Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

Where to Find the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Accessing accurate and up-to-date Amundi MSCI World II UCITS ETF USD Hedged Dist NAV data is essential. Several reliable sources provide this information:

-

Amundi's Official Website: The primary source for the most accurate and official Amundi MSCI World II UCITS ETF USD Hedged Dist NAV data is the ETF provider's website itself. Look for dedicated sections on ETF details or fund factsheets.

-

Major Financial Portals: Reputable financial news websites and portals like Bloomberg, Yahoo Finance, and Google Finance typically offer real-time and historical Amundi MSCI World II UCITS ETF USD Hedged Dist NAV data. These platforms often provide charting tools for visualizing NAV fluctuations over time.

-

Brokerage Platforms: If you hold the Amundi MSCI World II UCITS ETF USD Hedged Dist through a brokerage account, your platform will likely display the current NAV alongside other relevant investment information. Check your account statements and portfolio tracking tools.

It's crucial to rely on reputable sources for Amundi MSCI World II UCITS ETF USD Hedged Dist NAV data. Minor discrepancies might exist between different sources due to timing differences or data updates, but significant variations should prompt further investigation. Always prioritize data from the official ETF provider whenever possible. Keywords: Amundi MSCI World II UCITS ETF USD Hedged Dist NAV data, Real-time NAV, Historical NAV, ETF NAV sources.

Factors Influencing the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Several factors contribute to the fluctuations in the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV:

-

Underlying Asset Performance: The primary driver of NAV changes is the performance of the underlying assets within the ETF, which tracks the MSCI World Index. Positive global market movements generally lead to NAV increases, while negative movements result in decreases.

-

Currency Fluctuations: The "USD Hedged" aspect of the ETF aims to minimize the impact of currency fluctuations between the euro (likely the base currency of the ETF) and the US dollar. However, complete hedging is not always possible, and minor currency movements can still affect the NAV.

-

Dividend Distributions: When the underlying companies in the MSCI World Index pay dividends, the ETF receives these distributions. These dividends are typically reinvested or paid out to shareholders, influencing the NAV. The impact depends on the dividend payout policy of the ETF.

-

Expenses and Management Fees: The ETF's operating expenses, including management fees, are deducted from the asset base, slightly lowering the NAV over time. These fees are typically disclosed in the ETF's prospectus.

-

Tracking Error: An ETF aims to replicate the performance of its benchmark index (MSCI World Index). However, minor deviations, or tracking errors, can occur due to factors like transaction costs and timing differences. These can slightly affect the NAV's alignment with the index. Keywords: NAV fluctuations, MSCI World Index, USD hedging, ETF expenses, Tracking error, Dividend reinvestment.

Utilizing Amundi MSCI World II UCITS ETF USD Hedged Dist NAV for Investment Decisions

Understanding and tracking the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is crucial for informed investment decisions.

-

Identifying Potential Buying Opportunities: Comparing the current NAV to historical NAVs can help identify potential entry points. A dip in the NAV, potentially due to temporary market corrections, may offer a buying opportunity for long-term investors.

-

Performance Assessment: Tracking the NAV allows investors to assess the ETF's performance against its benchmark (MSCI World Index). Comparing the NAV movement with the index's movement helps evaluate the ETF's effectiveness in tracking its benchmark.

-

Return Calculation: The NAV is fundamental for calculating returns on your investment. By tracking NAV changes over time, you can precisely determine your gains or losses.

However, remember that NAV is just one piece of the puzzle. Consider your risk tolerance, investment goals, and overall investment strategy when making buy or sell decisions. Using NAV data effectively requires a broader understanding of market dynamics and investment principles. Keywords: Investment strategy, Buy and sell signals, Performance analysis, Return on investment, Risk management.

Conclusion: Mastering Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Tracking

Consistent tracking of the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is essential for successful investment management. By utilizing reliable sources, understanding the factors influencing NAV, and integrating this information into a broader investment strategy, you can make more informed decisions. Actively track the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV using the methods outlined above to gain a clearer picture of your investment's performance. Further research into Amundi MSCI World II UCITS ETF USD Hedged Dist performance and related investment strategies will enhance your understanding and investment success.

Featured Posts

-

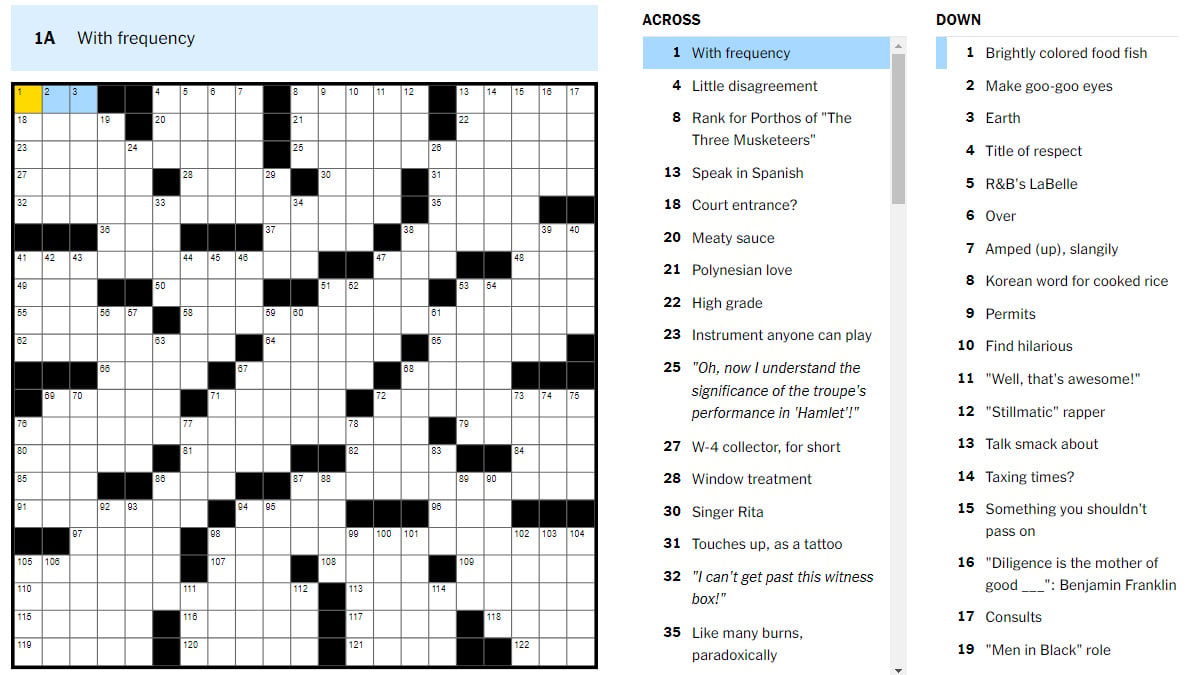

Nyt Mini Crossword March 6 2025 Complete Solution

May 24, 2025

Nyt Mini Crossword March 6 2025 Complete Solution

May 24, 2025 -

Hmlt Mdahmat Waset Alntaq Llshrtt Alalmanyt Dd Mshjeyn

May 24, 2025

Hmlt Mdahmat Waset Alntaq Llshrtt Alalmanyt Dd Mshjeyn

May 24, 2025 -

Nyt Mini Crossword Solutions For March 16 2025

May 24, 2025

Nyt Mini Crossword Solutions For March 16 2025

May 24, 2025 -

Essen Traenenreiche Geschichte Nahe Dem Uniklinikum

May 24, 2025

Essen Traenenreiche Geschichte Nahe Dem Uniklinikum

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 24, 2025

Latest Posts

-

The New Joy Crookes Single Carmen Out Now

May 24, 2025

The New Joy Crookes Single Carmen Out Now

May 24, 2025 -

Leak Reveals Glastonbury 2025 Lineup How To Buy Tickets

May 24, 2025

Leak Reveals Glastonbury 2025 Lineup How To Buy Tickets

May 24, 2025 -

Joy Crookes Carmen A New Single To Listen To

May 24, 2025

Joy Crookes Carmen A New Single To Listen To

May 24, 2025 -

Glastonbury 2025 Lineup Complete List Of Artists And Ticket Purchase Guide

May 24, 2025

Glastonbury 2025 Lineup Complete List Of Artists And Ticket Purchase Guide

May 24, 2025 -

New Music From Joy Crookes The Carmen Single

May 24, 2025

New Music From Joy Crookes The Carmen Single

May 24, 2025