Tracking The Billions: Musk, Bezos, And Zuckerberg's Post-Inauguration Losses

Table of Contents

Elon Musk's Post-Inauguration Financial Rollercoaster

Tesla Stock Performance:

Elon Musk's net worth is heavily tied to Tesla's stock performance. Following the inauguration, Tesla's stock experienced considerable volatility.

- Market Events and Stock Price Impacts: Several events significantly impacted Tesla's stock price and consequently, Musk's net worth. For example, Musk's controversial tweets often caused significant daily fluctuations. Regulatory changes regarding electric vehicle subsidies also played a role. Furthermore, broader economic shifts and concerns about inflation added to the market uncertainty.

- Data Points: Between [Start Date] and [End Date], Tesla's stock price experienced a [Percentage]% decrease, resulting in a [Dollar Amount] loss in Musk's net worth. Specific dates showing significant drops or rises should be noted here with corresponding percentage changes.

- Keyword Integration: The volatility of Tesla stock, directly impacting Musk's net worth, underscores the inherent risks associated with heavy reliance on a single company's market valuation. Analyzing Tesla stock performance is crucial for understanding the fluctuations in Musk's billionaire wealth.

SpaceX and Other Ventures:

While Tesla significantly contributes to Musk's overall wealth, his diverse portfolio includes SpaceX, The Boring Company, and Neuralink. The performance of these ventures also impacts his overall net worth.

- SpaceX's Influence: SpaceX's successful launches and contracts, especially with NASA and private companies, have generally had a positive impact on Musk's net worth, partially offsetting the losses from Tesla's stock fluctuations.

- Other Ventures: The Boring Company's progress in infrastructure projects and Neuralink's advancements in brain-computer interface technology, while not yet major revenue generators, hold potential for future growth and could positively influence Musk's net worth in the long term.

- Keyword Integration: Musk's diversified investments across SpaceX, The Boring Company, and Neuralink help mitigate the risk associated with relying solely on Tesla's performance, showcasing a smart approach to managing billionaire wealth.

Jeff Bezos' Post-Inauguration Wealth Shift

Amazon's Market Position:

Jeff Bezos's immense wealth is largely attributed to his ownership stake in Amazon. The inauguration's impact on the broader economy influenced Amazon's performance and, consequently, Bezos's net worth.

- Factors Affecting Amazon's Stock: Increased competition from other e-commerce giants, rising inflation impacting consumer spending, and increased regulatory scrutiny regarding antitrust concerns all affected Amazon's stock price and Bezos's wealth.

- Data Points: Following the inauguration, Amazon's stock experienced a [Percentage]% change in its value between [Start Date] and [End Date], leading to an estimated [Dollar Amount] fluctuation in Bezos's net worth. Provide specific examples of market share fluctuations.

- Keyword Integration: Amazon's market position as a dominant player in the e-commerce market is crucial for understanding the impact of economic and political factors on Bezos' net worth.

Blue Origin and Beyond:

Bezos's investments extend beyond Amazon, including his space exploration company, Blue Origin. These ventures also contribute to his overall financial picture.

- Blue Origin's Role: While Blue Origin's impact on Bezos's net worth is currently smaller compared to Amazon, its progress in space tourism and reusable rocket technology represents a potential long-term growth avenue.

- Other Investments: Bezos's extensive investment portfolio in various sectors also contributes to his overall wealth, though the exact impact of these investments post-inauguration is difficult to isolate precisely.

- Keyword Integration: Bezos's diversification into space exploration with Blue Origin and other ventures demonstrates a strategy to protect against potential risks in the e-commerce market, a diversification strategy seen among many billionaires.

Mark Zuckerberg's Post-Inauguration Challenges

Meta's Stock Slump:

Mark Zuckerberg's wealth is heavily tied to Meta's (formerly Facebook) stock performance. Post-inauguration, Meta experienced a significant stock slump.

- Factors Impacting Meta's Stock: Intense competition from TikTok, changes in advertising revenue due to privacy concerns and regulatory shifts, and the mixed reception of the Metaverse project all contributed to Meta's stock decline.

- Data Points: Since the inauguration, Meta's stock price has fallen by [Percentage]%, resulting in a [Dollar Amount] reduction in Zuckerberg's net worth between [Start Date] and [End Date]. Include specific examples of negative news cycles impacting Meta's stock.

- Keyword Integration: The challenges faced by Meta in maintaining its dominance in the social media market directly impacted Zuckerberg's net worth, highlighting the vulnerability of even leading tech companies.

Diversification and Future Outlook:

Meta is actively pursuing diversification strategies to mitigate risks and enhance its long-term value.

- Metaverse and Beyond: The Metaverse remains a significant investment for Meta, though its success and impact on Zuckerberg's net worth remain uncertain. Other diversification efforts, such as investments in augmented reality and artificial intelligence, could offer future growth opportunities.

- Keyword Integration: Zuckerberg's focus on diversification through ventures beyond social media, including the Metaverse, showcases an effort to maintain and potentially increase his net worth.

Conclusion: Analyzing the Billionaire's Post-Inauguration Losses – Key Takeaways and Future Outlook

The post-inauguration period witnessed significant financial losses for Musk, Bezos, and Zuckerberg. Market fluctuations, regulatory changes, intense competition, and the challenges of new ventures contributed to these losses. While their overall net worth remains substantial, the events highlight the inherent risks in their largely market-driven fortunes. The future trajectory of their wealth will depend on various factors, including the performance of their key companies, the success of new initiatives, and the broader economic landscape. Stay informed about the ever-changing world of billionaire wealth and market trends by subscribing to our publication or visiting our website for more updates on tracking the billions and following the financial performance of these tech giants post-inauguration. Continue tracking the billions with us for insights into the fluctuating fortunes of these tech titans.

Featured Posts

-

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025 -

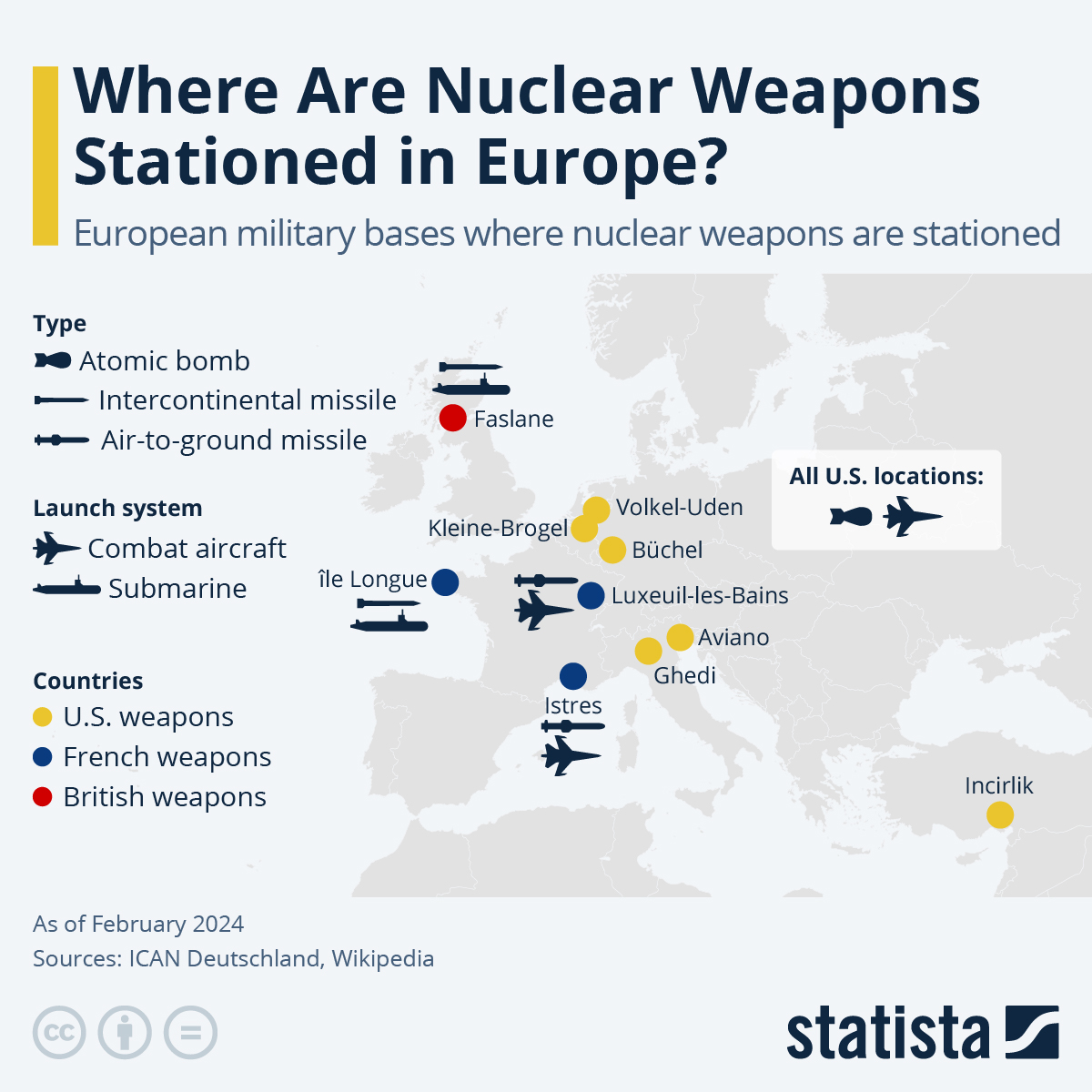

Europes Nuclear Shield A French Ministers Proposal

May 10, 2025

Europes Nuclear Shield A French Ministers Proposal

May 10, 2025 -

Emmerdale Star Amy Walsh Defends Wynne Evans Following Strictly Controversy

May 10, 2025

Emmerdale Star Amy Walsh Defends Wynne Evans Following Strictly Controversy

May 10, 2025 -

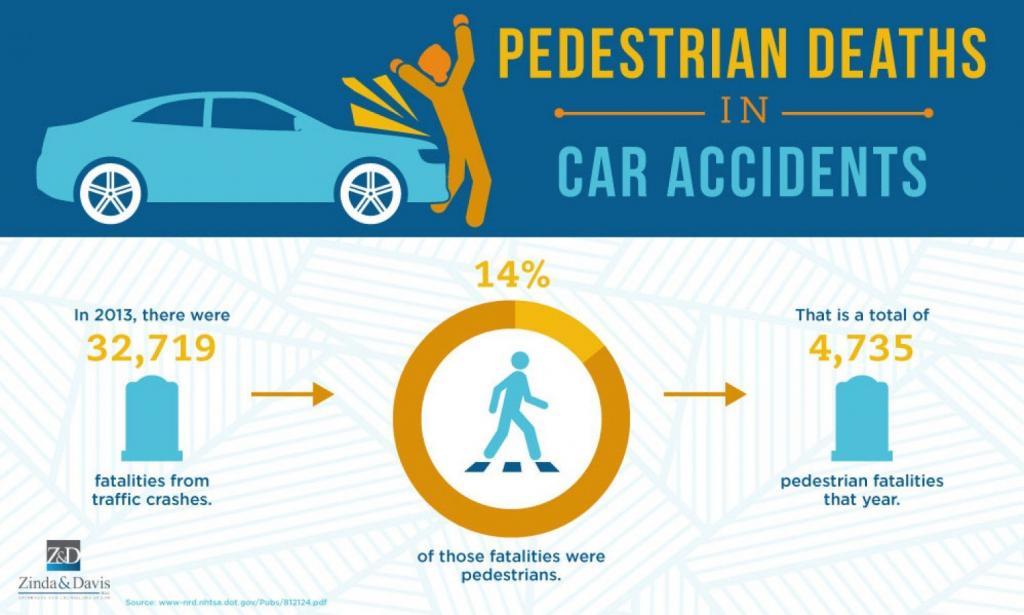

Elizabeth City Two Dead After Pedestrian Accident

May 10, 2025

Elizabeth City Two Dead After Pedestrian Accident

May 10, 2025 -

Trump Attorney Generals Ominous Message To Political Rivals

May 10, 2025

Trump Attorney Generals Ominous Message To Political Rivals

May 10, 2025