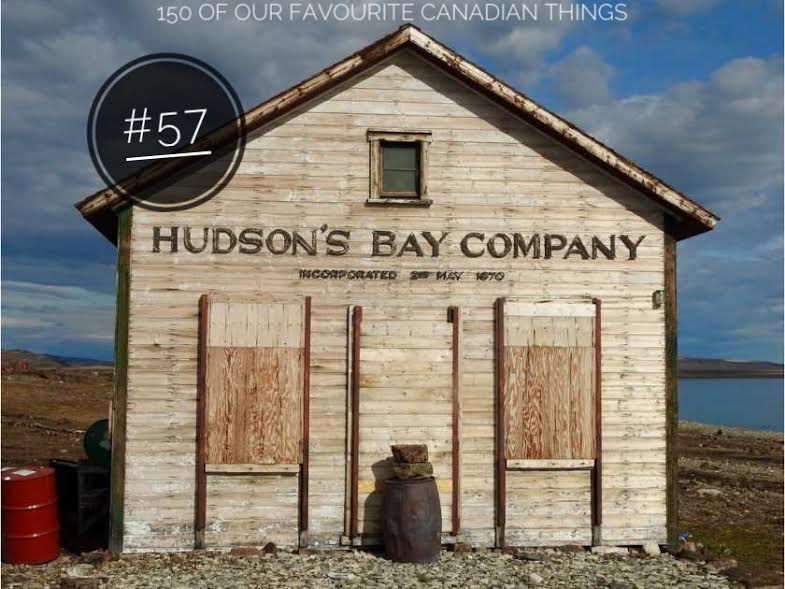

Toronto Firm's Bid For Hudson's Bay: Challenges And Prospects

Table of Contents

Financial Viability and Funding

Securing the necessary funding is paramount for the Toronto firm's success in acquiring HBC. The sheer acquisition cost, potentially running into billions of dollars, necessitates a robust financial strategy. The firm must navigate the complexities of financing such a large-scale transaction.

-

Acquisition Cost and Funding Sources: The initial bid price and any subsequent increases will significantly impact the feasibility of the acquisition. The Toronto firm will likely need to explore a mix of financing options, including:

- Debt Financing: Securing loans from banks and other financial institutions. This option carries the risk of significant debt burden impacting future profitability.

- Equity Partners: Bringing in investors to share the financial risk and reward. This dilutes ownership but provides crucial capital.

- Private Equity: Seeking investment from private equity firms known for their expertise in large-scale acquisitions. This often comes with stringent conditions and potential loss of control.

-

Due Diligence and Financial Health: A thorough due diligence process is crucial. This involves scrutinizing HBC's financial statements, operational efficiency, and legal compliance to assess its true value and potential risks. The firm's own financial health, including its debt-to-equity ratio and cash flow, will be critically examined by potential lenders and equity partners.

Strategic Challenges and Opportunities

Beyond the financial aspects, the Toronto firm faces significant strategic hurdles and opportunities. Successfully navigating these will be key to the long-term viability of the acquisition.

-

Competitive Landscape: The Canadian retail sector is fiercely competitive. The acquiring firm needs a robust retail strategy to compete against established players and online giants. Market share analysis and competitive differentiation will be essential.

-

Brand Revitalization: HBC's iconic brand requires revitalization to remain relevant in a changing consumer landscape. The firm needs a plan to modernize the brand, attract younger customers, and enhance its online presence. This involves careful marketing strategies and potential store renovations.

-

Synergies and Diversification: Identifying and realizing synergies between the acquiring firm and HBC is critical. This includes operational efficiencies, shared resources, and potential cost savings. Moreover, leveraging HBC's extensive real estate portfolio offers opportunities for diversification beyond retail, such as real estate development and management.

Integration and Operational Efficiency

Merging two large organizations is inherently complex. Successful integration is crucial for realizing cost savings and operational efficiencies.

-

Merger Challenges: Integrating different corporate cultures, IT systems, and supply chains can present considerable challenges. Careful planning and effective communication are essential.

-

Operational Restructuring: Identifying redundancies, streamlining processes, and implementing cost-saving measures will be crucial to improve profitability.

-

Employee Retention: Retaining key employees from both organizations is crucial to maintain operational continuity and institutional knowledge. Strategies for employee retention and engagement must be implemented.

Regulatory and Legal Hurdles

Navigating regulatory and legal hurdles is a critical aspect of this acquisition. The Competition Bureau of Canada will closely scrutinize the deal for potential antitrust concerns.

-

Competition Bureau Review: The acquisition will require approval from the Competition Bureau, which will assess its impact on competition in the Canadian retail market. Antitrust concerns will need to be addressed proactively.

-

Regulatory Approval: Obtaining necessary regulatory approvals from other relevant bodies may also be required, adding to the complexity and timeline.

-

Legal Challenges: Potential legal challenges could arise from various sources, including disgruntled shareholders or competitors. Thorough legal due diligence and proactive risk management are crucial.

Long-Term Prospects and Market Impact

The long-term success of this acquisition will depend on several factors, significantly impacting the Canadian retail and real estate markets.

-

Long-Term Growth Potential: The combined entity's long-term growth will depend on its ability to adapt to evolving consumer preferences, innovate, and effectively compete.

-

Market Share Impact: The acquisition could significantly reshape the Canadian retail landscape, potentially leading to increased market share and altered competitive dynamics.

-

Real Estate Development: HBC's vast real estate holdings present significant opportunities for development and redevelopment, potentially driving economic growth in various communities.

-

Economic Impact and Job Creation: The acquisition's success could stimulate economic activity, create jobs, and contribute positively to the Canadian economy, although job losses are also a possibility during restructuring.

Conclusion

The Toronto firm's bid for Hudson's Bay presents a complex scenario with both substantial challenges and potential rewards. From securing adequate financing and navigating regulatory hurdles to integrating operations and revitalizing the HBC brand, the path to success demands meticulous planning and execution. The long-term prospects are inextricably linked to adapting to evolving consumer preferences and realizing the full potential of HBC’s real estate assets. The ultimate impact on the Canadian retail and real estate landscape will depend on the outcome of this high-stakes gamble.

Call to Action: The Toronto firm's bid for Hudson's Bay is a significant event for the Canadian business world. Stay informed about the unfolding developments and their impact on the Canadian retail and real estate sectors. Follow our coverage to stay updated on this crucial acquisition and its implications for the Toronto firm and the future of Hudson's Bay.

Featured Posts

-

Mini Cameras Espias Em Formato De Chaveiro Avaliacao E Melhores Opcoes

May 02, 2025

Mini Cameras Espias Em Formato De Chaveiro Avaliacao E Melhores Opcoes

May 02, 2025 -

Egkrithike I Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Odigos Gia Tin P Syxiki Ygeia Stin Ellada

May 02, 2025

Egkrithike I Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Odigos Gia Tin P Syxiki Ygeia Stin Ellada

May 02, 2025 -

Enexis En Kampen In Juridisch Conflict Aansluiting Stroomnet

May 02, 2025

Enexis En Kampen In Juridisch Conflict Aansluiting Stroomnet

May 02, 2025 -

Unlocking Shared Experiences With Project Muse Collaboration And Community

May 02, 2025

Unlocking Shared Experiences With Project Muse Collaboration And Community

May 02, 2025 -

Play Station Network E Baglanma Ve Oturum Acma

May 02, 2025

Play Station Network E Baglanma Ve Oturum Acma

May 02, 2025

Latest Posts

-

Netanyahu Accuse Macron De Grave Erreur Sur Le Projet D Etat Palestinien

May 03, 2025

Netanyahu Accuse Macron De Grave Erreur Sur Le Projet D Etat Palestinien

May 03, 2025 -

La Rencontre Emouvante D Emmanuel Macron Avec Les Victimes De L Armee Israelienne

May 03, 2025

La Rencontre Emouvante D Emmanuel Macron Avec Les Victimes De L Armee Israelienne

May 03, 2025 -

Emmanuel Macron Rencontre Des Victimes De L Armee Israelienne Une Image Rare Et Poignante

May 03, 2025

Emmanuel Macron Rencontre Des Victimes De L Armee Israelienne Une Image Rare Et Poignante

May 03, 2025 -

Macron Et L Etat Palestinien Netanyahu Denonce Une Grave Erreur

May 03, 2025

Macron Et L Etat Palestinien Netanyahu Denonce Une Grave Erreur

May 03, 2025 -

Netanyahu Critique Severement Macron Sur La Question Palestinienne

May 03, 2025

Netanyahu Critique Severement Macron Sur La Question Palestinienne

May 03, 2025