Tracking The Markets: Dow And S&P 500 On May 29

Table of Contents

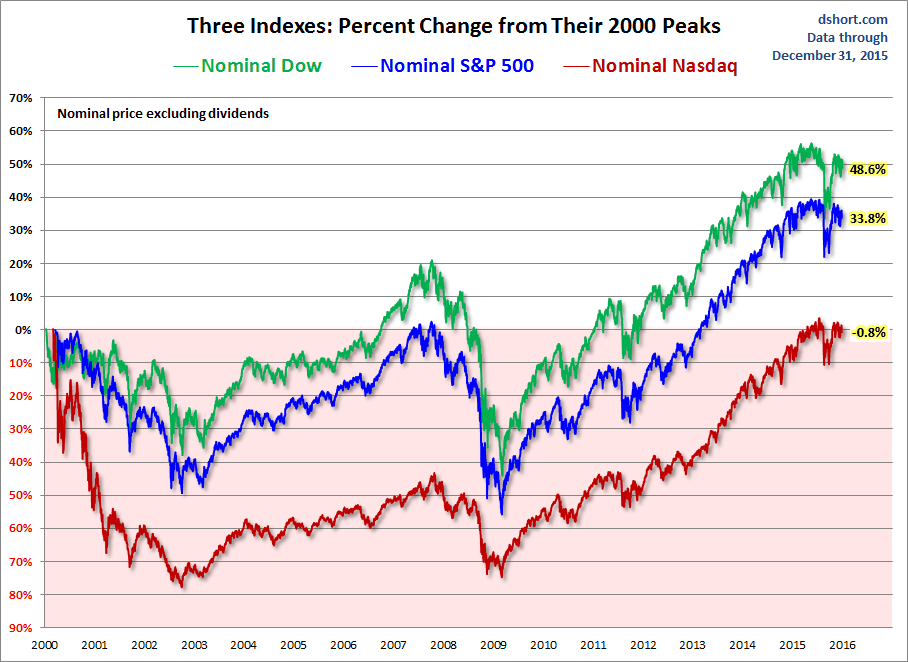

Dow Jones Industrial Average Performance on May 29th

The Dow Jones Industrial Average (DJIA), a price-weighted average of 30 large, publicly-owned companies, experienced [insert actual opening, closing, high, and low values for May 29th here]. This resulted in a [insert percentage change – e.g., 1.2%] change compared to the previous day's close. This movement reflects the overall sentiment towards these blue-chip stocks.

- Opening Value: [Insert Value] at [Insert Time]

- Closing Value: [Insert Value] at [Insert Time]

- High Value: [Insert Value]

- Low Value: [Insert Value]

- Percentage Change from Previous Day's Close: [Insert Percentage]

- Volume Traded: [Insert Volume]

- Significant Contributing Factors: [Analyze any specific company performance, economic news, or geopolitical events that notably impacted the Dow's performance on May 29th. For example, "Positive earnings reports from technology companies contributed to the upward trend, while concerns about rising inflation slightly tempered gains."]

S&P 500 Index Performance on May 29th

The S&P 500 index, a broader market index representing 500 large-cap companies, followed a similar trajectory to the Dow on May 29th, but with [insert nuances, if any]. Its performance provides a more comprehensive picture of the overall market sentiment compared to the Dow's focus on 30 blue-chip stocks. The S&P 500 opened at [Insert Value] and closed at [Insert Value], marking a daily change of [Insert Percentage].

- Opening Value: [Insert Value] at [Insert Time]

- Closing Value: [Insert Value] at [Insert Time]

- High Value: [Insert Value]

- Low Value: [Insert Value]

- Percentage Change from Previous Day's Close: [Insert Percentage]

- Volume Traded: [Insert Volume]

- Sector Performance: [Analyze sector-specific performance. For example, "The Technology sector outperformed other sectors, while Energy stocks experienced a slight downturn."]

Correlation Between Dow and S&P 500 Performance on May 29th

On May 29th, the Dow and S&P 500 exhibited a [positive/negative/weak] correlation. Both indices [rose/fell/moved in opposite directions] by approximately [Insert percentage change comparison]. This [high/low] degree of correlation suggests [Insert analysis of the implication of the correlation, e.g., a strong positive correlation indicates a broad market trend, while a weak correlation could suggest sector-specific influences]. Understanding this correlation is crucial for investors employing diversification strategies.

- Percentage Change Comparison: [Detailed comparison of the percentage changes for both indices]

- Divergence Analysis: [Explain any significant divergence and potential reasons. For example, "While both indices rose, the S&P 500 outperformed the Dow due to stronger gains in the technology sector."]

- Diversification Implications: [Explain how the correlation (or lack thereof) affects diversification strategies. For example, "A weak correlation highlights the benefits of holding a diversified portfolio across different asset classes."]

Market Outlook Based on May 29th Performance (Optional)

Based on May 29th's performance, a cautious outlook is warranted. [Insert cautiously optimistic or pessimistic outlook based on available data and market trends. Back up any statement with evidence. Avoid strong predictions. For example, "The overall positive trend suggests continued growth potential, but ongoing economic uncertainties necessitate a cautious approach."]

- Potential Future Trends: [Mention potential future trends supported by factual information, not speculation]

- Importance of Research: Thorough research is essential before making any investment decisions.

- Disclaimer: Market predictions are inherently speculative and should not be considered financial advice.

Conclusion: Staying Informed on Dow and S&P 500

Tracking the Dow Jones and S&P 500 indices is crucial for understanding broader market trends and making well-informed investment decisions. The performance on May 29th provided [summarize key insights from the analysis, e.g., "a snapshot of positive market sentiment, although sector-specific variations highlight the importance of diversification"]. Regularly monitoring these key market indicators, coupled with thorough research, helps investors navigate the complexities of the stock market. To stay updated on the Dow and S&P 500 performance and receive insightful market analysis, [insert call to action – e.g., subscribe to our newsletter or follow our social media channels].

Featured Posts

-

Metallica Announces Two Night Stand At Dublins Aviva Stadium In June 2026

May 30, 2025

Metallica Announces Two Night Stand At Dublins Aviva Stadium In June 2026

May 30, 2025 -

San Diego Battles Impacts Of Late Winter Storm

May 30, 2025

San Diego Battles Impacts Of Late Winter Storm

May 30, 2025 -

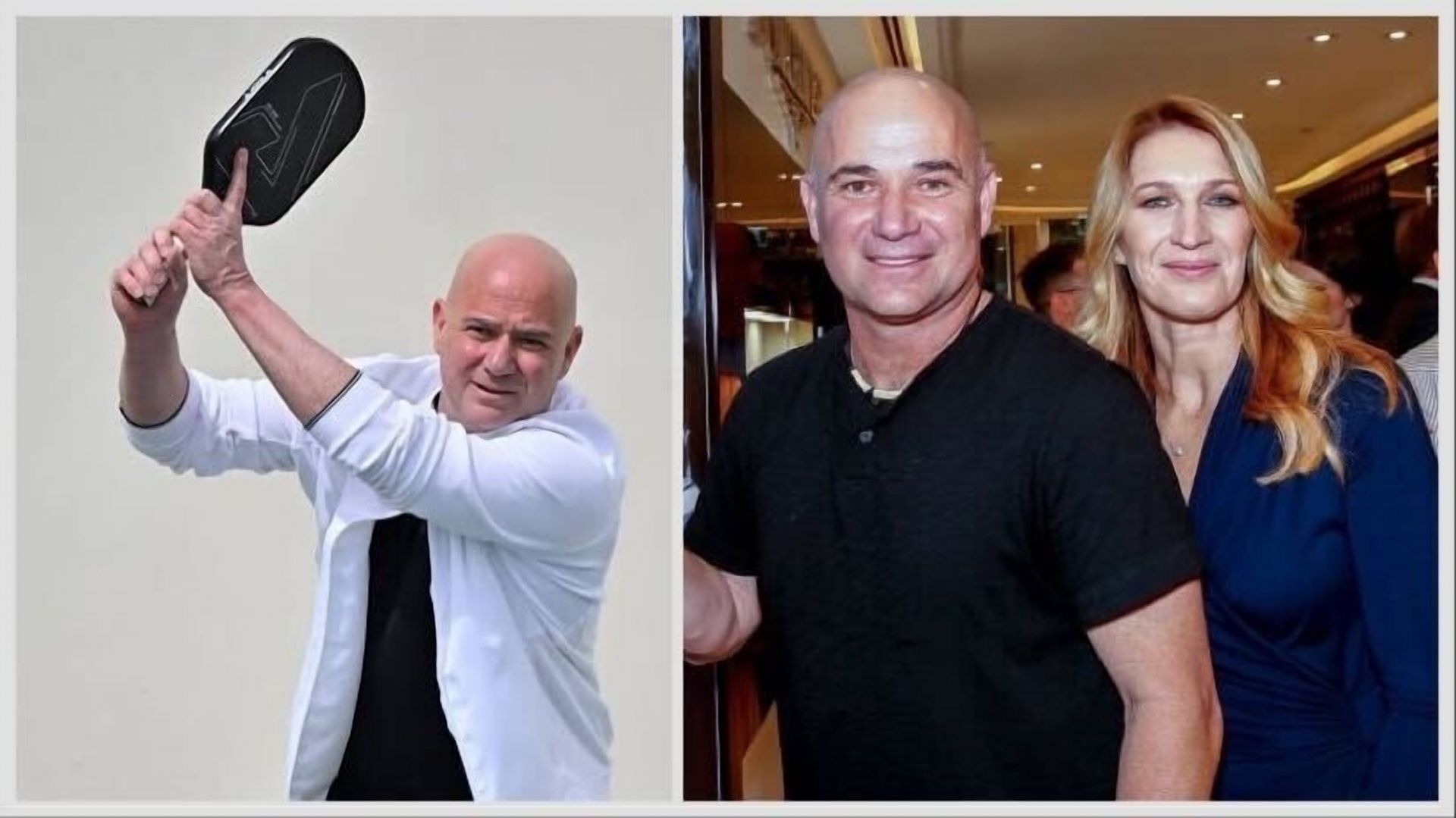

Andre Agassi Una Nueva Etapa En El Mundo Del Deporte

May 30, 2025

Andre Agassi Una Nueva Etapa En El Mundo Del Deporte

May 30, 2025 -

Is Canada On The Brink Of Losing Its Measles Elimination Status A Fall Forecast

May 30, 2025

Is Canada On The Brink Of Losing Its Measles Elimination Status A Fall Forecast

May 30, 2025 -

Steffi Graf Und Andre Agassi Enthuellen Ihre Pickleball Formel

May 30, 2025

Steffi Graf Und Andre Agassi Enthuellen Ihre Pickleball Formel

May 30, 2025

Latest Posts

-

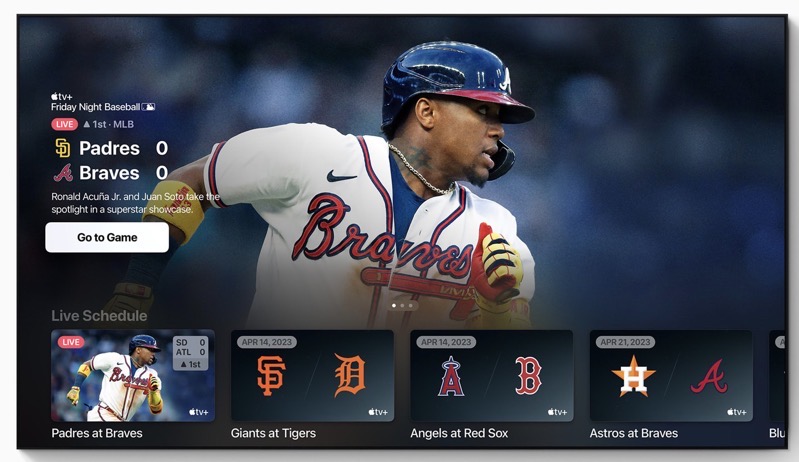

Yankees Vs Tigers Prediction Underdog Alert In Detroit

May 31, 2025

Yankees Vs Tigers Prediction Underdog Alert In Detroit

May 31, 2025 -

Detroit Tigers Road Trip Begins Friday Preview Of Twins Series

May 31, 2025

Detroit Tigers Road Trip Begins Friday Preview Of Twins Series

May 31, 2025 -

Former Mlb Star Brandon Inge Returns To The Dugout In Kalamazoo

May 31, 2025

Former Mlb Star Brandon Inge Returns To The Dugout In Kalamazoo

May 31, 2025 -

Is Parker Meadows Returning To The Detroit Tigers A Notebook Update

May 31, 2025

Is Parker Meadows Returning To The Detroit Tigers A Notebook Update

May 31, 2025 -

Friday Night Baseball Tigers Face Twins To Start Road Trip

May 31, 2025

Friday Night Baseball Tigers Face Twins To Start Road Trip

May 31, 2025