$TRUMP Coin Short Seller Scores White House Dinner

Table of Contents

The $TRUMP Coin Market and its Volatility

The cryptocurrency market is known for its dramatic price swings, and $TRUMP Coin is no exception. Understanding the factors contributing to its price fluctuations is crucial for navigating this volatile landscape.

Understanding $TRUMP Coin's Price Fluctuations

$TRUMP Coin's price is heavily influenced by a range of factors, including:

- Market Sentiment: Positive news surrounding Donald Trump, or even unrelated positive news cycles, can trigger buying sprees, driving the price up. Conversely, negative news or controversies can lead to rapid sell-offs and price crashes.

- News Events: Major political announcements, policy changes, or even social media posts by Trump himself can significantly impact the coin's value. Any news, positive or negative, related to Trump directly affects the coin's price.

- Regulatory Changes: Increased regulatory scrutiny of cryptocurrencies, including potential bans or restrictions, can cause significant price drops. Uncertainty around regulation always creates volatility.

Risks Associated with Investing in $TRUMP Coin:

- High Volatility: The price of $TRUMP Coin can fluctuate dramatically in short periods, leading to substantial losses for investors.

- Market Manipulation: The relatively small market capitalization of some cryptocurrencies makes them susceptible to manipulation by large investors.

- Lack of Regulation: The lack of comprehensive regulation in the cryptocurrency market increases the risk of fraud and scams.

Short Selling $TRUMP Coin:

Short selling involves borrowing and selling a cryptocurrency, hoping to buy it back later at a lower price and profit from the difference. This strategy is particularly attractive during periods of high volatility, like those experienced by $TRUMP Coin. Successful short selling requires accurate predictions of market trends. However, if the price rises unexpectedly, losses can be unlimited.

The Short Seller's Strategy and Success

While the identity of the individual or entity who successfully shorted $TRUMP Coin remains undisclosed for legal and privacy reasons, their strategy highlights the potential, and the peril, of this investment approach.

Identifying the Short Seller

Due to the privacy surrounding cryptocurrency transactions, the identity of the successful $TRUMP Coin short seller remains largely anonymous. However, the sheer scale of the short position suggests a significant player in the cryptocurrency market.

The Timing and Execution of the Short Sell

The timing of the short sale was likely crucial to its success. A period of elevated market sentiment followed by a significant downturn would have provided an ideal window for profit. The exact details of the execution are confidential, but it was likely a carefully planned and executed strategy that took advantage of market conditions and possibly employed sophisticated trading tools and algorithms.

Potential Profits and Risks of Short Selling:

- High Potential Returns: Successful short selling can generate substantial profits, particularly in volatile markets like the cryptocurrency space.

- Unlimited Potential Losses: If the price of the cryptocurrency rises unexpectedly, losses for short sellers can be unlimited.

- Legal and Ethical Considerations: Short selling is a complex financial strategy, and it's subject to various legal and ethical considerations. It's essential to operate within the confines of the law to prevent any legal ramifications.

The White House Dinner Invitation: Coincidence or Connection?

The invitation of a successful $TRUMP Coin short seller to a White House dinner raises eyebrows and prompts questions about possible connections.

The Nature of the Invitation

The specifics of the White House dinner invitation remain unclear. However, the mere fact of such an invitation raises immediate questions about the relationship between financial success in the cryptocurrency market and access to political circles.

Speculation and Theories

The proximity of the successful short sale and the White House dinner invitation fuels speculation, whether founded or not. Several potential connections (and their counterarguments) are being considered:

- Pure Coincidence: The simplest explanation is that the two events are entirely unrelated.

- Indirect Connections: The short seller might have other connections that led to the dinner invitation.

- Ethical Concerns: The situation does raise the ethical question of potential conflicts of interest if there were any prior relationships between the short seller and those involved in the invitation process.

Public Statements and Reactions:

While no official statements have been made addressing the link between the short sale and the dinner invitation, online speculation and media coverage highlight the intrigue and raise further questions.

Conclusion: Unraveling the Mystery of the $TRUMP Coin Short Seller

The story of the $TRUMP Coin short seller who received a White House dinner invitation is a fascinating case study illustrating the volatility of the cryptocurrency market, the potential rewards and substantial risks of short selling, and the often-blurred lines between finance and politics. The entire scenario serves as a reminder of the importance of thorough research, risk management, and ethical considerations in all investment decisions. The key takeaway is the importance of understanding the risks involved in volatile cryptocurrency investments like $TRUMP Coin, as well as the intricacies of advanced trading strategies such as short selling.

Stay informed about the ever-changing world of $TRUMP Coin and other cryptocurrencies by following reputable financial news sources and conducting your own thorough research before making any investment decisions. Remember to always consider the potential risks involved in cryptocurrency trading.

Featured Posts

-

Stranger Things 5 Teaser Trailer Netflix Release Date Speculation

May 29, 2025

Stranger Things 5 Teaser Trailer Netflix Release Date Speculation

May 29, 2025 -

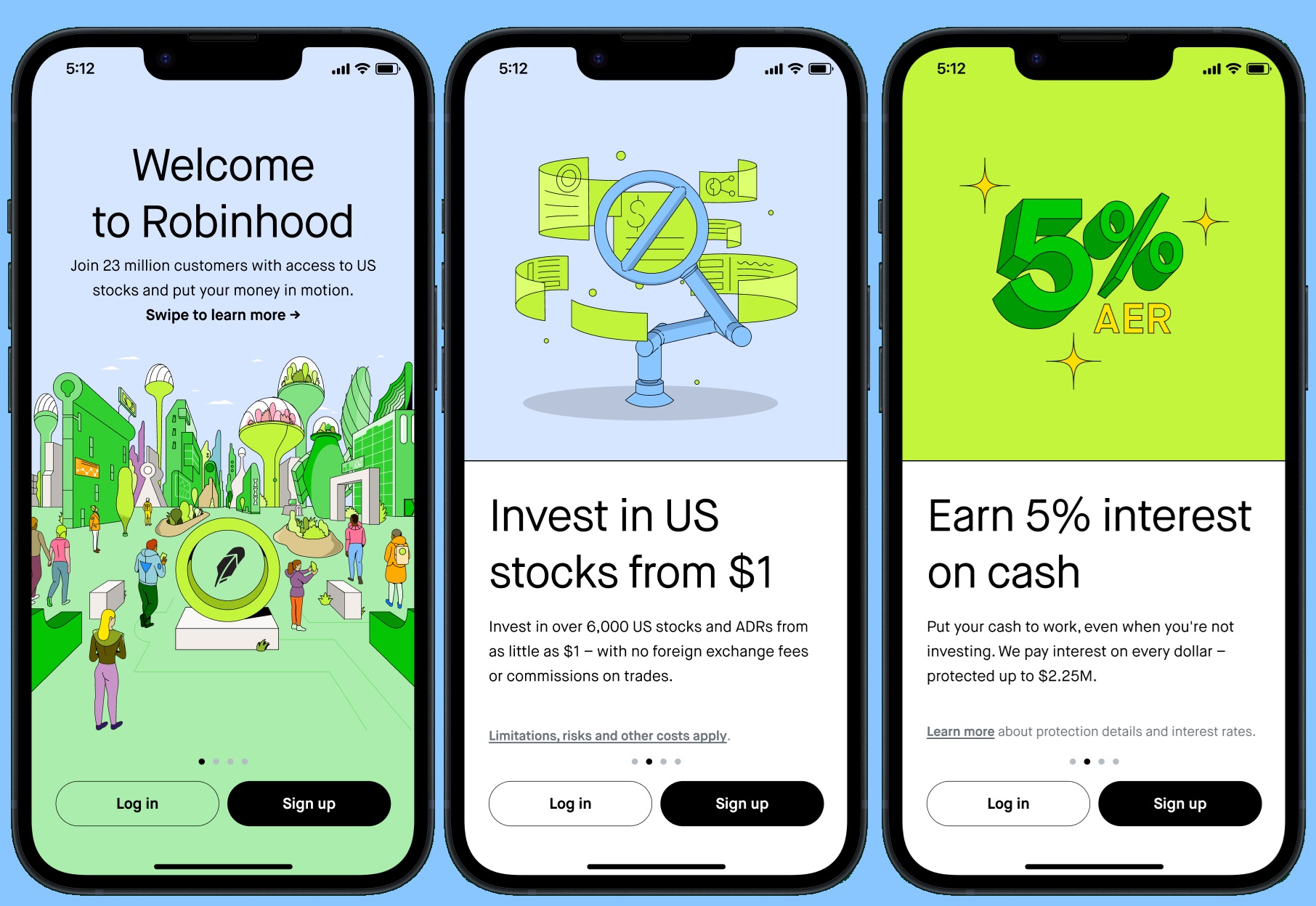

Robinhood Desktop Trading Platform Launches In The Uk

May 29, 2025

Robinhood Desktop Trading Platform Launches In The Uk

May 29, 2025 -

Prakiraan Cuaca Semarang Besok 22 April Hujan Siang Hari Di Jawa Tengah

May 29, 2025

Prakiraan Cuaca Semarang Besok 22 April Hujan Siang Hari Di Jawa Tengah

May 29, 2025 -

Schietpartij Venlo Man Vindt De Dood

May 29, 2025

Schietpartij Venlo Man Vindt De Dood

May 29, 2025 -

Toxic Chemical Fallout Ohio Train Derailments Lingering Impact On Buildings

May 29, 2025

Toxic Chemical Fallout Ohio Train Derailments Lingering Impact On Buildings

May 29, 2025

Latest Posts

-

Experience Banksy A New Immersive Exhibit In Vancouver

May 31, 2025

Experience Banksy A New Immersive Exhibit In Vancouver

May 31, 2025 -

Rare Banksy Collection Six Screenprints Plus A Hand Crafted Tool

May 31, 2025

Rare Banksy Collection Six Screenprints Plus A Hand Crafted Tool

May 31, 2025 -

Auction Listing Banksys Broken Heart Wall

May 31, 2025

Auction Listing Banksys Broken Heart Wall

May 31, 2025 -

Review The Immersive Banksy Experience In Vancouver

May 31, 2025

Review The Immersive Banksy Experience In Vancouver

May 31, 2025 -

Own A Piece Of Banksy History Six Screenprints And A Unique Tool

May 31, 2025

Own A Piece Of Banksy History Six Screenprints And A Unique Tool

May 31, 2025