Today's Stock Market Update: Analyzing Dow Futures And China's Economic Response To Tariffs

Table of Contents

Dow Futures: A Precursor to Today's Market Movement

Analyzing Current Dow Futures Contracts

Dow futures contracts are currently indicating [insert current data: e.g., a 50-point drop, a 1% decrease]. This movement suggests a potentially negative opening for the Dow Jones Industrial Average. Several factors are contributing to this trend:

- Overnight News: Negative sentiment stemming from [cite specific news source and event, e.g., a disappointing earnings report from a major tech company].

- Global Events: Concerns over [cite specific global event, e.g., escalating geopolitical tensions in the Middle East] are adding to investor anxiety.

- Investor Sentiment: A prevailing sense of pessimism among investors is reflected in the current futures prices.

Interpreting Dow Futures Volatility

The volatility in Dow futures indicates a high degree of uncertainty in the market. Several scenarios are possible throughout the day:

- Sharp Decline: If negative sentiment persists, the Dow could experience a significant drop, potentially triggering further sell-offs.

- Slight Recovery: Positive economic data or a shift in investor sentiment could lead to a partial recovery.

- Sideways Trading: The market may consolidate around current levels, with limited price movements.

Factors contributing to this volatility include upcoming economic data releases (e.g., inflation figures, employment reports), geopolitical events, and the release of corporate earnings reports. Different sectors are expected to react differently; for example, technology stocks might be more susceptible to global uncertainty, while defensive sectors might show more resilience.

China's Economic Response to Tariffs: A Macroeconomic Perspective

Recent Policy Announcements and Their Market Impact

China has recently announced a series of economic measures in response to the ongoing trade war, including:

- Targeted Stimulus Packages: Focused on infrastructure investment and boosting domestic consumption. [Cite source and quantify the stimulus].

- Currency Devaluation: A slight weakening of the Yuan, aimed at making Chinese exports more competitive. [Cite source and percentage change].

- Increased Trade with Other Nations: China is actively pursuing trade deals and partnerships with countries outside the US to lessen its dependence on the American market. [Cite example trade deals].

These policies aim to mitigate the negative impact of tariffs on the Chinese economy, but their effectiveness is yet to be fully seen.

Assessing the Effectiveness of China's Countermeasures

The effectiveness of China's response is a subject of ongoing debate among economists and financial analysts. While some argue that these measures are sufficient to counter the negative effects of tariffs, others point to potential risks:

- Inflationary Pressures: Stimulus packages could lead to increased inflation if not managed effectively.

- Currency Wars: A significant devaluation of the Yuan could trigger retaliatory measures from other countries.

- Disruption of Global Supply Chains: Trade tensions continue to disrupt global supply chains, impacting businesses worldwide.

Expert opinions vary, and the long-term effects remain uncertain. [Cite reputable sources and their differing perspectives].

Interconnectedness of Dow Futures and China's Economic Policies

The Ripple Effect on Global Markets

The US and Chinese economies are deeply interconnected. China's economic policies directly influence the global market and, therefore, Dow futures:

- Supply Chains: Disruptions in Chinese production affect global supply chains, impacting US companies reliant on Chinese manufacturing.

- Consumer Spending: Changes in Chinese consumer spending patterns can affect the demand for US goods and services.

- Investment Flows: Investor confidence in China can directly impact investment flows into the US market.

For example, [give a specific example of how a Chinese policy impacted the US markets].

Identifying Potential Investment Opportunities and Risks

The interconnectedness of these factors creates both opportunities and risks for investors. While some sectors might benefit from China's economic response, others might face challenges:

- Opportunities: Companies focused on domestic consumption in China or those diversifying away from reliance on Chinese manufacturing might see increased demand.

- Risks: Investors holding significant exposure to Chinese markets or companies heavily reliant on Chinese supply chains face increased risks.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Conclusion

Today's stock market is significantly impacted by the interplay between Dow futures and China's economic response to tariffs. Understanding the current state of Dow futures contracts and the implications of China's economic policies is crucial for navigating this complex market environment. Key takeaways include the high degree of uncertainty reflected in Dow futures volatility, the multifaceted nature of China's economic response, and the significant interconnectedness between the US and Chinese economies. Stay ahead of the curve by regularly checking for updates on today's stock market, focusing on the interplay between Dow futures and China's ongoing economic response to tariffs. Understanding these dynamics is crucial for navigating the complexities of today's global market. Monitor Dow futures analysis closely and stay informed about China's economic policies to make informed investment decisions.

Featured Posts

-

Indonesia Weighs Rare Rice Exports To Strengthen International Relations

Apr 26, 2025

Indonesia Weighs Rare Rice Exports To Strengthen International Relations

Apr 26, 2025 -

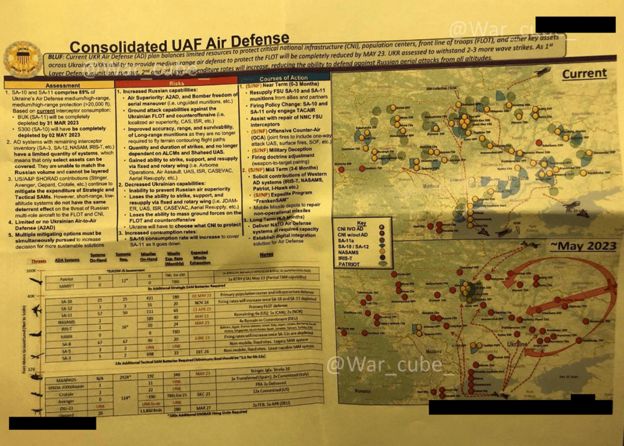

Polygraph Threats And Pentagon Leaks The Hegseth Story

Apr 26, 2025

Polygraph Threats And Pentagon Leaks The Hegseth Story

Apr 26, 2025 -

Benson Boone Conheca O Cantor Por Tras Do Hit Beautiful Thing E Do Lollapalooza Brasil

Apr 26, 2025

Benson Boone Conheca O Cantor Por Tras Do Hit Beautiful Thing E Do Lollapalooza Brasil

Apr 26, 2025 -

Hollywoods Nepotism Problem Explodes At The Oscars After Party

Apr 26, 2025

Hollywoods Nepotism Problem Explodes At The Oscars After Party

Apr 26, 2025 -

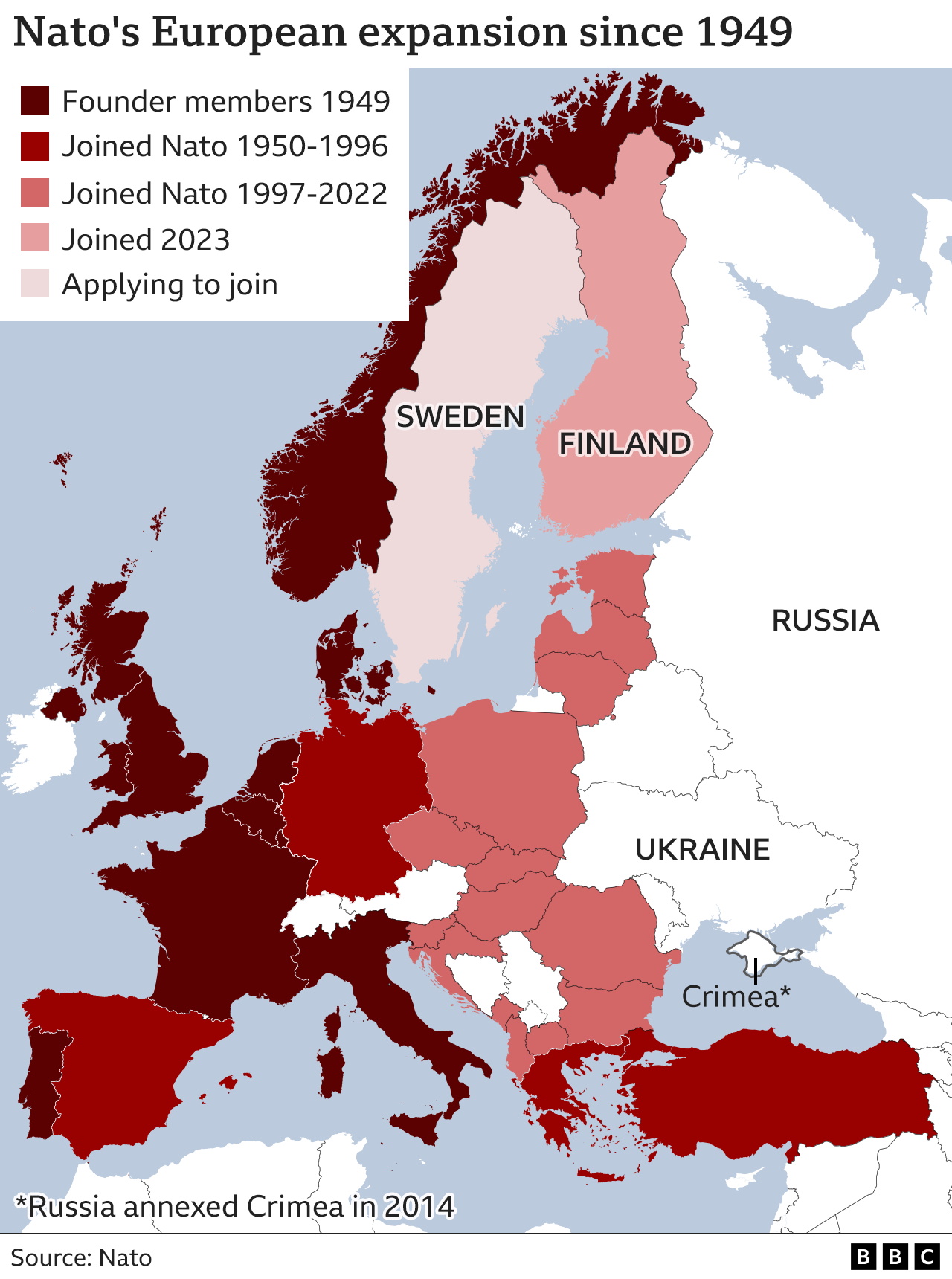

Nato Expansion And Ukraine Examining Trumps Opposition

Apr 26, 2025

Nato Expansion And Ukraine Examining Trumps Opposition

Apr 26, 2025

Latest Posts

-

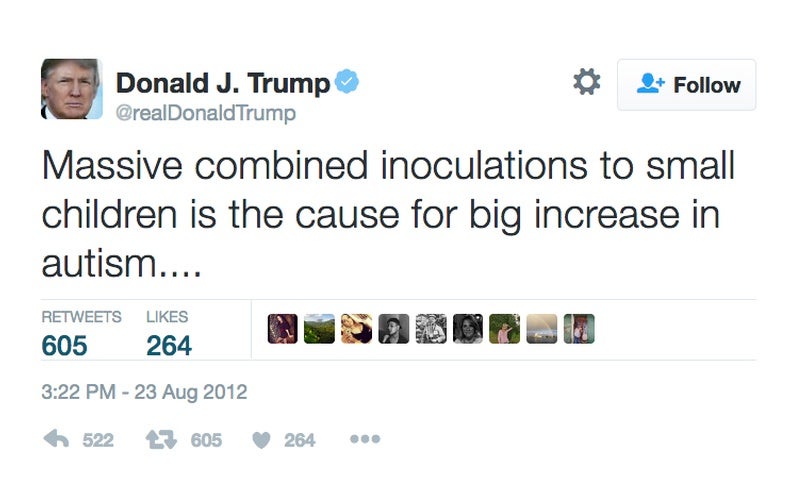

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025 -

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025 -

Hhs Investigation Into Debunked Autism Vaccine Link Sparks Outrage

Apr 27, 2025

Hhs Investigation Into Debunked Autism Vaccine Link Sparks Outrage

Apr 27, 2025