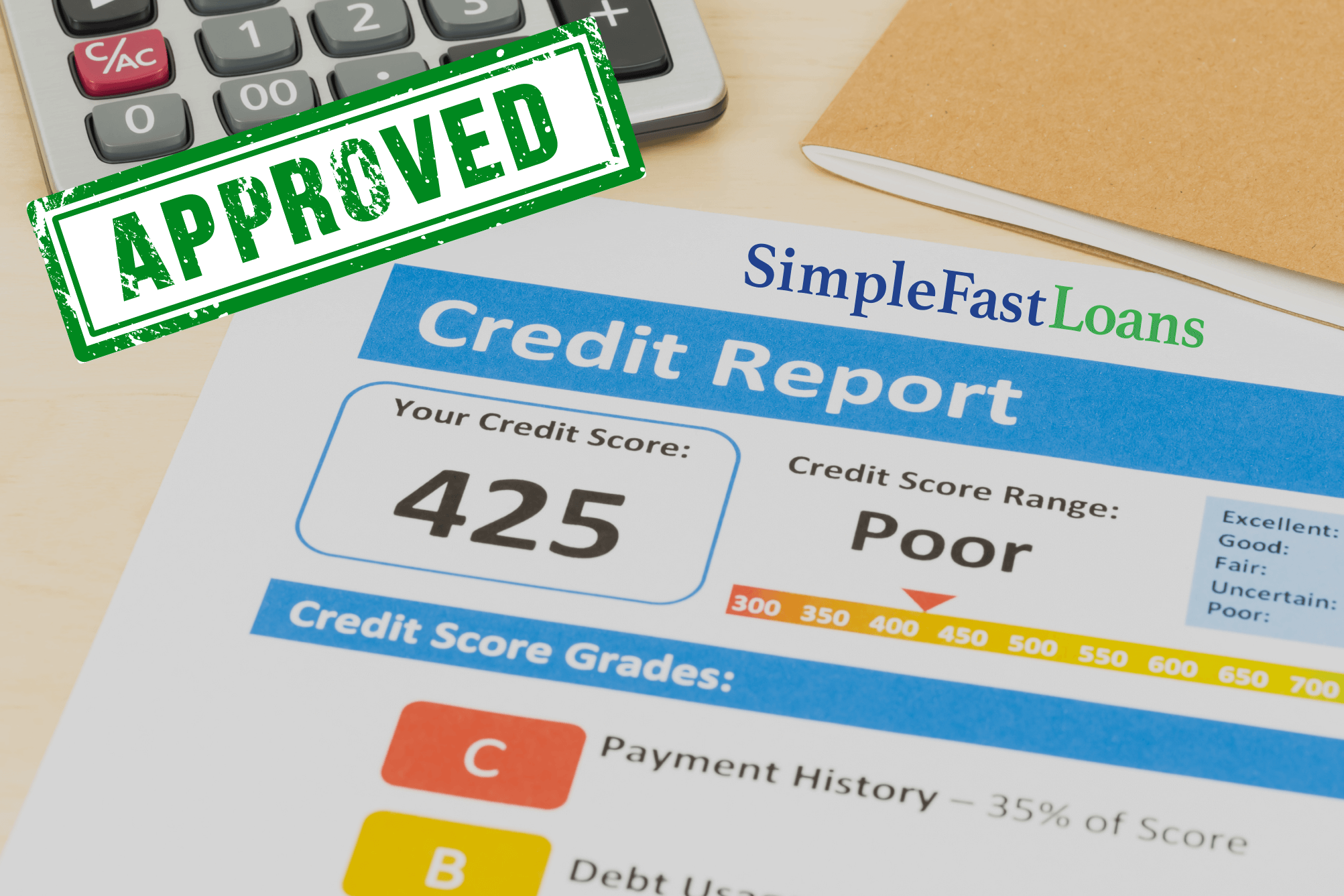

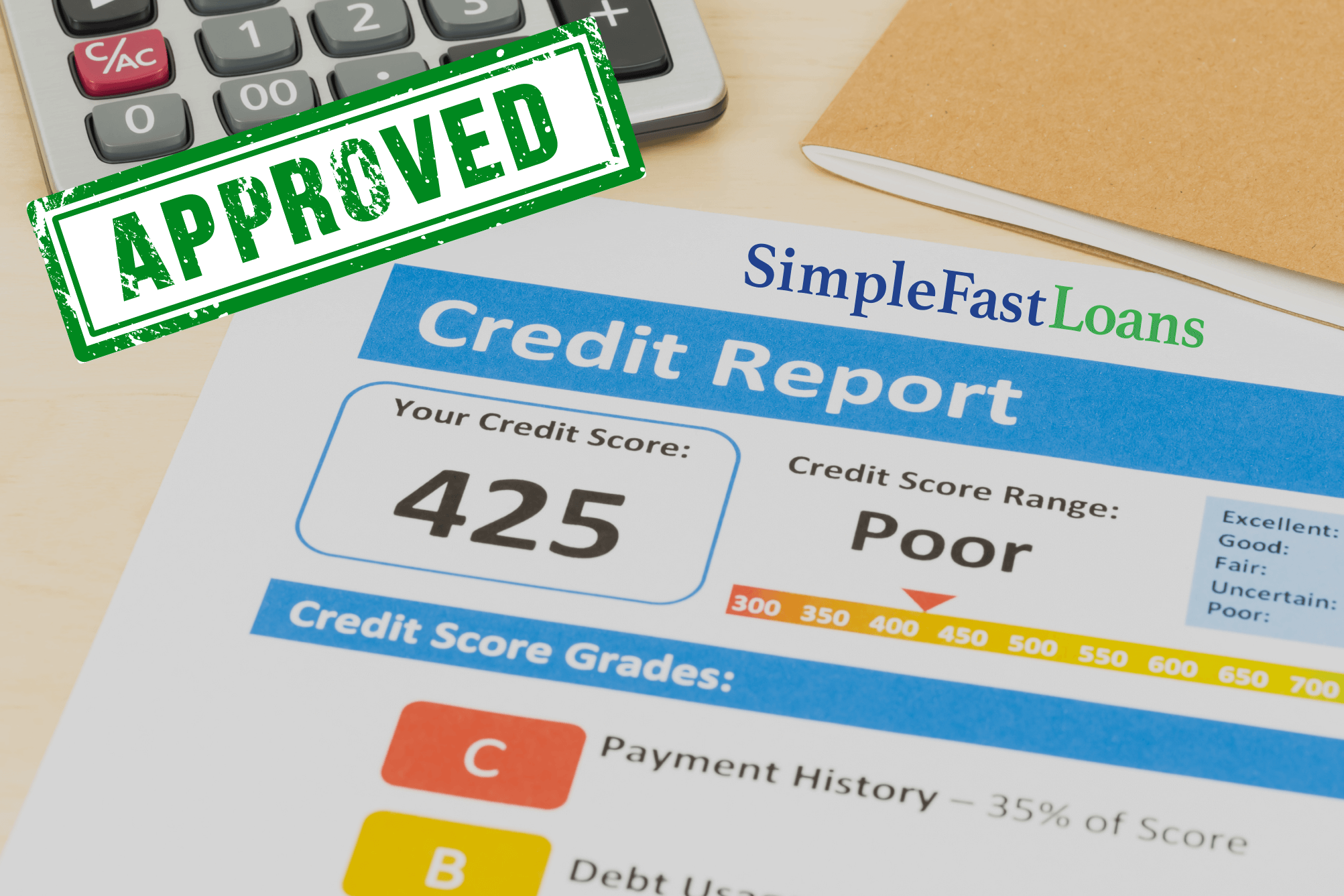

Top Tribal Loans For Bad Credit: Direct Lenders Offering Guaranteed Approval

Table of Contents

Understanding Tribal Loans and Their Advantages

Tribal loans are short-term loans offered by lenders associated with Native American tribes. These loans operate outside of traditional state usury laws, sometimes offering more flexible lending criteria. This doesn't mean they're without risk, but they can be a viable alternative for individuals with poor credit.

Potential Advantages:

- Higher Approval Rates: Compared to banks and credit unions, tribal lenders often have higher approval rates for applicants with bad credit.

- Less Stringent Credit Score Requirements: While a credit check is still typically performed, the requirements might be less strict than with traditional lenders.

- Faster Processing Times: Tribal loans can often be processed and funded more quickly than traditional loans.

- Access to Funds: This is a crucial benefit for those facing urgent financial needs and struggling to secure a loan through other means.

Potential Drawbacks and Risks:

- Higher Interest Rates: Be prepared for higher interest rates than conventional loans. This is a significant factor to consider.

- Thorough Understanding of Terms and Fees: Always read the fine print carefully. Understand all fees, including origination fees, late payment penalties, and prepayment penalties.

- Responsible Borrowing: Borrow only what you can comfortably repay. Defaulting on a tribal loan can negatively impact your credit score.

Finding Reputable Direct Lenders for Tribal Loans

Choosing the right lender is paramount. The tribal lending market, like any financial market, includes both legitimate and predatory lenders. Protecting yourself from scams is crucial. This section will help you navigate the complexities of finding trustworthy direct lenders for tribal loans for bad credit.

Tips for Identifying Reputable Direct Lenders:

- Online Reviews and Ratings: Check independent review sites like the Better Business Bureau (BBB) and Trustpilot for feedback from past borrowers.

- Licensing and Registration: Ensure the lender is properly licensed and registered with relevant authorities.

- Transparent Fees and Terms: Avoid lenders with hidden fees or unclear terms and conditions. Transparency is key.

- Avoid "Guaranteed Approval" Claims: Be cautious of lenders promising guaranteed approval without clearly outlining the qualifications.

- High-Pressure Sales Tactics: Legitimate lenders won't pressure you into making a quick decision.

Finding a trustworthy lender takes time and research. Don't rush the process. Thoroughly investigate any potential lender before applying for a loan.

Factors Affecting Tribal Loan Approval

While the term "guaranteed approval" is frequently used in marketing, several factors influence whether your application for top tribal loans for bad credit will be approved.

Key Factors:

- Credit Score: Although less stringent than traditional lenders, your credit score still plays a role.

- Income Verification: Lenders will require proof of income and employment to assess your repayment ability.

- Debt-to-Income Ratio: Your existing debt obligations significantly impact your approval chances.

- Loan Amount Requested: Requesting a larger loan amount may reduce your chances of approval.

- Employment History: A stable employment history demonstrates your ability to repay the loan.

Improving Your Chances of Approval:

- Improve Credit Score (if possible): Even a small improvement can increase your chances.

- Accurate Application: Provide complete and accurate information on your application.

- Realistic Loan Amount: Borrow only what you can afford to repay.

- Compare Offers: Shop around and compare offers from multiple lenders before making a decision.

Comparing Tribal Loan Offers and Interest Rates

Once you've identified a few reputable lenders, meticulously compare their offers. Interest rates are a major component of the cost of borrowing.

Factors Affecting Interest Rates:

- Credit Score: A higher credit score usually translates to a lower interest rate.

- Loan Amount: Larger loan amounts often carry higher interest rates.

- Loan Term: Longer loan terms can lead to higher total interest paid.

- Lender's Policies: Each lender has its own internal policies that influence interest rates.

Evaluating Interest Rates and APR: Pay close attention to the Annual Percentage Rate (APR), which includes all fees and interest charges. High interest rates can quickly escalate your debt. Understand the repayment terms thoroughly to avoid unexpected costs. The dangers of high-interest rates on short-term loans cannot be overstated.

Conclusion: Making Informed Decisions on Top Tribal Loans for Bad Credit

Securing top tribal loans for bad credit requires careful consideration. This article has highlighted the advantages and disadvantages, emphasizing the importance of choosing reputable direct lenders, understanding the approval process, and comparing loan offers. Remember, responsible borrowing practices are crucial. While tribal loans can offer a solution when traditional lenders are unavailable, they come with higher interest rates and potential risks. Thoroughly research lenders, compare offers, and only borrow what you can comfortably repay. Use this guide to find the best direct tribal lenders and make informed decisions about short-term tribal loans that align with your financial situation. Further research into individual lenders and financial literacy resources is recommended.

Featured Posts

-

Euro Millions Live E245 Million Jackpot Friday Draw Updates

May 28, 2025

Euro Millions Live E245 Million Jackpot Friday Draw Updates

May 28, 2025 -

Rome Champ Continued Success No Room For Complacency

May 28, 2025

Rome Champ Continued Success No Room For Complacency

May 28, 2025 -

Gubernur Koster Prioritaskan Bkk Untuk 6 Kabupaten Mekanisme Penyaluran Dan Program Strategis

May 28, 2025

Gubernur Koster Prioritaskan Bkk Untuk 6 Kabupaten Mekanisme Penyaluran Dan Program Strategis

May 28, 2025 -

Info Cuaca Besok Di Denpasar Dan Bali

May 28, 2025

Info Cuaca Besok Di Denpasar Dan Bali

May 28, 2025 -

Bianca Censori In Italy Rollerblading Lingerie And No Kanye

May 28, 2025

Bianca Censori In Italy Rollerblading Lingerie And No Kanye

May 28, 2025