Tracking The Markets: Dow And S&P 500 - May 5th

Table of Contents

Dow Jones Industrial Average Performance on May 5th

Opening and Closing Values

On May 5th, the Dow Jones Industrial Average (DJIA) opened at 33,820. It experienced some volatility throughout the trading day, ultimately closing at 33,780, representing a decrease of approximately 0.12%. This relatively small fluctuation indicates a period of market consolidation rather than a significant trend shift. This is important for those actively involved in daily stock market index tracking.

Key Influencing Factors

Several factors contributed to the Dow's performance on May 5th. These included:

- Economic Data: A slightly weaker-than-expected manufacturing PMI report fueled concerns about slowing economic growth, impacting investor confidence and leading to some profit-taking.

- Geopolitical Uncertainty: Ongoing tensions in Eastern Europe continued to cast a shadow over global markets, creating uncertainty among investors.

- Technology Sector Performance: The technology sector, a significant component of the Dow, experienced mixed results, with some large-cap tech companies reporting slightly disappointing earnings. For example, Company X saw a 2% drop in share price, impacting the overall Dow performance. This highlights the importance of tracking individual stock movements within the index to fully grasp the market picture.

- Interest Rate Expectations: Anticipation of further interest rate hikes by the Federal Reserve also played a role, impacting investor sentiment and contributing to the slight decline in the Dow.

Technical Analysis

While a full technical analysis is beyond the scope of this brief report, it is worth noting that the Dow briefly touched a key support level around 33,750. This provided some floor to further declines, suggesting that the selling pressure may have been limited. Further market tracking will be needed to confirm whether this level holds.

S&P 500 Performance on May 5th

Opening and Closing Values

The S&P 500, a broader market index than the Dow, opened at 4,130 and closed at 4,125 on May 5th. This represents a decrease of approximately 0.12%, mirroring the Dow's performance.

Correlation with Dow

The S&P 500 and Dow Jones exhibited a strong positive correlation on May 5th, moving in near-tandem. This is expected given the considerable overlap in their constituent companies and their shared sensitivity to overall market sentiment and economic conditions. Market tracking often involves monitoring this relationship to get a better understanding of overall market health.

Sector-Specific Performance

Within the S&P 500, the technology sector showed only a slight decline, while the energy sector performed relatively better due to positive news regarding oil prices. The healthcare sector also saw relatively modest changes, illustrating the diverse performance among different sectors within the broader market. This underscores the need for investors to diversify their portfolios and engage in robust sector-specific market tracking.

Overall Market Sentiment and Outlook

Investor Sentiment

Based on the day's performance and trading volume, investor sentiment on May 5th was largely neutral to slightly negative. The relatively low trading volume suggests a lack of strong conviction in either direction. The cautious approach likely reflects the ongoing uncertainties mentioned above. This type of sentiment analysis is crucial for market tracking.

Future Predictions (with caution)

Predicting the short-term future of the market is inherently challenging. However, based on the current trends, a period of consolidation or slight volatility is likely in the coming days. The interplay between economic data, geopolitical developments, and corporate earnings will continue to shape market direction. Continuous market tracking is essential to navigate this period effectively.

Expert Opinions

While no significant opinions from leading financial analysts were immediately available for this specific date, general consensus suggests that the market is likely to remain range-bound in the short term, barring major unforeseen events. Continuing to monitor the news and analyst reports will allow for more informed market tracking and investment decisions.

Conclusion: Staying Informed on Dow and S&P 500 Market Movements

In summary, May 5th saw relatively modest declines in both the Dow and S&P 500, reflecting a cautious market sentiment amidst ongoing economic and geopolitical uncertainties. The indices moved in tandem, indicating a general market trend. Understanding the daily fluctuations of the Dow and S&P 500, and engaging in consistent market tracking, is crucial for making informed investment decisions. Stay ahead of the curve by consistently tracking the Dow and S&P 500. Continue to monitor the market for further insights and utilize reliable resources for detailed market analysis.

Featured Posts

-

King Pro Maska Ta Trampa Zrada Ta Pidtrimka Putina

May 06, 2025

King Pro Maska Ta Trampa Zrada Ta Pidtrimka Putina

May 06, 2025 -

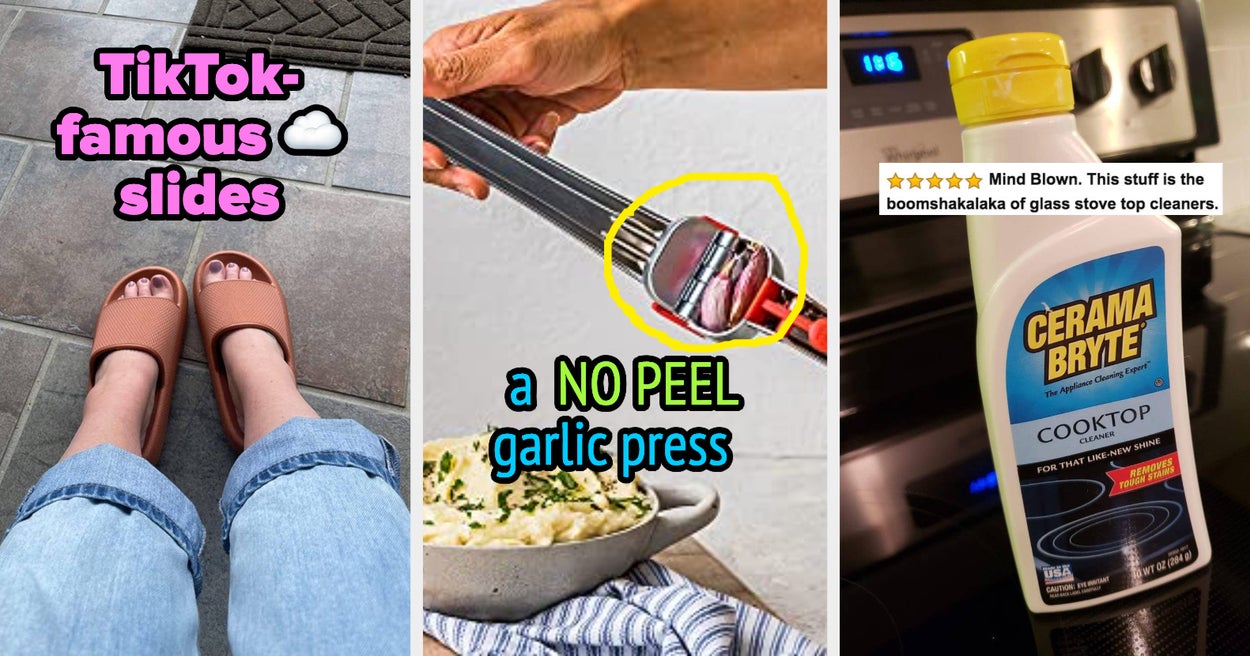

Cheap Products That Exceed Expectations

May 06, 2025

Cheap Products That Exceed Expectations

May 06, 2025 -

Sheins Stalled London Ipo The Us Tariff Fallout

May 06, 2025

Sheins Stalled London Ipo The Us Tariff Fallout

May 06, 2025 -

Learn About Sabrina Carpenters New Fortnite Dance Emotes

May 06, 2025

Learn About Sabrina Carpenters New Fortnite Dance Emotes

May 06, 2025 -

Binge Watch This Top Stephen King Show In Under 5 Hours

May 06, 2025

Binge Watch This Top Stephen King Show In Under 5 Hours

May 06, 2025