Today's Stock Market: Dow Futures Indicate Positive Weekly Close

Table of Contents

Analyzing Dow Futures: A Key Indicator of Market Sentiment

Dow futures are contracts obligating the buyer to purchase the Dow Jones Industrial Average (DJIA) at a predetermined price on a specific date. They're a powerful tool for predicting near-term market direction because they reflect the collective expectations of market participants.

- Definition and mechanics of Dow futures contracts: These contracts are traded on exchanges like the CME Group, allowing investors to speculate on the future price movements of the DJIA without directly owning the underlying stocks.

- How Dow futures movements reflect investor expectations: Rising Dow futures generally suggest optimism and anticipation of higher stock prices, while falling futures indicate pessimism and potential price declines.

- The relationship between Dow futures and the actual Dow Jones Industrial Average (DJIA): While not perfectly correlated, Dow futures often act as a leading indicator, providing insights into the likely direction of the DJIA. Significant discrepancies can sometimes occur, however.

- Limitations of using Dow futures as a sole predictor: Dow futures should not be the sole basis for investment decisions. Other economic factors, geopolitical events, and company-specific news all play a vital role.

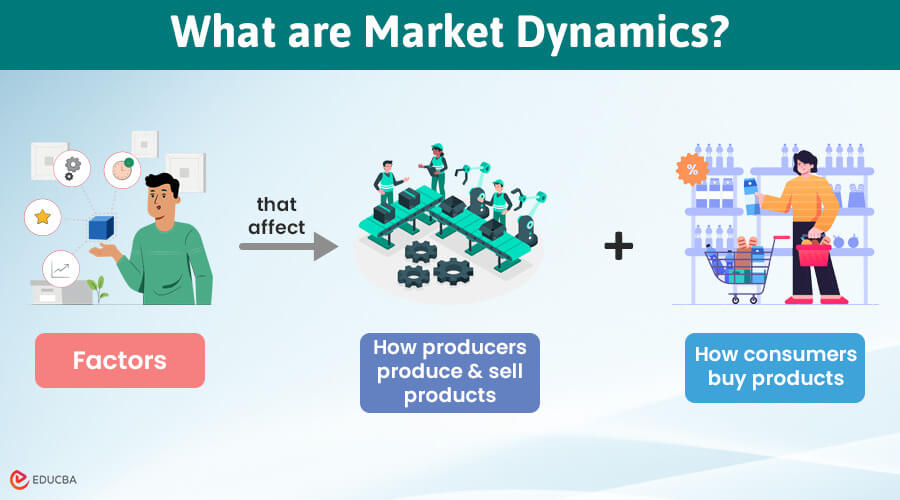

Factors Contributing to the Positive Weekly Close Prediction

The positive outlook reflected in today's Dow futures is a result of several converging factors. These factors, taken together, suggest a robust market environment for at least the short term.

- Positive economic data releases: Recent economic reports, such as positive employment numbers and strong GDP growth figures, have fueled optimism among investors. Stronger-than-expected consumer spending also contributes positively to the market outlook.

- Impact of corporate earnings reports: Positive corporate earnings announcements from key companies across various sectors have reinforced the belief in the overall strength of the economy.

- Geopolitical events and their influence on market sentiment: While geopolitical risks always exist, the current situation appears relatively stable, reducing some of the uncertainties that often negatively affect market sentiment.

- Changes in interest rates and monetary policy: Central bank decisions on interest rates and monetary policy significantly influence market conditions. Current monetary policies seem to be supporting economic growth without fueling excessive inflation, which is favorable for the stock market.

Potential Implications of a Positive Weekly Close for Investors

A positive weekly close, as suggested by the Dow futures, has important implications for investors employing various strategies.

- Opportunities for long-term investors: A positive market trend provides opportunities for long-term investors to build their portfolios and potentially benefit from compounding returns. Dollar-cost averaging becomes more appealing in a rising market.

- Considerations for short-term traders: Short-term traders can look to capitalize on short-term price fluctuations within the uptrend, but increased market volatility could also mean greater risk.

- Impact on various asset classes (stocks, bonds, etc.): A positive weekly close in equities often has a positive spillover effect on other asset classes, though the impact can vary depending on various factors.

- Importance of risk management in light of the positive outlook: Even during positive market trends, risk management remains essential. Diversification and setting stop-loss orders are crucial to protect against potential losses.

Monitoring Market Volatility and Future Predictions

While the Dow futures indicate a positive outlook, it's crucial to remember that stock market volatility is inherent. Unexpected events can always impact market direction.

- Importance of staying informed about market news and analysis: Continuous monitoring of financial news and expert analysis provides critical insights for navigating market fluctuations.

- Using technical and fundamental analysis for informed decision-making: Combining technical and fundamental analysis helps in making more informed trading and investment choices.

- Understanding risk tolerance and diversification strategies: Investors should assess their risk tolerance and diversify their portfolios across different asset classes to mitigate risk.

- Importance of consulting a financial advisor: Seeking professional advice from a qualified financial advisor is crucial for personalized guidance on investment strategies.

Conclusion

Today's Dow futures are signaling a potential positive weekly close for the stock market, driven by positive economic data, corporate earnings, and a relatively stable geopolitical environment. However, market volatility remains a significant consideration. To capitalize on this potentially positive trend while mitigating risk, stay updated on Dow futures, monitor the stock market closely, and make informed investment decisions based on Dow futures analysis and other market indicators. Remember to consult with a financial professional for personalized advice tailored to your investment goals and risk tolerance.

Featured Posts

-

King Announces Early Start To Birthday Celebrations

Apr 26, 2025

King Announces Early Start To Birthday Celebrations

Apr 26, 2025 -

Food Dye Ban What Dr Sanjay Gupta Says

Apr 26, 2025

Food Dye Ban What Dr Sanjay Gupta Says

Apr 26, 2025 -

Microsofts Vision Designing The Future With Human Centered Ai

Apr 26, 2025

Microsofts Vision Designing The Future With Human Centered Ai

Apr 26, 2025 -

Navigating The Chinese Market Lessons From Bmw And Porsches Experiences

Apr 26, 2025

Navigating The Chinese Market Lessons From Bmw And Porsches Experiences

Apr 26, 2025 -

Benson Boones I Heart Radio Music Awards 2025 Outfit A Closer Look At Photo 5137819

Apr 26, 2025

Benson Boones I Heart Radio Music Awards 2025 Outfit A Closer Look At Photo 5137819

Apr 26, 2025

Latest Posts

-

Bmw And Porsche In China Understanding Market Dynamics And Future Strategies

Apr 26, 2025

Bmw And Porsche In China Understanding Market Dynamics And Future Strategies

Apr 26, 2025 -

Premium Car Sales In China Bmw And Porsches Strategies And Results

Apr 26, 2025

Premium Car Sales In China Bmw And Porsches Strategies And Results

Apr 26, 2025 -

Gambling On Calamity The Case Of The Los Angeles Wildfires

Apr 26, 2025

Gambling On Calamity The Case Of The Los Angeles Wildfires

Apr 26, 2025 -

Los Angeles Wildfires The Growing Market For Disaster Betting

Apr 26, 2025

Los Angeles Wildfires The Growing Market For Disaster Betting

Apr 26, 2025 -

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 26, 2025

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 26, 2025