Trump Tariffs: Did They Kill The Affirm (AFRM) IPO? A Detailed Analysis

Table of Contents

The Impact of Trump Tariffs on the US Economy

The Trump administration's tariffs, implemented as part of its "America First" trade policy, had a multifaceted impact on the US economy, creating ripples that extended far beyond specific industries. These effects significantly influenced investor sentiment and market conditions surrounding the Affirm IPO.

Increased Inflation and Consumer Spending

Tariffs, essentially taxes on imported goods, led to increased prices for consumers. This increase in the cost of imported goods directly fueled inflation. The Consumer Price Index (CPI) saw a noticeable uptick during periods of high tariff implementation. This inflation eroded consumer purchasing power, impacting discretionary spending – the very lifeblood of Affirm's Buy Now, Pay Later (BNPL) business model.

- Examples of specific goods affected: Steel, aluminum, and various consumer electronics experienced price increases due to tariffs.

- Impact on consumer purchasing power: Reduced disposable income led consumers to cut back on non-essential purchases.

- Decline in retail sales: Reports indicated slower-than-expected growth in retail sales during periods of heightened tariff activity. This slowdown directly correlated with reduced consumer confidence.

Uncertainty in the Financial Markets

The trade wars initiated by the Trump administration created significant uncertainty in the financial markets. The unpredictable nature of tariff announcements and retaliatory measures from other countries led to increased market volatility. Investors, facing heightened uncertainty, often adopted a more risk-averse approach, impacting investment decisions across the board.

- Stock market indices during relevant periods: Major indices like the Dow Jones Industrial Average and the S&P 500 experienced fluctuations directly linked to periods of escalating trade tensions.

- Investor flight to safety: Investors moved money into safer assets like government bonds, reducing investment in riskier ventures, including IPOs.

- Decreased risk appetite: The overall uncertainty dampened investor appetite for new investments, particularly in sectors sensitive to economic downturns like the BNPL market.

Effect on Businesses and Supply Chains

Businesses heavily reliant on imported goods or materials faced significant challenges due to tariffs. The increased cost of inputs led to higher production costs, reduced profit margins, and supply chain disruptions. This had a cascading effect throughout the economy.

- Increased costs of goods sold: Businesses had to absorb increased input costs or pass them on to consumers, impacting competitiveness and profitability.

- Supply chain bottlenecks: Tariffs disrupted global supply chains, causing delays and shortages of essential materials.

- Reduced profitability: Many businesses experienced reduced profitability due to increased costs and decreased demand. This negatively impacted overall economic growth.

Affirm (AFRM)'s Business Model and Vulnerability to Economic Downturns

Affirm's business model, centered around the Buy Now, Pay Later (BNPL) sector, is particularly susceptible to economic downturns. The company's performance is directly tied to consumer spending and credit risk.

Buy Now, Pay Later (BNPL) Sector Sensitivity

The BNPL sector thrives during periods of strong consumer spending and low credit risk. However, during economic downturns, consumer spending decreases, and credit risk increases, resulting in higher default rates and tighter lending criteria. These factors directly impact BNPL companies' profitability and growth potential.

- Increased default rates: As consumers face financial strain, the likelihood of defaults on BNPL loans increases.

- Tightened lending criteria: To mitigate increased credit risk, BNPL lenders often tighten their approval processes, reducing the number of approved loans.

- Reduced transaction volumes: Reduced consumer spending translates directly into fewer transactions for BNPL platforms.

AFRM's IPO Timing and Market Conditions

Affirm's IPO coincided with a period of economic uncertainty stemming from the Trump tariffs. The prevailing market sentiment was cautious, and investor expectations were tempered by concerns about inflation, trade wars, and potential economic slowdown. This less-than-ideal market environment likely impacted the company's IPO performance.

- IPO pricing: The initial public offering price might have been affected by the prevailing market conditions.

- First-day performance: The stock's first-day performance likely reflected the overall market sentiment and investor concerns.

- Long-term stock performance compared to benchmarks: A comparison of AFRM's long-term performance with other IPOs and market benchmarks during the same period provides insights into the impact of the broader economic environment.

Correlation vs. Causation: Attributing AFRM's IPO Performance

While the economic uncertainty generated by the Trump tariffs undoubtedly created a challenging environment for Affirm's IPO, it's crucial to avoid assigning sole causality. Other factors also played a role in the company's stock performance.

- Competition: The BNPL sector is competitive, and other factors like competition from established players likely affected AFRM's performance.

- Regulatory changes: Potential changes in regulations concerning BNPL services could have also impacted investor sentiment.

- Company-specific factors: Internal factors within Affirm, such as management decisions and operational efficiency, also contributed to its performance.

- Broader macroeconomic trends: Global economic conditions beyond tariffs influenced investor behavior and market performance.

Conclusion

While definitively proving a direct causal link between the Trump tariffs and the performance of Affirm's IPO is difficult, this analysis reveals a strong correlation. The economic uncertainty and market volatility generated by the trade wars likely contributed to a less-than-ideal environment for Affirm's launch. The sensitivity of the BNPL sector to consumer confidence and economic downturns exacerbated the situation. Understanding the complex interplay between geopolitical events, macroeconomic conditions, and individual company performance is crucial for investors. Further research into the impact of Trump tariffs and other trade policies on IPO performance is needed. Continue exploring the intricacies of Trump tariffs and their impact on the financial market by researching similar case studies of companies affected by these trade wars and their influence on the IPO market.

Featured Posts

-

Nationalpark Schutz Fortschrittliche Technik Zur Waldbrandverhinderung

May 14, 2025

Nationalpark Schutz Fortschrittliche Technik Zur Waldbrandverhinderung

May 14, 2025 -

Omezeni Pristupu Novinaru Na Brifinku Ct Reakce Deniku N A Seznam Zprav

May 14, 2025

Omezeni Pristupu Novinaru Na Brifinku Ct Reakce Deniku N A Seznam Zprav

May 14, 2025 -

Captain America Brave New World Digital Release And Disney Streaming Date

May 14, 2025

Captain America Brave New World Digital Release And Disney Streaming Date

May 14, 2025 -

Scotty Mc Creerys Son Honors George Strait In Sweet Video Watch Now

May 14, 2025

Scotty Mc Creerys Son Honors George Strait In Sweet Video Watch Now

May 14, 2025 -

Dispute Erupts Jake Pauls Rival Denies Joshua Fight Claims

May 14, 2025

Dispute Erupts Jake Pauls Rival Denies Joshua Fight Claims

May 14, 2025

Latest Posts

-

Recenzija Novakove Patike Od 1 500 Evra

May 14, 2025

Recenzija Novakove Patike Od 1 500 Evra

May 14, 2025 -

A Star Studded Success Vince Vaughns New Netflix Drama Impresses

May 14, 2025

A Star Studded Success Vince Vaughns New Netflix Drama Impresses

May 14, 2025 -

Kupovina Novakovikh Patika Gde I Kako

May 14, 2025

Kupovina Novakovikh Patika Gde I Kako

May 14, 2025 -

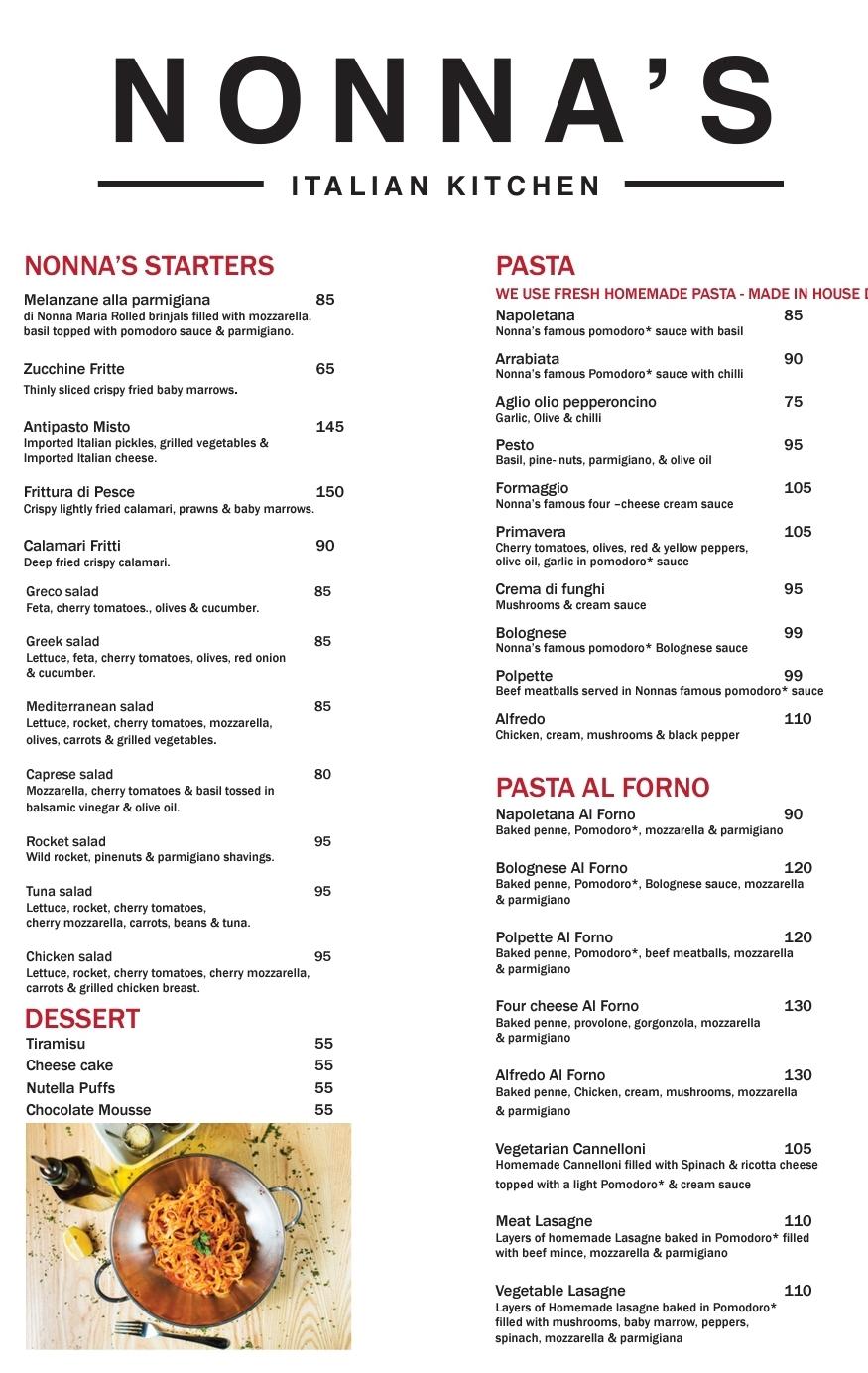

Nonnas Italian Kitchen Vince Vaughns New Restaurant Opens Its Doors

May 14, 2025

Nonnas Italian Kitchen Vince Vaughns New Restaurant Opens Its Doors

May 14, 2025 -

Vince Vaughns Latest Netflix Project A Hit With Viewers

May 14, 2025

Vince Vaughns Latest Netflix Project A Hit With Viewers

May 14, 2025