Trade War Intensifies: Another Drop For Dutch Stocks

Table of Contents

The Impact of Trade Tariffs on Dutch Exports

The imposition of trade tariffs is a significant factor driving the decline in Dutch stocks. Many Dutch companies rely heavily on exports, making them particularly vulnerable to disruptions in global trade.

Specific Sectors Affected

Several key sectors in the Netherlands are experiencing significant headwinds due to the trade war. The agricultural sector, for example, is facing challenges with exports of dairy products and horticultural goods to key markets. The technology sector, reliant on global supply chains, is also feeling the pinch, with delays and increased costs impacting production. Similarly, manufacturing companies are facing higher input costs and reduced demand for their products in affected markets. Companies like ASML Holding, a key player in semiconductor manufacturing, are closely watching the trade situation for its impact on global demand and supply chains.

- Quantifying the Decline: Recent data indicates a 5% decline in agricultural exports and a 3% decrease in technology exports in the last quarter. These figures are expected to worsen if trade tensions persist.

- Government Response: The Dutch government has announced some support packages aimed at helping affected businesses, including subsidies for diversification and investment in new markets. However, these measures may not be sufficient to fully offset the impact of the trade war.

- Diversification Strategies: Companies are actively seeking to diversify their export markets and supply chains to mitigate the risks associated with trade wars. This involves exploring new trade partnerships and investing in local production in key markets.

Investor Sentiment and Market Volatility

The escalating trade war has significantly impacted investor sentiment and increased market volatility in the Netherlands.

Analysis of Stock Market Indices

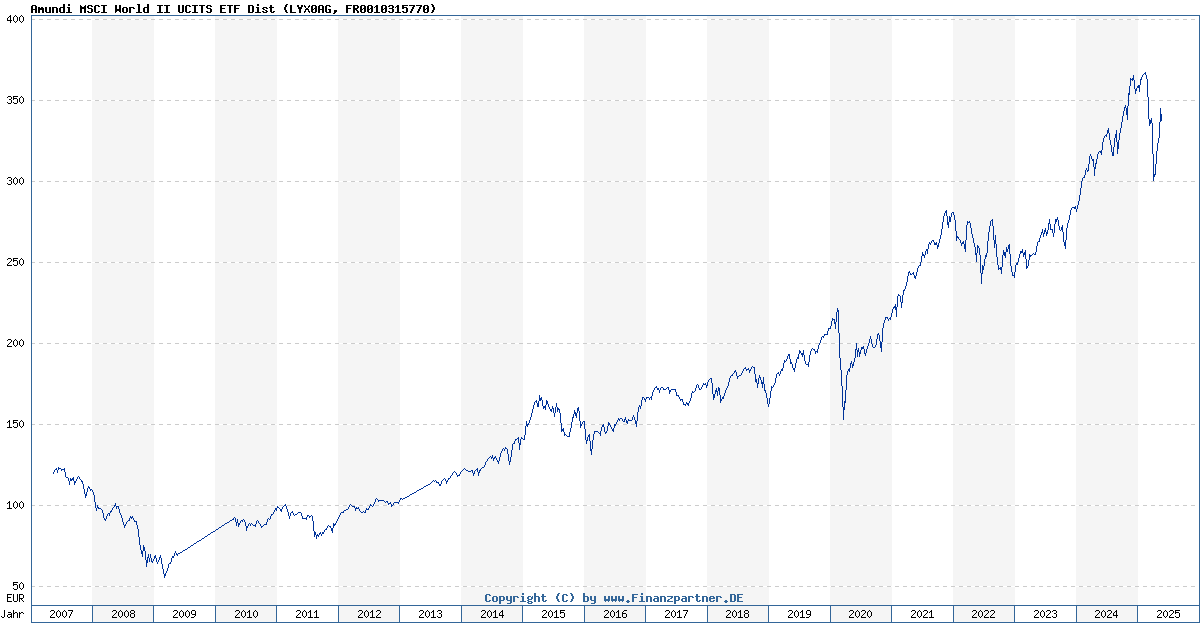

The AEX index, a key indicator of the performance of Dutch stocks, has experienced a notable decline since the intensification of global trade tensions. This reflects a broader trend of investor uncertainty and risk aversion. Charts clearly demonstrate a correlation between the escalation of trade disputes and the downward trend of the AEX.

- Market Decline: The AEX index has fallen by X% since the start of the year, showcasing the significant impact of the trade war on investor confidence. (Insert chart/graph here illustrating the decline).

- Investor Behavior: Investors are exhibiting caution, favoring safer asset classes and reducing exposure to riskier equities like Dutch stocks. This is evident in reduced trading volumes and increased volatility.

- Analyst Predictions: Financial analysts predict further volatility in the short term, with the outlook dependent on the resolution of the trade disputes. Some forecast a further decline in the AEX before a potential recovery.

Potential Long-Term Effects on the Dutch Economy

The prolonged effects of the trade war could have significant long-term implications for the Dutch economy.

GDP Growth Projections

The ongoing trade tensions pose a considerable threat to Dutch GDP growth projections. Reduced exports, decreased investment, and weakened consumer confidence could all contribute to slower economic growth in the coming years.

- Ripple Effects: Reduced export earnings will likely impact employment levels and consumer spending, creating a ripple effect through the Dutch economy.

- Government Response: The Dutch government's fiscal and monetary policy responses will play a crucial role in mitigating the negative impact. Stimulus packages and interest rate adjustments could be employed to bolster the economy.

- Foreign Investment: The trade war could discourage foreign investment in the Netherlands, further dampening economic growth and creating uncertainty.

Strategies for Investors

Navigating the current environment requires careful planning and a proactive approach to risk management.

Risk Management and Portfolio Diversification

Investors should adopt a cautious approach and prioritize risk management during this period of uncertainty.

- Diversification: Diversifying investments across different asset classes (stocks, bonds, real estate) and geographic regions is crucial to mitigate risk. Reducing exposure to Dutch stocks and incorporating international assets into your portfolio is advisable.

- Long-Term Strategy: Maintaining a long-term investment strategy is essential, avoiding panic selling. While short-term fluctuations are expected, focusing on long-term growth goals can help weather market volatility.

- Seek Professional Advice: Consulting with a qualified financial advisor is recommended to tailor your investment strategy to your individual risk tolerance and financial goals.

Conclusion

The intensifying global trade war is significantly impacting Dutch stocks, creating volatility and uncertainty in the market. Sectors heavily reliant on exports, such as agriculture and technology, are experiencing the most significant effects. The potential long-term consequences for the Dutch economy include reduced GDP growth, lower employment, and decreased foreign investment. For investors, a proactive approach to risk management, including portfolio diversification and seeking professional advice, is crucial to navigate this challenging environment. Stay informed about the evolving global trade situation and its impact on Dutch stocks. Monitor market trends, diversify your portfolio, and consider seeking professional financial advice to navigate this challenging environment. Continue to research the effects of trade wars on Dutch stocks for up-to-date information and informed decision-making.

Featured Posts

-

Amundi Msci World Ex Us Ucits Etf Acc Net Asset Value Explained

May 25, 2025

Amundi Msci World Ex Us Ucits Etf Acc Net Asset Value Explained

May 25, 2025 -

Prepustanie V Nemecku H Nonline Sk Prinasa Aktualne Spravy O Hospodarskom Poklese

May 25, 2025

Prepustanie V Nemecku H Nonline Sk Prinasa Aktualne Spravy O Hospodarskom Poklese

May 25, 2025 -

News Corp Undervalued And Underappreciated Analyzing The Potential

May 25, 2025

News Corp Undervalued And Underappreciated Analyzing The Potential

May 25, 2025 -

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets A Complete Guide

May 25, 2025

Secure Your Bbc Radio 1 Big Weekend 2025 Tickets A Complete Guide

May 25, 2025 -

Unbuilt Roads Exploring The Proposed M62 Relief Route Through Bury

May 25, 2025

Unbuilt Roads Exploring The Proposed M62 Relief Route Through Bury

May 25, 2025

Latest Posts

-

Cybersecurity Breach At Marks And Spencer Results In 300 Million Loss

May 25, 2025

Cybersecurity Breach At Marks And Spencer Results In 300 Million Loss

May 25, 2025 -

300 Million Cyberattack Hit On Marks And Spencer Impact And Response

May 25, 2025

300 Million Cyberattack Hit On Marks And Spencer Impact And Response

May 25, 2025 -

Ftc Investigates Open Ai Chat Gpt Under Scrutiny

May 25, 2025

Ftc Investigates Open Ai Chat Gpt Under Scrutiny

May 25, 2025 -

Blue Origin Rocket Launch Abruptly Halted By Technical Issue

May 25, 2025

Blue Origin Rocket Launch Abruptly Halted By Technical Issue

May 25, 2025 -

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 25, 2025

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 25, 2025