Tracking The NAV Of Amundi MSCI World Ex-United States UCITS ETF Acc

Table of Contents

Understanding the Amundi MSCI World ex-United States UCITS ETF Acc

What is the ETF?

The Amundi MSCI World ex-United States UCITS ETF Acc is a passively managed ETF designed to track the performance of the MSCI World ex-USA Index. This index represents a broad range of global equities, excluding companies based in the United States. This offers investors diversified exposure to international markets, potentially reducing reliance on the US economy's performance.

- Investment Objective: To replicate the performance of the MSCI World ex-USA Index, providing investors with broad international equity exposure.

- Investment Strategy: A passive replication strategy, mirroring the composition of the underlying index. This usually involves holding a portfolio of stocks proportionate to their weighting in the index.

- UCITS Designation: The "UCITS" (Undertakings for Collective Investment in Transferable Securities) designation indicates that the ETF complies with European Union regulations for collective investment schemes, providing a level of investor protection.

Why Track the NAV?

Tracking the NAV of the Amundi MSCI World ex-United States UCITS ETF Acc is essential for several reasons:

- Performance Assessment: The NAV reflects the current market value of the ETF's underlying assets. Monitoring NAV changes allows you to accurately assess the ETF's performance over time.

- Informed Decision-Making: Understanding NAV fluctuations helps in making informed buy and sell decisions. Rising NAV suggests potential gains, while falling NAV might indicate a need for review or adjustment to your investment strategy.

- Risk Management: Tracking NAV helps monitor the risk associated with your investment. Significant and sustained drops in NAV may signal a need to reassess your risk tolerance.

Methods for Tracking the NAV of Amundi MSCI World ex-United States UCITS ETF Acc

Official Sources:

- Amundi Website: The official Amundi website is the primary source for accurate and up-to-date NAV information. Look for dedicated ETF pages or investor relations sections.

- Major Financial Data Providers: Reputable financial data providers like Bloomberg, Refinitiv, or FactSet provide real-time and historical NAV data for various ETFs, including the Amundi MSCI World ex-United States UCITS ETF Acc. Subscription may be required.

Brokerage Platforms:

Most brokerage accounts displaying your portfolio holdings will automatically update the NAV of your investments, including ETFs like the Amundi MSCI World ex-United States UCITS ETF Acc.

- Real-time Updates: Many brokers offer real-time NAV updates, providing immediate insight into your investment's current value.

- Data Delays: Some brokers may have slight delays in NAV updates compared to official sources. Check your broker's specific data provision terms.

Financial News Websites:

Several financial news websites provide ETF data, including NAV information. However, always verify the source's reliability and potential data delays.

Interpreting NAV Changes and Their Implications

Factors Influencing NAV Fluctuations:

Numerous factors influence the NAV of the Amundi MSCI World ex-United States UCITS ETF Acc:

- Market Movements: Overall market trends significantly impact the NAV. Bull markets generally lead to NAV increases, while bear markets can cause declines.

- Currency Exchange Rates: As the ETF invests in non-US companies, fluctuations in currency exchange rates can affect the NAV, particularly if your base currency differs from the ETF's.

- Dividend Distributions: Dividend payments from the underlying companies will affect the NAV, usually resulting in a slight decrease on the ex-dividend date.

Analyzing NAV Trends:

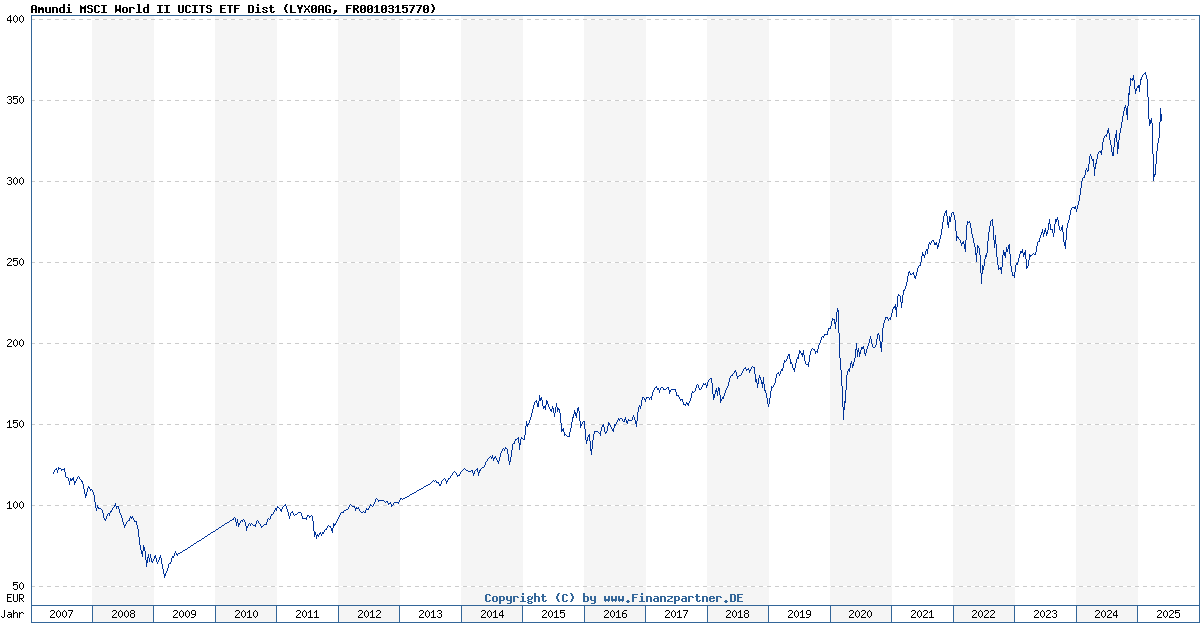

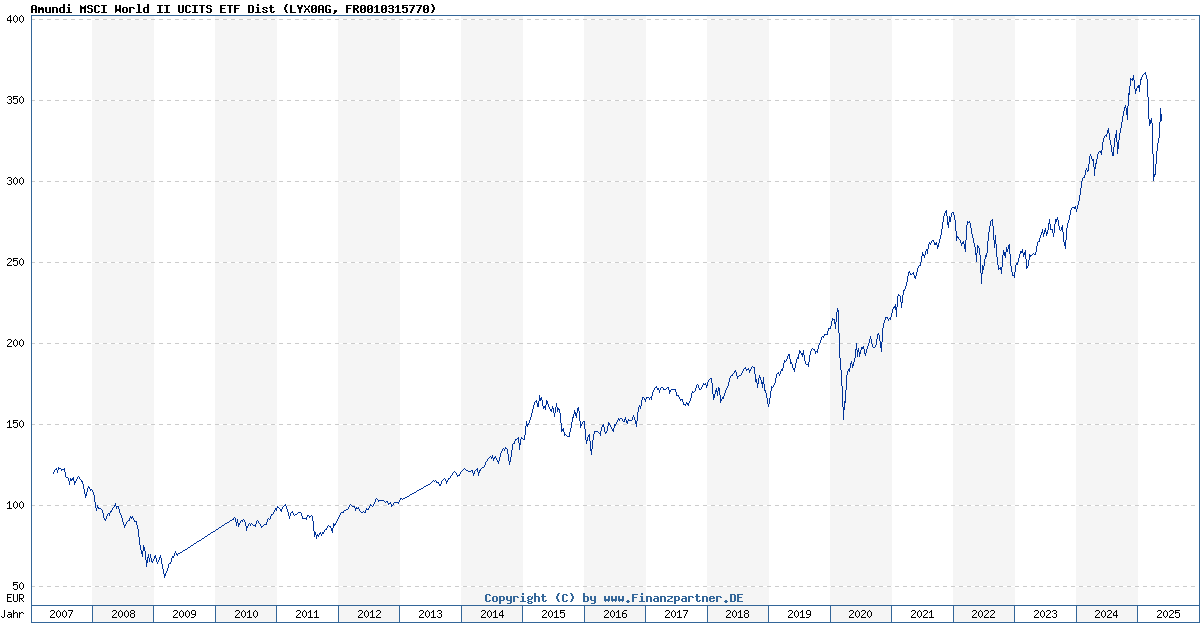

Analyzing both short-term and long-term NAV trends is crucial for understanding the ETF's performance.

- Short-Term Trends: Short-term fluctuations can be volatile and often influenced by market sentiment and news events.

- Long-Term Trends: Long-term NAV trends provide a better indication of the ETF's overall performance and its ability to track the underlying index.

Potential Risks and Considerations

Currency Risk:

Investing in a globally diversified ETF like the Amundi MSCI World ex-United States UCITS ETF Acc exposes you to currency risk. Fluctuations in exchange rates between your base currency and the currencies of the underlying assets can impact the NAV.

Market Risk:

Equity investments inherently carry market risk. The NAV of the Amundi MSCI World ex-United States UCITS ETF Acc can fluctuate significantly due to broader market conditions, economic factors, and geopolitical events.

Expense Ratio:

The ETF's expense ratio, a yearly fee charged to manage the fund, slightly impacts the NAV over time. It's crucial to understand the expense ratio and consider its long-term effect on your returns.

Conclusion

Monitoring the NAV of the Amundi MSCI World ex-United States UCITS ETF Acc is essential for informed investment decision-making. By utilizing official sources, brokerage platforms, and reliable financial news websites, you can effectively track NAV changes and understand the factors influencing them. Remember to analyze both short-term and long-term NAV trends and consider the inherent risks associated with equity investments. Start tracking the NAV of your Amundi MSCI World ex-United States UCITS ETF Acc today! Mastering NAV tracking empowers your investment strategy and allows for more informed and confident participation in global markets.

Featured Posts

-

Naechtlicher Waldbrand In Essen Heisingen 07 04 2025 Aktuelle Polizeimeldungen

May 24, 2025

Naechtlicher Waldbrand In Essen Heisingen 07 04 2025 Aktuelle Polizeimeldungen

May 24, 2025 -

The Ultimate Guide To An Escape To The Country Lifestyle

May 24, 2025

The Ultimate Guide To An Escape To The Country Lifestyle

May 24, 2025 -

Prepad Na Trhu Prace Nemecke Firmy Redukuju Stavy Zamestnancov

May 24, 2025

Prepad Na Trhu Prace Nemecke Firmy Redukuju Stavy Zamestnancov

May 24, 2025 -

11 1 Win For Maryland Softball Aubrey Wursts Dominant Performance

May 24, 2025

11 1 Win For Maryland Softball Aubrey Wursts Dominant Performance

May 24, 2025 -

Securing Bbc Radio 1 Big Weekend 2025 Tickets Full Artist List

May 24, 2025

Securing Bbc Radio 1 Big Weekend 2025 Tickets Full Artist List

May 24, 2025

Latest Posts

-

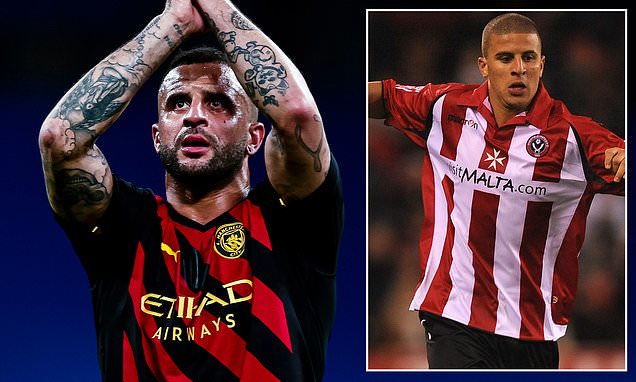

The Kyle Walker Annie Kilner Story A Look At Recent Events

May 24, 2025

The Kyle Walker Annie Kilner Story A Look At Recent Events

May 24, 2025 -

Revealed Kyle Walkers Post Match Milan Activities

May 24, 2025

Revealed Kyle Walkers Post Match Milan Activities

May 24, 2025 -

Kyle Walker And The Mysterious Milan Night Out

May 24, 2025

Kyle Walker And The Mysterious Milan Night Out

May 24, 2025 -

Kyle Walker And Mystery Women Annie Kilners Reaction And Departure Explained

May 24, 2025

Kyle Walker And Mystery Women Annie Kilners Reaction And Departure Explained

May 24, 2025 -

Leeds Transfer Pursuit Focus On Kyle Walker Peters

May 24, 2025

Leeds Transfer Pursuit Focus On Kyle Walker Peters

May 24, 2025