Trump Tariffs Devastate Billionaire Net Worth: Buffett, Bezos Among Losers

Table of Contents

The Mechanism of Tariff Impact on Billionaire Wealth

Trump's tariffs, designed to protect domestic industries, worked by increasing the cost of imported goods. This seemingly simple mechanism had far-reaching consequences, impacting businesses and supply chains across the globe. The increased import costs were not absorbed by businesses alone; instead, they were largely passed on to consumers in the form of higher prices. This resulted in decreased consumer demand, creating a ripple effect that negatively impacted businesses invested in the affected sectors.

Specifically, this mechanism played out in several ways:

- Increased input costs for manufacturing: Many US manufacturers rely on imported raw materials and components. Tariffs made these inputs significantly more expensive, eating into profit margins and forcing some companies to raise prices or reduce production.

- Reduced consumer spending due to higher prices: Higher prices for imported goods and domestically produced goods using imported components led to reduced consumer spending. This decrease in demand further hurt businesses and impacted company valuations.

- Disrupted global supply chains leading to production delays: Tariffs complicated established global supply chains, causing delays and disruptions that impacted production schedules and overall efficiency. This uncertainty further destabilized markets and reduced profitability.

- Decreased profits for companies invested in affected sectors: The combined effects of increased costs, reduced demand, and supply chain disruptions led to decreased profits for companies invested in sectors heavily reliant on imports or competing with imported goods. This directly translated into lower valuations for the companies owned by billionaires with substantial holdings in these sectors.

Specific Billionaire Impacts

Several billionaires experienced significant losses due to the impact of the tariffs. Let's look at a couple of high-profile examples:

Warren Buffett and Berkshire Hathaway

Berkshire Hathaway, Warren Buffett's investment conglomerate, holds significant stakes in various sectors, including manufacturing and retail, which were directly affected by the tariffs. While precise figures quantifying the losses are difficult to isolate, the impact was undoubtedly substantial. Increased costs for raw materials and reduced consumer demand significantly affected the profitability of several Berkshire Hathaway subsidiaries.

- Examples of specific Berkshire Hathaway companies negatively impacted by tariffs: This impact varied widely across Berkshire's diverse portfolio, but companies heavily reliant on imported goods or involved in manufacturing sectors targeted by tariffs likely faced the greatest challenges.

- Public statements by Buffett regarding the tariffs: While Buffett has rarely commented directly on the specific financial impact of tariffs on Berkshire Hathaway, his general stance on free trade suggests that he likely viewed the tariffs negatively.

Jeff Bezos and Amazon

Amazon, headed by Jeff Bezos, experienced a multifaceted impact from the tariffs. The increased costs of imported goods directly affected Amazon's retail business, impacting profitability on numerous products. Furthermore, tariffs likely added complexity and cost to Amazon's extensive global logistics network.

- Effect on Amazon's retail sales and AWS: While Amazon's cloud computing business (AWS) was less directly impacted, the overall economic slowdown caused by the tariffs may have indirectly affected its growth.

- Amazon's response to the tariffs: Amazon, like other large retailers, likely absorbed some costs, while others were passed on to consumers through higher prices.

Other Notable Billionaire Losses

Other billionaires with substantial investments in sectors significantly impacted by the tariffs likely experienced considerable losses. While quantifying these losses precisely is challenging without detailed financial breakdowns, the impact was felt across many portfolios. Further research into individual investment portfolios is needed to fully assess the complete impact.

The Broader Economic Consequences of the Tariffs

Beyond the impact on billionaire net worth, Trump's tariffs had broader negative consequences for the US economy. The trade war initiated by these tariffs triggered retaliatory tariffs from other countries, escalating the damage.

- Increased inflation rates: The tariffs directly contributed to higher prices for consumers, leading to increased inflation.

- Retaliatory tariffs from other countries: Other countries responded with their own tariffs, harming US exporters and negatively affecting various industries.

- Negative impact on US competitiveness: The tariffs reduced US competitiveness in global markets, hindering economic growth.

- Trade war implications: The tariffs escalated trade tensions, damaging international relationships and potentially harming long-term economic growth.

Conclusion

Trump's tariffs significantly impacted the net worth of prominent billionaires like Buffett and Bezos. The increased costs of imported goods, decreased consumer demand, and disrupted supply chains all contributed to these losses. The wider economic repercussions, including increased inflation, retaliatory tariffs, and decreased competitiveness, highlight the far-reaching negative effects of these trade policies. We reiterated that the considerable financial losses experienced by these billionaires were a direct consequence of the implemented tariffs.

Were Trump's tariffs ultimately beneficial or detrimental to the overall US economy? Further investigate the lasting impact of these trade policies and their ripple effect on global trade.

Featured Posts

-

Ashhr Almdkhnyn Fy Tarykh Krt Alqdm Hqayq Warqam

May 10, 2025

Ashhr Almdkhnyn Fy Tarykh Krt Alqdm Hqayq Warqam

May 10, 2025 -

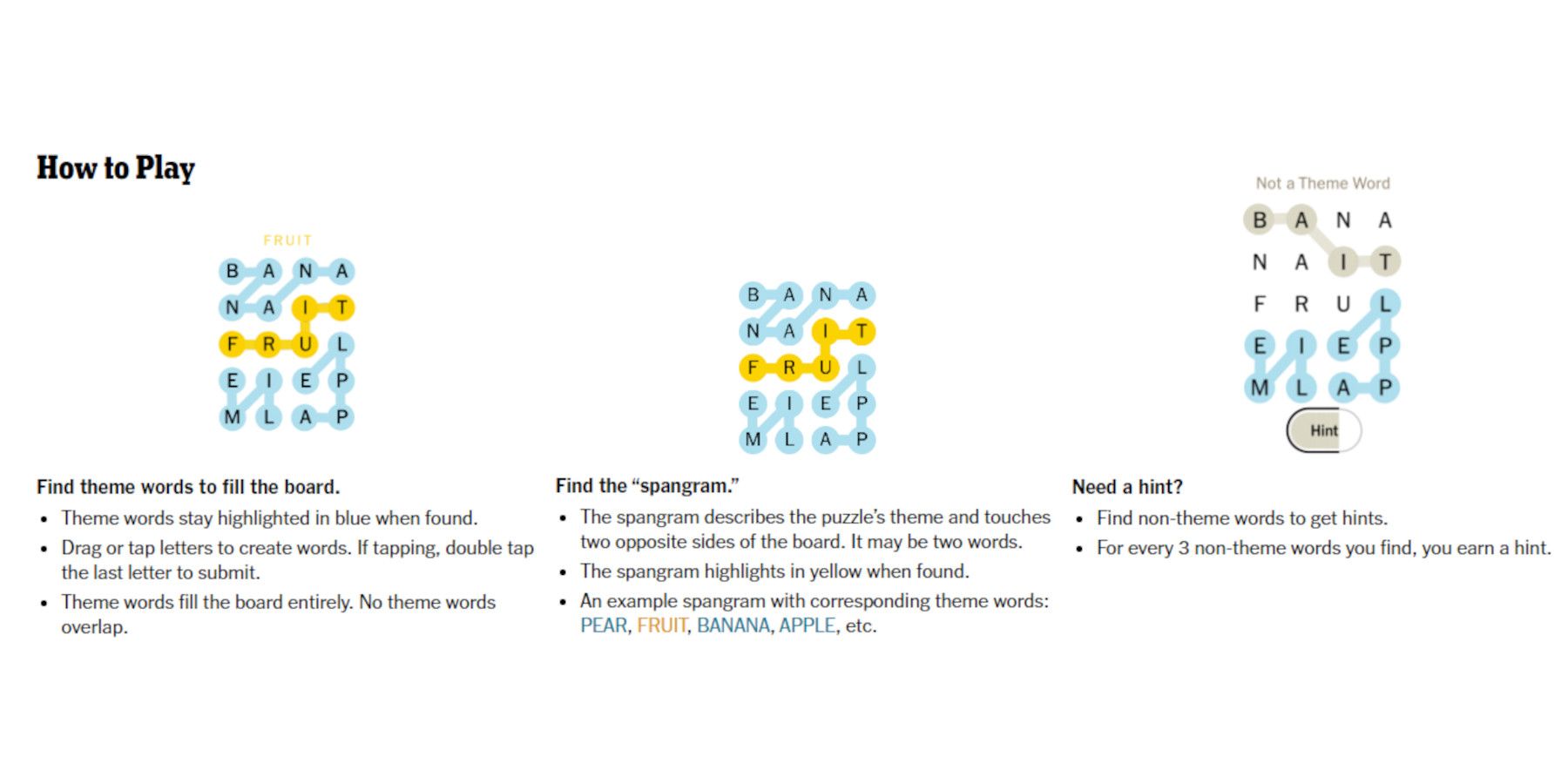

Solving The New York Times Crossword Strands Puzzle April 12 2025

May 10, 2025

Solving The New York Times Crossword Strands Puzzle April 12 2025

May 10, 2025 -

From Wolves Reject To European Champion His Rise To The Top

May 10, 2025

From Wolves Reject To European Champion His Rise To The Top

May 10, 2025 -

Uk Imposes Stricter Visa Regulations Impact On Certain Nationalities

May 10, 2025

Uk Imposes Stricter Visa Regulations Impact On Certain Nationalities

May 10, 2025 -

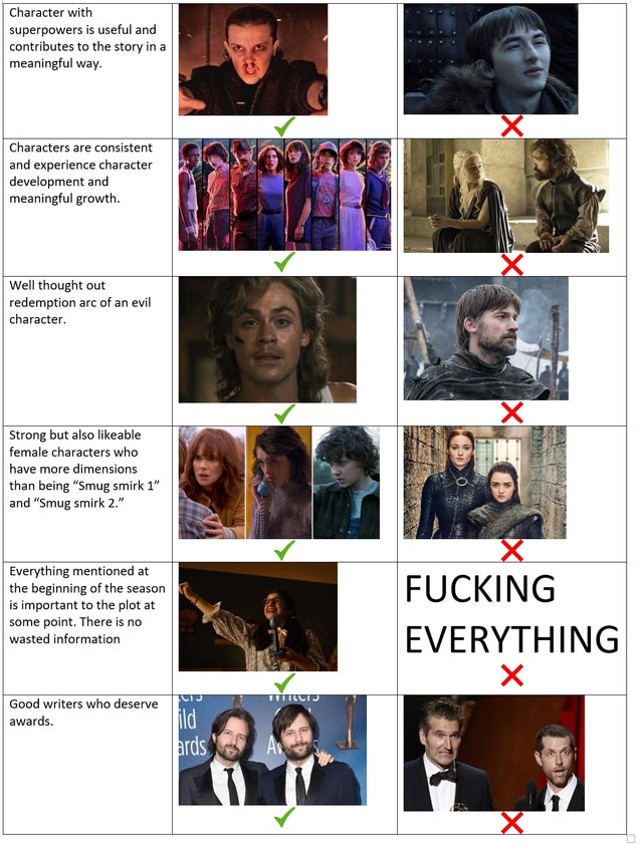

Stranger Things Vs It Stephen King Weighs In

May 10, 2025

Stranger Things Vs It Stephen King Weighs In

May 10, 2025