Trading The Euro On Swissquote Bank: Impact Of US Market Trends

Table of Contents

Understanding the EUR/CHF Relationship

The US dollar plays a pivotal role in global finance, and its movements significantly impact other currencies, including the Euro. Generally, there's an inverse relationship between the US dollar and the Euro. A strengthening US dollar typically weakens the Euro (EUR/USD falls), which indirectly affects the EUR/CHF pair. Swiss Francs also tend to react to safe-haven demand; however, the impact of the US dollar remains significant.

- US economic data releases: Reports like Non-Farm Payrolls (NFP), indicating employment levels, and Gross Domestic Product (GDP) figures, reflecting economic growth, heavily influence the dollar's strength. Positive surprises usually boost the dollar, negatively impacting the Euro and, by extension, the EUR/CHF.

- Federal Reserve interest rate decisions: Changes in interest rates by the Federal Reserve (Fed) directly impact the attractiveness of the US dollar. Higher rates usually attract foreign investment, strengthening the dollar and weakening the Euro.

- Geopolitical events impacting the US: Global events affecting the US economy, such as trade wars or political instability, often create uncertainty, influencing the dollar's value and subsequently the EUR/CHF.

Swissquote Bank's Trading Platform and Tools

Swissquote Bank provides a robust forex trading platform packed with features ideal for EUR/CHF trading. Its user-friendly interface and advanced tools allow traders to analyze market trends, execute trades efficiently, and manage risk effectively.

- Advantages of using Swissquote for EUR/CHF trading: Swissquote boasts competitive spreads (the difference between the bid and ask price), providing traders with potentially better execution prices. They also offer access to advanced charting and analytical tools.

- Specific charting tools: The platform provides various charting tools, including correlation indicators to assess the relationship between the EUR/CHF and US market indices. This helps traders identify potential trading opportunities based on US market movements.

- Risk management features: Swissquote offers vital risk management tools such as stop-loss orders to automatically limit potential losses, protecting your capital during adverse market conditions.

Analyzing US Market Trends for EUR/CHF Trading

Successful EUR/CHF trading on Swissquote necessitates a thorough understanding of US market trends. This requires a combination of fundamental and technical analysis.

- Interpreting key US economic indicators: Understanding the implications of US economic data releases is paramount. For example, strong NFP numbers might signal a rate hike by the Fed, leading to a stronger dollar and consequently a weaker EUR/CHF. Conversely, disappointing data might weaken the dollar and strengthen the EUR/CHF.

- Fundamental analysis techniques: Analyzing US economic reports, Federal Reserve statements, and geopolitical factors provides valuable insights into market sentiment and potential future price movements. This helps traders anticipate shifts in the EUR/CHF exchange rate.

- Importance of monitoring US market indices: Keeping a close watch on major US market indices like the Dow Jones Industrial Average and the S&P 500 provides a broader perspective on US market health and can help predict potential EUR/CHF reactions. Using technical analysis to complement fundamental analysis will lead to a better-informed approach.

Developing a Trading Strategy on Swissquote

By combining your understanding of US market dynamics with Swissquote's platform features, you can develop effective trading strategies. Remember, risk management is paramount.

- Example strategy 1: Trading on anticipated Federal Reserve decisions: By analyzing economic data and Fed statements, traders can anticipate rate hikes or cuts. This anticipation allows for pre-emptive positioning in the EUR/CHF market before the actual announcement.

- Example strategy 2: Capitalizing on market volatility following US economic data releases: Major economic announcements often cause short-term market volatility. Experienced traders can use this volatility to their advantage by employing appropriate trading strategies such as scalping or swing trading.

- Importance of setting realistic profit targets and stop-loss orders: Always define clear profit targets to secure your profits and stop-loss orders to mitigate potential losses, protecting your capital.

Conclusion

Understanding the impact of US market trends on the EUR/CHF exchange rate is crucial for successful forex trading. Swissquote Bank's platform, with its advanced tools and user-friendly interface, provides an ideal environment to develop and execute trading strategies based on these trends. By mastering both fundamental and technical analysis and utilizing Swissquote's risk management features, you can potentially profit from the EUR/CHF exchange rate. Start exploring Swissquote Bank's platform today and begin trading the Euro on Swissquote Bank, leveraging your knowledge of US market dynamics to achieve your trading goals. [Link to Swissquote's website]

Featured Posts

-

Eurovision Voting System Rules Regulations And How It Impacts The Results

May 19, 2025

Eurovision Voting System Rules Regulations And How It Impacts The Results

May 19, 2025 -

Kibris Isguecue Piyasasi Icin Dijital Veri Tabani Rehberi

May 19, 2025

Kibris Isguecue Piyasasi Icin Dijital Veri Tabani Rehberi

May 19, 2025 -

Marvel The Avengers Crossword Clue Complete Guide To Solving The Puzzle

May 19, 2025

Marvel The Avengers Crossword Clue Complete Guide To Solving The Puzzle

May 19, 2025 -

A Tech Billionaires Spreadsheet Challenge To Frances Woke Policies

May 19, 2025

A Tech Billionaires Spreadsheet Challenge To Frances Woke Policies

May 19, 2025 -

Ana Paola Hall Y La Estructura Del Cne Independencia Y Caracter Colegiado

May 19, 2025

Ana Paola Hall Y La Estructura Del Cne Independencia Y Caracter Colegiado

May 19, 2025

Latest Posts

-

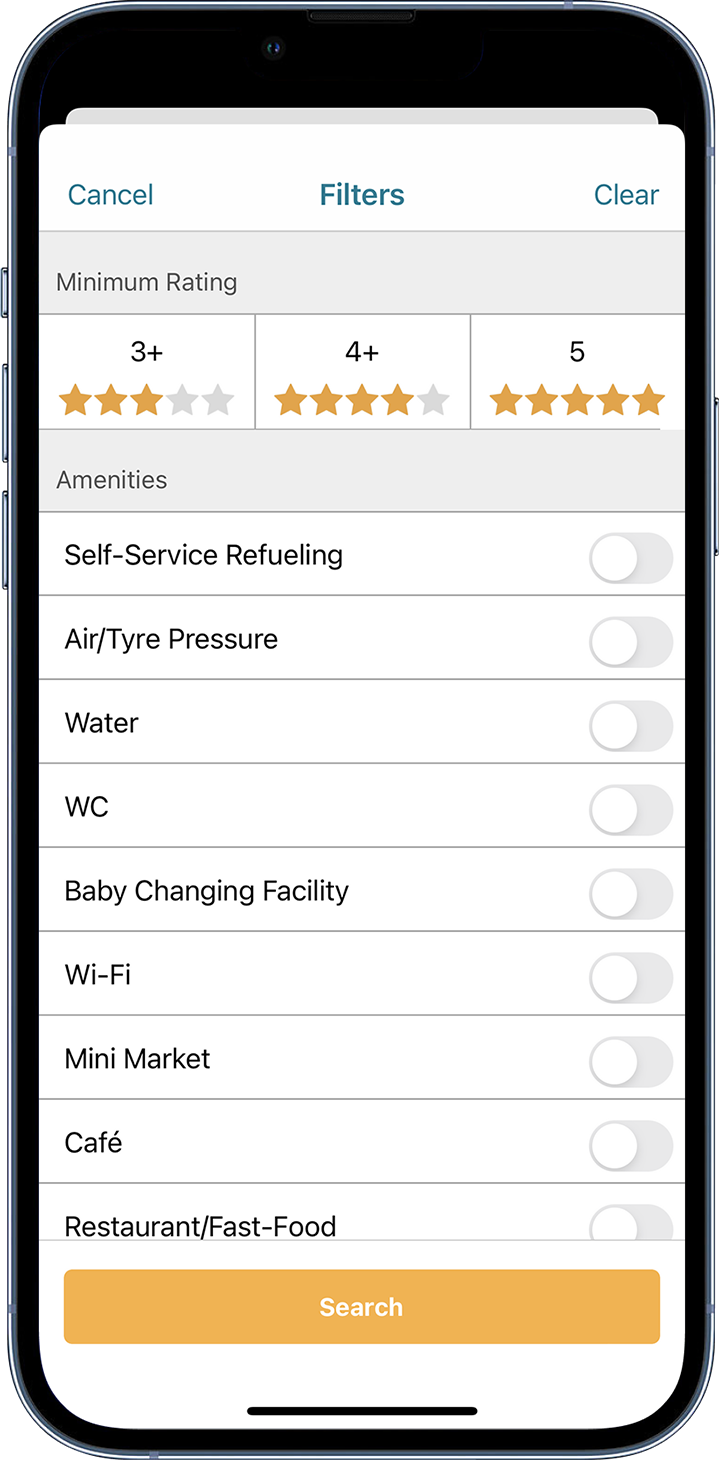

Kaysima Pos Na Eksoikonomisete Xrimata Stin Kypro

May 19, 2025

Kaysima Pos Na Eksoikonomisete Xrimata Stin Kypro

May 19, 2025 -

Poy Na Breite Ta Fthinotera Kaysima Stin Kypro

May 19, 2025

Poy Na Breite Ta Fthinotera Kaysima Stin Kypro

May 19, 2025 -

Odigos Gia Tin Eyresi Fthinon Kaysimon Stin Kypro

May 19, 2025

Odigos Gia Tin Eyresi Fthinon Kaysimon Stin Kypro

May 19, 2025 -

Eyresi Ton Xamiloteron Timon Se Kaysima Stin Kypro

May 19, 2025

Eyresi Ton Xamiloteron Timon Se Kaysima Stin Kypro

May 19, 2025 -

Akrivotera Kai Fthinotera Pratiria Kaysimon Stin Kypro

May 19, 2025

Akrivotera Kai Fthinotera Pratiria Kaysimon Stin Kypro

May 19, 2025