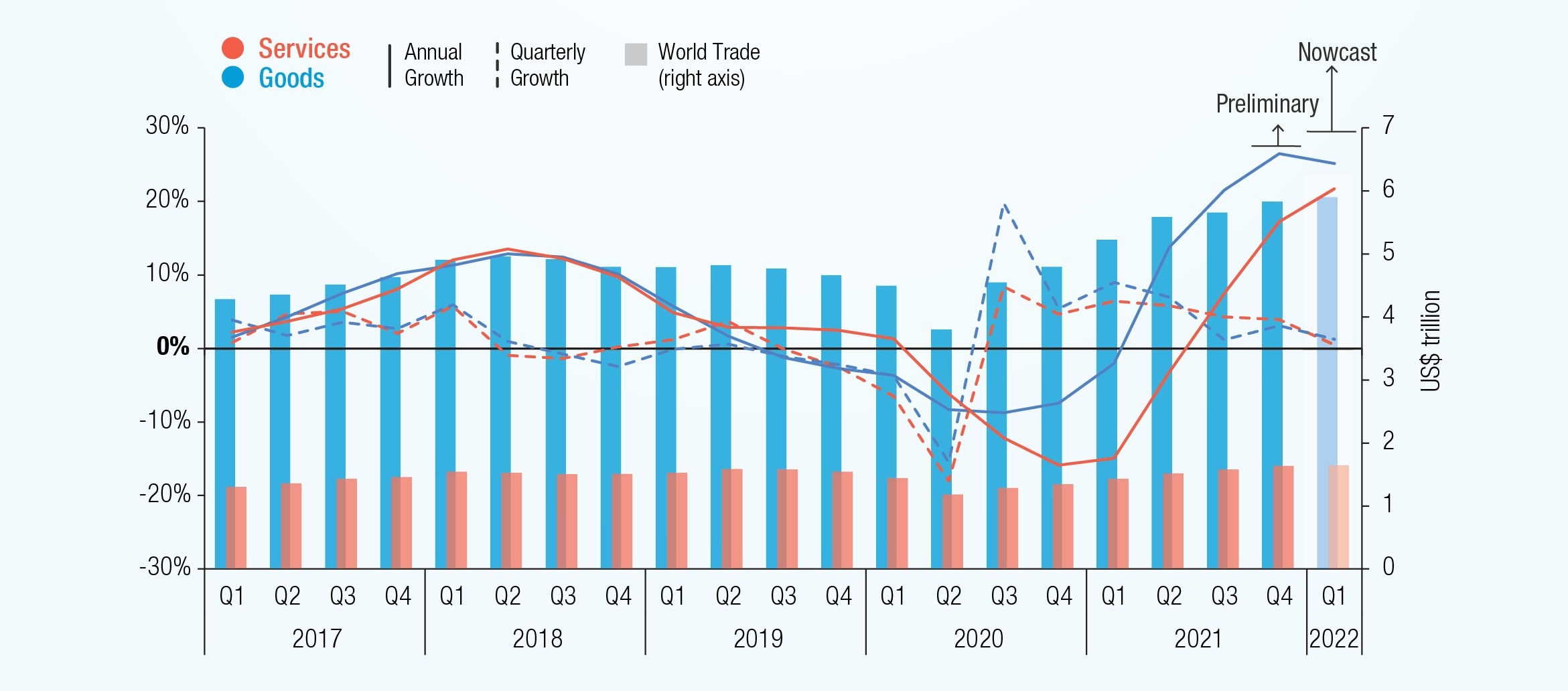

2025 Indy 500 Analyzing The Drivers At Risk Of Elimination

May 11, 2025

2025 Indy 500 Analyzing The Drivers At Risk Of Elimination

May 11, 2025 -

Sheehans Assessment Ipswich Towns Fightback Begins

May 11, 2025

Sheehans Assessment Ipswich Towns Fightback Begins

May 11, 2025 -

Boston Celtics Two Players Achieve Rare 40 Point Scoring Feat

May 11, 2025

Boston Celtics Two Players Achieve Rare 40 Point Scoring Feat

May 11, 2025 -

Five Drivers On The Bubble Who Will Miss The 2025 Indy 500

May 11, 2025

Five Drivers On The Bubble Who Will Miss The 2025 Indy 500

May 11, 2025 -

The 33 Best Restaurants In Littleton Reviews And Recommendations

May 11, 2025

The 33 Best Restaurants In Littleton Reviews And Recommendations

May 11, 2025

Latest Posts

-

Plei Of Nba 2024 Imerominies Agonon Kai Analytiki Episkopisi Ton Zeygarion

May 12, 2025

Plei Of Nba 2024 Imerominies Agonon Kai Analytiki Episkopisi Ton Zeygarion

May 12, 2025 -

Magic Johnsons Knicks Pistons Series Prediction

May 12, 2025

Magic Johnsons Knicks Pistons Series Prediction

May 12, 2025 -

Nba Playoffs Pliris Lista Agonon Kai Imerominion

May 12, 2025

Nba Playoffs Pliris Lista Agonon Kai Imerominion

May 12, 2025 -

New York Knicks Secure Back To Back Overtime Wins Against Chicago Bulls

May 12, 2025

New York Knicks Secure Back To Back Overtime Wins Against Chicago Bulls

May 12, 2025 -

Close Call Knicks Secure Second Straight Overtime Win Against Bulls

May 12, 2025

Close Call Knicks Secure Second Straight Overtime Win Against Bulls

May 12, 2025