Trump Tariff Impact: Winners And Losers In The US Manufacturing Sector.

Table of Contents

Winners: Sectors Benefiting from Increased Domestic Demand and Protection

The tariffs, in some instances, acted as a protective shield for certain US manufacturing sectors, leading to increased domestic demand and production.

The Steel and Aluminum Industries:

The steel and aluminum industries were primary beneficiaries of the Trump tariffs. These tariffs imposed significant duties on imported steel and aluminum, making foreign competitors less price-competitive.

- Increased Domestic Production: The tariffs led to a surge in domestic steel and aluminum production as US manufacturers gained a larger share of the market. While precise figures are debated, anecdotal evidence and industry reports suggest a noticeable increase in output.

- Employment Growth: The increased production resulted in job creation within these sectors, although the extent of this growth is a subject of ongoing discussion among economists. Some studies point to a modest increase in employment, while others argue the impact was minimal.

- Government Support: Government initiatives, in addition to the tariffs, aimed to support these industries, including investment in infrastructure and research and development.

- Downsides: The higher prices for steel and aluminum, however, negatively impacted downstream industries that relied on these materials as inputs, leading to increased production costs for manufacturers of automobiles, construction materials, and other goods.

Specific Manufacturing Sub-sectors:

While steel and aluminum were the most prominent examples, other manufacturing sub-sectors experienced positive effects, albeit to a lesser degree. Some smaller-scale manufacturers of components used in construction and other industries benefited from reduced competition from imported goods. Further research is required to identify and fully analyze these specific sub-sectors and their responses to the tariff regime. It's important to note that success stories were often linked to factors beyond just the tariffs, including skilled labor, access to raw materials, and government incentives.

Losers: Sectors Harmed by Increased Input Costs and Reduced Exports

Conversely, many US manufacturing sectors suffered significantly under the weight of the Trump tariffs. Increased input costs and retaliatory tariffs from other countries severely hampered their competitiveness.

Industries Relying on Imported Inputs:

Numerous industries rely heavily on imported materials for their production processes. The tariffs significantly increased their input costs, rendering them less competitive in both domestic and international markets.

- Automotive Industry: Automakers faced increased costs for steel and aluminum, impacting their profitability and competitiveness. This resulted in some cases, in reduced production and potential job losses.

- Construction Industry: The construction sector, reliant on imported steel and other materials, experienced higher costs, potentially delaying or canceling projects.

- Job Losses and Plant Closures: While precise figures remain debated, many analysts link job losses and plant closures in several sectors to the increased input costs driven by the tariffs.

Export-Oriented Manufacturers:

Retaliatory tariffs imposed by other countries on US goods significantly impacted export-oriented manufacturers.

- Reduced Sales and Profitability: US companies that export products globally faced reduced sales and profitability due to these retaliatory measures. This impacted various sectors, including agriculture and technology.

- Trade Deficit: The overall impact contributed to a widening trade deficit, as US exports declined while imports continued. The long-term implications of this remain a subject of economic debate.

The Long-Term Economic Consequences: Assessing the Net Impact on US Manufacturing

The long-term economic consequences of the Trump tariffs on US manufacturing are complex and multifaceted.

Inflationary Pressures:

The increased costs of imported goods led to inflationary pressures across the economy, impacting consumers and businesses alike.

Supply Chain Disruptions:

The tariffs disrupted global supply chains, forcing companies to seek alternative sources of materials, which often proved costly and inefficient.

Global Trade Relations:

The Trump tariffs strained relationships with key trading partners, impacting international cooperation and potentially hindering future economic growth.

A balanced analysis suggests that while some sectors experienced short-term benefits, the overall long-term economic effects likely outweighed the positive outcomes. The increased input costs, reduced exports, and damaged global trade relationships likely resulted in a net negative impact on US manufacturing and the broader economy.

Conclusion: Navigating the Complex Landscape of Tariff Impact on US Manufacturing

The Trump tariffs created a complex situation for US manufacturing, with clear winners and losers. While some industries benefitted from increased domestic demand and protection, many others suffered from higher input costs and reduced export opportunities. The long-term economic consequences, encompassing inflationary pressures, supply chain disruptions, and strained global trade relations, suggest a net negative impact. To fully grasp the continuing ramifications, further research into the Trump tariff impact on US manufacturing, including detailed analyses of specific industries and their responses, is crucial. We encourage readers to explore further resources and studies to gain a comprehensive understanding of this multifaceted issue.

Featured Posts

-

A Worthy Sequel Does It Live Up To The Originals Legacy

May 06, 2025

A Worthy Sequel Does It Live Up To The Originals Legacy

May 06, 2025 -

Watch Gypsy Rose Life After Lockup Season 2 A Complete Guide

May 06, 2025

Watch Gypsy Rose Life After Lockup Season 2 A Complete Guide

May 06, 2025 -

Rihannas Parisian Glam Fenty Beauty Event And Fan Encounter

May 06, 2025

Rihannas Parisian Glam Fenty Beauty Event And Fan Encounter

May 06, 2025 -

Democratic Party Rift Tensions Flare Over Veteran Lawmakers

May 06, 2025

Democratic Party Rift Tensions Flare Over Veteran Lawmakers

May 06, 2025 -

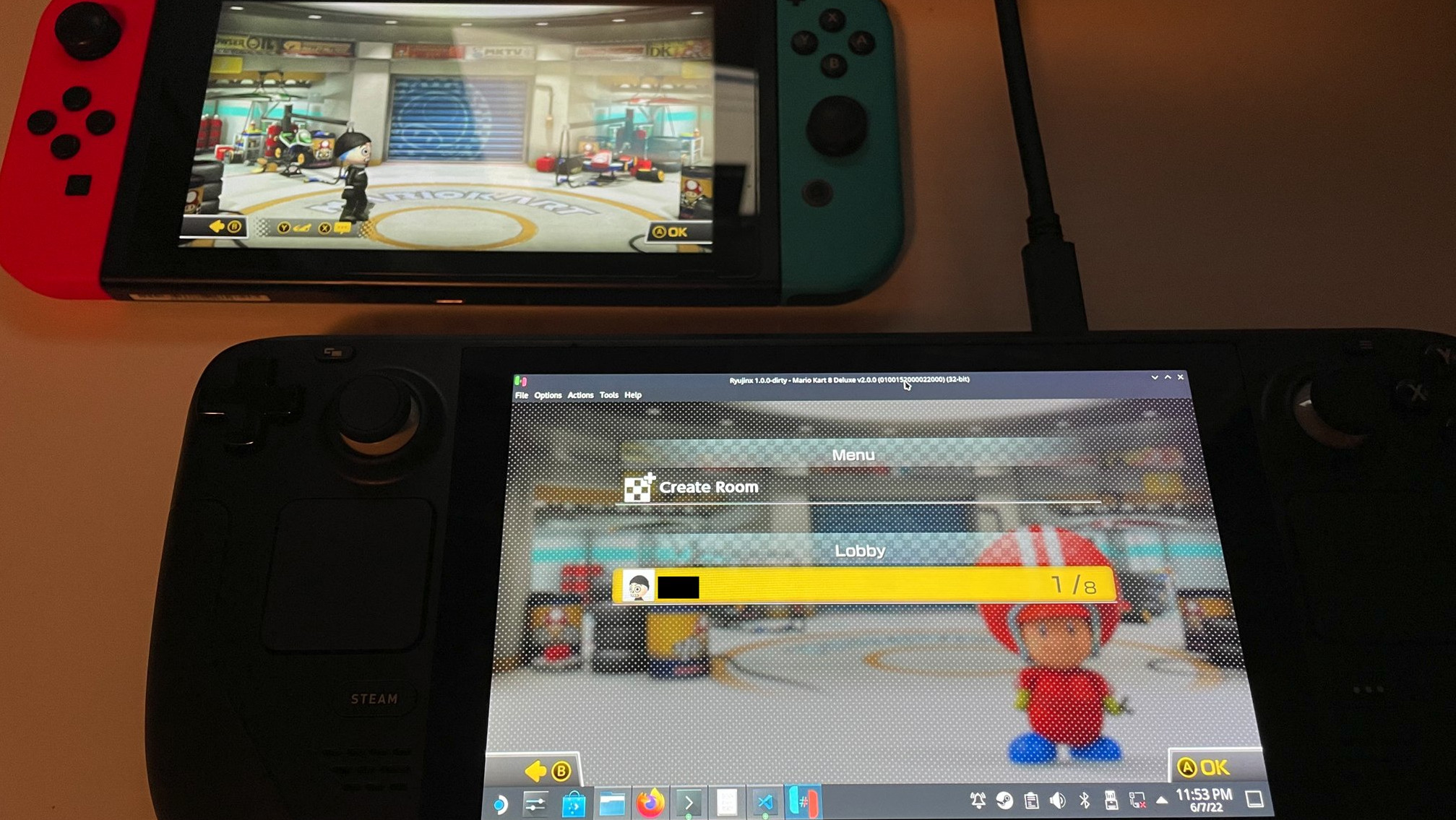

The Future Of Ryujinx After Nintendos Intervention

May 06, 2025

The Future Of Ryujinx After Nintendos Intervention

May 06, 2025