Tribal Loans For Bad Credit: Guaranteed Approval? A Realistic Look

Table of Contents

What are Tribal Loans?

Tribal loans are offered by lending institutions affiliated with Native American tribes. These lenders often operate online and claim to be exempt from certain state and federal regulations, sometimes leading to higher interest rates and less stringent lending practices than traditional banks or credit unions. The regulatory environment surrounding tribal lending is complex and often unclear, creating a grey area in terms of consumer protection. Understanding this complexity is crucial before considering this type of loan.

- Definition of tribal loans: Loans provided by lenders associated with Native American tribes, often marketed towards individuals with poor credit histories.

- Jurisdictional differences and regulatory grey areas: The legal framework governing tribal lending is intricate, with jurisdictional disputes frequently arising between tribal authorities and state or federal regulators. This often results in inconsistent oversight and protection for borrowers.

- Potential advantages and disadvantages of tribal lenders: While some may advertise faster processing times, the primary disadvantage is the potential for significantly higher interest rates and fees compared to traditional lenders.

- Common misconceptions surrounding tribal loans: Many believe these loans offer guaranteed approval. This is a dangerous misconception. Another misconception is that they are inherently immune to standard lending practices and consumer protection laws.

The "Guaranteed Approval" Myth

The notion of "guaranteed approval" for any loan, including tribal loans for bad credit, is a myth. No legitimate lender can guarantee approval because responsible lending practices require an assessment of the applicant's creditworthiness. Even lenders offering tribal loans will review your application based on factors such as your credit score, income, existing debt, and debt-to-income ratio.

- Why no lender can truly guarantee approval: Lenders are required to assess risk. Approving a loan without assessing this risk would be irresponsible and financially unsustainable for the lender.

- Factors influencing loan approval (credit score, income, debt-to-income ratio): Your credit history and financial stability are key factors in determining your eligibility for a loan, regardless of the lender.

- The role of responsible lending practices: Responsible lenders always evaluate an applicant's ability to repay the loan before approving the application.

- Consequences of applying for multiple loans simultaneously: Applying for numerous loans simultaneously can negatively impact your credit score and reduce your chances of approval for any loan, including tribal loans.

Alternatives to Tribal Loans for Bad Credit

If you're struggling with bad credit, exploring alternatives to tribal loans is crucial. Several options offer potentially more favorable terms and better protect your financial well-being.

- Secured loans (e.g., secured credit cards): These require collateral, reducing the lender's risk and often leading to lower interest rates.

- Unsecured loans (e.g., personal loans from credit unions): Credit unions often offer more competitive interest rates and flexible repayment options than other lenders.

- Debt consolidation loans: Consolidating multiple debts into a single loan can simplify repayment and potentially lower your monthly payments.

- Peer-to-peer lending platforms: These platforms connect borrowers directly with investors, sometimes offering more flexible lending terms.

- Credit counseling services: A credit counselor can help you create a budget, manage your debt, and improve your credit score. [Link to a reputable credit counseling service]

Understanding the Risks of High-Interest Tribal Loans

Tribal loans often come with extremely high annual percentage rates (APRs) and fees, which can quickly lead to a debt trap. It's vital to carefully read all loan terms and conditions before signing any agreement.

- APR and other fees associated with tribal loans: Research APRs carefully; they can be substantially higher than those offered by traditional lenders.

- Potential for debt traps and cycles of borrowing: High interest rates and fees can make repayment difficult, leading to a cycle of borrowing to pay off existing debts.

- The importance of comparing loan offers: Always compare multiple loan offers before making a decision. Don't just focus on the advertised interest rate; consider all fees and terms.

- Tips for avoiding predatory lending practices: Be wary of lenders who pressure you to borrow or who fail to provide clear and transparent information about the loan terms.

Conclusion

Tribal loans for bad credit are not a guaranteed solution. The myth of guaranteed approval needs to be dispelled. While they may seem like a quick fix, the high interest rates and potential for predatory lending practices make them a risky choice. Before applying for tribal loans for bad credit, thoroughly research all available options and choose the solution that best fits your financial situation and long-term goals. Compare interest rates, fees, and repayment terms carefully. Consider alternative financing options for bad credit before seeking high-risk loans. Explore the alternatives outlined above and prioritize responsible borrowing to build a healthier financial future.

Featured Posts

-

Understanding The South Korean Presidential Election Candidates And Key Issues

May 28, 2025

Understanding The South Korean Presidential Election Candidates And Key Issues

May 28, 2025 -

Las Vegas To Host American Music Awards With Jennifer Lopez

May 28, 2025

Las Vegas To Host American Music Awards With Jennifer Lopez

May 28, 2025 -

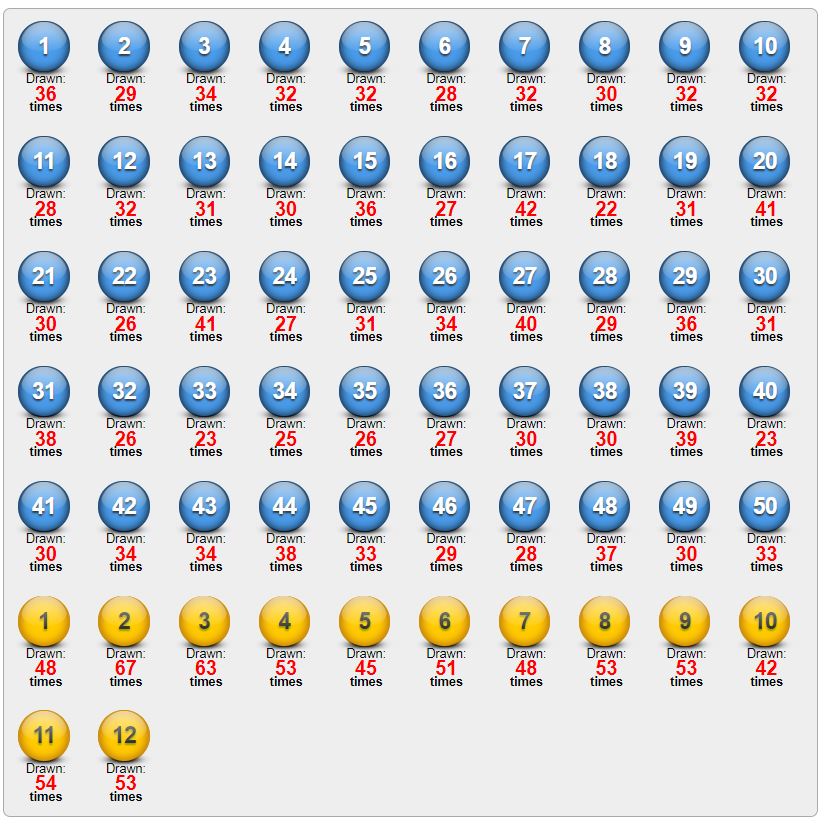

Record E245 Million Euro Millions Jackpot Fridays Draw Live Results

May 28, 2025

Record E245 Million Euro Millions Jackpot Fridays Draw Live Results

May 28, 2025 -

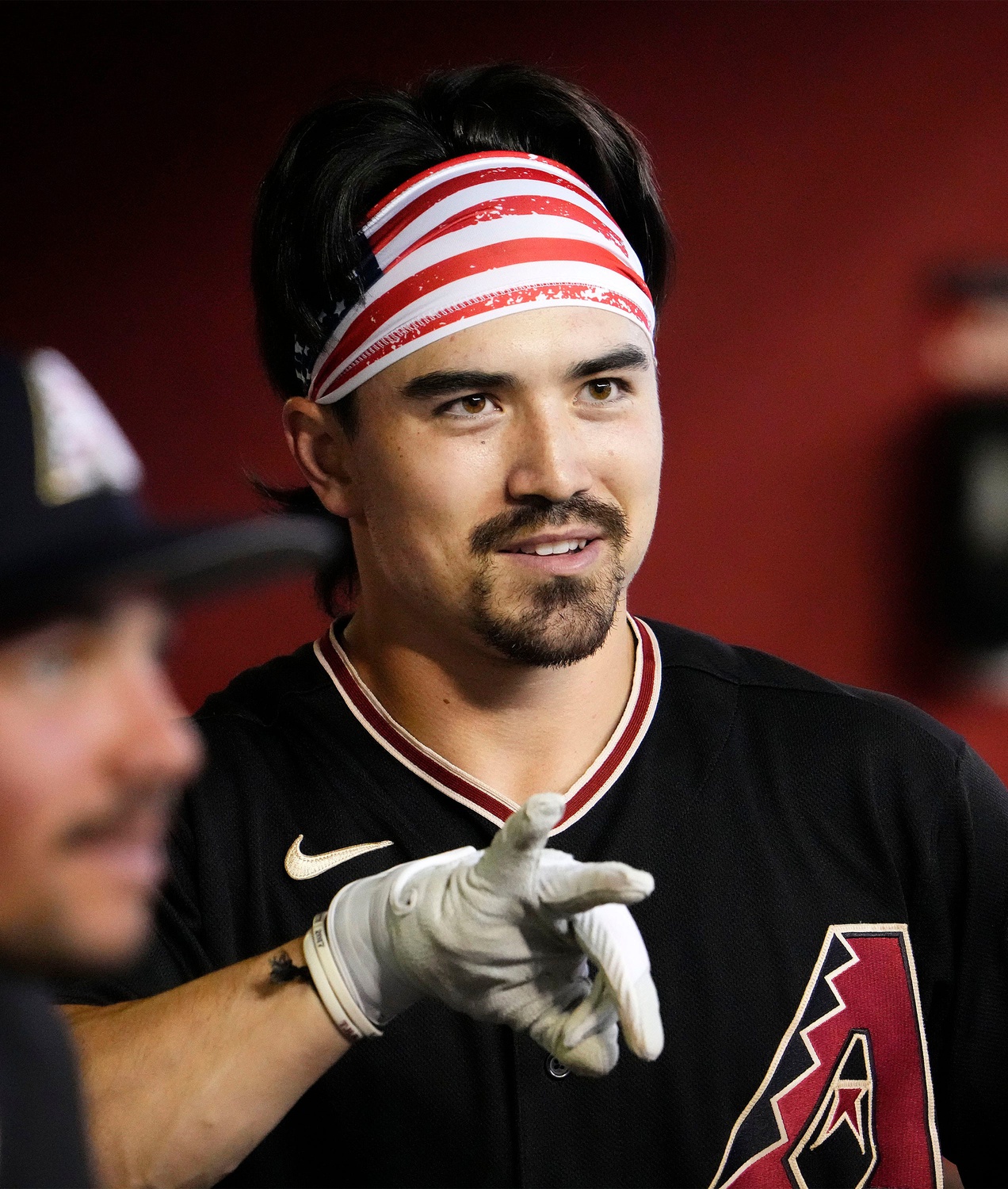

Cubs Vs Diamondbacks Prediction Who Will Win

May 28, 2025

Cubs Vs Diamondbacks Prediction Who Will Win

May 28, 2025 -

Jadwal Terbaru Km Lambelu Nunukan Makassar Juni 2025

May 28, 2025

Jadwal Terbaru Km Lambelu Nunukan Makassar Juni 2025

May 28, 2025

Latest Posts

-

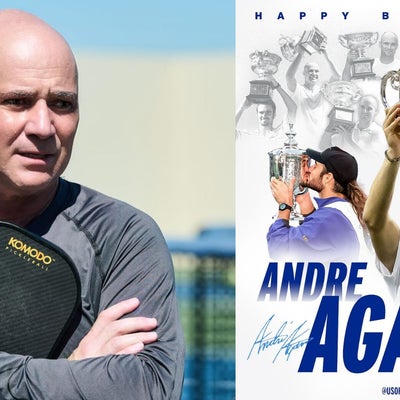

El Regreso De Andre Agassi Mas Alla Del Tenis Profesional

May 30, 2025

El Regreso De Andre Agassi Mas Alla Del Tenis Profesional

May 30, 2025 -

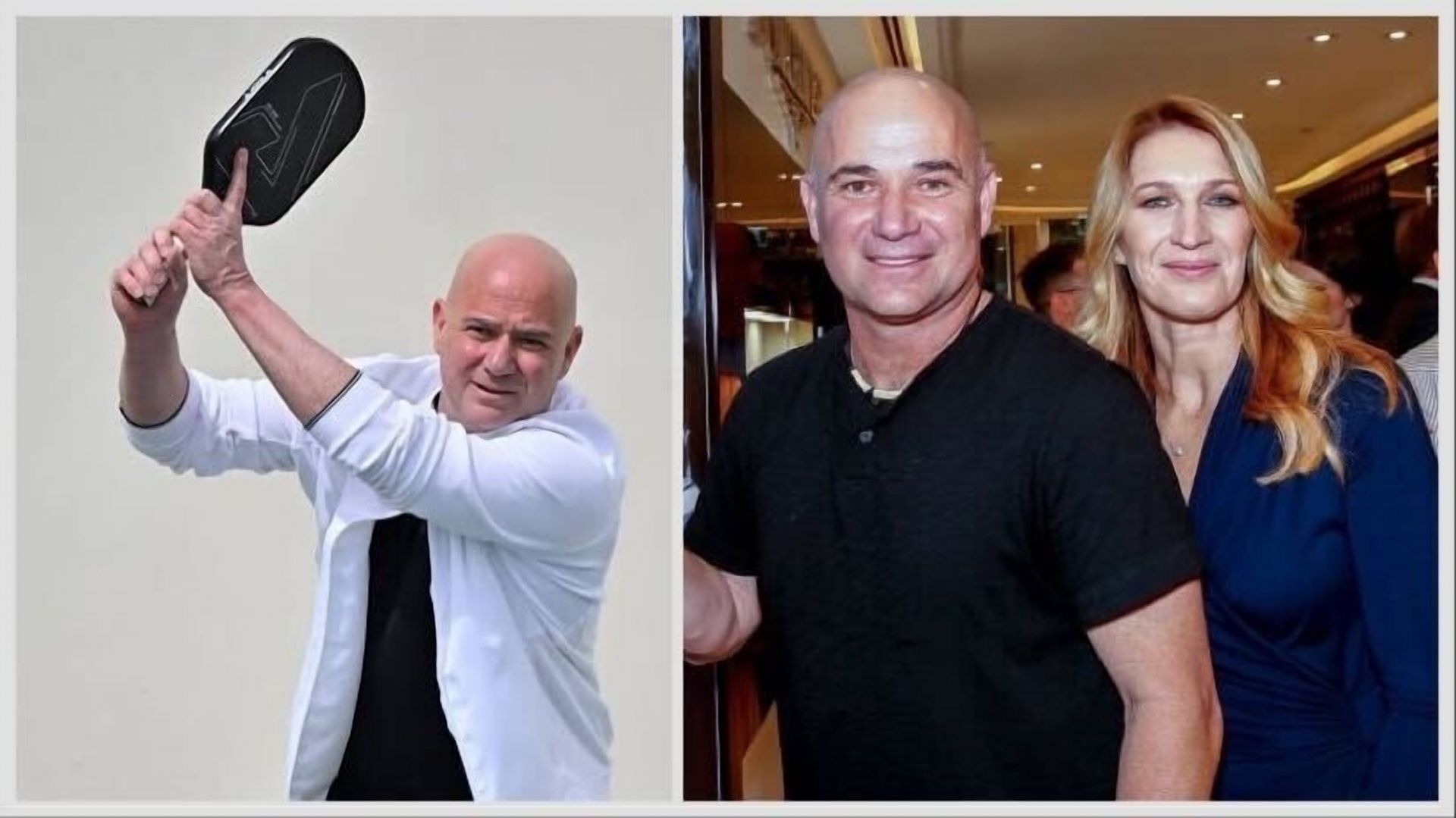

Steffi Graf Und Andre Agassi Enthuellen Ihre Pickleball Formel

May 30, 2025

Steffi Graf Und Andre Agassi Enthuellen Ihre Pickleball Formel

May 30, 2025 -

Andre Agassi Vuelve Al Deporte Su Nueva Cancha De Juego

May 30, 2025

Andre Agassi Vuelve Al Deporte Su Nueva Cancha De Juego

May 30, 2025 -

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Strategien

May 30, 2025

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Strategien

May 30, 2025 -

Andre Agassi Un Regreso Inesperado Lejos De Las Pistas De Tenis

May 30, 2025

Andre Agassi Un Regreso Inesperado Lejos De Las Pistas De Tenis

May 30, 2025