Treasury Official: US Debt Limit Measures Could Expire In August

Table of Contents

Understanding the US Debt Limit and its Implications

The US debt limit is a congressionally mandated cap on the total amount of money the US government can borrow to meet its existing legal obligations. It's not a limit on spending; rather, it's a limit on the government's ability to finance already-authorized spending through borrowing. The process of raising or suspending the debt limit typically involves a vote in both the House of Representatives and the Senate.

Failing to raise or suspend the debt limit before the Treasury exhausts its extraordinary measures could lead to several severe economic consequences:

- Government Shutdown: The federal government may be forced to shut down, halting essential services and impacting millions of Americans.

- Credit Rating Downgrade: A failure to meet debt obligations could result in a downgrade of the US credit rating, increasing borrowing costs for the government and potentially impacting the economy.

- Increased Interest Rates: The uncertainty surrounding the debt ceiling could lead to higher interest rates, making borrowing more expensive for businesses and consumers.

- Market Volatility: The risk of default could trigger significant market volatility, potentially leading to losses for investors and impacting global financial stability.

Treasury Secretary's Warning and the August Deadline

A recent statement from the Treasury Secretary highlighted the increasingly tight timeframe for Congressional action. The Secretary warned that the Treasury Department's extraordinary measures to manage the debt ceiling could be exhausted as early as August, potentially triggering a default. The statement underscored the urgency of the situation and the need for immediate action from Congress.

Several factors contribute to this looming deadline, including the current level of government spending and the ongoing debate surrounding the federal budget. The lack of bipartisan agreement on raising or suspending the debt limit has further exacerbated the urgency of the situation. Congress must act swiftly to avoid a catastrophic economic fallout.

Political Ramifications and Potential Solutions

Raising the debt limit has become highly politicized, with disagreements between the Republican and Democratic parties hindering progress. Republicans often seek to link debt limit increases to spending cuts or policy changes, while Democrats typically advocate for raising the limit without conditions.

Potential solutions include:

- Raising the debt limit without conditions: This would provide immediate relief and prevent a default, but it may not address the underlying concerns about long-term fiscal sustainability.

- Raising the debt limit with spending cuts: This approach would address concerns about fiscal responsibility but requires negotiating a bipartisan agreement on spending cuts, a challenging task given the current political climate.

- Suspending the debt limit temporarily: This buys time for further negotiations but only postpones the need for a long-term solution.

Impact on the US Economy and Global Markets

The potential consequences of exceeding the US debt limit are far-reaching. Domestically, it could lead to reduced economic growth, increased unemployment, and a decline in consumer confidence. Globally, the implications are equally significant. A US default could trigger a global financial crisis, impacting international trade, investment flows, and the stability of global markets. The uncertainty surrounding the debt ceiling is already affecting investor confidence, and a failure to act could further erode trust in the US economy. Mitigating these risks requires decisive action from Congress and careful monitoring of economic indicators.

Monitoring the Situation and Staying Informed

Staying informed about the evolving US debt limit situation is crucial for both investors and citizens. Reliable sources of information include the Congressional Budget Office (CBO), the Treasury Department website, and reputable financial news outlets like the Wall Street Journal, Bloomberg, and Reuters. Following these sources will provide up-to-date insights into the ongoing political negotiations, potential solutions, and the overall economic impact of the debt limit debate.

Acting Now on the US Debt Limit is Crucial

The impending expiration of the US debt limit presents a grave threat to the US economy and global financial stability. Failure to raise or suspend the debt ceiling before the August deadline could trigger a catastrophic fiscal crisis. Congressional action is urgently needed to avert a default and prevent the far-reaching negative consequences that would ensue. Contact your elected officials to express your concerns about the US debt limit and urge them to reach a bipartisan agreement before it's too late. Stay informed about the evolving US debt ceiling crisis, the federal debt limit, and the national debt limit to protect your financial interests and contribute to informed public discourse. The time to act on the US debt limit is now.

Featured Posts

-

Ray Epps V Fox News A Deep Dive Into The Defamation Lawsuit And Jan 6th Allegations

May 10, 2025

Ray Epps V Fox News A Deep Dive Into The Defamation Lawsuit And Jan 6th Allegations

May 10, 2025 -

Hills Shutout Performance Propels Golden Knights To 4 0 Win Against Blue Jackets

May 10, 2025

Hills Shutout Performance Propels Golden Knights To 4 0 Win Against Blue Jackets

May 10, 2025 -

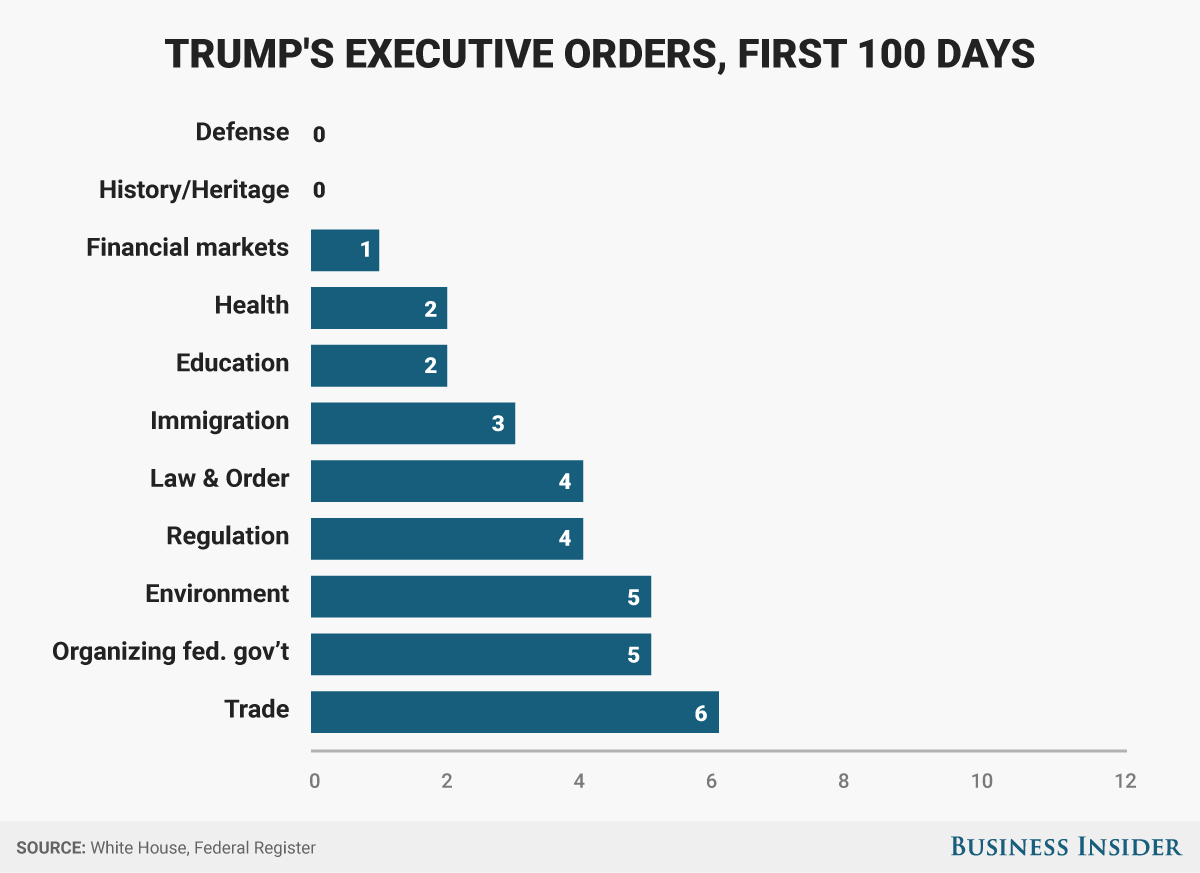

The Impact Of Trumps Executive Orders On The Transgender Population Your Story Matters

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Population Your Story Matters

May 10, 2025 -

Addressing West Hams 25 Million Financial Shortfall

May 10, 2025

Addressing West Hams 25 Million Financial Shortfall

May 10, 2025 -

Trade Disruptions How The Crisis Affects Chinese Exports Like Bubble Blasters

May 10, 2025

Trade Disruptions How The Crisis Affects Chinese Exports Like Bubble Blasters

May 10, 2025

Latest Posts

-

Den Of Thieves 2 Streaming Netflix Availability And Alternatives

May 13, 2025

Den Of Thieves 2 Streaming Netflix Availability And Alternatives

May 13, 2025 -

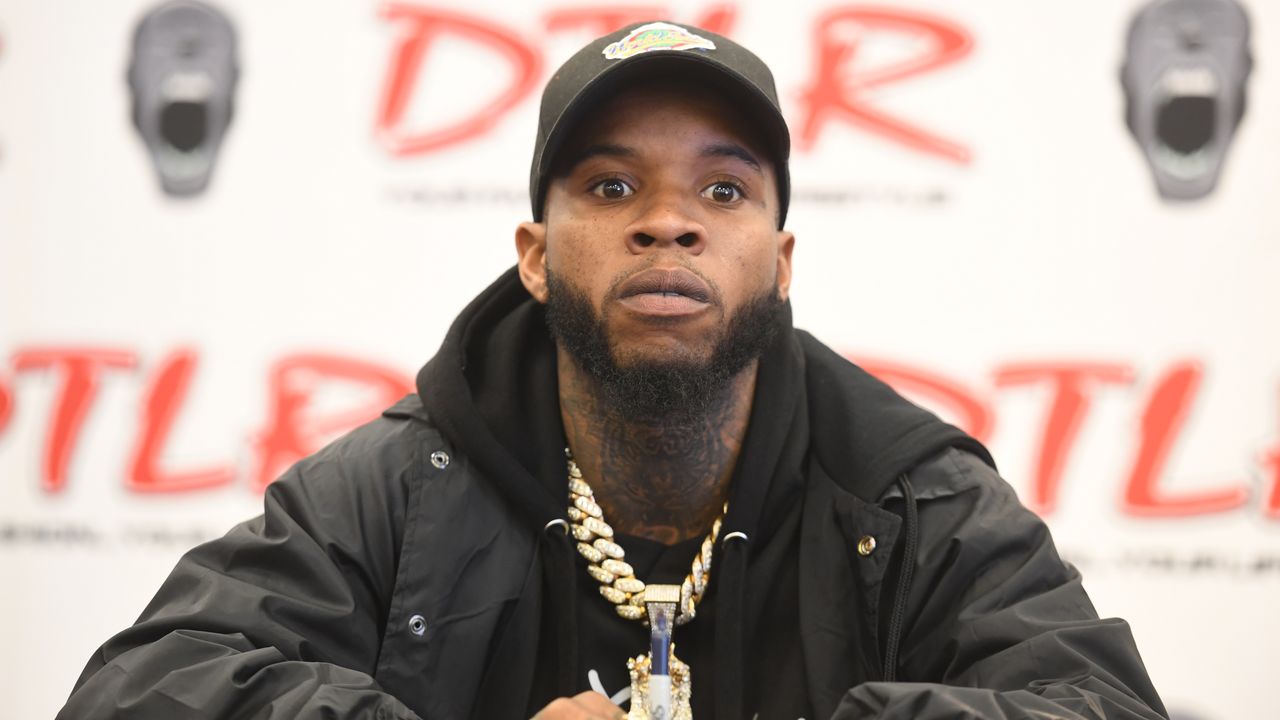

Tory Lanez Prison Stabbing Details Emerge After Cell Raid Controversy

May 13, 2025

Tory Lanez Prison Stabbing Details Emerge After Cell Raid Controversy

May 13, 2025 -

Where To Stream Den Of Thieves 2 Netflix And Other Options

May 13, 2025

Where To Stream Den Of Thieves 2 Netflix And Other Options

May 13, 2025 -

Report Tory Lanez Seriously Injured After Prison Stabbing Incident

May 13, 2025

Report Tory Lanez Seriously Injured After Prison Stabbing Incident

May 13, 2025 -

Courtroom Drama Tory Lanezs Heated Exchange With His Legal Team

May 13, 2025

Courtroom Drama Tory Lanezs Heated Exchange With His Legal Team

May 13, 2025