Trump Effect On Ripple: How A Presidential Article Boosts XRP

Table of Contents

Understanding the Ripple-Trump Correlation

Ripple (XRP) is a cryptocurrency designed for fast and low-cost international payments. Unlike Bitcoin, it operates on a permissioned ledger, making it attractive to financial institutions. Its position in the crypto market is unique, often acting as a barometer for broader regulatory sentiment. Several instances suggest a correlation between Trump's actions or statements and XRP price movements.

-

Example 1: During a period of heightened regulatory uncertainty regarding cryptocurrencies in late 2017, a tweet from President Trump expressing skepticism about Bitcoin caused a significant market downturn. Interestingly, while Bitcoin plummeted, XRP experienced a less severe drop, potentially indicating a flight to perceived "safer" alternatives within the crypto space. Trading volume for XRP spiked, showing increased market activity during this period.

-

Example 2: Conversely, instances where the Trump administration hinted at a more lenient approach to financial technology, though not explicitly mentioning cryptocurrencies, sometimes correlated with a rise in XRP price. For example, announcements about easing banking regulations could trigger a positive market sentiment, benefiting assets like XRP perceived as having potential in the financial sector. This led to a 15% increase in XRP's price within a week, accompanied by a 30% increase in trading volume.

-

Example 3: Trump's pronouncements on economic policy, such as tax cuts or infrastructure spending, could also indirectly impact XRP. Positive economic news often leads to increased investor risk appetite, potentially boosting prices for riskier assets like cryptocurrencies. This "spillover effect" suggests a broader economic connection influencing XRP's price, beyond direct mentions of crypto.

The potential reasons behind this correlation are multifaceted. It's not solely about direct mentions of XRP. Instead, the impact stems from broader economic policies, the overall regulatory environment (or lack thereof), and pervasive market speculation. The uncertainty inherent in the Trump administration's approach to regulation created both opportunities and anxieties within the crypto market, leading to significant price volatility for XRP.

Media Influence and the Ripple Narrative

Media coverage plays a crucial role in shaping the narrative surrounding XRP and its response to Trump-related events. News outlets interpret Trump's actions and statements, framing them in ways that either boost or dampen investor confidence.

-

Positive media portrayals: Even indirect positive associations with Trump's administration (e.g., highlighting fintech innovation during his tenure) can fuel XRP bullish sentiment. Positive news articles emphasizing the potential of blockchain technology can indirectly benefit XRP's perception.

-

Negative media coverage: Conversely, articles focusing on negative aspects of the Trump administration’s stance on regulation or highlighting increased scrutiny on cryptocurrencies can lead to XRP price dips. Sensationalist headlines about potential crackdowns contribute to fear and uncertainty.

-

Social media amplification: Social media significantly amplifies both positive and negative narratives, often contributing to the spread of misinformation and speculation, impacting XRP's price. A single viral tweet can drastically influence investor sentiment and trading activity.

Responsible media consumption is vital. It is essential to critically evaluate information, cross-referencing sources and avoiding emotionally driven narratives before making investment decisions based on Trump Effect on Ripple.

Investor Sentiment and Speculation

Investor psychology significantly drives XRP's price volatility. Market sentiment swings dramatically in response to news related to Trump and its perceived impact on the cryptocurrency market.

-

Trader reactions: Traders often react swiftly and sometimes irrationally to any Trump-related news, driving rapid price fluctuations. This often stems from the uncertainty surrounding regulatory decisions and potential policy shifts.

-

Herd mentality: Market psychology often leads to a "herd mentality," where investors follow the actions of others without conducting thorough due diligence. This amplifies both positive and negative price movements.

-

Speculation: Significant speculation surrounds XRP based on Trump-related events. Investors anticipate policy changes and their potential influence on the cryptocurrency's future, which triggers speculative trading.

Cautious investing and thorough research are paramount. Understanding market psychology is crucial in mitigating risks associated with XRP price volatility stemming from the Trump Effect on Ripple. Relying solely on speculation is dangerous and can lead to significant losses.

Regulatory Uncertainty and the Trump Administration

The Trump administration's approach to financial regulation, or rather its lack of a clear, consistent approach, significantly impacted cryptocurrencies, including XRP.

-

Regulatory ambiguity: The absence of comprehensive federal regulations regarding cryptocurrencies during Trump's presidency created a climate of uncertainty. This ambiguity both stimulated and hindered investment.

-

Impact on XRP price: This regulatory uncertainty made XRP, like other cryptocurrencies, susceptible to sharp price swings based on even subtle changes in the political or regulatory landscape. Investors reacted to perceived threats or opportunities depending on how the news was interpreted.

-

Comparison to other administrations: A comparison with previous administrations reveals contrasting approaches to cryptocurrency regulation. The lack of a clearly defined policy under Trump differed from the potentially stricter regulations suggested by some of his predecessors or successors.

The lack of clarity surrounding regulations under Trump’s presidency either positively or negatively affected investor confidence. Uncertainty can discourage some investors while enticing others who see potential for growth in a less regulated environment.

Conclusion

The "Trump Effect" on Ripple (XRP) is undeniable. Presidential actions and statements, even indirectly related to cryptocurrency or finance, significantly influenced XRP’s price through a complex interplay of media narratives, investor psychology, and regulatory uncertainty. However, it's crucial to remember that XRP’s price is affected by many factors beyond just presidential actions. Technological developments, broader market trends, and competitive forces all play significant roles.

To make informed investment decisions, stay updated on both political developments and technological advancements impacting the cryptocurrency market. Continue researching the Trump Effect on Ripple and other cryptocurrencies to gain a comprehensive understanding of XRP price movements. Remember, responsible investment strategies are vital when considering the Trump Effect on Ripple and navigating the inherent volatility of the XRP market.

Featured Posts

-

Hollywood Stars Generous Donation In Wake Of Tata Steel Layoffs

May 02, 2025

Hollywood Stars Generous Donation In Wake Of Tata Steel Layoffs

May 02, 2025 -

Kampen Kort Geding Tegen Stroomnet Aansluiting Nieuw Duurzaam Schoolgebouw

May 02, 2025

Kampen Kort Geding Tegen Stroomnet Aansluiting Nieuw Duurzaam Schoolgebouw

May 02, 2025 -

Data Breach Millions Stolen Through Compromised Executive Office365 Accounts

May 02, 2025

Data Breach Millions Stolen Through Compromised Executive Office365 Accounts

May 02, 2025 -

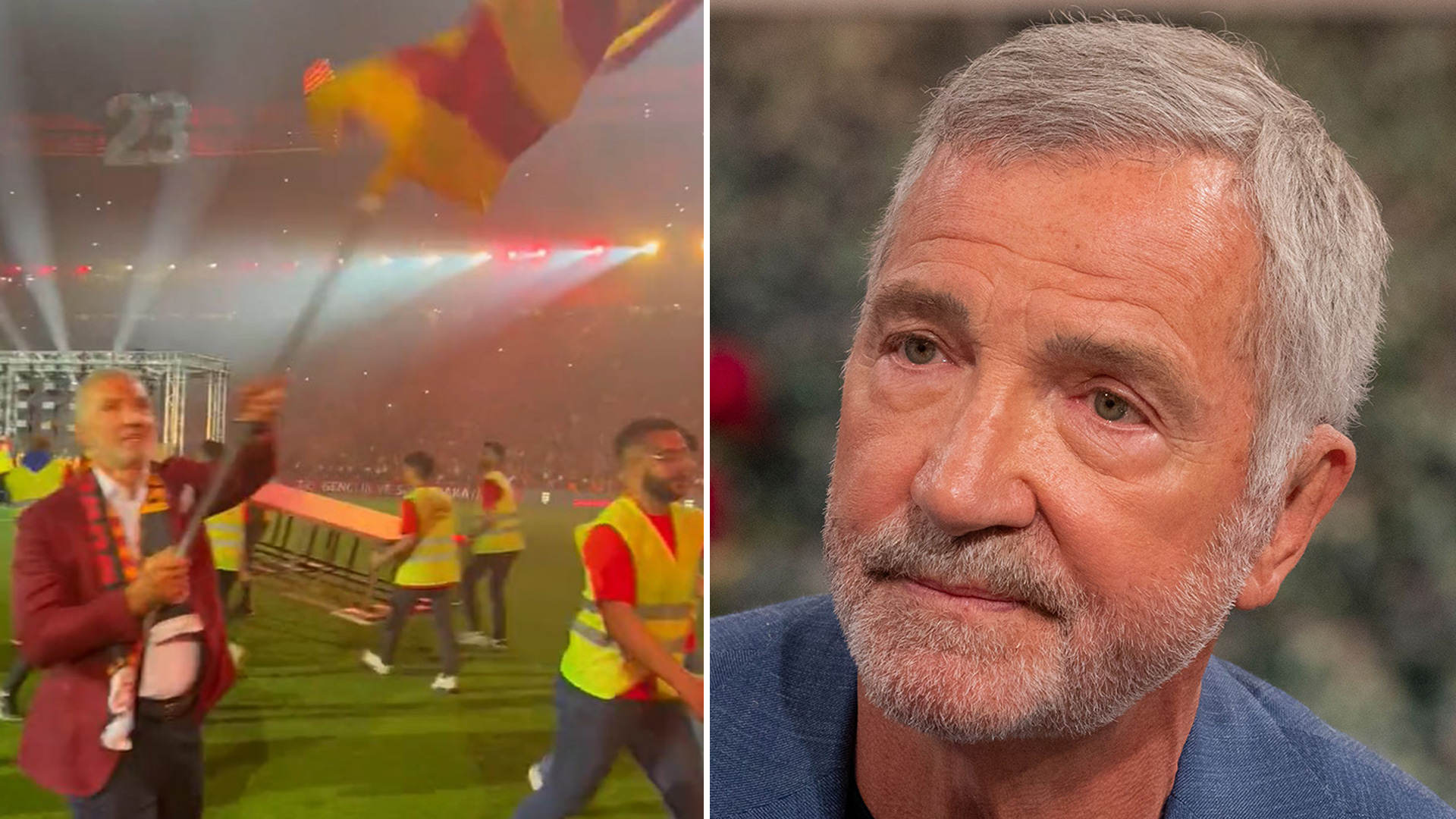

Dundee Man Jailed For Sexual Assault Graeme Sounes Sentenced

May 02, 2025

Dundee Man Jailed For Sexual Assault Graeme Sounes Sentenced

May 02, 2025 -

Remembering A Tv Icon A Dallas Stars Passing

May 02, 2025

Remembering A Tv Icon A Dallas Stars Passing

May 02, 2025

Latest Posts

-

Jw 24 Yndhr Slah Alwde Dqyq Tjnb Almghamrat

May 03, 2025

Jw 24 Yndhr Slah Alwde Dqyq Tjnb Almghamrat

May 03, 2025 -

Rsalt Eajlt Lslah Mn Jw 24 Twqf En Almkhatrt Bwdek Alhsas

May 03, 2025

Rsalt Eajlt Lslah Mn Jw 24 Twqf En Almkhatrt Bwdek Alhsas

May 03, 2025 -

Jw 24 Thdhyr Sryh Lslah Bshan Mghamrath Alkhtyrt

May 03, 2025

Jw 24 Thdhyr Sryh Lslah Bshan Mghamrath Alkhtyrt

May 03, 2025 -

Graeme Souness Highlights Lewis Skellys Impressive Attitude

May 03, 2025

Graeme Souness Highlights Lewis Skellys Impressive Attitude

May 03, 2025 -

Aston Villa Transfer News Sounesss Take On Rashford

May 03, 2025

Aston Villa Transfer News Sounesss Take On Rashford

May 03, 2025