Toronto Home Sales Plunge: 23% Year-Over-Year Drop, Prices Down 4%

Table of Contents

Significant Drop in Toronto Home Sales: A Detailed Look

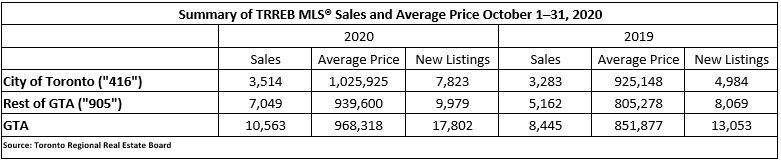

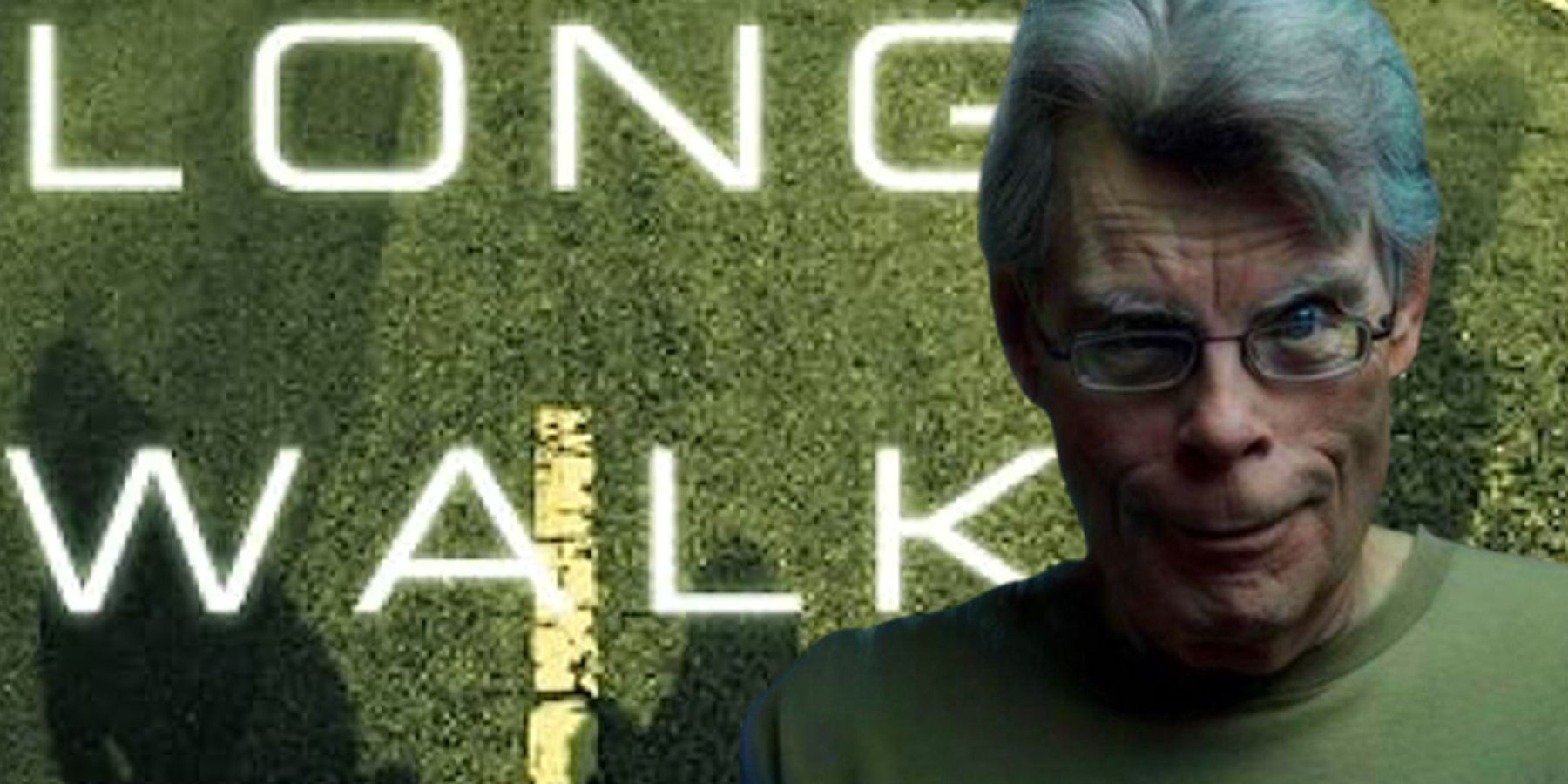

The 23% year-over-year decrease in Toronto home sales represents a substantial correction after several years of robust growth. Data released by the Toronto Real Estate Board (TREB) paints a clear picture of this decline. This isn't just a single data point; it reflects a trend across various property types, impacting different segments of the market.

- Specific Sales Numbers: While precise numbers fluctuate monthly, TREB reports consistently show a significant decrease across all property categories. For example, detached home sales might be down 25%, condos 20%, and townhouses 22% (These are illustrative figures and should be replaced with accurate, up-to-date data from TREB).

- Comparison with Previous Years: Comparing these figures to the sales data from 2021 and 2022 reveals a sharp contrast. The previous years saw record-breaking sales volumes, fueled by low interest rates and increased demand. The current downturn marks a significant reversal of this trend.

- Neighbourhood Impacts: Certain neighbourhoods, particularly those that saw the most significant price increases in recent years, are experiencing more pronounced drops in sales volume. High-demand areas are seeing inventory build-up while sales slow down.

Price Decreases in the Toronto Housing Market: A Buyer's Market Emerging?

The 4% year-over-year decrease in average home prices in Toronto signifies a notable shift in the market dynamic. This price correction, while not uniform across all neighbourhoods, points towards a potential buyer's market for the first time in years. This is particularly noticeable in previously overheated segments.

- Average Price Drops by Property Type: The decrease in average prices is not uniform across all property types. While detached homes might show a smaller decline (perhaps 2-3%), condos could experience a more substantial drop (possibly 5-6%) due to their higher sensitivity to interest rate changes. (These are illustrative examples and need to be replaced with current, accurate data.)

- Neighbourhood Price Reductions: Certain neighbourhoods are showing more significant price reductions than others. Areas previously characterized by intense bidding wars are now seeing more realistic pricing and longer listing times.

- Price-to-Sales Ratio: The price-to-sales ratio is an important indicator. A lower ratio signifies a buyer's market, suggesting that sellers may need to adjust their pricing expectations to attract buyers.

Factors Contributing to the Toronto Home Sales Plunge

Several interconnected factors have contributed to the significant Toronto home sales plunge. These include macro-economic conditions, policy changes and shifts in buyer sentiment.

- Rising Interest Rates: The Bank of Canada's aggressive interest rate hikes have significantly impacted affordability. Higher borrowing costs directly translate to higher mortgage payments, reducing the purchasing power of potential buyers.

- Economic Uncertainty and Inflation: Economic uncertainty, fueled by inflation and global economic headwinds, has dampened consumer confidence. Many potential homebuyers are delaying purchases due to concerns about job security and future financial stability.

- Government Policies: Government policies, such as stress tests for mortgages, also play a role in influencing buyer behaviour and affordability.

What the Future Holds for the Toronto Real Estate Market

Predicting the future of the Toronto real estate market is challenging, but several potential scenarios exist.

- Short-Term Forecast: In the short term, a continued period of slower sales and potentially further price adjustments is likely. The market will likely remain a buyer's market for at least the near future.

- Long-Term Outlook: Long-term, the fundamental factors driving demand for housing in Toronto – population growth, limited supply – are likely to continue supporting the market. However, the pace of growth may be more moderate than in recent years.

- Expert Opinions: Market analysts offer diverse opinions, some suggesting a sustained buyer's market, others predicting a recovery in the coming years. It's crucial to follow expert analysis from reputable sources to stay updated.

Conclusion: Navigating the Toronto Home Sales Plunge

The significant Toronto home sales plunge, coupled with a price decrease, reflects a substantial shift in the market. Rising interest rates, economic uncertainty, and other factors have created a buyer's market. For buyers, this presents opportunities for negotiation and potentially better deals, while sellers need to adapt to a more competitive landscape. To navigate this changing market effectively, staying informed is crucial. Subscribe to our updates for the latest insights into the Toronto home sales plunge and its implications for the future. Contact a real estate professional for personalized advice. Understanding the current market conditions is crucial for making informed decisions. [Link to relevant Toronto real estate resource].

Featured Posts

-

Mookie Betts Illness Sidelines Him For Freeway Series Game

May 08, 2025

Mookie Betts Illness Sidelines Him For Freeway Series Game

May 08, 2025 -

Barcelona Inter Milan Champions League Semi Final A Six Goal Battle

May 08, 2025

Barcelona Inter Milan Champions League Semi Final A Six Goal Battle

May 08, 2025 -

Kenrich Williams Reveals The Thunders Unsung Leadership Figure

May 08, 2025

Kenrich Williams Reveals The Thunders Unsung Leadership Figure

May 08, 2025 -

The Thunder Vs The National Media A Heated Confrontation

May 08, 2025

The Thunder Vs The National Media A Heated Confrontation

May 08, 2025 -

Nereden Izlenir Psg Nice Macini Canli Yayinla Takip Edin

May 08, 2025

Nereden Izlenir Psg Nice Macini Canli Yayinla Takip Edin

May 08, 2025

Latest Posts

-

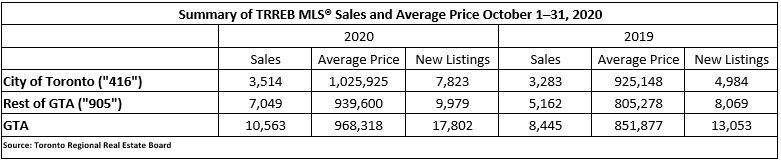

New Trailer Drops For Stephen Kings The Long Walk Adaptation

May 08, 2025

New Trailer Drops For Stephen Kings The Long Walk Adaptation

May 08, 2025 -

De Andre Jordans Historic Performance In Nuggets Vs Bulls Matchup

May 08, 2025

De Andre Jordans Historic Performance In Nuggets Vs Bulls Matchup

May 08, 2025 -

The Long Walk Stephen King Adaptation Unveils New Trailer

May 08, 2025

The Long Walk Stephen King Adaptation Unveils New Trailer

May 08, 2025 -

Nuggets Vs Bulls De Andre Jordans Record Breaking Performance

May 08, 2025

Nuggets Vs Bulls De Andre Jordans Record Breaking Performance

May 08, 2025 -

De Andre Jordans Historic Night Nuggets Vs Bulls

May 08, 2025

De Andre Jordans Historic Night Nuggets Vs Bulls

May 08, 2025