Trump Tax Bill: House Passage And What It Means

Table of Contents

Key Provisions of the Passed Trump Tax Bill

The Trump Tax Bill introduced several significant changes to both individual and corporate taxation. These modifications aimed to stimulate economic growth by lowering tax burdens and incentivizing investment. Here are some of the most impactful provisions:

-

Corporate Tax Rate Reduction: The bill slashed the corporate tax rate from 35% to 21%, a dramatic reduction intended to boost corporate profits and investment. This was a cornerstone of the bill's pro-growth agenda.

-

Changes to Individual Income Tax Brackets and Standard Deduction: The bill simplified the individual income tax system by reducing the number of tax brackets and significantly increasing the standard deduction. This impacted many taxpayers, providing some tax relief while altering the overall tax burden for others.

-

Modifications to Itemized Deductions: The bill limited or eliminated several itemized deductions, including state and local tax (SALT) deductions. This change disproportionately affected taxpayers in high-tax states.

-

Changes to the Alternative Minimum Tax (AMT): The AMT, designed to ensure high-income earners pay a minimum amount of tax, was significantly altered. While some individuals saw relief, the changes were complex and varied in their impact.

Economic Impact of the Trump Tax Bill

The economic consequences of the Trump Tax Bill have been a subject of intense debate. Proponents argued the tax cuts would stimulate economic growth through increased investment and job creation. Opponents, however, expressed concerns about the potential impact on the national debt and income inequality.

-

Projected GDP Growth: Supporters pointed to projections of increased GDP growth as evidence of the bill's success. However, the extent to which the tax cuts directly contributed to this growth remains a subject of ongoing economic analysis.

-

Potential Impact on the National Debt: A significant concern surrounding the bill was its potential to increase the national debt. The substantial tax cuts, without corresponding spending cuts, were predicted to widen the federal deficit.

-

Arguments for and Against the Bill's Economic Benefits: The economic effects of the Trump Tax Bill are still being debated. While some indicators suggest positive growth, the long-term impacts and the extent to which the bill contributed to this growth are complex and not fully understood.

Impact on Different Income Groups

The Trump Tax Bill's impact varied significantly across different income groups. While some benefited from substantial tax savings, others experienced minimal or even negative impacts.

-

Tax Savings for High-Income Earners: High-income earners generally benefited most from the tax cuts, particularly through the reduction in the top individual income tax rates and changes to the corporate tax rate.

-

Tax Changes for Middle-Income Families: The impact on middle-income families was more nuanced, with some experiencing modest tax savings due to the increased standard deduction, while others faced changes to itemized deductions.

-

Potential Impacts on Low-Income Households: The impact on low-income households was less dramatic, with the effects varying depending on their specific circumstances and whether they itemized deductions or utilized the standard deduction.

Political Ramifications of the House Passage

The House passage of the Trump Tax Bill was a highly partisan event, generating significant political fallout.

-

Political Impact: The bill's passage solidified a key legislative victory for the Republican party, fulfilling a major campaign promise. However, it also heightened divisions within the political landscape.

-

Election Implications: The bill’s impact on the economy and various income groups played a significant role in subsequent elections, shaping political narratives and voter preferences.

-

Bipartisan Support and Political Opposition: While the bill passed with Republican support, it garnered little to no Democratic backing, highlighting deep partisan divisions regarding tax policy and economic priorities.

Conclusion: Understanding the Long-Term Effects of the Trump Tax Bill

The Trump Tax Bill's House passage significantly altered the American tax code, resulting in wide-ranging economic and political consequences. The key provisions – corporate tax rate reduction, changes to individual income tax brackets, modifications to itemized deductions, and AMT adjustments – continue to shape economic debates and impact various income groups. The long-term effects, including the impact on the national debt and income inequality, remain subjects of ongoing study and analysis. To stay informed about the ongoing implications and future developments of this impactful tax reform, continue to seek out reliable news sources and in-depth analyses of the Trump Tax Bill and its implementation. Understanding the complexities of this legislation is crucial for navigating the evolving tax landscape.

Featured Posts

-

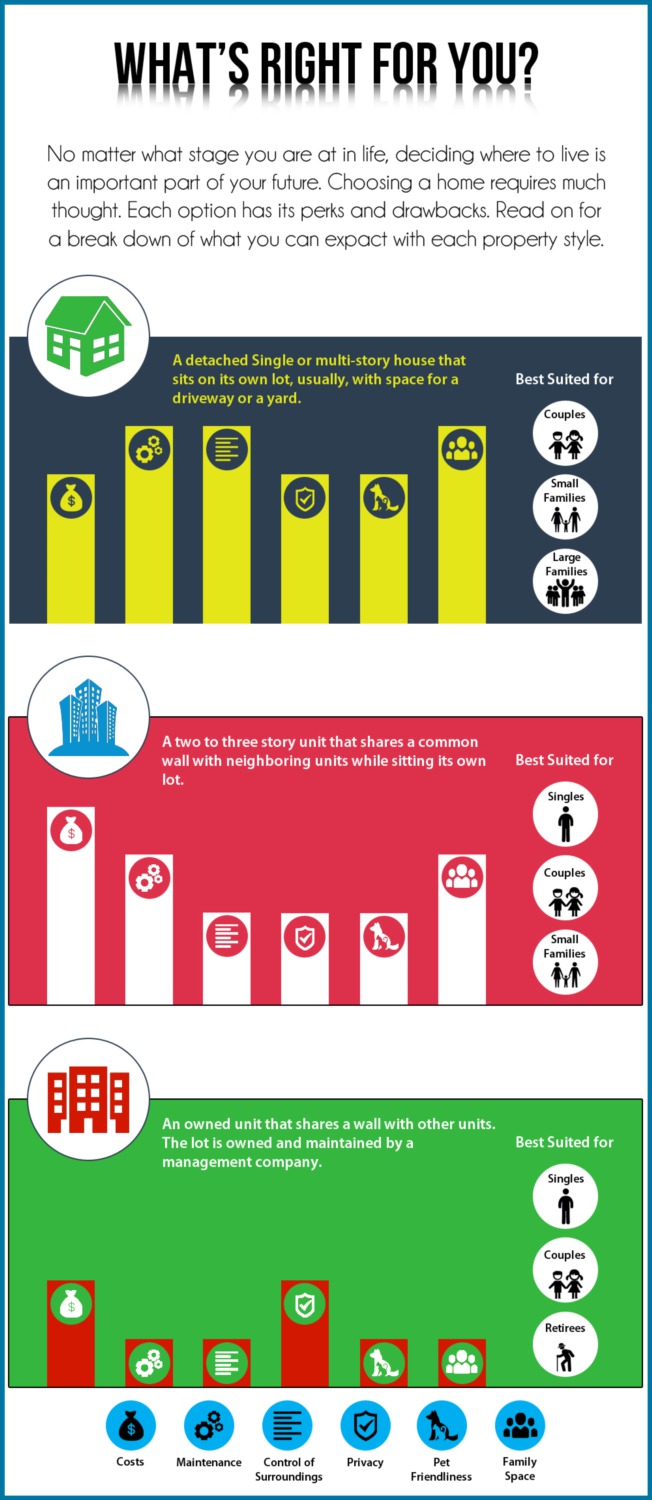

Escape To The Countryside Choosing The Right Property For Your Needs

May 24, 2025

Escape To The Countryside Choosing The Right Property For Your Needs

May 24, 2025 -

Sterke Aex Prestaties Na Trumps Uitstel

May 24, 2025

Sterke Aex Prestaties Na Trumps Uitstel

May 24, 2025 -

Joy Crookes Carmen A New Single To Listen To

May 24, 2025

Joy Crookes Carmen A New Single To Listen To

May 24, 2025 -

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025 -

The 5 Luckiest Zodiac Signs On March 20 2025

May 24, 2025

The 5 Luckiest Zodiac Signs On March 20 2025

May 24, 2025

Latest Posts

-

Dc Legends Of Tomorrow Team Building And Synergies Explained

May 24, 2025

Dc Legends Of Tomorrow Team Building And Synergies Explained

May 24, 2025 -

Mastering Dc Legends Of Tomorrow Tips And Tricks For Success

May 24, 2025

Mastering Dc Legends Of Tomorrow Tips And Tricks For Success

May 24, 2025 -

Wrestle Mania 41 Golden Championship Belts And Tickets Memorial Day Weekend Sale

May 24, 2025

Wrestle Mania 41 Golden Championship Belts And Tickets Memorial Day Weekend Sale

May 24, 2025 -

Wwe Wrestle Mania 41 Secure Your Tickets This Memorial Day Weekend Championship Belts Available

May 24, 2025

Wwe Wrestle Mania 41 Secure Your Tickets This Memorial Day Weekend Championship Belts Available

May 24, 2025 -

Experience Free Films And Meet Stars At The Dallas Usa Film Festival

May 24, 2025

Experience Free Films And Meet Stars At The Dallas Usa Film Festival

May 24, 2025